Blog > The Complete Guide to Salesforce Billing – Native Payment Processing Solutions

The Complete Guide to Salesforce Billing – Native Payment Processing Solutions

Billing may not be the most glamorous part of running a business, but it’s one of the most important. Closing a deal is exciting, but the real test comes when it’s time to turn that deal into cash. If billing falters, it can quickly erode trust – not just with customers, but also with leadership and the teams that depend on accurate numbers. Salesforce billing exists to prevent those breakdowns. By carrying the quoting and sales process all the way through to invoicing and payment, the Salesforce billing platform closes the loop and keeps revenue flowing smoothly.

This guide explores what Salesforce billing does, how it works, and why native payment processing makes such a difference. You’ll find explanations of billing and invoicing basics, insights into Salesforce payment gateways, integration advice, compliance considerations, and advanced features. If you’re a Salesforce admin, a finance lead, or a RevOps professional working to untangle quote-to-cash, this resource is built with you in mind.

Understanding Salesforce Billing

At its core, Salesforce billing picks up where quoting leaves off. Many companies already use Salesforce CPQ to build quotes, apply discounts, and generate orders. But once the deal is signed, the process can fall apart without the right tools. Teams may end up exporting spreadsheets, keying invoices by hand, or relying on separate accounting software. That’s slow, prone to mistakes, and costly in both time and money.

The Salesforce billing platform solves that by tying everything together. It lets you create invoices, issue credits, record payments, and even handle revenue recognition right inside the Salesforce platform. With customer data, product details, contracts, and pricing rules all in the same place, there are fewer handoffs, less duplication, and a lot less room for things to go wrong.

Some common terms you’ll hear:

- Billing runs: The process of generating invoices on a schedule.

- Schedules: Define when charges occur, whether one-time, recurring, or usage-based.

- Invoice templates: Customizable formats for presenting charges to customers.

- Adjustments: Credits, refunds, or changes applied after the fact.

Why do businesses adopt Salesforce billing? Usually, because they’re tired of reconciling multiple systems. With everything on one platform, reconciliation becomes simpler, reporting is clearer, and the handoff from sales to finance is seamless.

Billing & Invoicing Fundamentals

Invoices are the financial handshake between a business and its customer. If they’re clear, accurate, and timely, the relationship grows stronger. If they’re wrong or confusing, trust evaporates. Salesforce billing puts structure around that handshake so it consistently reinforces credibility.

In Salesforce billing, invoices aren’t an afterthought—they’re generated directly from orders and pricing rules. That means if sales set up a subscription or usage-based agreement in CPQ, billing knows exactly how to process it.

Supported Models

- One-time charges: Straightforward billing for fixed items, like setup fees or physical goods.

- Recurring subscriptions: Monthly, quarterly, or annual charges. These can include proration for mid-cycle changes.

- Usage-based billing: Charges calculated on consumption, like API calls, gigabytes used, or seats active.

- Hybrid billing: A mix of the above, which is common in SaaS or service-based industries.

Why This Matters

Accurate invoicing isn’t just about collecting money. It affects cash flow, customer trust, and compliance. An error on an invoice erodes confidence quickly. Imagine a customer paying thousands for services and receiving an invoice with mistakes. Suddenly, the relationship feels shaky.

The Salesforce billing solution gives you control. You can consolidate multiple subscriptions into one invoice or split them out, depending on customer needs. Templates can reflect your brand while also making it crystal clear how charges were calculated. Invoices can be delivered over email, posted to a customer portal, or accessed via API.

When businesses rely on manual invoicing, errors multiply. With Salesforce billing, invoices tie back directly to the products and services sold, ensuring consistency and accuracy.

Salesforce Payment Gateways and Native Processing

Payment processing is often treated as a back-office function, but for customers, it’s the front line. If paying is easy, they barely notice it. If it’s clunky, they remember. Salesforce makes smooth payment experiences possible through Salesforce payment gateways.

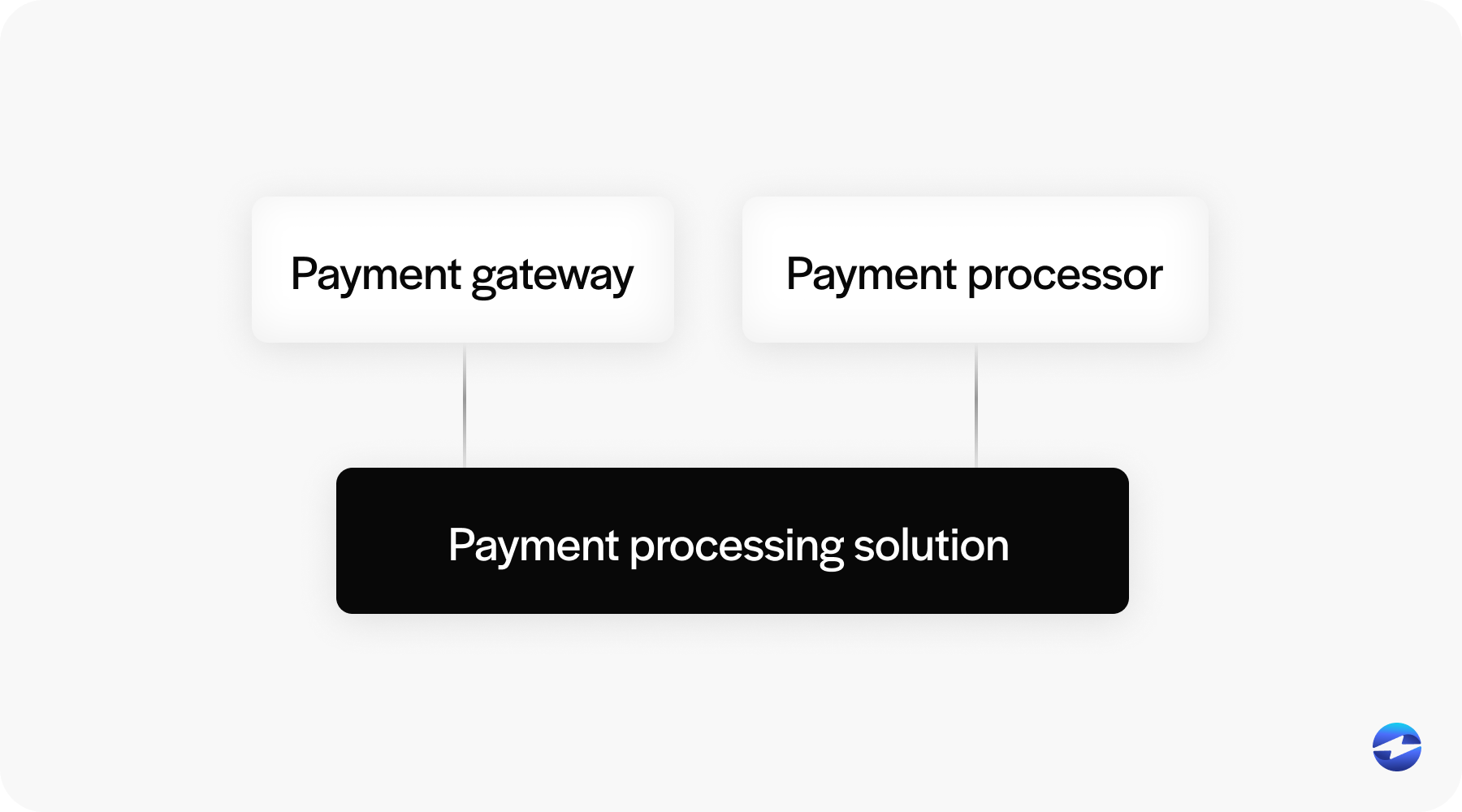

A payment gateway is the technology that securely transmits payment details (like credit card or ACH info) to the network. A payment processor, on the other hand, is the service that moves funds and deposits them into your account. Sometimes one company does both; sometimes they’re separate. A payment processing solution combines these pieces into something your team can actually use.

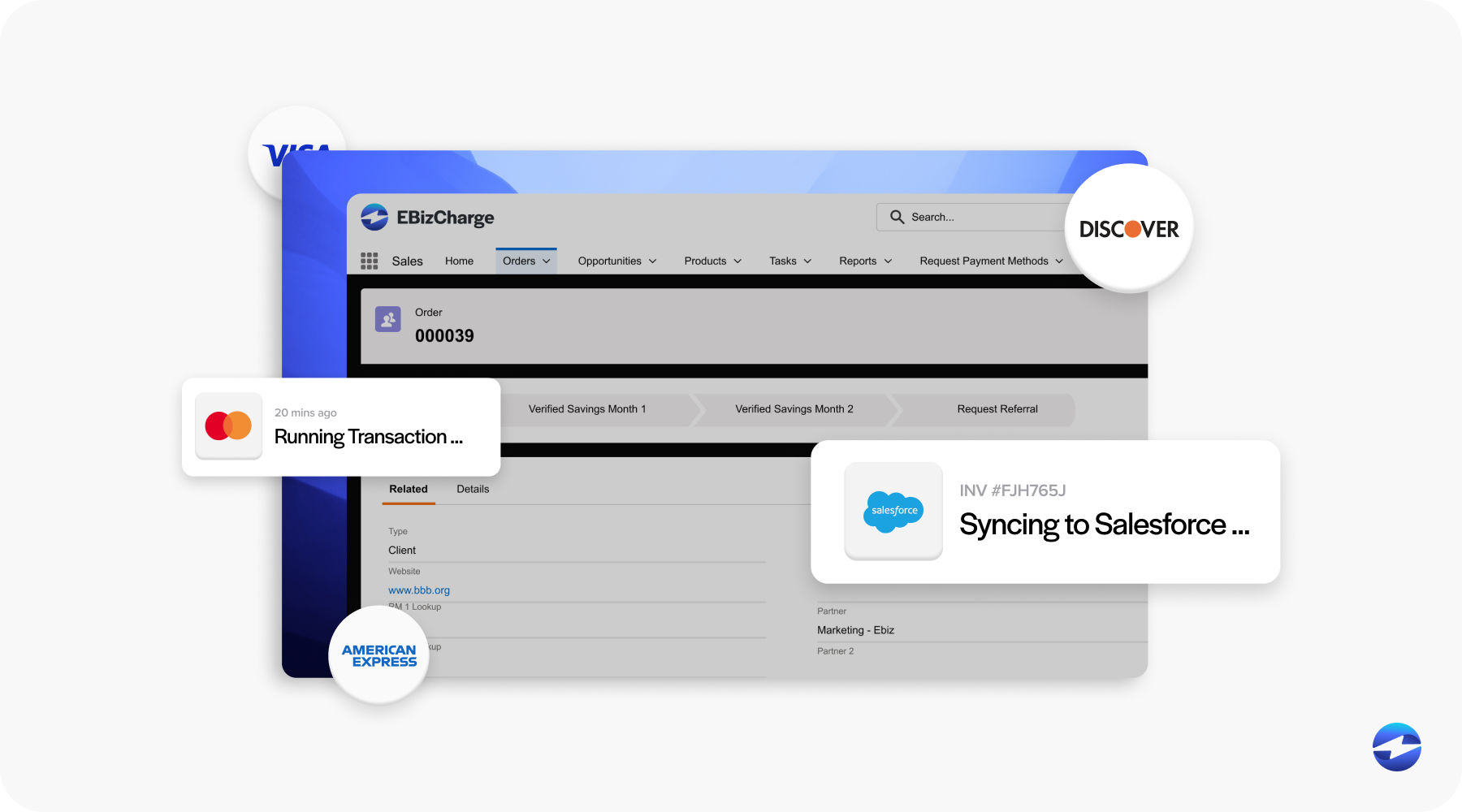

When people talk about “native” payment processing in Salesforce, they mean that payments are initiated, authorized, and captured without leaving the Salesforce platform. A native integration means payment records flow back to invoices automatically. Customers pay from a link on their invoice or through a portal, and Salesforce updates everything in real time. No file exports, no nightly syncs, no extra reconciliation jobs.

Here’s what native integration makes possible:

- Tokens stored securely, so cards can be charged again for renewals

- Real-time authorization and capture for transactions

- ACH support with verification flows

- Multi-currency payments tied back to the general ledger

- Automatic reconciliation, even for partial payments

By contrast, a third-party payment processing solution often requires more work. Payments may occur outside Salesforce and then sync back in later. That delay can create reconciliation issues and data mismatches.

For companies that want to reduce errors and speed up cash collection, native Salesforce payment gateway integration is often the smartest move.

Consider an eCommerce brand: a customer buys, pays through the gateway, and the invoice instantly flips to “Paid” in Salesforce. No waiting, no re-entry, no missed steps.

Payment Processing Options and Tradeoffs

There’s no single “right” way to process payments in Salesforce. Each business has different needs, and each approach has tradeoffs. The key is understanding your options.

Businesses typically choose from three approaches:

- Fully native payment processing solution: Installed from the AppExchange, tightly integrated with Salesforce billing objects. These reduce manual work and keep everything on the Salesforce platform.

- Hybrid models: The checkout might occur on an external website, but tokens and payment data are synced back to Salesforce for invoicing and reporting. This can preserve a custom customer experience while still giving finance the single source of truth it needs.

- Third-party payment processing solution: Payments happen entirely outside Salesforce, with results imported later. This may work at small scale, but it introduces complexity as transaction volumes grow.

Each approach comes with tradeoffs. Native solutions are simpler to operate but may limit flexibility if you need a highly customized checkout. Hybrid models strike a balance but require careful integration work. Third-party solutions can offer powerful features but create more reconciliation headaches.

The right choice depends on your industry, transaction volume, and your team’s technical skills. What matters most is choosing a setup that your finance and operations teams can actually manage long-term.

Integration

Billing doesn’t happen in a vacuum. It touches tax, accounting, and customer-facing systems. That means integration is just as important as the billing logic itself. For Salesforce billing to deliver its full value, it must integrate with other critical systems.

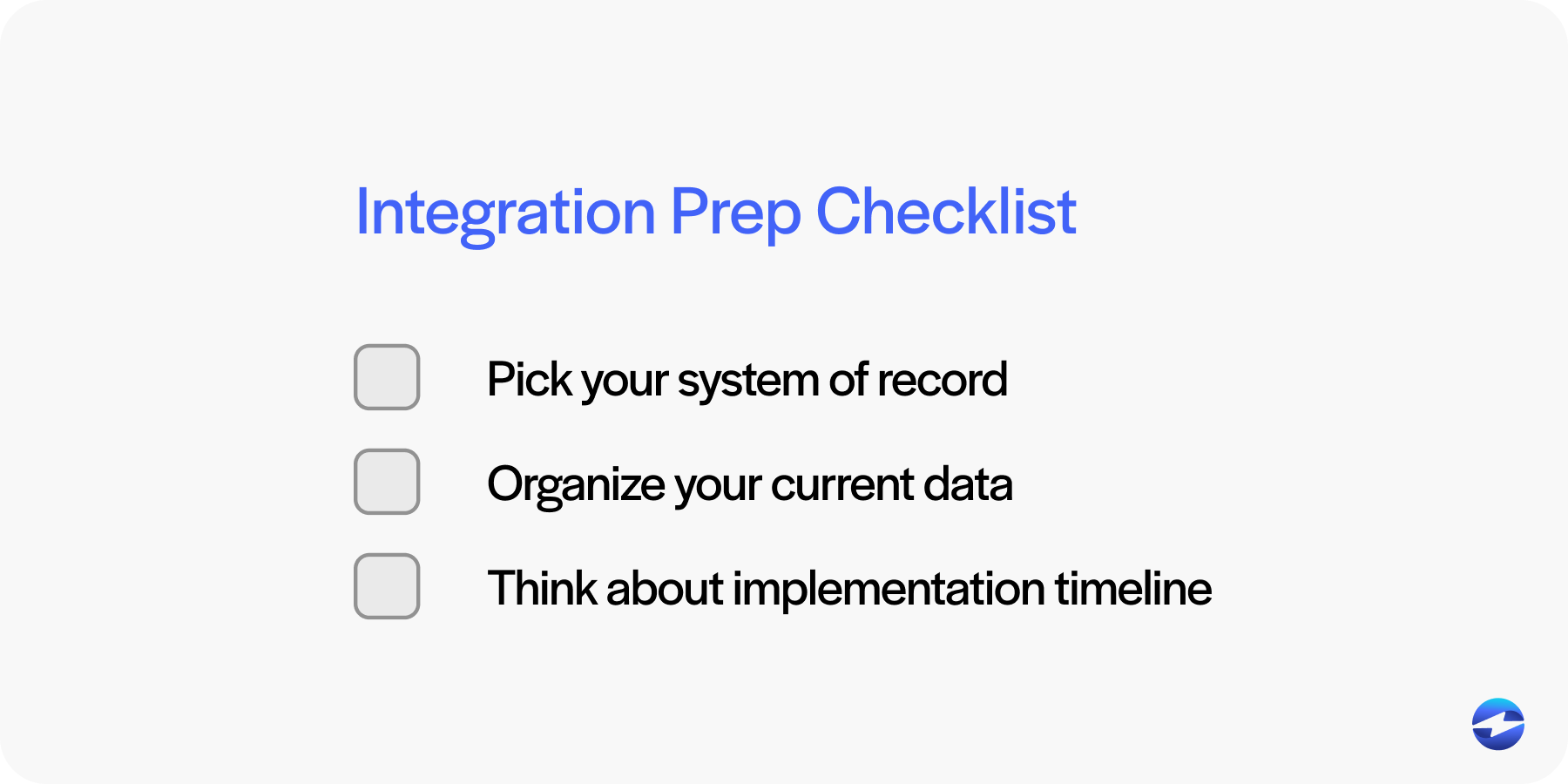

What to Know Before You Integrate

- Pick your system of record. Decide whether Salesforce, your ERP, or another system should be the “source of truth” for data like taxes, revenue schedules, or customer hierarchies. Clear ownership prevents confusion later.

- Line up your data. Invoices, payments, credits, and adjustments should use consistent fields everywhere. Document mappings clearly so you don’t run into duplicate postings when data is synced.

- Think about timing. Real-time updates are great for visibility, but batch jobs may be more practical for high volumes. Choose the balance that fits your team’s workload and skills.

Common Integration Points

- ERP and General Ledger: Ensure invoices and payments flow into the GL with the right codes so finance reports stay accurate.

- Usage systems: Send consumption data into Salesforce regularly, with clear rules for handling late events.

- Customer portals: Let customers view and pay invoices themselves, ideally with secure payment components and single sign-on (SSO) for convenience.

Most projects follow a simple rhythm: define what needs to flow where, build and test in a sandbox, validate tricky cases, and then go live. The goal is stability and confidence, not speed. Write down assumptions, version your integration contracts, and ensure more than one person understands how everything works.

Compliance and Security

Every invoice and payment carries sensitive information. Protecting it isn’t optional—it’s an obligation. Salesforce billing helps organizations stay compliant and secure.

Payments bring compliance obligations, and ignoring them is not an option. Customers trust you with sensitive data, and regulators require strict controls.

Key Areas

- PCI DSS: Any company handling card data must comply. Native solutions often reduce scope by tokenizing data.

- Tokenization and encryption: Ensures sensitive data is never exposed.

- Fraud detection: Tools to block suspicious transactions before they settle.

- Global privacy laws: GDPR, HIPAA, and others may affect how you store and process data.

- Audit trails and permissions: Track who created or modified billing records and control access tightly.

Ignoring compliance is not just risky—it’s expensive. Fines, penalties, and reputational damage can be devastating. A native payment processing solution in Salesforce makes staying compliant much easier by embedding security into everyday operations.

Advanced Features

Once the basics are stable, companies naturally look for more advanced tools to improve efficiency and insight. Salesforce billing is designed to grow with those needs.

- Revenue recognition: Align billing with ASC 606 or IFRS 15 standards.

- Multi-currency support: Essential for companies selling internationally.

- Dunning management: Automated reminders and retries for failed payments.

- Collections workflows: Escalations for high-value overdue accounts.

- Analytics and dashboards: Track metrics like Days Sales Outstanding (DSO), recovery rates, and dispute outcomes.

A mature Salesforce billing solution should not only send invoices but also give leadership visibility into how billing performance affects the broader business.

For example, analytics dashboards built into the Salesforce platform can show real-time payment success rates, aging reports, and trends in customer behavior. These insights help finance teams stay proactive instead of reactive.

Competitor Analysis: EBizCharge vs. Stripe for Salesforce

Before diving into specifics, it’s helpful to remember why these comparisons matter. Many teams evaluating Salesforce also need to pick a payment solution that aligns with how they do business day-to-day. A short comparison can highlight the fit without turning into a long feature checklist.

Here are a few points to compare:

- EBizCharge:

- Operates natively on the Salesforce platform with deep mappings to invoices, payments, and AR.

- Strong fit for B2B, invoicing, and collections inside Salesforce.

- Provides customer portals for self-service payments.

- Supports Level 2/3 data for interchange savings.

- Offers tokenization and multi-currency support.

- Robust posting back to billing objects.

- Emphasizes PCI scope reduction and operational efficiency out of the box, meaning less custom setup and faster time to value for Salesforce-focused teams.

- Stripe:

- Known for global coverage and wide acceptance.

- Offers strong developer tooling and APIs.

- Supports alternative payment methods beyond cards and ACH.

- Good option for digital checkout and embedded payment experiences.

- For Salesforce billing, often requires connectors and extra configuration to match the native posting and dunning behaviors available with EBizCharge.

- Can be powerful, but generally requires more engineering effort to integrate smoothly.

For organizations that run the bulk of their quoting, invoicing, and collections on Salesforce, EBizCharge usually delivers the more native and straightforward Salesforce billing solution with less friction. Stripe’s ecosystem is attractive for custom web or mobile checkouts with heavy international focus, but in those scenarios, teams should be prepared for added integration work to reach the same level of operational efficiency that EBizCharge provides out of the box.

Platform and Pricing

Pricing can feel like a moving target. Understanding all the components helps build a realistic budget.

Budgeting for Salesforce billing requires looking at several layers:

- Salesforce licenses: Revenue Cloud or Billing entitlements.

- Payment processor fees: Transaction costs, cross-border fees, and chargeback fees.

- Gateway costs: Sometimes included, sometimes separate.

- Implementation costs: Partner or internal time for setup and integration.

- Maintenance: Compliance updates, support, and optimization over time.

A third-party payment processing solution may look cheaper initially, but native options often reduce hidden costs like reconciliation time and manual errors.

When evaluating cost, think beyond transaction fees. Consider the impact on DSO, error rates, and the time your team spends cleaning up mistakes. The cheapest option upfront isn’t always the most cost-effective over the long run.

Streamlining Salesforce Billing with A Native Solution

Salesforce billing isn’t just about sending invoices – it’s about creating a dependable backbone for your revenue operations. By leveraging the Salesforce billing platform, implementing the right Salesforce billing solution, and choosing a native payment processing solution with strong Salesforce payment gateway integration, you can reduce errors, speed up cash collection, and improve compliance.

For many organizations, the choice comes down to control and trust. Native solutions give you both, while third-party payment processing solutions may add flexibility at the cost of complexity. The key is to pick the approach that aligns with your business model and resources.

If you’re the admin, finance leader, or RevOps manager driving this project, know that the effort pays off. A reliable billing engine doesn’t just make your life easier – it strengthens your customer relationships and builds confidence at every level of the company.

- Understanding Salesforce Billing

- Billing & Invoicing Fundamentals

- Salesforce Payment Gateways and Native Processing

- Payment Processing Options and Tradeoffs

- Integration

- Compliance and Security

- Advanced Features

- Competitor Analysis: EBizCharge vs. Stripe for Salesforce

- Platform and Pricing

- Streamlining Salesforce Billing with A Native Solution