Blog > The 6 Key Questions to Ask When Choosing a Payment Processor

The 6 Key Questions to Ask When Choosing a Payment Processor

The credit card processing industry is baffling, especially for a new business owner. Choosing a merchant services provider to process your credit card transactions can feel like walking across foreign terrain—you don’t know what dangers lurk or where to turn.

Don’t fret. You’re not alone in feeling overwhelmed when it comes to the processing industry—which is why we created a list of 6 key questions to ask when choosing a payment processor.

Will They Protect My Data?

Remember in 2013 when Target was hacked? Credit and debit card data from over 40 million accounts were stolen overnight. The cause? Lack of data security. Learn from their blunder and make sure your customers’ data is protected. With credit card transactions and fraud continuing to rise, it’s important to find a processor that provides intelligent data protection.

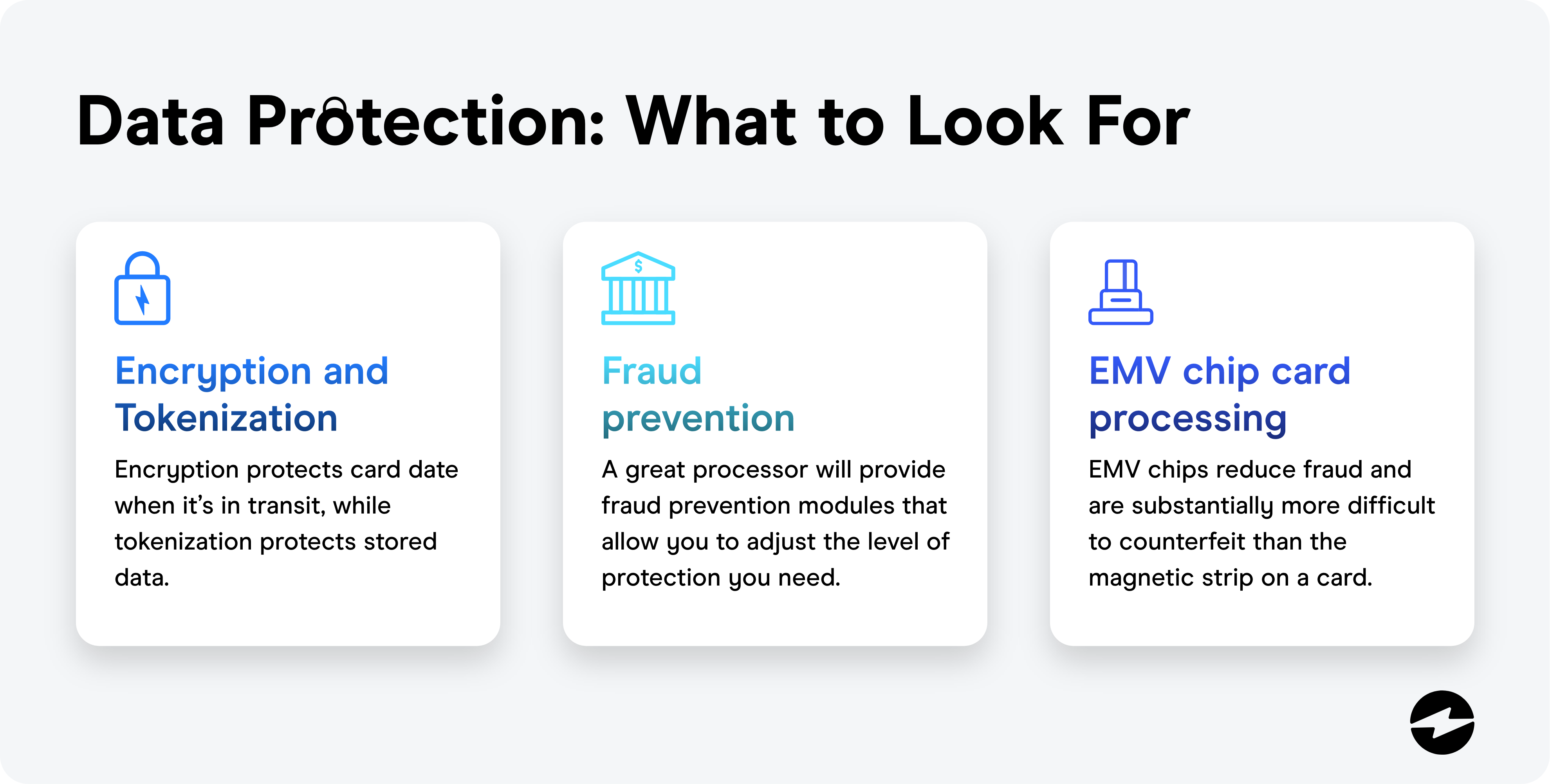

Here’s what to look for:

- Encryption and tokenization. Encryption protects card data when it’s in transit, while tokenization protects stored data. Your processor should offer both encryption and tokenization with their service.

- Fraud prevention. A good processor will offer resources on how to protect yourself from shady transactions. A great processor will provide fraud prevention modules that allow you to adjust the level of protection you need.

- EMV chip card processing. Make sure your physical terminals are EMV compatible so you may process and authenticate chip cards. EMV chips reduce fraud and are substantially more difficult to counterfeit than the magnetic strip on a card.

Will They Make My Life Easier?

Many merchants process payments using either a physical or virtual terminal. They then enter the same information into their online accounting software, which is used for recording and reporting a company’s finances.

Finding a payment processor that integrates the two steps will save you time and decrease the chance for human error via incorrect data entry. Integrated software solutions allow merchants to accept payments directly within their accounting software.

There are many advantages to using a processor that provides integration. For example, integration:

- Automatically posts payments to invoices

- Reconciles accounts receivable and general ledger

- Reduces time spent managing accounting

Who Will Be There For Me?

Problems happen. Technology fails, payments go missing, and duplicate transactions take place. The question is: How will your payment processor respond when problems arise? Will they direct you to a call center in India or force you to talk to an automated phone system?

Low processing rates don’t mean much if the processor fails to deliver on everything else. Minor problems can quickly escalate into major issues when not addressed promptly. Having a support team on standby will keep your business running smoothly.

Excellent customer service is worth its weight in gold. Take the time to ask potential merchant services providers who will be answering the phone when you need help. Find a payment processor with in-house, live support. When trouble comes your way, you’ll be happy you have a team standing by to help.

What Fees Will I Pay?

Low fees can be tempting. Salespeople will dangle a low flat fee in front of you as they paint a picture about how much money you’ll save. But you should be wary of processors that offer prices that seem too good to be true. They probably are.

There are many ways processors hide their true fees. Some cut corners by offering poor customer service or tacking on high annual fees. Others may add fees for batch processing, statements, and fund transfers. There may be fees for software installation, annual fees, and gateway fees.

This is when you should pull out your magnifying glass. No matter how great a salesperson makes their company sound, always do your own research to make sure you get a fair price that won’t rise once you’ve signed on the dotted line.

Are They PCI Compliant?

Payment Card Industry (PCI) compliance means your business adheres to strict security standards for protecting the information acquired from credit card transactions. Companies that accept credit cards must follow these established guidelines.

Businesses that are not PCI compliant may:

- Suffer financial losses from heavy fines

- Lose the ability to accept credit cards

- Lose customers due to a diminished reputation

Not all processors follow the security standards needed to be PCI compliant. Make sure you choose a merchant services provider whose network and systems are fully compliant with the standards set forth by the payment industry.

What Does the Contract Say?

Read and understand the contract agreement before you sign anything. This may seem like a no-brainer, but in a world of unread contracts (think of all those times you’ve agreed to the Terms of Service), it needs saying.

Figure out how long the contract term is and if there are early termination fees. A good company should be confident in their services. If they try to trap you in a long-term contract loaded with exit fees, then reconsider. Also, steer clear of processors with “liquidated damages” termination fees. These fees prevent you from cancelling early by requiring payment for the full contract.

Contracts might be dull and lengthy, but joining forces with a payment processor is a big deal and deserves your full attention. Read the fine print! Make sure there won’t be any surprises down the road so you can dedicate yourself to growing your business and not shrinking your headache.

Not all processors are out to get you. In fact, there are many merchant services providers that help their merchants flourish. The key is to do your research. Don’t rush to sign up with the first processor that entices you with attractive promises. Many processors know how to bait and hook first-time business owners. Look at the different options available and read reviews about the processor you’re considering.

Your business is important. Find a payment processor that believes that, too.