Blog > What Are Merchant Category Codes (MCCs)?

What Are Merchant Category Codes (MCCs)?

Understanding financial transactions has never been more crucial for businesses. One key element in this realm is the merchant category code (MCC), a seemingly obscure concept that’s vital to how transactions are processed.

By classifying businesses according to the nature of their services, MCCs facilitate a smoother payment experience.

This article will explore the world of merchant category codes, covering their purpose, benefits, and the specifics of using them in the credit card processing landscape.

What is a merchant category code (MCC)?

Merchant category codes (MCCs) are four-digit numbers credit card companies use to classify different types of businesses. These codes help identify what a business sells during credit card transactions.

MCCs serve a range of sectors, from retail outlet services to transportation services. They categorize beauty shops, service providers like furniture rental and repair, and other businesses.

Who sets merchant category codes?

MCCs are set by major credit card networks such as Visa, MasterCard, American Express, and Discover when merchants set up their credit card processing accounts to ensure transactions are accurately processed, and interchange fees are correctly applied.

Now that you know what merchant category codes are and who sets them, you should understand the benefits they yield for businesses and their customers.

What are the benefits of MCCs?

Since MCCs offer several advantages for businesses and consumers, it’s essential to understand these benefits to help you make the most of your credit card transactions.

Here are three top benefits of MCCs:

- Streamlined payment processing: MCCs enable payment processors to categorize transactions quickly, speeding up payment approvals from credit card companies.

- Transparent financial reporting and reconciliation: MCCs also contribute to clearer financial reporting and reconciliation. With each transaction tagged by a specific MCC, businesses can easily track spending patterns. This categorization simplifies record-keeping and helps identify which business types contribute most to revenue. It also aids in matching transactions to specific accounts during financial audits.

- Specialized reward programs: MCCs allow credit card users to participate in specialized reward programs. Credit card companies often offer cashback or rewards for purchases in specific categories, like travel or dining. By understanding the MCCs tied to these categories, users can optimize their spending to maximize rewards.

Understanding how these codes are used throughout credit card processing operations is also important. The following section will outline this process.

How are merchant category codes used in credit card processing?

Beyond their classification role, MCCs influence numerous aspects of how transactions are processed, priced, and monitored.

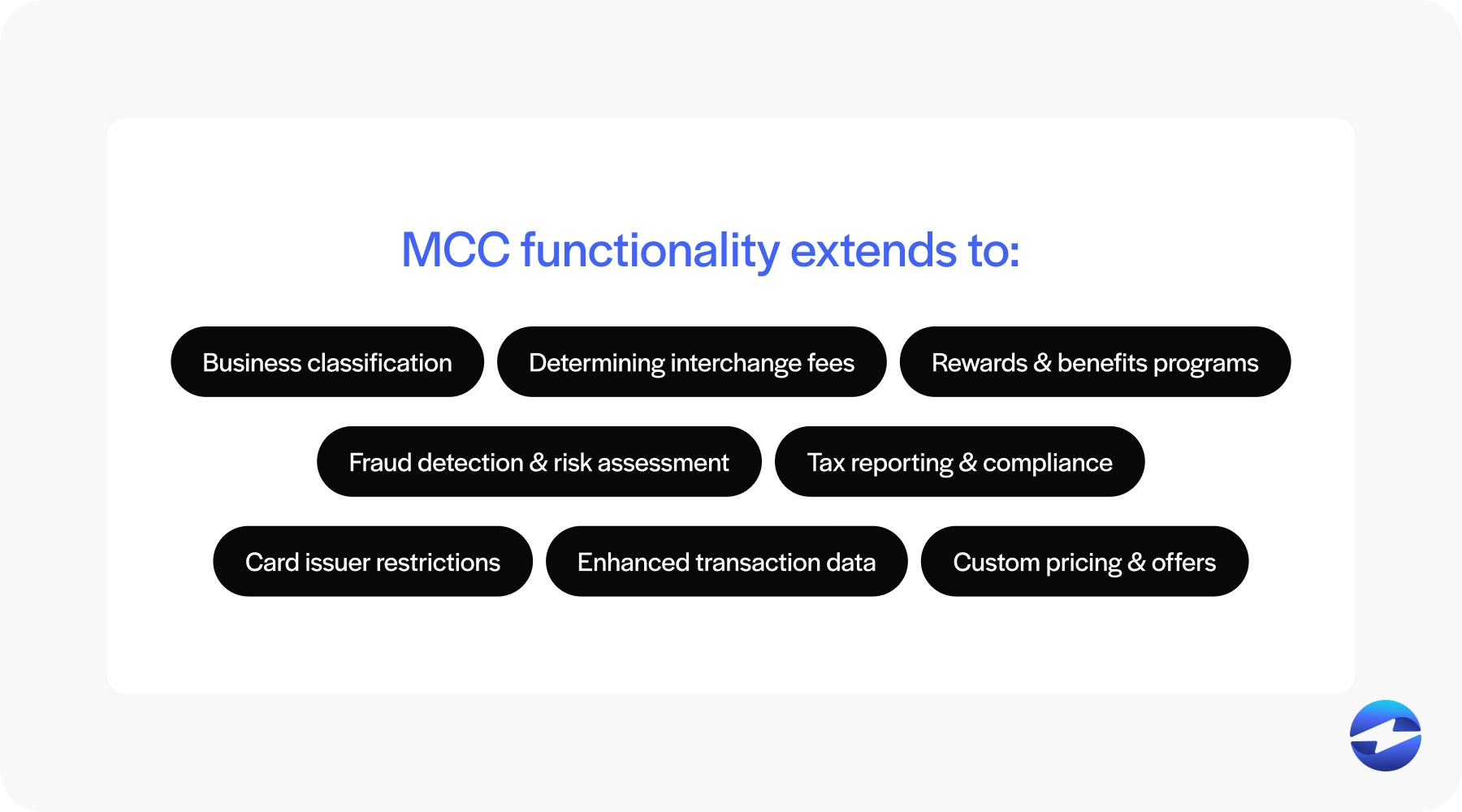

MCC functionality extends into various operational areas such as:

- Business classification: MCCs classify businesses based on their primary services or products. For instance, a business selling school supplies may have a different code than a game shop. This helps credit card companies and payment processors understand what kind of goods or services are being sold.

- Determining interchange fees: Interchange fees are costs paid between banks for accepting card-based transactions. MCCs play a role in setting these fees. For example, transactions at grocery stores may accrue lower fees than luxury goods because of different risk levels and transaction types.

- Rewards and benefits programs: MCCs are key in rewards and benefits programs since credit card companies often offer cashback or points based on the category of purchase. For example, if your card has a home improvement benefit, you may get extra points for shopping at a wallpaper store.

- Fraud detection and risk assessment: MCCs assist fraud detection and risk assessment operations by flagging suspicious transactions. For example, if a credit card is suddenly used at a pawn shop after being consistently used at beauty shops, this can indicate fraud.

- Tax reporting and compliance: MCCs aid in tax reporting and compliance with regulatory bodies like Payment Card Industry Data Security Standards (PCI DSS) and Anti-Money Laundering (AML). Financial institutions use MCCs to monitor transactions and identify unusual or high-risk activities that can signal money laundering, ensuring adherence to AML guidelines. MCCs enable businesses and regulatory bodies to maintain accurate financial records, streamline tax reporting, and reduce the risk of non-compliance.

- Card issuer restrictions: Card issuers sometimes place restrictions on where cards can be used. MCCs help enforce these restrictions. For instance, a card may be restricted from use at specific types of retail outlet services, ensuring it aligns with the cardholder’s preferences or issuer policies.

- Enhanced transaction data: MCCs provide enhanced transaction data, which is more detailed than just a typical sales receipt and can help businesses understand consumer behavior better.

- Custom pricing and offers: With MCCs, businesses can create custom pricing and offers, which can enhance customer loyalty and engagement. For example, a furniture rental service may offer discounts to customers who frequently shop at related MCCs like appliance rentals or commercial furniture shops.

By streamlining processes like fee determination, fraud prevention, and tailored customer offerings, MCCs create efficiencies that benefit all parties involved.

If you’re having difficulty finding your merchant category code, the following section will explain how to find and verify it.

How to find and verify your MCC

Knowing your MCC is crucial for any business, as this four-digit code determines the category of your business type and ensures you pay the correct fees and conduct accurate tax reporting.

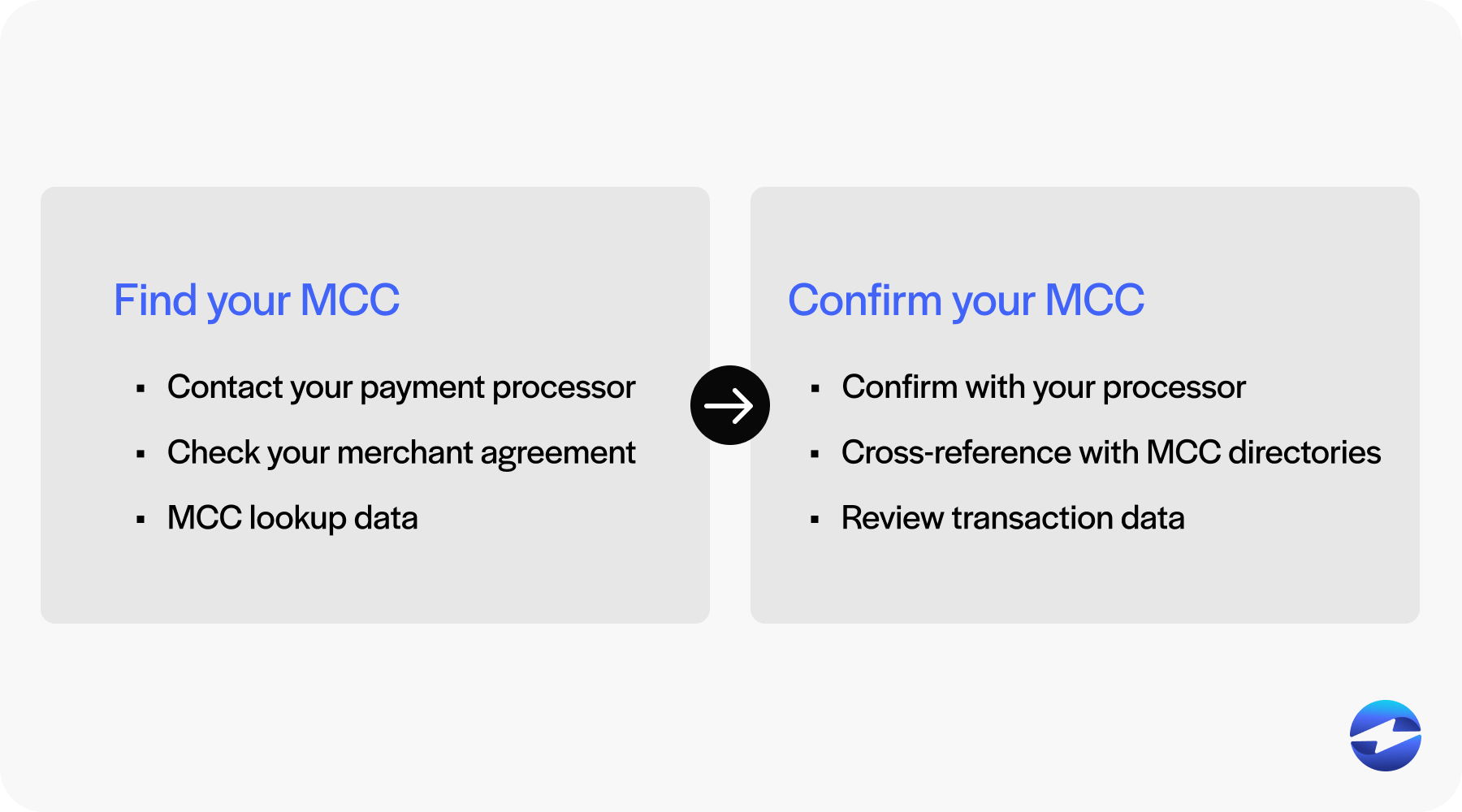

You can follow these three steps to find your merchant category code:

- Contact your payment processor: Contacting your payment processor is one of the simplest ways to find your MCC. Your processor handles your credit card transactions and is a direct and reliable source for your MCC. They can verify that your MCC aligns with your specific business type, whether you run a beauty shop, a pet food business, or an appliance rental service. Additionally, most processors offer customer support services to help you identify and understand your MCC, ensuring clarity and accuracy.

- Check your merchant agreement: Your merchant agreement contains detailed information about your payment processing arrangement, including the MCC. As a standard part of your documentation, MCCs are often listed in sections related to transaction types or fee structures. Reviewing your merchant agreement can also confirm whether the MCC accurately reflects your business activities.

- MCC lookup tools: Online MCC lookup tools typically provide comprehensive lists of MCCs categorized by various business types, such as clothing stores, transportation services, or confectionary shops. With just a few clicks, you can easily match your business to the appropriate MCC. Many of these tools are frequently updated to reflect the latest industry standards and new business categories, offering accessible and up-to-date information to ensure accuracy.

In addition to knowing how to find your MCC, it’s essential to verify these codes are accurate to avoid any discrepancies.

You can follow these three steps to verify your merchant category code:

- Confirm with your processor: To verify your MCC, the first step is to contact your payment processor to confirm which category they have on file for you. This is important because different MCCs can lead to varied interchange rates. Ensuring your code matches your business types helps avoid any unnecessary fees.

- Cross-reference with MCC directories: You can verify your MCC by referencing MCC directories, which list codes and their corresponding business types. By cross-referencing your code with these directories, you can ensure it accurately reflects your business. If you find a discrepancy, discussing it with your payment processor may lead to a reclassification that better fits your services or products.

- Review transaction data: Finally, you can review past transaction data to gain insights into your MCC since card payments often confirm which code is being recorded. This helps ensure consistency in your credit card processing and identifies any potential problems with incorrect categorization.

There are many different merchant category codes, making it difficult to keep track. The following section will provide some MCC examples to help you find your own.

MCC examples

From railroads and travel agencies to grocery stores and medical services, MCCs provide codes that categorize numerous industries for better clarity and transaction structure, accurate reporting, rewards allocation, and compliance.

Here are 57 common MCC examples:

4011 – Railroads – Freight

4111 – Transportation – Suburban and local commuter passengers, including ferries

4112 – Passenger railways

4119 – Ambulance services

4121 – Taxi cabs and Limousines

4131 – Bus Lines

4215 – Courier Services and Ground Freight Forwarders

4468 – Marinas & Marine Service/Supplies

4722 – Travel agencies and tour operators

4784 – Bridge and Road Fees and Tolls

4829 – Money Orders – Wire Transfer

5094 – Precious Stones and Metals, Watches and Jewelry

5122 – Drugs, Drug Proprietors, and Druggist’s Sundries

5211 – Lumber and Building Materials Stores

5310 – Discount Stores

5411 – Grocery Stores and Supermarkets

5441 – Confectionery Stores

5499 – Misc. Food Stores – Convenience Stores and Specialty Markets

5533 – Automotive Parts, Accessories Stores

5541 – Service Stations

5542 – Automated Fuel Dispensers

5722 – Household Appliance Stores

5734 – Computer Software Stores

5812 – Eating Places and Restaurants

5814 – Fast Food Restaurants

5912 – Drug Stores and Pharmacies

5932 – Antique Shops – Sales, Repairs, and Restoration Services

5933 – Pawn Shops and Salvage Yards

5940 – Bicycle Shops – Sales and Service

5941 – Sporting Goods Stores

5942 – Book Stores

5943 – Stationery Stores, Office and School Supply Stores

5944 – Watch, Clock, Jewelry, and Silverware Stores

5945 – Hobby, Toy, and Game Shops

5966 – Direct Marketing – Outbound telemarketing

5967 – Direct Marketing -Inbound Teleservices Merchant

5992 – Florists

5993 – Cigar Stores and Stands

5996 – Swimming Pools – Sales, Service, and Supplies

6012 – Financial Institutions – Merchandise and Services

6300 – Insurance Sales, Underwriting, and Premiums

7011 – Lodging – Hotels, Motels, Resorts, Central Reservation Services (not elsewhere classified)

7033 – Trailer Parks and Campgrounds

7217 – Carpet and Upholstery Cleaning

7230 – Barber and Beauty Shops

7261 – Funeral Service and Crematories

7394 – Equipment Rental and Leasing Services, Tool Rental, Furniture Rental, and Appliance Rental

7512 – Car Rental Companies

7523 – Automobile Parking Lots and Garages

7699 – Repair Shops and Related Services, Not Elsewhere Classified

7995 – Gambling and Betting (Lottery Tickets, Casino Gaming Chips, Off–track Betting and Wagers)

8021 – Dentists and Orthodontists

8099 – Medical Services and Health Practitioners (Not Elsewhere Classified)

8699 – Membership Organizations

8999 – Professional Services

9311 – Tax Payments

9399 – Government Services.

These MCC examples highlight the diverse scope of industries and their integral role in the financial ecosystems.

Setting up your merchant account with EBizCharge

Setting up a merchant account with EBizCharge is a straightforward and efficient process designed to help businesses start accepting online payments seamlessly.

EBizCharge streamlines the application process, guiding merchants every step of the way to ensure a quick and hassle-free setup.

The EBizCharge payment platform is secure and cost-effective, offering advanced security options like fraud prevention tools and 3D Secure and competitive rates that help businesses manage interchange fees and other costs efficiently.

Additionally, EBizCharge provides robust payment integrations that seamlessly sync with the top accounting, enterprise resource planning (ERP), customer relationship management (CRM), and eCommerce systems without disrupting existing workflows.

Working with a transparent and efficient payment processor like EBizCharge can help merchants identify their MCCs for better transaction categorization, compliance, and tax reporting.

By simplifying online payment processing, EBizCharge allows businesses to focus on what matters most – growth and success.