Blog > What are Pre Authorization Charges? Your Key to Streamlined Operations and Financial Security

What are Pre Authorization Charges? Your Key to Streamlined Operations and Financial Security

Today, over 166 million Americans use credit cards in the U.S. and continues to rise. While credit cards have been around for some time now, the different ways companies process cards have drastically changed for the better.

Gone are the days of cumbersome paper-based transactions and manual verifications, thanks to innovative technologies and streamlined processes transforming the credit card processing landscape, offering businesses and consumers a seamless and secure payment experience.

Credit card processing innovations like preauthorization charges now promote buyer and seller accountability.

What is a preauthorization charge and why is it important?

Electronic payment processing consists of millions of daily transactions, making it essential to have a system that encourages a healthy seller-to-buyer relationship. This relationship can be established via preauthorization to ensure the buyer is trustworthy and has sufficient funds in their bank account before completing a transaction.

Preauthorization charges (or preauthorized payments) refer to the fees or costs associated with obtaining permission or approval before initiating a specific action, service, or transaction. One example of preauthorization charges is when booking a hotel room. Before your arrival, the hotel may place a preauthorization charge on your credit card to ensure the funds are available for the reservation — this holds your room and protects the hotel in the case of any incidents or damages.

Preauthorization charges streamline operations and enhance financial security across various industries by ensuring all necessary approvals are obtained before moving forward.

Preauthorization payments are critical in credit card processing to validate transactions. Preauth charges assess the proposed action or service’s feasibility, compliance, and potential risks. By obtaining preauthorization, businesses and individuals can confidently navigate their endeavors knowing the necessary approvals have been secured.

Companies and consumers should learn the preauthorization process to understand its role in credit card processing.

Understanding the 3-step process of preauthorization charges

Preauthorization charges function through the collaboration between merchants and payment gateways, as they work together to establish and verify the preauth settings to enable merchants to preauthorize their customers.

To fully grasp the significance of preauthorization payments, it’s essential to understand the three critical steps involved in this process:

- Requesting a reauthorization

- Review and approval

- Provider notification

1. Requesting a preauthorization

The first step in this process is to submit a formal request for preauthorization. This preauthorization request outlines the proposed action, service, or transaction and any supporting documentation required for assessment.

Make sure to provide accurate and comprehensive information during this stage to ensure your preauthorization is approved.

2. Review and approval

Once the preauthorization request is submitted, it undergoes a review process. The responsible authority evaluates the information provided to determine feasibility, compliance, and adherence to relevant criteria.

The financial institutions will consider factors such as legal requirements, financial considerations, and operational feasibility. If the request meets the necessary measures, preauthorization is granted.

3. Provider notification

After preauthorization is approved, the relevant providers are notified. This notification ensures that all associated parties know the approved authorization status and can proceed accordingly.

While the 3-step process of preauthorization charges remains the same, the duration may vary depending on a few factors.

How long do preauthorization holds last?

The duration of preauth holds varies depending on the specific industry, service, or transaction. In some cases, preauthorization remains valid for a particular period, allowing the approved action or service to be performed within that timeframe.

However, certain preauthorization charges may have a time limit, requiring renewal or reevaluation if the action or service extends beyond the initial authorization period. It’s essential to verify the duration of preauthorization for each specific case.

Despite the length of preauthorization holds, these charges come with many benefits.

5 benefits associated with using preauths in payments

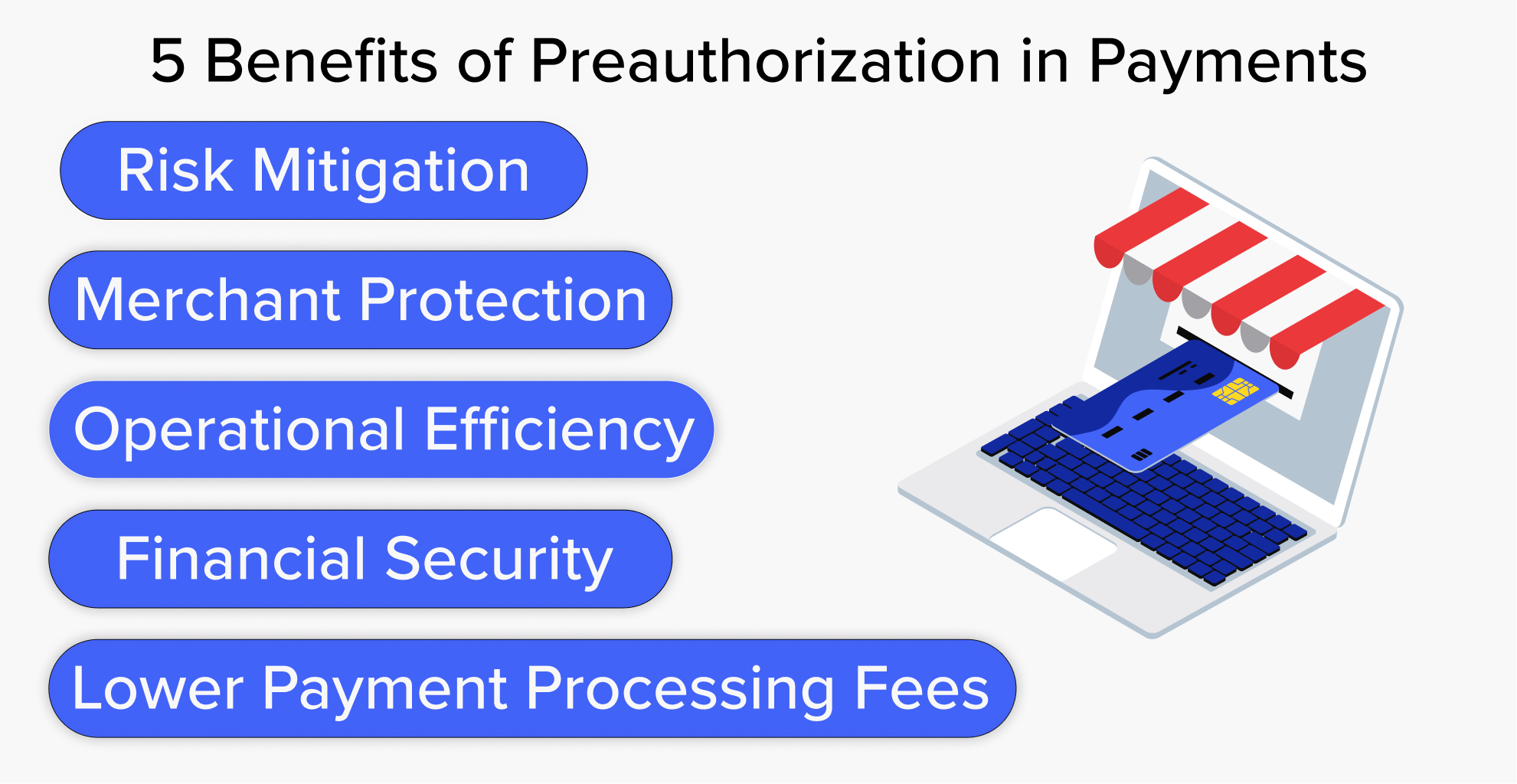

Preauthorization charges offer several benefits for businesses that contribute to an efficient and secure way of accepting payments from their customers.

Here are five advantages of incorporating preauthorizations in the payment process:

- Risk mitigation. Preauthorization helps identify potential risks and issues before they occur, reducing the likelihood of complications or negative consequences. If a customer has insufficient funds in their bank account, the preauthorization charge will be able to identify that and prevent the transaction from going forth.

- Merchant protection. Preauthorization payments prevent customers from filing a chargeback claim and protect merchants from potential fraud.

- Financial security. Preauthorization ensures that the approved action or service is reviewed and authorized in advance, minimizing the risk of financial disputes or loss.

- Operational efficiency. Preauthorization provides a structured framework for obtaining approvals, ensuring efficient resource allocation and utilization.

- Lower payment processing fees. In a typical transaction, payment processing companies will charge a fee for the initial transaction and any refunds. Preauthorization charges only occur if the transaction is finalized, saving money for the merchant.

While it’s evident that preauthorization charges can significantly benefit buyers and sellers, some challenges are still involved.

Challenges of using preauths in payments

Preauthorization charges can cause challenges and concerns revolving around processing delays for businesses and consumers.

Preauthorizations may come with delays, particularly when complex assessments or multiple levels of approval are involved. Streamlining the process and maintaining effective coordination is essential to minimize delays.

Thankfully, your business can take advantage of helpful tips and resources to effectively manage preauthorization charges and combat these challenges.

3 tips to better manage preauthorization charges

With proper implementation and management, merchants can leverage preauthorization charges to streamline payments.

Here are three tips to help you effectively manage preauthorization charges:

- Understand your insurance coverage

- Communication is vital

- Keep track of preauthorization requests

Tip 1: Understand your insurance coverage

To ensure a smooth preauthorization process, you must become familiar with your insurance coverage and its specific requirements. Take the time to understand the criteria and documentation needed for preauthorization and any cost-sharing responsibilities you may have.

Being well-informed about insurance coverage can help your business proactively gather the necessary information and documentation to save time and avoid potential setbacks. This knowledge allows you to navigate the preauthorization process confidently, ensuring all requirements are met and increasing the likelihood of successful approval.

Remember, being proactive and knowledgeable about insurance coverage is the key to a streamlined preauthorization experience.

Tip 2: Communication is vital

Maintain open and transparent communication with the relevant authorities or providers throughout the preauthorization process.

Seek clarification, ask questions, and ensure all associated parties fully understand the expectations and requirements of preauthorization charges.

Tip 3: Keep track of preauthorization requests

Maintaining orderly records of all preauthorization requests, including supporting documentation, approval dates, and any related communications, is essential.

Tracking these requests will help you stay organized, facilitate follow-ups, and serve as a reference for future requirements or audits.

Organized records help preauthorization requests by providing:

- Easy reference and retrieval of information. Whether for follow-up inquiries, future requirements, or audits, having a well-documented history of preauthorization requests helps you quickly locate and provide the necessary information.

- Efficient follow-ups. If there are any delays or discrepancies in the preauthorization process, having a clear record allows you to pinpoint the issue, track the progress, follow up with the relevant parties, and promptly resolve any concerns or challenges.

- Enhanced compliance and accountability. Documenting the entire preauthorization process creates a trail of evidence that showcases your adherence to regulatory requirements and internal policies. This becomes especially valuable during audits or reviews, as you can demonstrate your commitment to transparency and due diligence.

When utilized correctly, these tips can help your company effectively use preauthorization charges to their full potential.

Unlocking the power of preauthorizations with EBizCharge

Businesses can confidently navigate preauthorization charges to streamline their operations and financial security by understanding the process, recognizing the benefits, and implementing effective management strategies.

Merchants can also leverage payment software like EBizCharge to optimize their payment processing experience by providing customers with an abundance of payment features to speed up the invoicing process and help their businesses get paid on time.

- What is a preauthorization charge and why is it important?

- Understanding the 3-step process of preauthorization charges

- How long do preauthorization holds last?

- 5 benefits associated with using preauths in payments

- Challenges of using preauths in payments

- 3 tips to better manage preauthorization charges

- Unlocking the power of preauthorizations with EBizCharge