Blog > Surcharge vs. Convenience Fee: What’s the Difference?

Surcharge vs. Convenience Fee: What’s the Difference?

As payment processing costs continue to rise, many businesses are looking for ways to offset these fees. Two popular options—credit card surcharges and convenience fees—can help recover some of these costs. But understanding the key differences and legal requirements for each is crucial for compliance and customer trust.

At EBizCharge, we help businesses implement surcharge programs that reduce costs without violating card network rules or state laws. This guide will break down the differences between surcharges and convenience fees so you can choose the right path for your business.

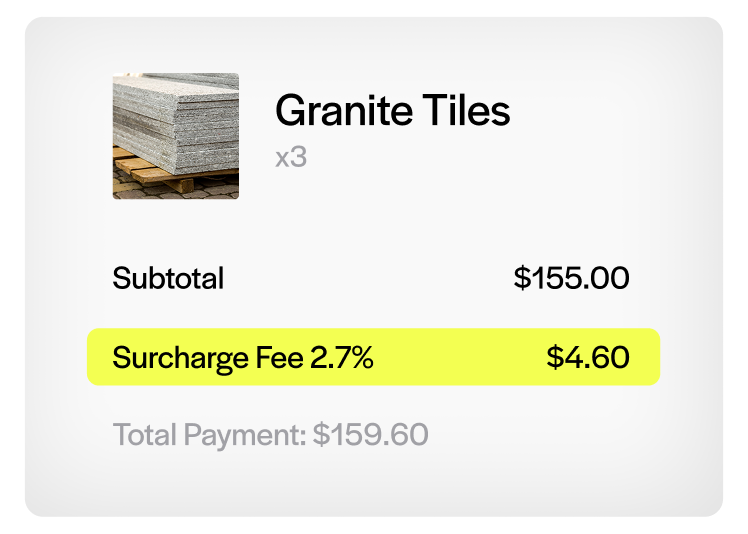

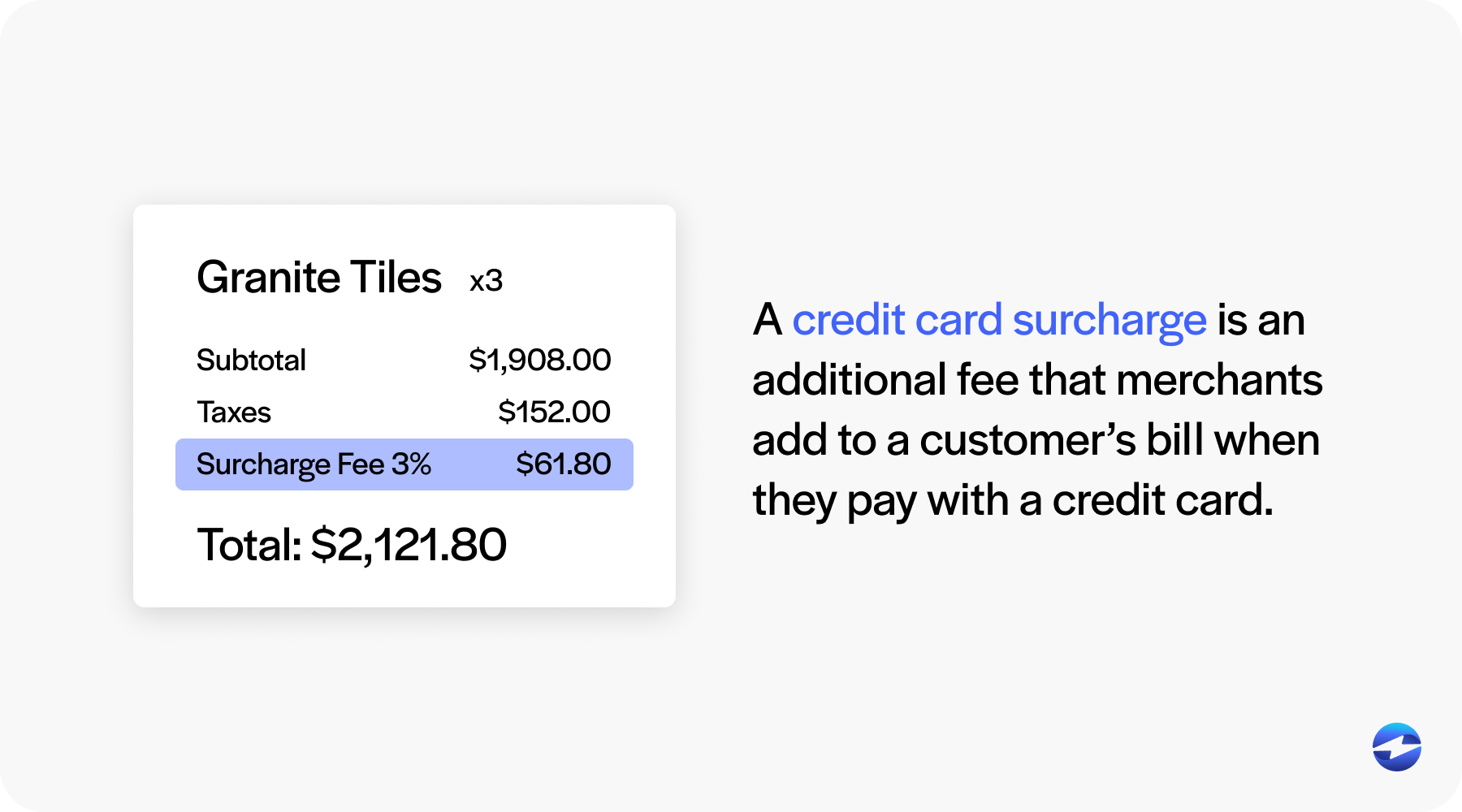

What Is a Credit Card Surcharge?

A credit card surcharge is an additional fee that merchants add to a customer’s bill when they pay with a credit card. This fee helps businesses recoup the costs of processing those transactions.

Common Use Cases:

- Frequently used in service-based industries where margins are thin.

- Popular among providers such as auto shops, travel and property managers.

- Used by merchants who want to keep prices competitive without absorbing card processing costs.

Guidelines:

- Only applies to credit cards, not debit or prepaid cards.

- Must be clearly disclosed at the point of sale and on the receipt.

- Capped at 3% or the actual cost of processing, whichever is lower.

- Requires registration with Visa and Mastercard before implementation.

Visa and Mastercard require merchants to register before applying surcharges and follow strict notification and receipt disclosure rules. The surcharge amount must be listed separately on the receipt.

What Is a Convenience Fee?

A convenience fee is a charge for the option to pay using a method that’s different from the business’s standard payment channel. For example, if a school accepts checks but allows online credit card payments, they might charge a convenience fee for the extra option.

Common Use Cases:

- Educational institutions

- Government agencies

- Utility companies

Guidelines:

- Can apply to credit or debit cards depending on the situation.

- Must be flat-fee based, not percentage-based.

- Can’t be used if the card is accepted in person (Visa rules).

- Requires advance notice to the customer.

Surcharge vs. Convenience Fee: Key Differences

Here’s a side-by-side comparison

| Feature | Surcharge | Convenience Fee |

|---|---|---|

| Applies to | Credit card only | All payment types (depends) |

| When charged | Always on card | Only when using non-standard method |

| Legal restrictions | Varies by state | Fewer but still regulated |

| Notice requirement | Yes | Yes |

| Who can charge | Most merchants | Limited types of merchants |

Real-world example: An auto body repair shop might add a 3% surcharge to invoices paid by credit card. A university might charge a $3 flat convenience fee for online tuition payments.

Can You Legally Charge These Fees?

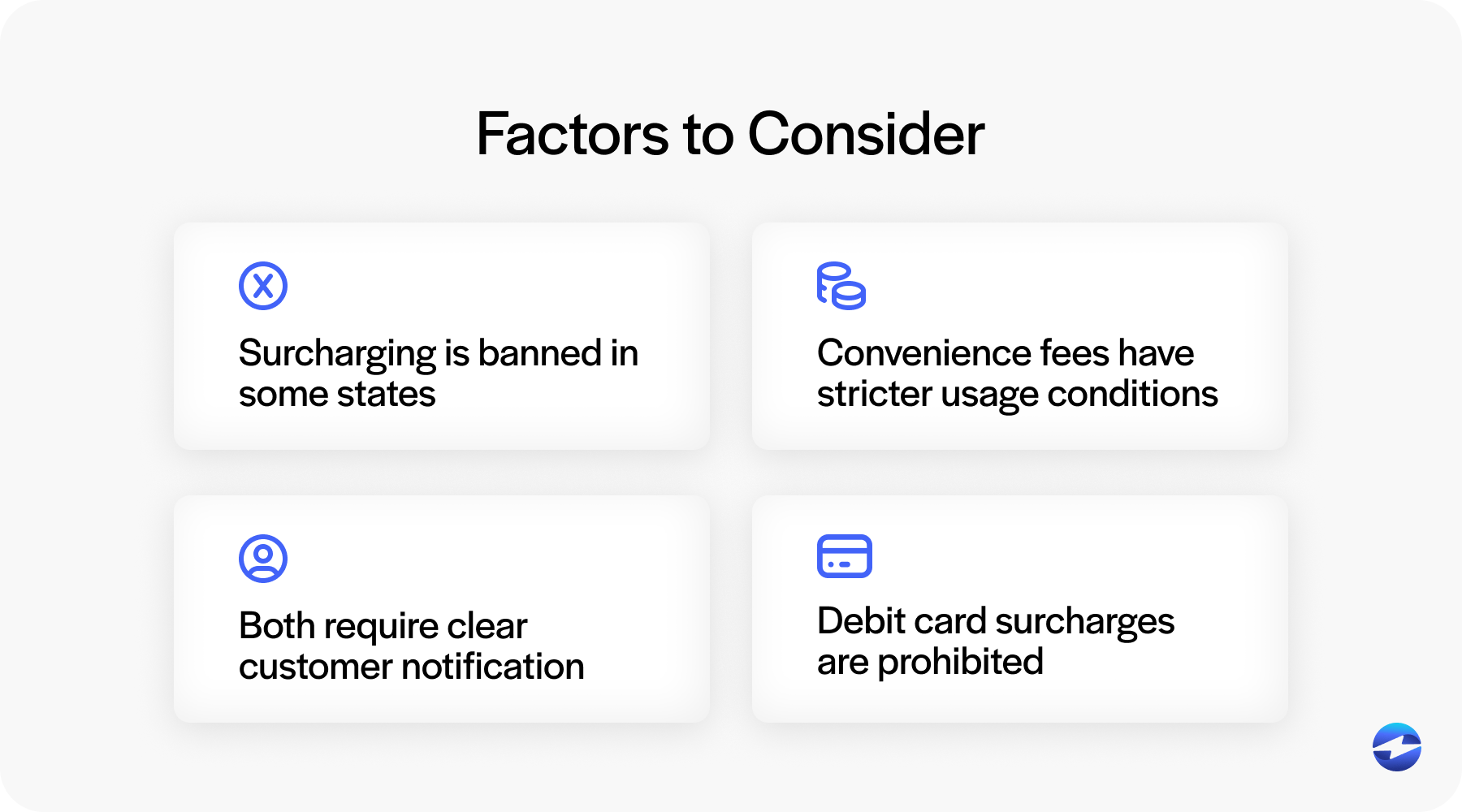

To charge a surcharge or convenience fee, you need to know both your state’s laws and the card brand regulations. These rules can be very different and failing to follow them can have serious consequences.

Some states ban credit card surcharges altogether, regardless of what card networks allow. Convenience fees, while more flexible, still have specific restrictions, especially from major card brands.

Visa and Mastercard have detailed rules on how and when each type of fee can be charged. These include clear disclosure requirements, limitations on applying fees to certain card types (like debit), and restrictions on fee structures.

Consider:

- Surcharges are banned in some states like Connecticut and Massachusetts.

- Convenience fees have fewer state restrictions but stricter usage conditions.

- Both require clear customer notification.

- Debit card surcharges are prohibited by card brand rules.

Non-compliance can result in fines, customer disputes and the loss of your ability to accept card payments.

When to Use a Convenience Fee?

A convenience fee might be your best option when you’re offering customers an optional, alternate way to pay that adds costs to your business. This usually happens when businesses accept payments outside their standard or normal methods—for example, accepting online or phone payments when in-person transactions are the norm.

Convenience fees are useful for businesses in industries where surcharging is either restricted or discouraged by customer expectations. If you’re in an industry like education, government or utilities where offering flexible payment channels is key—adding a small fee can help offset those costs without surprising customers.

A convenience fee might be your best option when:

- You offer an alternative payment method that adds processing or administrative costs.

- You’re in an industry where surcharging is not allowed or practical.

- The fee is for a non-standard channel (e.g., online vs. in-person).

- You can apply it to all eligible customers.

Make sure to structure the fee according to Visa/Mastercard rules and don’t apply it to in-person payments. Always notify the customer of the fee before the transaction is completed to be transparent and avoid disputes.

When to Use a Surcharge?

A surcharge is good when your business processes a high volume of credit card transactions and you want to reduce overhead without raising prices. For many companies, especially those with thin margins, absorbing the full cost of credit card fees can eat into profits quickly.

This works well if your business is in a state where surcharging is allowed and you serve a customer base that won’t mind a transparent, well-communicated surcharge policy. Surcharging is good for professional services firms, B2B companies and other service-based businesses where large invoices or recurring payments are common.

A surcharge is good when:

- You accept credit cards and want to offset costs.

- Your business is in a state where surcharging is legal.

- You’re in a B2B or professional services industry.

- Transparency and cost savings are key.

Surcharging helps protect margins without raising prices across the board. When done correctly, it creates a fair system where customers who choose to use credit cards help cover the transaction fees.

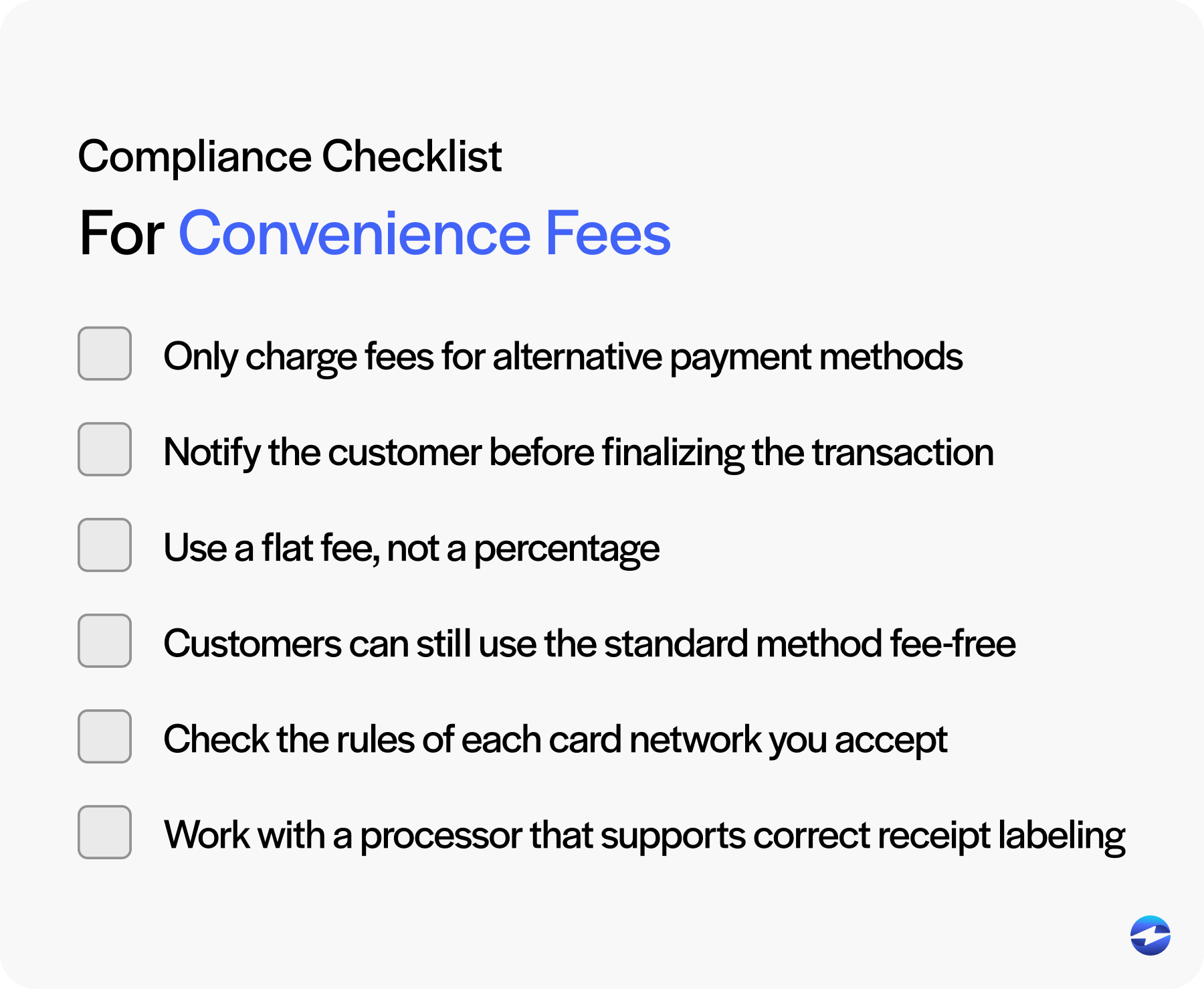

How to Legally and Effectively Charge a Convenience Fee

Charging a convenience fee requires more than just adding a line item to an invoice. It involves understanding card network rules, transparency with customers and setting up your systems to support the fee.

Convenience fees are only allowed when offering a payment method that’s different from the merchant’s normal payment channel. For example, if a business usually accepts payments in person, it can charge a convenience fee for online or phone payments. But this fee must be a flat amount—not a percentage—and disclosed before the transaction is completed.

To be compliant:

- Only charge the fee for alternative payment methods.

- Notify the customer before finalizing the transaction.

- Use a flat fee, not a percentage.

- Customers can still use the standard method fee-free.

- Check the rules of each card network you accept.

- Work with a processor that supports correct receipt labeling.

Correct implementation also means making sure your POS or payment gateway can clearly and separately show the convenience fee on the customer’s receipt. Train staff and include a clear explanation on your payment page or invoice to avoid misunderstandings and build trust with your customers.

How to Legally and Effectively Charge a Surcharge Fee

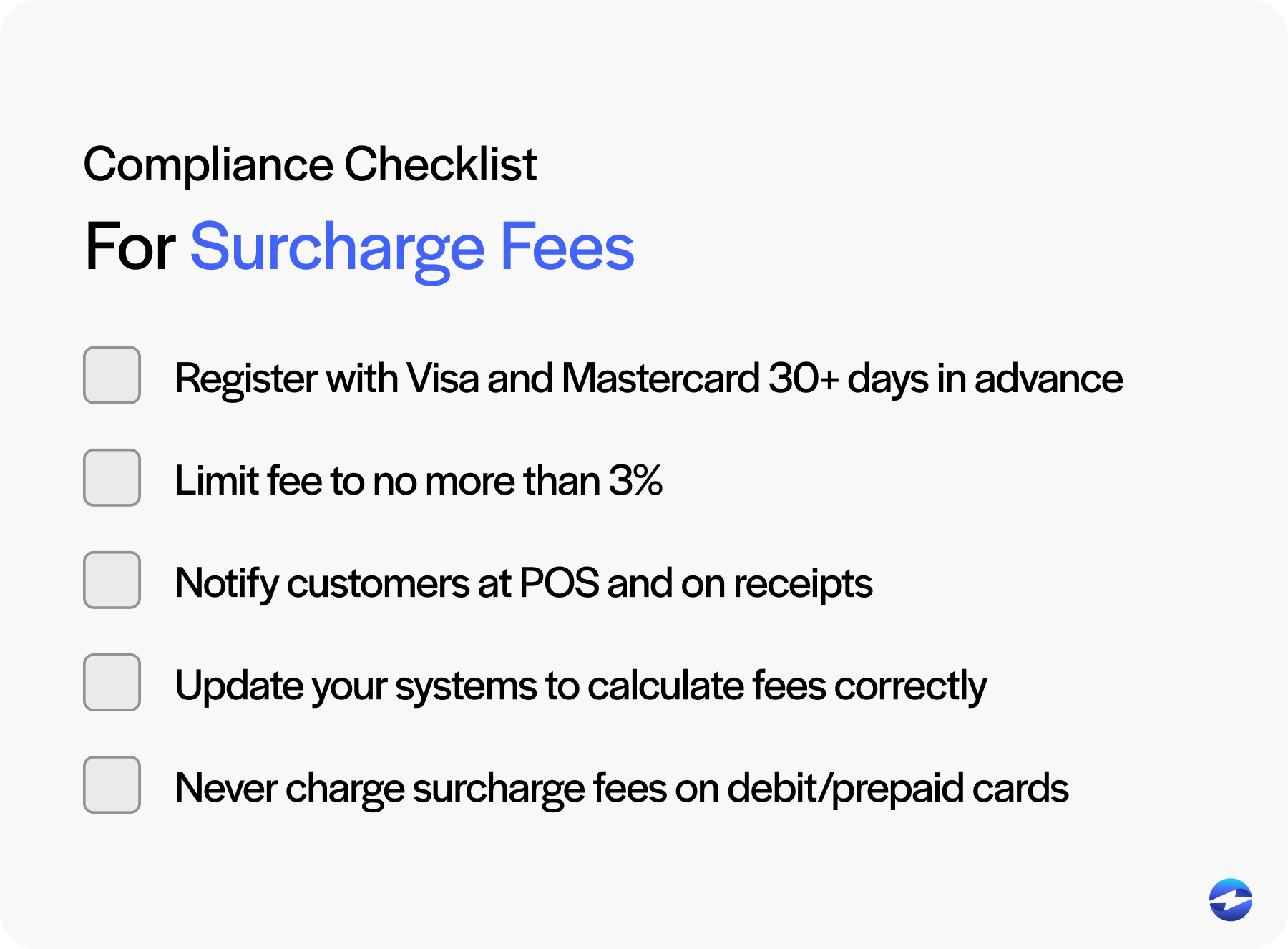

Charging a surcharge fee is a straightforward process if you do it right and follow the rules. The goal is to be transparent to your customers while being fully compliant with card brand rules and state laws.

Before charging a surcharge fee, you must notify the card networks—Visa and Mastercard require at least 30 days’ notice. You’ll also need to make sure your systems can calculate and display the fee. This includes your POS system, online checkout and any invoicing platforms you use.

Notices should be at the point of entry, at the point of sale and on receipts so customers are aware of the fee before they complete the purchase. Follow these steps to charge a surcharge fee legally:

- Register with Visa and Mastercard at least 30 days in advance.

- Limit fee to no more than 3%.

- Notify customers at point of sale and on receipts.

- Update your POS, invoice or payment gateway to calculate fees correctly.

- Never charge surcharge fees on debit or prepaid cards.

Proper training for staff, good customer messaging and coordination with your payment processor will all help your convenience fee program run smoothly and legally.

How EBizCharge Makes Charging Surcharge Fees Easy

EBizCharge takes the complexity out of charging surcharge fees. Our all-in-one payment solution is designed to help you charge convenience fees legally, efficiently and with minimal disruption to customer experience.

With EBizCharge you get:

- Automated fee calculation and labeling, reducing manual errors

- Built-in compliance with card brand and state regulations

- Seamless integration with top accounting, ERP and invoicing systems

- Detailed reporting and analytics to track convenience fee revenue and compliance

- Customizable settings to fit your industry and workflow

By making setup and operations easier, EBizCharge lets you pass credit card fees to customers transparently and compliantly—more revenue for your business.

Contact us today to learn how EBizCharge can support your surcharge.

Conclusion and Next Steps

Understanding the difference between a credit card surcharge and a convenience fee is crucial to making an informed decision. Each has its own rules, risks and use cases.

Evaluate your business model, industry and legal environment before you choose. And remember, whether you surcharge or charge for convenience, transparency and compliance are non-negotiable.

Need help setting up a compliant surcharge program? Contact EBizCharge to get started.