Blog > Understanding Third-Party Billing: A Comprehensive Guide

Understanding Third-Party Billing: A Comprehensive Guide

Third-party billing connects the ideal of streamlined operations with the complexities of today’s market ecosystems. It serves as a fundamental aspect of modern business, allowing companies to outsource their invoicing and payment collection tasks to specialized firms, thereby alleviating the burden.

What is third-party billing?

Third-party billing involves a process where charges for services rendered, or goods sold, are not directly paid by the customer but are billed to an independent entity. This means the third-party payer assumes the financial responsibility for the payment. Commonly utilized in sectors like healthcare, telecommunications, and insurance, it allows a specialized organization or service provider to manage the invoicing and collection of payments on behalf of the original company, streamlining AR operations and improving cash flow.

Importance of third-party billing in modern business operations

The prevalence of third-party billing in modern business operations cannot be overstated. In many industries, it streamlines financial transactions by outsourcing billing processes to specialized companies, thereby reducing administrative burdens on businesses. It enables companies that need more infrastructure for extensive billing and collections to access these services without heavy investment. Third-party billing can also offer customers more flexible payment options, indirectly contributing to customer satisfaction and loyalty. Furthermore, it can expedite payment cycles and improve cash flow for businesses, as third-party companies often have optimized processes for efficient accounts receivable management.

How third-party billing works

Third-party billing operates through a defined, multi-step sequence that involves various entities beyond the buyer and seller. When a customer purchases a service or product, the vendor provides the service or delivers the product but does not charge the customer directly. Instead, an intermediary, the third-party billing company, is tasked with handling the transaction.

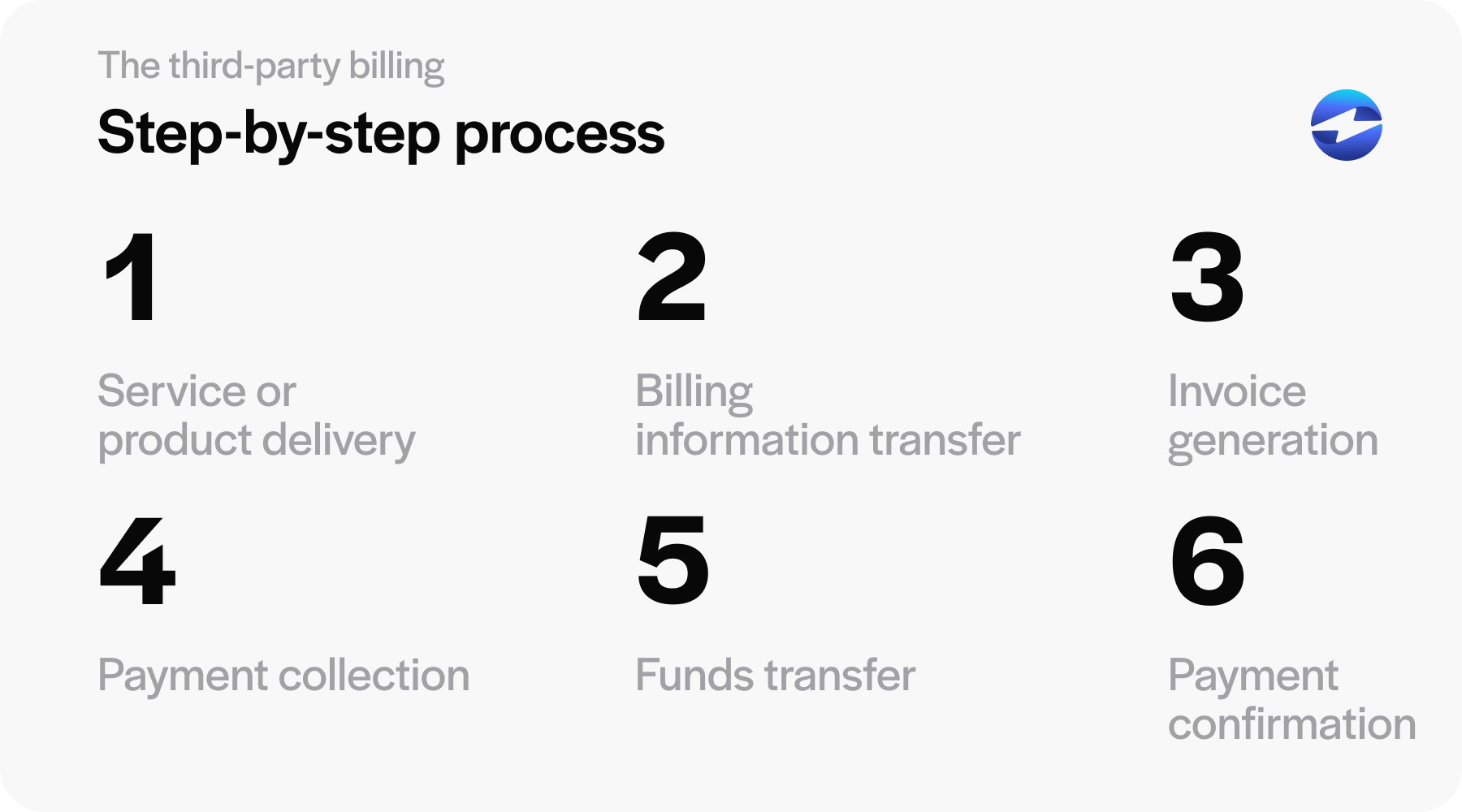

Below is the step-by-step process third-party billing goes through when handling a transaction.

Step-by-step process

The intricacies of third-party billing can be broken down into a simplified step-by-step process:

- Service or Product Delivery: The customer receives a product or service from the provider.

- Billing Information Transfer: The provider submits the necessary billing details to the third-party billing company. This often includes the cost of the product or service, customer contact information, and any other pertinent data.

- Invoice Generation: The third-party billing company uses the provided information to generate an invoice, which is then sent directly to the customer.

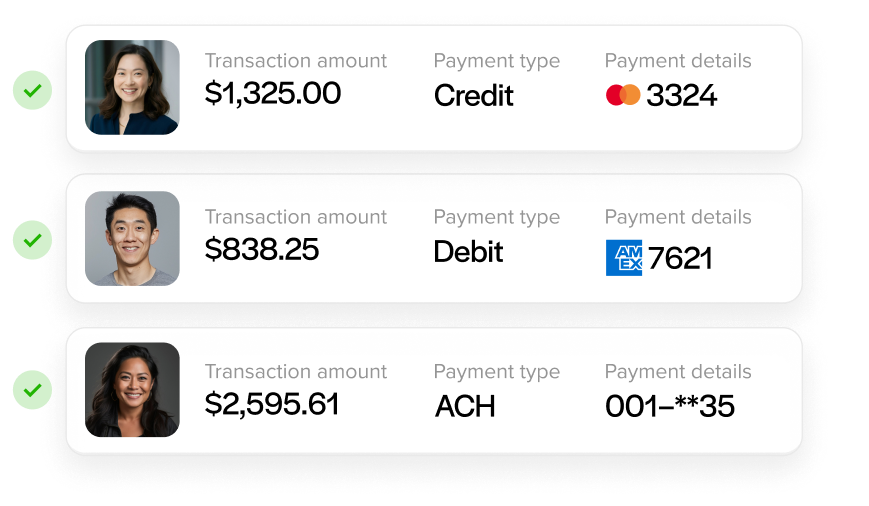

- Payment Collection: The customer pays the invoice. Payment options may include credit/debit cards, bank transfers, or other payment methods facilitated by the third-party billing company, which often enables no-fee credit card processing for the customer.

- Funds Transfer: Once payment is collected, the third-party company deducts their service fee and transfers the remaining funds to the provider.

- Payment Confirmation: The original provider is informed of the completed transaction, and the customer’s account is updated to reflect the payment.

By following these steps, third-party billing streamlines the entire transaction process from the point of sale to the final payment, ensuring accuracy and efficiency for both the business and the client. This method centralizes financial transactions and reduces errors and delays that can negatively impact cash flow and customer relations.

Benefits of third-party billing

When businesses choose third-party billing, they tap into a wealth of advantages. Utilizing these services often translates into reduced financial strain and more streamlined operations. Firms specializing in billing provide enhanced proficiency by staying abreast of the latest protocols in financial processing. This expertise not only refines the billing cycle but also assists in maintaining a healthy cash flow.

Cost Efficiency

One of the principal incentives to enlist a third-party billing provider is the opportunity for cost savings. With third-party billing, companies can cut down on the need to hire and train a dedicated billing department. Furthermore, businesses can allocate their resources more effectively by avoiding investments in specialized billing software and infrastructure, emphasizing their core competencies and growth potential.

Ensuring Compliance with Industry Regulations

Navigating the complex web of industry regulations can be daunting. Third-party billing ensures that billing practices conform to current legal standards. This adherence shields companies from the repercussions of unintentional regulatory oversights and upholds business reputability.

Simplifying Invoice Collection

Managing invoice collection can take time and effort. Delegating this task to experienced third-party billing services can simplify the process, as they employ efficient strategies and technologies for timely follow-ups and payment streamlining. This not only expedites payments but also alleviates the administrative burden on staff.

Regulatory Compliance

Maintaining regulatory compliance is critical, given the ever-evolving nature of industry-specific legislation and standards. Third-party billing agencies specialize in keeping abreast of these changes, thus ensuring that businesses remain compliant and avoid potential legal complications.

Improved Cash Flow Management

Effective cash flow is vital to any business’s health. Third-party billing services can optimize this through meticulous invoicing and swift collection practices, resulting in more predictable revenue streams and improved financial forecasting.

Safety

Concerns over data security and the safety of sensitive financial information are paramount. Professional billing companies employ robust security measures to protect data integrity and confidentiality. This reduces the risk of breaches and builds trust between the business and its clients.

Limitations of third-party billing

While third-party billing services can bring considerable advantages to a business, it’s important to acknowledge certain limitations that accompany their use.

Loss of Control Over Your Finances

Relying on an external entity for billing services can lead to a feeling of diminished control for some businesses, particularly concerning day-to-day oversight and troubleshooting of financial transactions. Such reliance might affect the immediate responses to inquiries from customers or adapting to unique billing scenarios that require a company’s direct intervention.

Additional Costs and Fees

Although third-party billing can be cost-effective in many respects, it’s vital to consider this service has expenses. Businesses may face additional costs such as setup fees, monthly charges, and percentages of the collected revenue. Companies need to factor these additional costs into their financial planning to ensure that the benefits of using a billing service outweigh these expenses.

Data Security Concerns

The digital handling of sensitive financial information invariably raises questions regarding data protection. While third-party billing companies often implement robust security measures, the risk of data breaches cannot be entirely removed, and entrusting critical data to an outside firm always involves a calculated risk. Businesses must, therefore, conduct due diligence in assessing the security protocols of their chosen billing providers to mitigate potential data vulnerabilities.

It’s prudent for businesses to consider the limitations of third-party billing concerning control, costs, and security. A balanced evaluation of these factors will enable a decision that aligns closely with the company’s operational procedures and financial goals.

An alternative to third-party billing with EBizCharge

Rather than outsourcing billing to a third party, businesses can bring the entire process in-house by connecting payments to the tools they already use. With payment processing for NetSuite, finance teams can automate invoicing, collect payments, and reconcile transactions directly within their ERP. Sales-driven organizations can take a similar approach with a Salesforce credit card integration that lets teams collect payments without leaving their CRM. Both options give businesses full control over their billing while eliminating the manual work that makes third-party services appealing in the first place.

Understanding the intricacies of billing strategies is crucial for businesses striving for efficiency. Third-party billing involves outsourcing the invoice and payment process to an external entity. However, there’s an alternative worth considering: EBizCharge.

EBizCharge stands out as a comprehensive solution that simplifies the payment process and significantly reduces time and effort spent tracking payments. It seamlessly integrates into existing ERP or accounting systems, eliminating the need for third-party billing services. Businesses can streamline their accounts receivable process while customers enjoy a smooth and secure transaction experience.