Blog > What is a Temporary Hold on a Credit Card?

What is a Temporary Hold on a Credit Card?

Have you ever had a transaction that didn’t go through due to a temporary hold on your credit card? These elusive pauses in spending can disrupt your financial activities and leave you questioning what went wrong.

A temporary hold on a credit card is more common than you might think, often triggered by various factors ranging from overdue payments to suspicious transactions. Understanding these holds can help you navigate your credit situation and maintain buying power.

This article will explore what a temporary hold is, the reasons behind these holds, and how they can impact your finances.

What is a credit card hold?

A credit card hold is when a portion of your credit limit is reserved for a potential transaction. This amount is unavailable for other uses until the merchant finalizes the transaction or the hold is released.

Credit card holds are enforced by merchants, payment processors, credit card networks, and card-issuing banks.

A credit card hold can become an actual charge if a transaction is completed. If this hold is lifted, it will free up your credit limit again. Pre-authorizations and security deposits are common forms of temporary holds. These holds are commonly used by hotels, rental companies, and gas stations.

To manage your credit limit effectively, you should always verify with the merchant how long a temporary hold will last. Since there are various reasons why merchants, processors, networks, and card-issuing banks enforce card holds, it’s important to understand these reasons to avoid future holds.

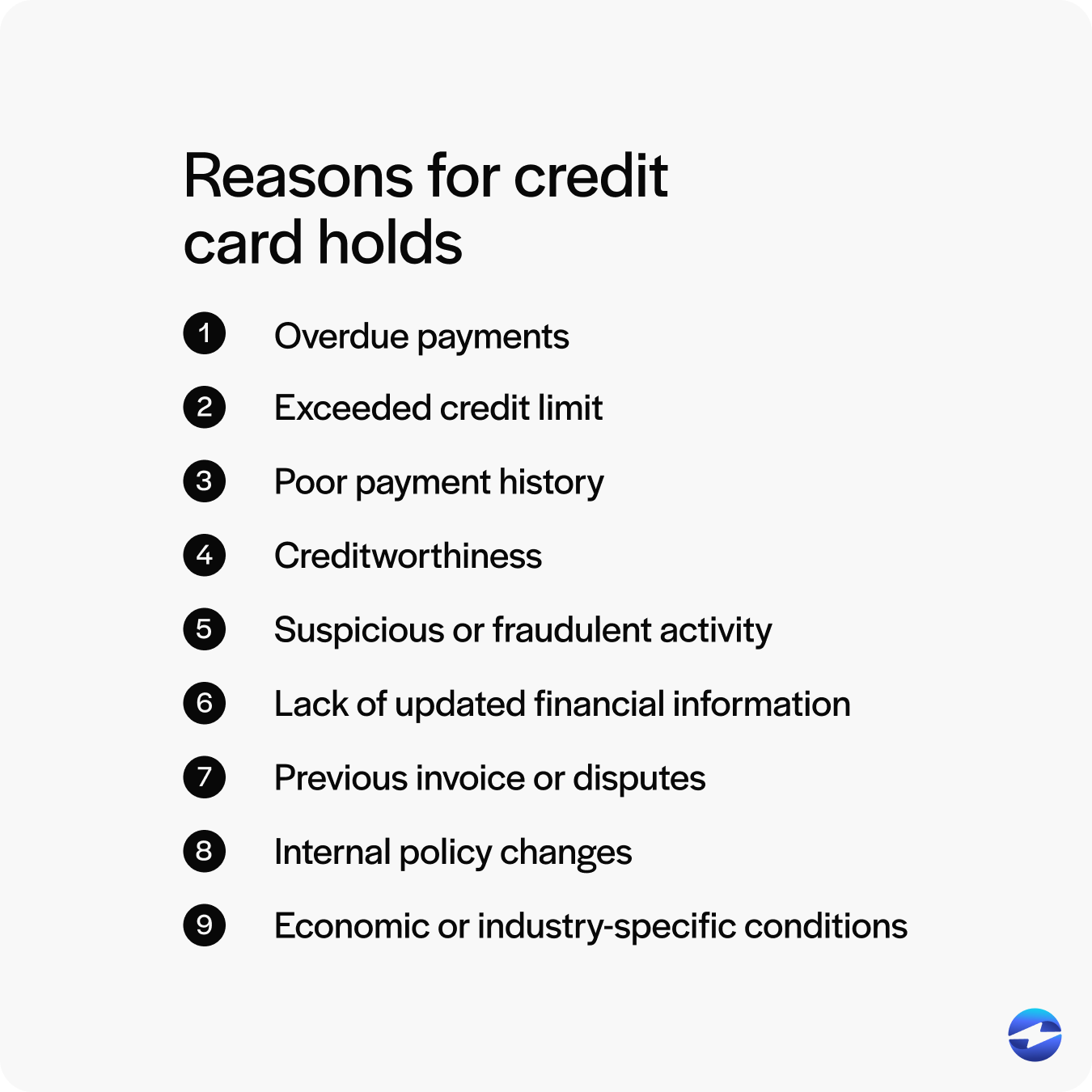

9 reasons for credit card holds

Understanding why credit card holds are issued is crucial to better financial management, as these holds can temporarily limit your available credit, affecting your cash flow and ability to make purchases.

Knowing the reasons behind credit card holds can help you quickly avoid or resolve these holds to deliver a better user experience and maintain a healthy credit score.

Here are nine reasons a credit card hold may be enforced:

- Overdue payments: Overdue payments can signal to credit card issuers that you may struggle to repay borrowed funds. As a precaution, they may place a hold on your account to limit spending until the overdue balance is cleared. This is a method to mitigate risk and encourage timely payments.

- Exceeded credit limit: Exceeding your credit limit is another reason for a credit card hold. When your balance surpasses the approved limit, issuers may restrict further usage until you decrease your balance below the limit. Regularly monitoring your spending helps prevent such situations.

- Poor payment history: A history of late or missed payments can lead to credit card holds. Issuers may view your account as high-risk and restrain further charges to protect against potential defaults. Improving your payment habits over time can restore full access to your credit card.

- Creditworthiness: Your creditworthiness impacts lenders’ trust in your ability to manage credit responsibly. If your financial profile shows signs of weakening, such as a drop in your credit score, issuers may institute a hold as a protective measure. Regularly checking your credit report can help maintain your credit standing.

- Suspicious or fraudulent activity: Suspicious or fraudulent activity prompts immediate action from credit card issuers. A hold is applied to prevent unauthorized charges and protect your account. Reporting any unusual transactions promptly ensures quick resolution and security for your funds.

- Lack of updated financial information: Outdated financial information on file can cause credit card holds. Issuers need accurate data to assess their creditworthiness. If your contact or financial details change, notifying your credit card provider helps avoid unnecessary holds and service interruptions.

- Previous invoice or order disputes: A dispute over a past invoice or order may trigger a temporary hold. Until the issue is resolved, the hold ensures no further changes are made that may complicate the situation. Resolving disputes quickly is essential to lift the hold and prevent payment delays.

- Internal policy changes: Credit card issuers sometimes implement policy changes that impact account holds. These changes can be related to risk management or compliance with regulations. Staying informed about your card issuers’ policies can help you understand and anticipate potential holds.

- Economic or industry-specific conditions: Broader economic shifts or industry-specific conditions can lead to unexpected credit card holds. During financial downturns or sector volatility, issuers may tighten credit to mitigate risk. Awareness of economic trends can help you predict and prepare for such circumstances.

With these causes in mind, it’s vital to be aware of personal behaviors and external conditions that can trigger a credit card hold to ensure you maintain uninterrupted access to credit and can plan your spending effectively.

Now that you know the various reasons for credit card holds, the following section will explain the different types of holds that can impact your finances.

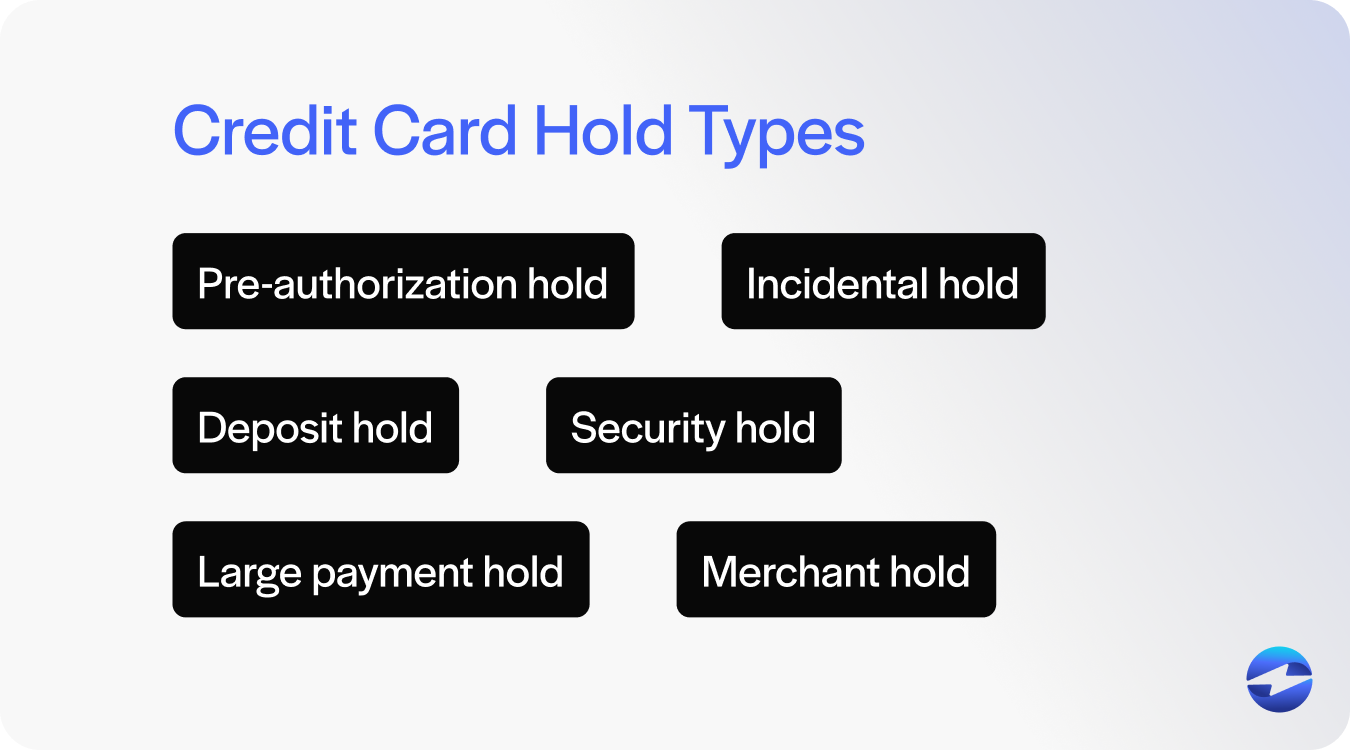

6 types of credit card holds

Understanding the various credit card holds will help you effectively manage your cash flow, prepare for any situation, and avoid unexpected dips in credit.

Here are six types of credit card holds to familiarize yourself with:

- Pre-authorization hold: A pre-authorization hold can occur when merchants reserve a portion of their credit line before completing transactions. This is common in industries like hotels and car rentals. These holds ensure sufficient funds are available, usually lasting a few business days until the actual charge is finalized.

- Incidental hold: An incidental hold can protect your business against unforeseen costs and will typically last until the actual charges are posted. These holds are common in the hospitality and travel industries and cover potential additional charges such as room service or minibar use.

- Deposit hold: A deposit hold is required as a security measure when future payments are expected. They’re often used in rental services, such as cars or equipment, where the merchant needs assurance against damage or loss. The hold is generally removed once the equipment is returned in good condition.

- Security hold: A security hold is implemented by credit card issuers to protect against fraud or suspicious activities. If a transaction appears unusual, the issuer may place a hold on your card to investigate. These are typically lifted once the issue is resolved, ensuring your credit score isn’t adversely affected.

- Merchant hold: A merchant hold occurs when a business places a temporary hold on funds to ensure payment upon completion of services. They’re commonly applied to industries with variable charges, like gas stations. This hold is typically adjusted to reflect the actual charge once the transaction batch is processed.

- Large payment hold: A large payment hold can happen when a substantial transaction is flagged for verification by card networks. Businesses occasionally use this to ensure sufficient funds are available before finalizing a large purchase. These holds last until the bank confirms the legitimacy of the transactions.

By recognizing how and when various credit card holds are applied, you can anticipate potential impacts on your credit availability and make more informed spending decisions.

Now that you know the different types of credit card holds, you should also understand how they can affect your customers.

What do credit card holds mean for your customers?

Consumers must be aware of credit card holds since they can impact their credit limit and lead to declined payments.

Monitoring transactions and being informed about the merchant’s hold policy can enhance customer experience and help them manage credit more efficiently. Here are seven things customers can expect during a credit card hold:

- Temporary reservation of funds: When a credit card hold is placed, a portion of the customer’s available credit is set aside or “held” by the merchant. While the customer’s balance doesn’t change, this amount can temporarily reduce the available credit limit.

- Limited spending power: When a hold is active, customers have less credit for other purchases. If the amount held is significant, it can impact the customer’s ability to make other purchases until it’s released or a final charge is posted.

- Customer and merchant protection: Credit card holds protect merchants by ensuring sufficient funds are available to cover a transaction. Holds can also protect customers since only the amount owed is charged after services are provided. If a customer doesn’t accrue additional costs, any excess amount held is released.

- Duration of holds: Credit card holds typically can vary between a few days to a week but can be extended based on a merchant or card issuer’s policies. If the final charge isn’t posted within that period, the hold expires, and the reserved funds are automatically released.

- Inconvenient customer experience: Customers may be inconvenienced by credit card holds, especially if their credit limit is reduced unexpectedly, holds are placed repeatedly, or aren’t properly managed. It’s also worth noting that if a hold remains on the account after the transaction has been completed, customers may need to contact the merchant or card issuer to expedite the release.

- No impact on credit scores: While credit card holds impact customers’ available credit limits, they don’t affect credit scores since they don’t count as debt and aren’t reported to credit bureaus. Thus, these holds don’t affect your overall credit balance or long-term credit health.

- Transparency of charges: Customers should be informed of any potential holds in advance. Businesses often disclose these policies, allowing customers to plan accordingly or request lower hold amounts if possible.

Credit card holds, despite their temporary nature, are a common practice that enables merchants to verify payments and can protect consumers from being overcharged.

If customers want to avoid these holds altogether, there are several steps they can take.

How customers can manage credit card holds

Managing or avoiding payment holds requires proactive planning and communication with merchants.

Customers can start by choosing payment methods that don’t involve holds, such as using a debit card or cash if these options are available. When using a credit card, it’s essential to ask the merchant about their hold policy in advance to understand how much will be reserved and for how long. If the amount of the hold seems excessive, customers can request a lower hold or explore alternative arrangements.

For recurring transactions or bookings, using the same credit card consistently can help avoid duplicate holds. Monitoring transactions closely and ensuring sufficient available credit before making purchases or reservations can also minimize potential issues.

By staying informed and taking these steps, customers can reduce the likelihood of encountering inconvenient holds on their credit cards.

On the merchant side, businesses can alleviate card hold issues and improve their hold management by working with reliable payment processors like EBizCharge, which offers robust payment software and features that streamline payment operations.

How EBizCharge helps businesses avoid credit card holds

EBizCharge helps businesses avoid credit card holds by streamlining payment processes and providing real-time transaction monitoring, which reduces the likelihood of holds due to suspicious activity or errors.

In addition to allowing merchants to manage credit card transactions securely, EBizCharge provides robust payment integrations into popular business systems. EBizCharge also ensures customer payment data is accurate and compliant with Payment Card Industry Data Security Standards (PCI-DSS), minimizing risks that typically prompt credit card issuers to place holds.

Additionally, EBizCharge offers numerous payment collection features like automated payment reminders and pre-authorizations to help businesses manage overdue payments and maintain transparent communication with customers to reduce unexpected holds from missed payments or disputes.

Thanks to its powerful payment software, EBizCharge delivers seamless, uninterrupted funds for businesses and consumers by fostering a secure, efficient payment processing environment.