Blog > Understanding Financing for Manufacturers

Understanding Financing for Manufacturers

Manufacturers often face unique challenges, from managing working capital to funding research and development. The right financial support is essential for those looking to enhance operations, foster innovation, or scale their business.

This article will explore the various facets of financing for manufacturers, including what it entails, why it’s necessary, and how businesses can effectively navigate the financing process.

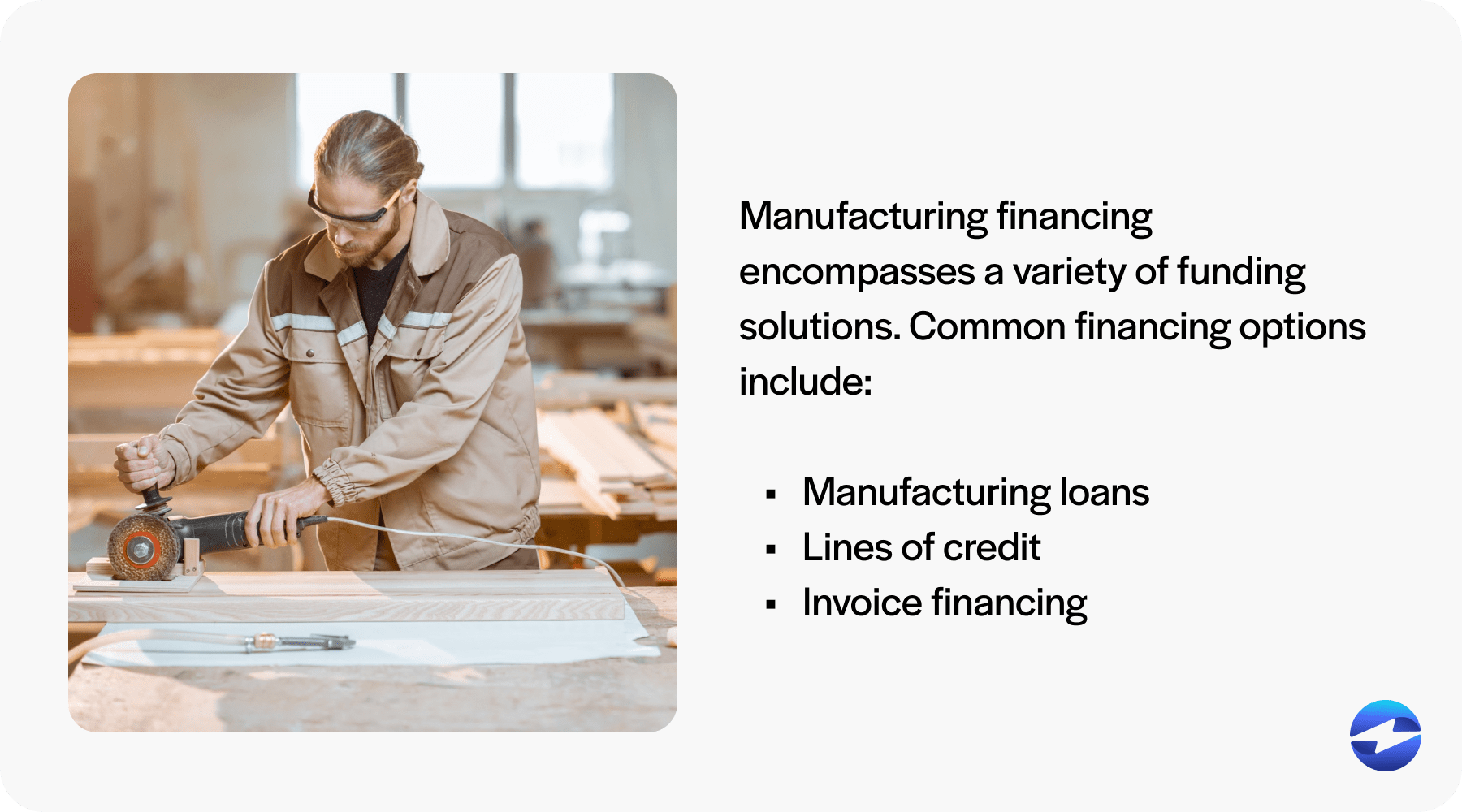

What is manufacturing financing?

Manufacturing financing encompasses a variety of funding solutions tailored to meet the financial needs of manufacturers. These solutions support expenses related to production, equipment purchases, and daily operations. Common financing options include manufacturing loans, lines of credit, and invoice financing.

Manufacturing loans are designed for large-scale projects and business expansions, while equipment loans facilitate the purchase or upgrade of machinery. By providing funds when cash reserves are low, financing helps manufacturers avoid financial strain.

Why manufacturers need financing

Manufacturers operate in a high-stakes environment where significant upfront costs and ongoing operational expenses are the norm. From purchasing equipment to acquiring raw materials, the financial demands of manufacturing can be overwhelming. This is where financing becomes a critical lifeline, enabling businesses to navigate these challenges and thrive.

Here are a few reasons why manufacturers need financing:

Working capital requirements: Manufacturers often face challenges with working capital requirements. This money is used for expenses like payroll, rent, and utilities. For instance, cash tied up in unpaid invoices can cause cash flow issues. Financing, such as lines of credit or invoice financing, provides funds to cover these expenses, preventing financial strain and helping to maintain production lines.

Innovation and R&D: Financing is key to innovation and research and development (R&D) for manufacturers. Investing in new products and technologies requires capital. With proper financing, companies can explore new ideas and stay competitive. Funding options include business loans or specialized R&D financing. This helps manufacturers keep up with market demands and enhance their offerings.

Scaling operations: Scaling operations are essential for manufacturers looking to grow. This means expanding production capacity, hiring more staff, and opening new manufacturing facilities. Financing supports large projects and expansions through manufacturing loans or equipment loans. These funds help purchase machines or upgrade existing equipment. With scaling, manufacturers can meet increasing demand and boost efficiency.

Financing isn’t just a tool for covering costs; it’s a strategic resource that empowers manufacturers to achieve their goals. By addressing working capital needs, funding innovation, and supporting growth initiatives, financing ensures manufacturers can operate efficiently and adapt to changing market conditions.

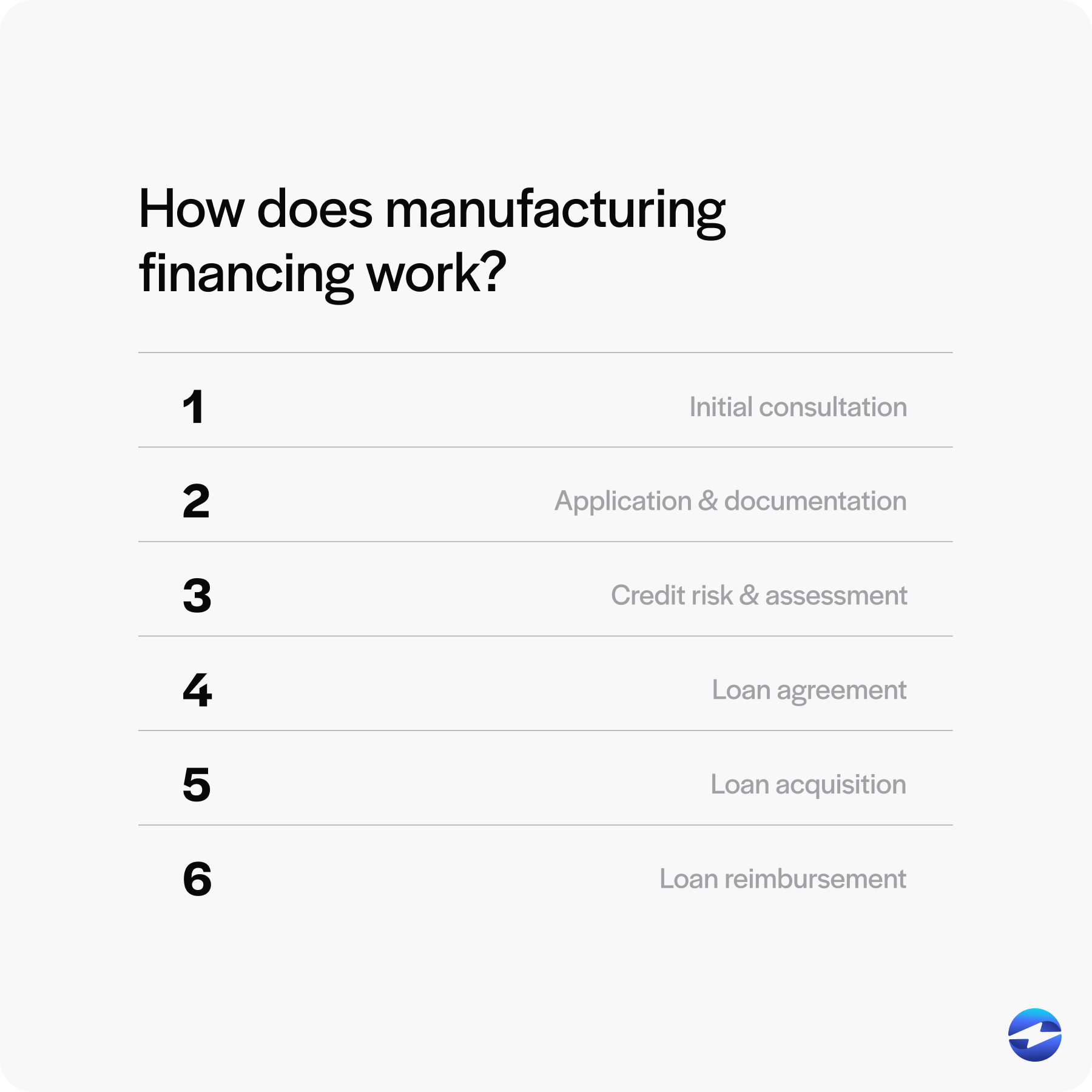

Applying for manufacturing financing is a fairly simple process consisting of only six steps.

How does manufacturing financing work?

Whether you need a manufacturing loan or invoice financing, knowing your options can help you manage cash flow and avoid financial strain. This knowledge ensures manufacturers can plan their production capacity and maintain smooth business operations.

Here is a quick breakdown of how the financing process works:

1. Initial consultation

The first step in manufacturing financing is having an initial consultation. During this session, you discuss your business needs with your financial advisor. This meeting helps you identify the types of financing that best suit your manufacturing business. You might discuss equipment purchases, cash reserves, or how to handle unpaid invoices. The goal is to explore financing options that offer favorable terms and fit your situation.

2. Application and documentation

After the initial consultation, manufacturers fill out the necessary forms to apply for financing. This step involves gathering vital documents like financial statements and business plans. These documents give lenders insight into your business and help them determine your loan eligibility. Organized documentation can speed up the process, leading to quicker approvals.

3. Credit and risk assessment

The next step involves credit and risk documentation. Lenders assess your credit scores and evaluate potential risks. They look at your business’s history and its ability to repay loans. This evaluation determines the types of loans you may qualify for. High credit scores can lead to better terms, such as lower interest rates and longer repayment schedules.

4. Loan agreement

Once your credit is assessed, you move on to the loan agreement. In this step, you agree to the terms and conditions set by the lender. This includes confirming the loan amount, interest rate, and any aspects that can prevent surprises and help maintain good cash flow management.

5. Loan acquisition

Loan acquisition is when funds are distributed to you after the agreement is signed. Whether from traditional banks or online lenders, the funds help cover upfront costs like equipment purchases or expanding manufacturing facilities. Acquiring the loan allows manufacturers to enhance production capacity, improve production lines, and maintain effective business operations.

6. Loan reimbursement

The final step in manufacturing financing is loan reimbursement. Here, businesses repay the loan according to the agreed-upon terms. This usually involves making monthly payments, but it can vary based on the lender and loan type. Adhering to the repayment schedule is vital to avoid financial discrepancies and maintain good credit. It ensures long-term financial health and opens doors to future financing options when needed.

The initial consultation will allow you to determine if they qualify for financing. Before the consultation, businesses can also do a quick self-evaluation to determine their eligibility.

Qualifying factors for manufacturing financing

Securing financing for a manufacturing business involves several factors. Lenders examine these elements to assess risk and determine eligibility. Understanding what these factors entail can help manufacturers better prepare for financing applications.

- Credit score: Lenders use credit scores to gauge the risk of lending to a business. A higher score often means better terms and easier access to loans, serving as a quick snapshot of your creditworthiness.

- Financial history: Lenders look at past earnings, expenses, and financial stability. Consistent growth and well-managed finances can boost confidence and improve loan prospects.

- Cash flow: Lenders want to see that a business can cover day-to-day expenses and repay loans on time. Positive cash flow suggests a healthy business capable of managing financial obligations.

- Collateral: Collateral helps secure a loan by offering assets as backup. It can be equipment, property, or inventory. Lenders feel safer lending to businesses that have collateral. It reduces risk and can lead to more favorable terms.

- Business plan: A strong business plan outlines goals, strategies, and financial projections. It shows lenders how you plan to grow and succeed. A well-crafted plan reassures lenders that you have a clear direction and are ready for challenges.

- Industry experience: Lenders prefer businesses run by people who understand their market. Expertise reduces risk and increases confidence in a business’s ability to thrive.

- Debt-to-income ratio: The debt-to-income ratio compares existing debt to income. A lower ratio means less risk for lenders. It shows that your business isn’t over-relying on debt and can manage repayments effectively. Keeping this ratio in check is crucial for securing loans.

Qualifying for manufacturing financing requires careful preparation and a solid understanding of what lenders look for. From maintaining a strong credit score to presenting a detailed business plan, each factor plays a critical role in building lender confidence and securing favorable terms.

Financing options for manufacturers

Manufacturers have access to various financing options tailored to meet their unique needs and challenges. From managing day-to-day cash flow to investing in equipment or scaling operations, these funding solutions play a crucial role in driving business growth and stability. Understanding the range of available options empowers manufacturers to make informed decisions and secure the resources they need to thrive in a competitive market.

- Net terms financing: Net terms financing lets manufacturers delay payment for goods received. This option helps manage monthly payments by extending repayment schedules. It provides more time to generate revenue from sold products before they have to pay suppliers.

- Asset finance: Asset finance allows manufacturers to buy equipment using the asset as collateral. This reduces upfront costs for essential purchases, like machinery, and helps manage operating expenses efficiently.

- Secured loans: Secured loans involve borrowing funds with collateral backing the loan. These loans provide favorable terms and are ideal for manufacturers with valuable assets, such as properties or large machinery.

- Unsecured loans: Unsecured loans don’t require collateral. These are suitable for manufacturers who may not have assets to pledge. Though they often have higher interest rates, they provide an option for quick cash without risking assets.

- Invoice finance: Invoice finance gives manufacturers immediate access to cash by borrowing against unpaid invoices. This funding option aids in maintaining smooth cash flow and tackling financial strain without waiting for customer payments.

- Trade credit: Trade credit allows manufacturers to obtain goods or services now and pay later. It offers a way to increase production capacity without immediate financial outflow, which helps manage business operations.

- Lines of credit: Lines of credit provide flexible access to funds for manufacturers, helping them manage cash flow and daily expenses. It ensures money is available when unexpected costs arise or when expanding production lines.

- Invoice factoring: Invoice factoring involves selling unpaid invoices to a lender at a discount. This option provides immediate cash, improving cash reserves and enabling manufacturers to manage cash flow without waiting for customer payments.

- Manufacturing business loans: Manufacturing business loans are general-purpose loans designed to meet various business needs. They can help fund expansions, cover operating costs, or increase production capacity with repayment terms tailored to business size and goals.

- Finance cash flow: Financing cash flow involves using various funding sources to maintain a steady cash supply. This approach ensures manufacturers can cover planned and unforeseen expenses without financial strain.

- Ledgered line of credit: A ledgered line of credit is a type of financing where specific invoices secure borrowing. This option helps manufacturers to get flexible funding while keeping track of which invoices cover the borrowed amount.

- Manufacturing equipment: Manufacturing equipment financing specifically aids in buying production machinery. It allows manufacturers to spread the cover over time, reducing the burden of upfront costs and facilitating production line upgrades.

- Venture capital for manufacturing: Venture capital involves investors funding companies with growth potential. For manufacturers, securing venture capital can provide significant funds for innovation and expansion, often in exchange for equity in the business.

By evaluating these options carefully and aligning them with their specific needs, manufacturers can build a strong financial foundation that supports both short-term and long-term success.

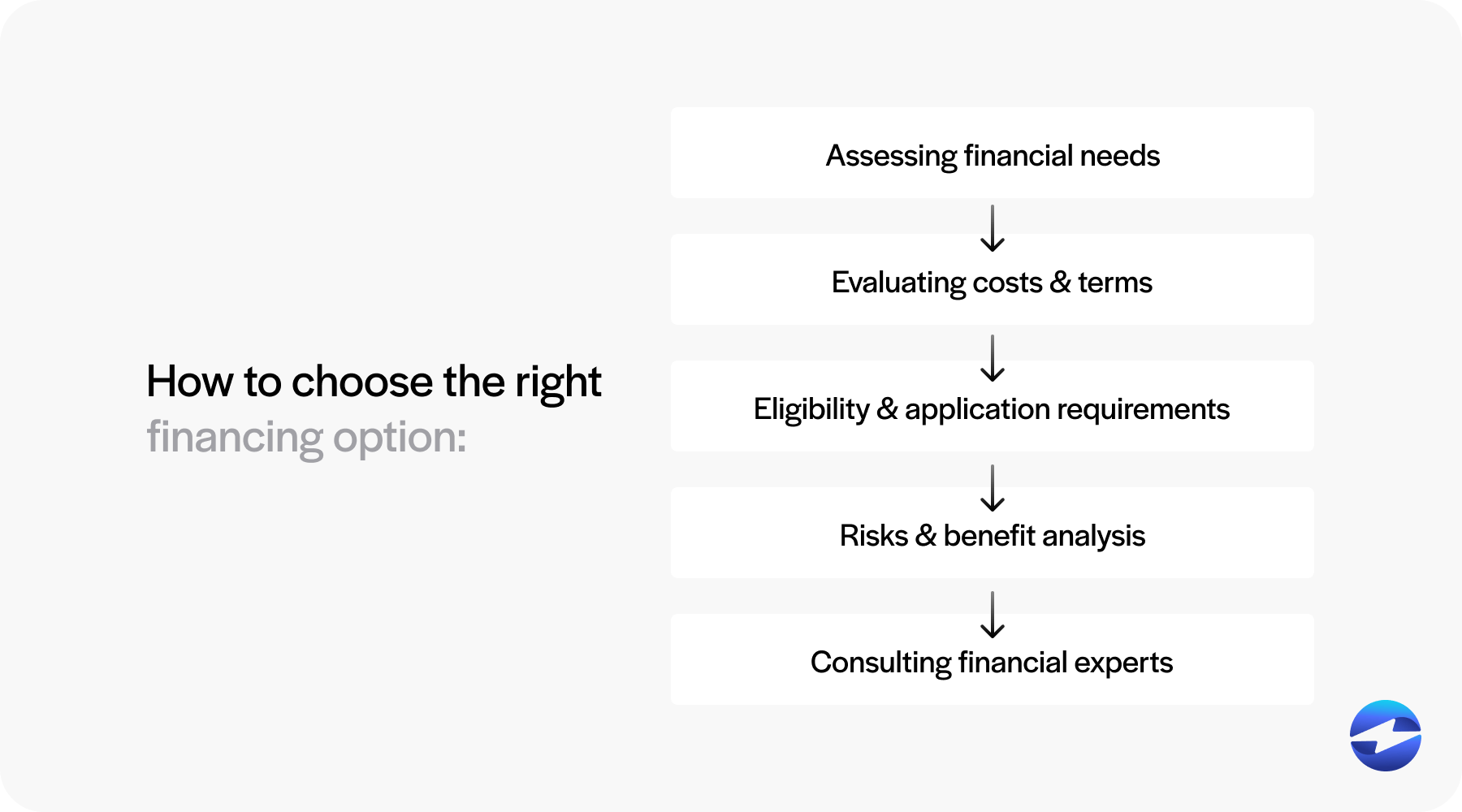

How to choose the right financing option

With numerous options available, it’s important for manufacturers to carefully assess their specific needs, evaluate costs and terms, and consider eligibility criteria. By taking a strategic approach and analyzing risks and benefits, businesses can identify financing solutions that align with their goals and drive long-term success.

- Assessing financial needs: Manufacturers should identify what they need money for. It could be for upfront costs in setting up new production lines or daily expenses. Knowing your needs helps you pick suitable financing options, like short-term loans for immediate costs or long-term loans for new equipment purchases. Clear financial goals ensure manufacturers choose the right type of financing to meet their business operations.

- Evaluating costs and terms: Different loans have different interest rates and repayment schedules. For example, traditional banks may offer long-term loans with fixed rates, but they might require high credit scores. In contrast, online lenders might provide flexible options with varying terms. Comparing these costs helps manufacturers find loans with favorable terms and ensures manageable monthly payments.

- Eligibility and application requirements: Each type of loan has its own criteria. For instance, invoice financing might need proof of unpaid invoices, while equipment loans require documentation of equipment purchases. Knowing these requirements helps manufacturers prepare the necessary paperwork, making the application process smoother and increasing the chances of approval.

- Risks and benefits analysis: While some loans may offer immediate cash reserves, they might also come with long-term costs or financial strain. Weighing the potential benefits against the risks allows manufacturers to make informed decisions. This ensures they choose a loan that supports their business growth without unmanageable debt.

- Consulting financial experts: Financial professionals can provide insights into various financing options and their implications. They can help analyze credit scores, assess production capacity needs, and guide repayment terms. A financial

expert’s advice can lead to better financing decisions, ensuring manufacturers choose options that best fit their business goals and minimize risks.

Collaborating with financial experts can further enhance decision-making, ensuring manufacturers secure financing that strengthens their business and positions them for sustained success in a competitive marketplace.

EBizCharge’s lending program

EBizCharge’s lending program, in partnership with Lendica, offers a tailored solution for manufacturing business loans by combining EBizCharge’s payment processing expertise with Lendica’s innovative technology. This partnership provides manufacturers with quick access to funds, competitive terms, and a seamless application process. With features like automated approvals and integration with existing payment systems, manufacturers can address cash flow challenges, fund equipment purchases, or scale operations efficiently. The collaboration ensures that manufacturers receive financing solutions designed to meet the unique demands of their industry while maintaining financial flexibility and operational stability.

By leveraging strategic financing solutions and seeking guidance from experts, manufacturers can not only overcome immediate challenges but also build a resilient foundation for innovation, scalability, and long-term success in an ever-changing market.