Blog > What is Debit Card Processing and How Much are Debit Card Processing Fees?

What is Debit Card Processing and How Much are Debit Card Processing Fees?

While credit cards are widely used by consumers all across the country, debit cards still remain the most popular payment method in the United States.

Despite the major focus on credit cards in publications and advertisements, businesses that allocate their resources to also offer debit card processing can create a more efficient payment process for their customers.

This article will highlight what debit card processing is and how it actually works to help you better understand the importance of these payments and the benefits associated with them.

What is Debit Card Processing?

Put simply, debit card processing is the process of accepting payments from customers using debit cards. These cards link payments to the customer’s checking account, where the funds for the purchase are deducted and transferred to the merchant’s account in real time.

Debit Card vs. Credit Card Processing

Debit card and credit card processing may look the same since they both involve the use of card readers or virtual terminals to capture payment information and the use of acquiring and issuing banks to facilitate transactions. However, there are several differences between these two types of processing:

- Debit cards are linked to the customer’s checking or savings account, and the funds for the purchase are transferred directly from the customer’s account at the time of the transaction. Whereas, credit cards allow customers to borrow money from the issuing bank to make a purchase and pay back the borrowed amount over time.

- Debit card transactions are typically processed through the Interchange system, while credit card transactions are processed through the credit card networks.

- Debit card transactions are typically authorized with a personal identification number (PIN), while credit card transactions are authorized with a signature or through online authentication.

- Debit card transactions usually have lower fees for merchants than credit card transactions because they’re considered less risky.

- Credit cards offer more fraud protection and liability protection than debit cards. If your credit card gets stolen and used for fraudulent purchases, many card companies will offer $0 liability on unauthorized charges. This means you’re not liable for any fraudulent purchases or responsible for paying any of the associated costs.

- Credit cards have more rewards, cashback, and points programs compared to debit cards.

Now that you’ve learned the key differences between credit and debit cards, it’s important to understand how debit card processing works.

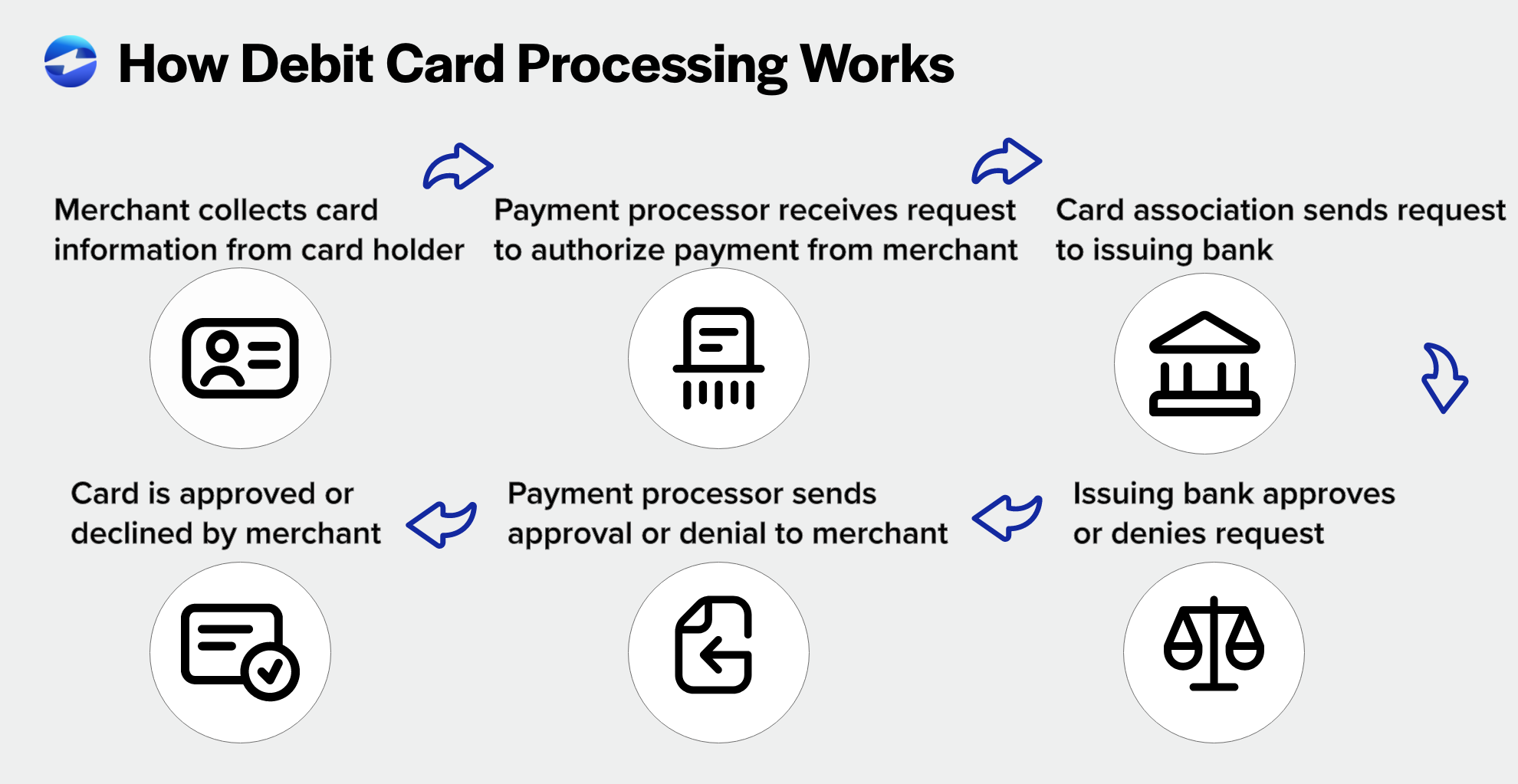

How Debit Card Processing Works

Despite the similarities between debit card and credit card processing, debit cards can be processed using fewer steps.

Here’s how debit card processing works:

When a customer purchases products or services using a debit card, the transaction process begins with the customer swiping or inserting his/or her card into a terminal at a merchant’s storefront or online store.

The terminal then sends the transaction information to the merchant services provider which acts as an intermediary between the merchant and the payment network. The payment network, such as Visa or Mastercard, then forwards the transaction information to the customer’s issuing bank to verify there are sufficient funds available in the customer’s account.

Once the funds have been verified, the payment network sends an approval or decline message back to the merchant services provider, who then sends the same message to the merchant’s terminal. If the transaction is approved, the funds are transferred from the customer’s account to the merchant’s account.

In addition to the technical steps behind accepting debit cards, merchants should also be aware of the fees associated with debit card processing. This next section will provide more insight into these fees.

Debit Card Fees

Debit card processing comes with its own set of fees which typically include:

-

Interchange fees:

Interchange fees are charged by the card issuer (usually a bank) for each transaction processed using a debit card. Interchange fees are set by the card networks (Visa, Mastercard, etc.) and are generally lower for debit card transactions compared to credit card transactions. Interchange fees are a percentage of the transaction amount, typically around 1.5%.

-

Assessment fees:

Assessment fees are charged by card networks (Visa, Mastercard, etc.) to merchants for accepting debit card transactions. These fees are typically a percentage of each transaction amount, along with a per-transaction fee. The actual fees vary depending on the card network and the type of transaction (online, in-person, etc.).

-

Monthly processing fees:

Monthly processing fees are commonly charged by payment processors for providing debit card processing services. These fees can be a flat rate, a percentage of the transaction, or a combination of both.

-

Equipment costs:

If you don’t already have a payment processing terminal, you may need to purchase or lease this hardware to process debit card transactions which can result in equipment costs.

It’s important to note that fees can greatly vary depending on the payment processor and the type of card processing solution you choose. Therefore, it’s important to do your research and compare the fees of different providers before making a decision.

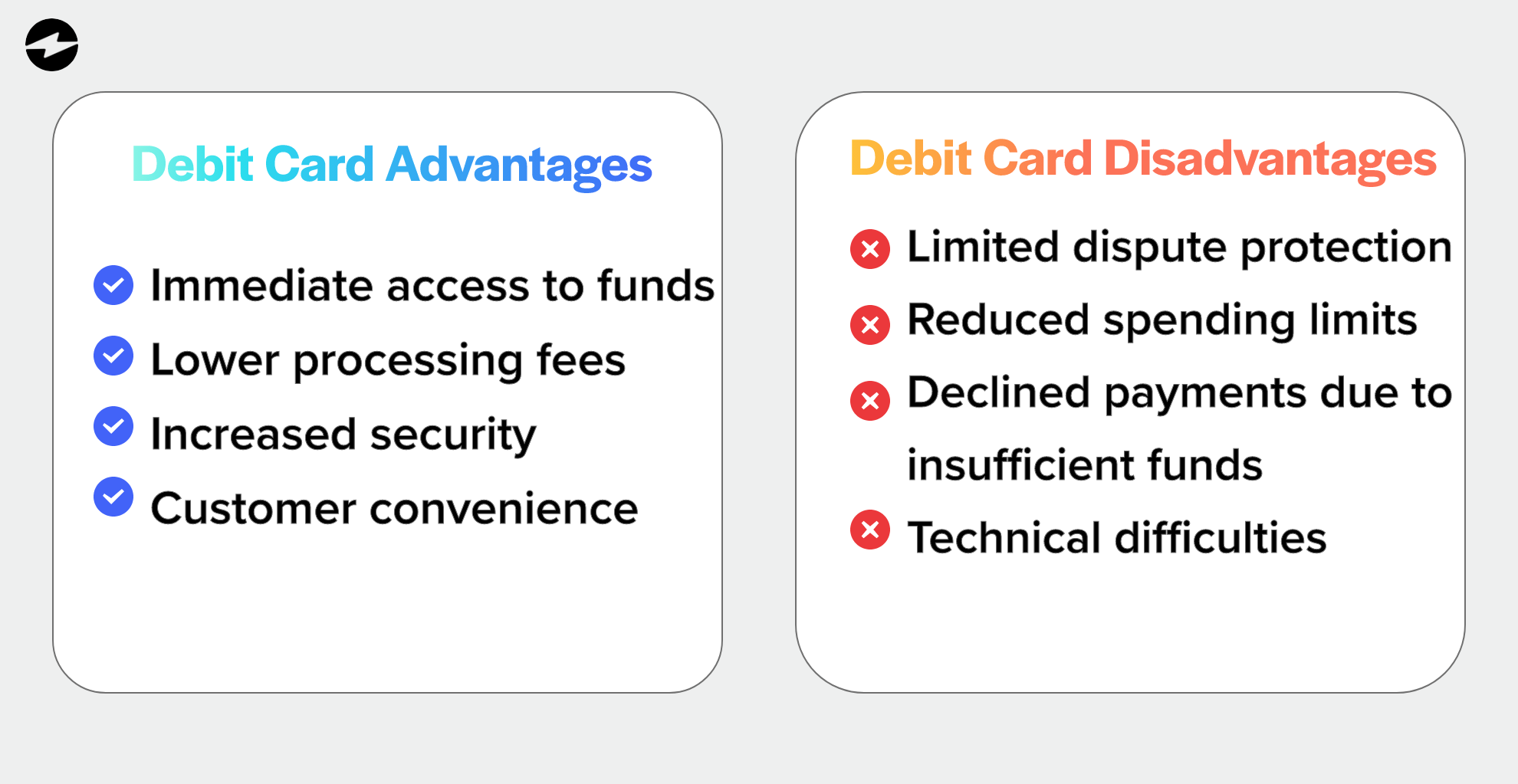

Advantages and Disadvantages of Debit Card Processing

Understanding the advantages and disadvantages of debit card processing can help your company determine whether or not to incorporate this type of processing into its infrastructure, how much capital is needed for these operations, and their associated fees.

Accepting debit cards can result in faster transactions, reduced fraud, and lower fees than credit card processing. However, this type of card processing can also result in limited protection for consumers, possible overdraft fees, and fewer rewards and benefits.

Below are some of the main advantages and disadvantages of debit card processing to help your company determine if it’s the right fit for your business model…

Advantages of debit card processing:

- Immediate access to funds:

With debit card processing, payments are immediately transferred from the customer’s account to your business accounts, providing quicker access to funds to operate your business more efficiently.

- Lower processing fees:

Compared to credit card processing, debit card processing fees are generally lower, which allows businesses to save money on these costs.

- Increased security:

Debit cards have the added security feature of being linked directly to a customer’s bank account, reducing the risk of fraudulent transactions.

- Customer convenience:

Debit cards are widely accepted, providing customers with a convenient and familiar method of payment.

Disadvantages of debit card processing:

- Limited dispute protection:

Unlike credit cards, debit cards have limited protection for customers in the event of fraud or disputes, meaning that funds may be immediately taken from their accounts.

- Reduced spending limits:

Debit cards often have lower spending limits compared to credit cards which can limit the amount customers are able to spend in your store.

- Declined payments due to insufficient funds:

Debit card transactions are more likely to be declined due to insufficient funds in the customer’s bank account, resulting in a loss of sales for your business.

- Technical difficulties:

Debit card processing may require additional hardware and software, which can result in technical difficulties that may impact your ability to process payments.

Setup debit card processing with EBizCharge

Understanding debit card processing, the fees involved, and the advantages and disadvantages of this process will help you decide whether or not to accept these payments. For most businesses, debit card processing offers a convenient and efficient way to collect payments from customers.

If your company is ready to start accepting credit and debit card payments, EBizCharge offers a simple setup and installation process. EBizCharge gives merchants access to a seamless payment solution to process credit cards and debit cards directly inside their accounting software, eCommerce shopping carts, or CRM platforms, without hefty fees.