Blog > Top Expense Policy Strategies for Modern Businesses

Top Expense Policy Strategies for Modern Businesses

In today’s competitive business environment, every penny counts, and an expense policy is a must. A robust expense policy provides a framework for how employees should spend company funds, ensuring accountability and preventing fraud.

Understanding the components of an expense policy is vital for any organization aiming to streamline its expense reporting policy. Clarifying categories, documentation, approval processes, and non-reimbursable items can make or break a business expense policy’s success. This article lays out essential strategies to construct a clear and comprehensive guideline for expenditure.

What is an expense policy?

An expense policy is a set of guidelines that a company establishes to manage business-related spending by its employees. This policy outlines acceptable expenses, the procedures for submitting expenses for reimbursement, and the roles and responsibilities of staff and management in the expense reporting process. A thorough expense policy ensures financial control and compliance with regulatory requirements.

By implementing a clear and concise expense policy, businesses can reduce the risk of fraud, prevent overspending, and promote transparency in financial practices. An effective policy also helps optimize the expense reporting process, making it easier for employees to comply and for the finance department to process and monitor company expenditures.

Why is it essential to write a solid expense policy in modern business?

A solid expense policy is paramount to ensure transparency and accountability, paving the way for smooth financial operations and compliance with tax regulations.

A well-crafted expense policy serves as a clear guideline for employees to determine what qualifies as a reimbursable business expense and to prevent misuse of company resources. Additionally, it simplifies the expense reporting process, aiding in seamless bookkeeping and budgeting.

An expense policy also reduces the risk of fraud and financial discrepancies. Enforcing explicit procedures for approval and reimbursement creates a standard for audits. It contributes to employee morale by establishing trust and fairness in expense management.

With a firm business expense policy, your company can generate better future growth initiatives and monetary projections and maintain financial integrity.

How do you write an expense policy?

Crafting an expense policy begins with a thorough understanding of the company’s financial needs and compliance requirements. The goal is to create straightforward, enforceable guidelines that govern how expenses are reported, approved, and reimbursed.

To write an effective policy, you need to complete the following steps:

- Outline allowable expenses: Outline the expenses eligible for reimbursement and the conditions under which they qualify.

- Specify documentation requirements: Specify the necessary documentation, such as receipts or invoices, needed to support expense claims.

- Submission process: Describe the process for submitting claims, including the timeframe and method of reimbursement.

- Establish responsibilities: Indicate who is authorized to approve expenses and outline the responsibilities involved.

- Include provisions for exceptions: Address scenarios requiring higher management approval. This ensures that unique or unforeseen situations are handled appropriately and with the necessary oversight.

- Address violations and discrepancies: Provide steps for handling policy violations and discrepancies and create an avenue for queries or disputes.

- Integrate technology: Recommend or require expense management software to streamline reporting and ensure accuracy.

- Review and update regularly: Continuously update the policy to reflect changes in tax laws or business structure.

Once you have a framework for writing your expense policy, it’s essential to ensure it covers all necessary areas comprehensively.

8 critical components of an expense policy

Creating a comprehensive expense policy is essential for managing business finances effectively.

To achieve this, you can include the following eight components in your expense policy to ensure clarity, consistency, and compliance across your organization.

1. Purpose and scope

The scope of a company expense policy typically includes various expenditures, such as travel costs, meals, accommodation, and office supplies. It outlines the expense approval process, sets spending limits, and describes the documentation required for reimbursement.

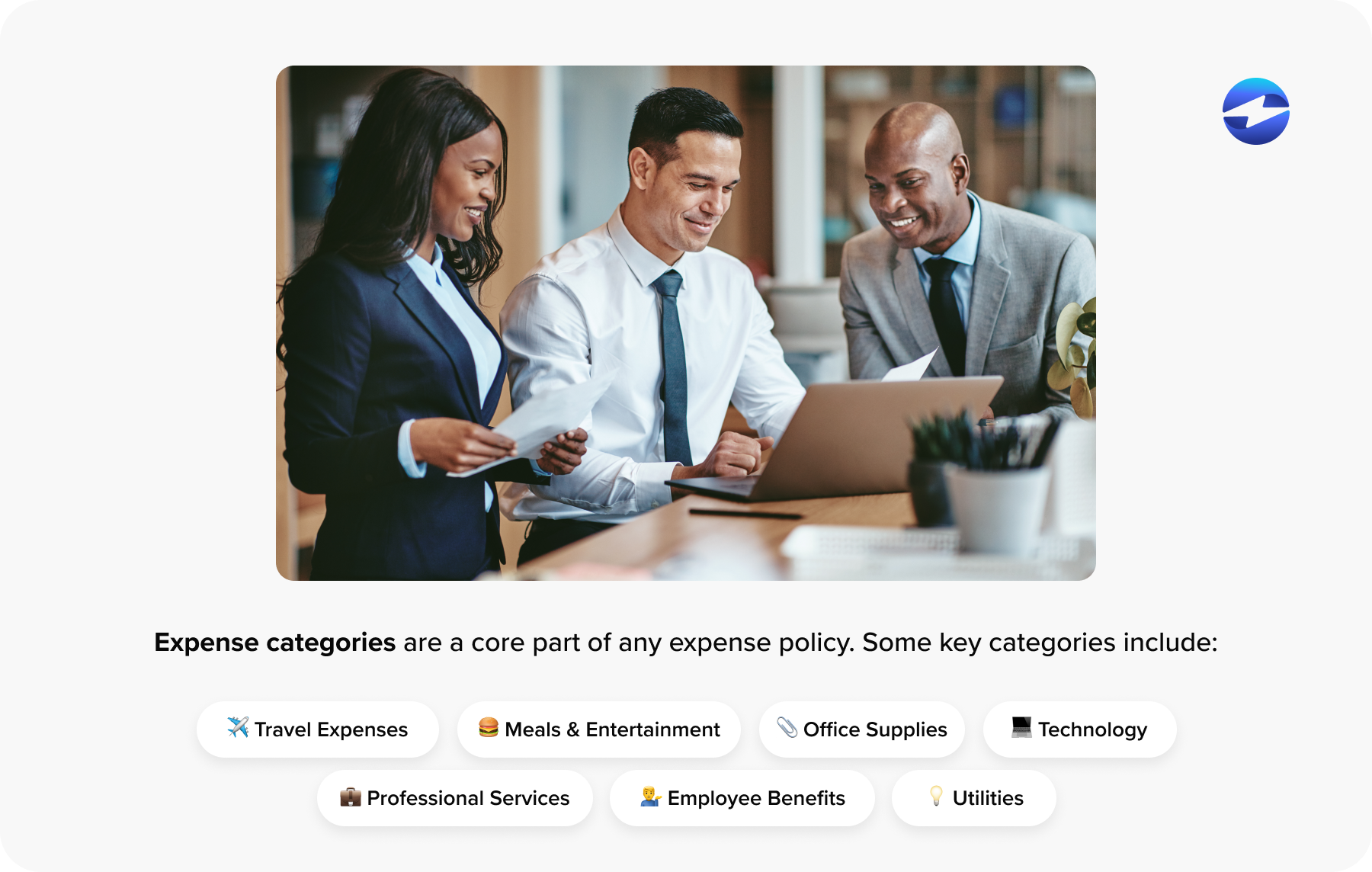

2. Expense categories

Expense categories are a core part of any expense policy since they delineate how costs are recognized and accounted for within a company’s financial systems. A well-defined expense categories list helps staff and finance departments manage and track expenditures effectively. Key expense categories typically include:

- Travel expenses: Costs associated with business travel, such as airfare, lodging, and transportation.

- Meals and entertainment: Spending on food and activities during business operations.

- Office supplies: Purchases of stationery, software, and other consumables used for business operations.

- Professional services: Fees for external services like consulting, legal advice, or marketing.

- Employee benefits: Costs related to health insurance, retirement plans, or other employee perks.

- Technology expenses: Investments in hardware, software, and IT support.

- Utilities: Charges for electricity, water, internet, and other essential services.

Each expense category streamlines the expense reporting process, aiding in accurate record-keeping and ensuring that company funds are used appropriately. A business expense policy should clearly outline acceptable spending limits and protocols for each category, providing a clear framework for expense management.

3. Documentation requirements

Documentation requirements are a crucial element of a solid expense policy. Essentially, employees must provide adequate documentation for each expense they report. This typically includes itemized receipts, invoices, and proof of payment.

For example, a company expense policy may stipulate that any business expense over $25 requires an itemized receipt for reimbursement.

Essential documentation requirements often found in expense policies include:

- Itemized receipts for lodging, meals, and transportation

- Boarding passes for air travel

- Mileage logs for personal vehicle use, dates, distances, and business purposes

- Conference and seminar materials when attendance is funded

An effective expense reporting policy will also outline the acceptable submission format, whether digital copies or original paper receipts are required. Timeliness is also highlighted, as many business expense policies demand documentation to be submitted within a specific timeframe to avoid financial discrepancies.

Clear documentation rules support transparency and ease auditing, reinforcing the company’s commitment to financial accountability.

4. Expense approval process

An efficient expense approval process is vital for streamlining the review and authorization of business expenses.

An expense approval process begins with the establishment of clear thresholds, where expenses below a certain amount may require minimal approval, while higher expenditures necessitate multiple levels of authorization. A tiered system ensures that higher expenses receive appropriate scrutiny.

A standardized form or digital submission platform aids in consistency and expedites the approval workflow. To maintain compliance and budgetary control, the expense approval process should have designated approvers familiar with the company expense policy.

Moreover, setting turnaround times for approvals helps in reducing bottlenecks and keeps the process moving efficiently. For transparency and accountability, each expense report must include details such as date, purpose, and receipts, ensuring all submissions are complete and verifiable.

By adhering to these components, businesses can maintain financial operations while permitting necessary expenditures to proceed without delay.

5. Non-reimbursable expenses

Non-reimbursable expenses are critical to any expense policy since they clarify the internal spending a business doesn’t cover. An effective expense reporting policy typically highlights these exclusions to prevent misunderstandings.

Common examples of non-reimbursable expenses include:

- Personal items and services (family-related costs or personal entertainment)

- Traffic fines or legal penalties incurred while on business travel

- Expenses exceeding set limits or needing proper documentation

- Upgrades beyond approved travel or accommodation classes

- Alcohol or extravagant meals

A business expense policy clearly defines non-reimbursable expenses, safeguarding the company’s resources, guiding employees on acceptable spending, and aiding in financial planning and regulatory compliance.

By excluding personal and non-essential expenses from reimbursement, expense policies set clear boundaries for employee spending, and encourage accountability and cost control within an organization.

6. Per diem rates

Per diem rates, a cornerstone of many business expense policies, are fixed amounts of money given to employees to cover daily expenses while on business travel. Rather than saving every receipt, a per diem simplifies expense reporting by providing a pre-determined allowance for meals, lodging, and incidental costs. The federal government often sets these rates, varying by destination and time of year.

A company can use the General Services Administration (GSA) rates in the U.S., updated annually, or create its own rates based on internal cost analysis. Sticking to per diem rates helps businesses maintain clear expense policies, control costs, and reduce the time spent processing expense reports.

Although helpful, per diem rates must be managed carefully within a company expense policy to ensure compliance and fairness. Employees should be informed about what expenditures are covered and the documentation required for exceptions.

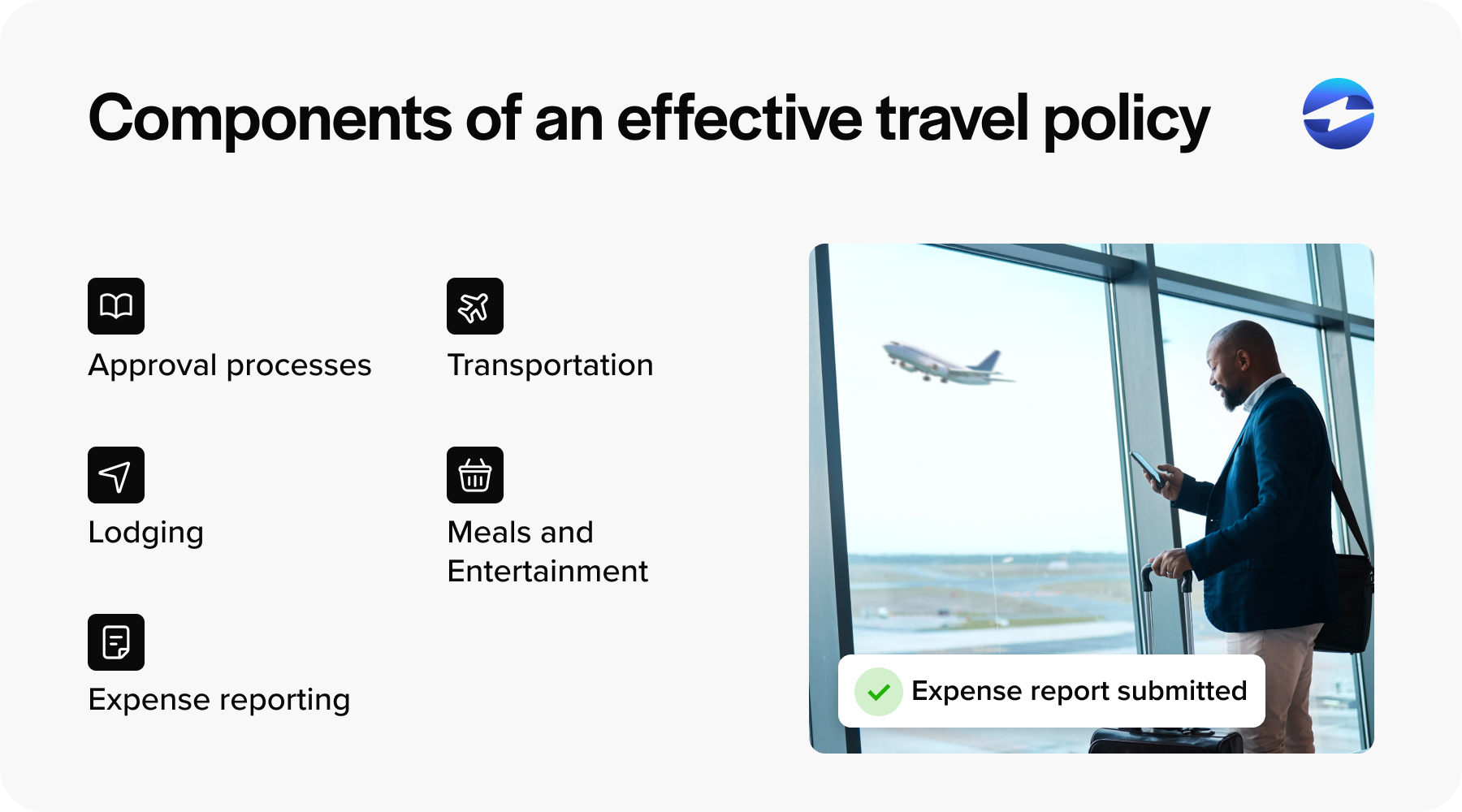

7. Travel policy

A travel policy is a critical segment of an expense policy that explains allowable expenses and procedures for employees while traveling on business. An efficient travel policy ensures cost control, compliance, and employee safety.

Travel policies typically include guidelines on transportation methods, accommodation preferences, per diem allowances, and the process for submitting travel expenses.

An effective travel policy must clearly outline:

- Approval processes: Establish who must authorize trips and the criteria for approval.

- Transportation: Specify preferred transportation modes, booking methods, and spending limits.

- Lodging: Identify preferred hotel partners and budget constraints.

- Meals and entertainment: Define daily meal allowances and rules for entertaining clients.

- Expense reporting: Clarify documentation needed, acceptable time frames for reports, and reimbursement procedures.

Businesses should regularly update and train their staff on travel policies to keep up with changing travel norms and regulations. Transparency in the policy contributes to higher compliance and reduces the risk of fraudulent claims.

As part of the business expense policy, a well-formulated travel policy supports fiscal responsibility and fosters trust between employers and employees.

8. Expense reimbursement

Expense reimbursement refers to the process by which companies pay back employees who have spent their own money on business-related expenses. A clear expense reporting policy is crucial to ensure that the reimbursement is fair and within company guidelines.

Standard components of an expense reimbursement policy may include:

- Eligible expenses: Eligible expenses are purchases that are reimbursable, such as travel, lodging, meals, or materials.

- Receipts and documentation: Employees must provide proof of purchase in the form of receipts or other documents to avoid fraudulent claims.

- Spending limits: Travel policies may set per diem rates or maximum limits on specific spending categories.

- Approval process: The approval process defines which employees can approve expenses.

- Reimbursement method and timing: The reimbursement and timing method explains how and when employees will receive their reimbursements.

Companies use a business expense policy to maintain budget control, ensure compliance with tax laws, and prevent misuse of funds.

By establishing a company expense policy, businesses can streamline the expense reimbursement process, making it efficient and transparent for all parties involved.

Best practices for implementing expense policies

When implementing expense policies, businesses must focus on clarity and consistency to clearly outline the proper restrictions and guidelines, ensuring they’re comprehensive and leave no room for ambiguity.

To ensure adherence, a user-friendly expense reporting policy is vital. Businesses should invest in digital tools that facilitate quick reporting and reimbursement. Establishing a pre-approval process for unusual expenses aids in maintaining budget control.

Transparency in a company expense policy builds trust, so regular updates and clear communication channels are essential. Training in expense policies also ensures everyone knows the procedures and the repercussions of non-compliance.

Finally, periodic reviews enable businesses to adjust their expense policies to changing economic conditions and business needs, ensuring sustainability and relevance. Keeping these best practices at the forefront will help companies create effective and efficient expense policies.

Top expense policy strategies for modern businesses

Modern businesses can optimize their expense management by implementing these three strategies:

- Implement automation and technology: Utilize expense management software to streamline the submission, approval, and reimbursement processes. This reduces manual errors, saves time, and provides real-time insights into spending patterns.

- Set clear and comprehensive guidelines: Clearly define what constitutes allowable expenses, required documentation, submission timelines, and approval processes.

- Regularly review and update policies: Review and update the expense policies frequently to reflect changes in tax laws, business structure, and industry best practices.

Having established these strategies, the next crucial step is to identify and select key players who will effectively manage and enforce your expense policy.

Select key players to manage your expense policy

An effective expense policy requires a well-defined team to oversee its implementation and ongoing management.

Six key players in managing a company expense policy typically include:

- Finance departments: Finance departments are responsible for developing the expense reporting policy, defining acceptable expenses, and ensuring compliance with regulations.

- Accounting departments: Accounting departments typically process reimbursements, maintain records, and audit reports to prevent fraud and overspending.

- Managers: Management is pivotal in approving expenses, providing guidance to team members, and ensuring that the business expense policy is followed.

- Employees: Employees must adhere to the policy when incurring expenses and submit accurate, timely expense reports.

- HR Department: HR departments oversee the communication of the expense policies to the staff and may handle disputes or questions regarding allowable expenses.

- Policy Compliance Officers: Policy Compliance Officers are specified individuals or teams that monitor adherence to expense policies, update policy changes, and provide training as needed.

With a solid team in place to manage your expense policy, the next step is to streamline the tracking and reporting process. Automating expense tracking can significantly enhance efficiency, accuracy, and compliance, ensuring that all expense-related activities are managed seamlessly.

Automating expense tracking for your business

Maintaining seamless business operations often involves meticulous financial management, which requires keeping a close watch on expenses. Thankfully, businesses can use automation software to enhance this process.

Automating expense tracking is an efficient method that modern businesses are increasingly adopting that significantly reduces manual errors and saves time, allowing employees and finance teams to focus on more strategic tasks.

With expense tracking software, businesses can access a real-time view of their financial outflow. Automation syncs various processes, from receipt submission to expense report approval, and can enforce company expense policies, flagging out-of-policy spending automatically.

By embracing reliable automation tools and expense policy best practices, businesses can transform their expense management from a cumbersome chore into a strategic advantage.