Blog > SuiteCommerce Payment Security: Best Practices for Secure Transaction Processing

SuiteCommerce Payment Security: Best Practices for Secure Transaction Processing

Every business that accepts payments online faces the same challenge: keeping transactions safe. For companies running on SuiteCommerce, the stakes are even higher. Customers expect a smooth and trustworthy checkout experience, while finance teams need accurate, secure data flowing directly into their ERP system. When payment processing isn’t handled correctly, the risks can include fraud, chargebacks, compliance penalties, and long-term damage to customer trust.

So, how do you ensure secure payment processing on SuiteCommerce sites? The answer lies in combining good security practices with the right integrations and tools. This article will explore why payment security is so important, the best practices to follow, and how SuiteCommerce merchants can strengthen their defenses while keeping transactions fast and user-friendly.

The Importance of Payment Security in SuiteCommerce

The online payment landscape is full of risks. Fraud attempts, phishing schemes, and data breaches are constant threats to businesses of all sizes. For NetSuite SuiteCommerce B2B merchants in particular, larger transaction values and extended terms make them even more attractive targets. A single weak point in the checkout or reconciliation process can create significant vulnerabilities.

One reason payment security is so critical in SuiteCommerce is its connection to NetSuite software. SuiteCommerce doesn’t just process payments on the storefront—it ties directly into accounting, inventory, and finance. That makes accuracy and protection vital. A compromised transaction could mean not just a fraudulent charge but also errors in accounts receivable, the general ledger, and even financial reporting. For companies handling thousands of invoices or high-volume recurring payments, that accuracy is non-negotiable.

By investing in strong payment security, merchants protect more than just sensitive customer data—they protect the integrity of their entire financial system. Customers gain confidence in the buying process, and finance teams gain peace of mind knowing that payments are being processed correctly every time.

How Do You Ensure Secure Payment Processing on SuiteCommerce Sites?

The first step in ensuring secure payment processing on SuiteCommerce sites is adopting the core security standards and tools available today:

- PCI DSS compliance: Payment Card Industry Data Security Standards set the baseline requirements. Merchants using SuiteCommerce must ensure their checkout and storage processes comply.

- Tokenization: This replaces sensitive cardholder data with secure, non-sensitive tokens. Even if intercepted, tokens are useless to attackers.

- Encryption: Data should be encrypted both during transmission and while stored, protecting it from unauthorized access.

- Fraud detection tools: Whether AI-based or rules-driven, fraud tools flag suspicious activity and help prevent chargebacks.

- Two-factor authentication: 2FA protects admin and finance access points with added verification reduces the risk of account compromise.

Each of these practices creates an additional layer of defense, helping businesses reduce vulnerabilities without sacrificing performance. When combined, they form a security net that covers both the customer-facing storefront and the back-end financial system.

Leveraging SuiteCommerce Integrations for Security

While native tools provide a starting point, many businesses strengthen payment security by using a third-party payment processor. These integrations add advanced layers of protection that go beyond what comes out of the box.

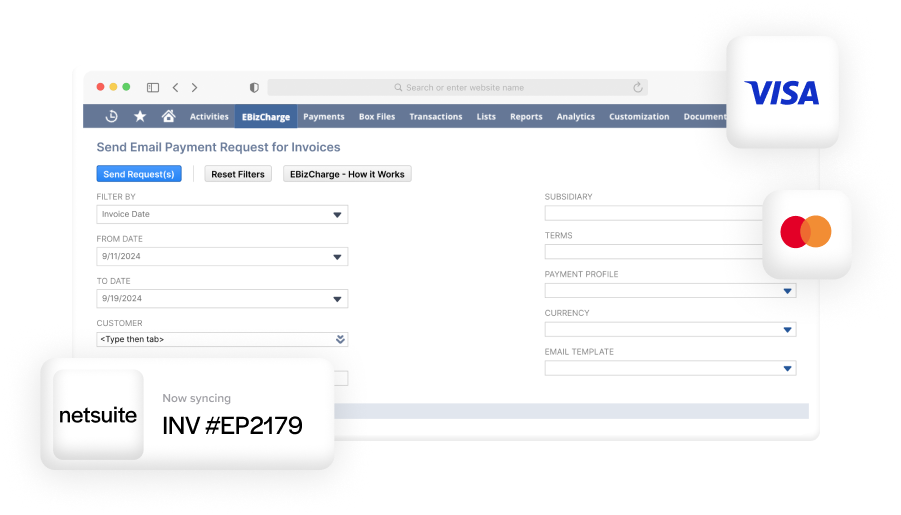

A well-chosen payment processing solution can provide tokenization, PCI-compliant storage, and sophisticated fraud monitoring. Customer portals offered by third-party processors also give buyers a secure way to manage invoices and payments without exposing sensitive data. This is especially valuable for NetSuite SuiteCommerce B2B operations, where clients may need to view past invoices or manage recurring transactions.

On the technical side, API connections and webhook management support real-time fraud alerts and data integrity. For example, if a suspicious transaction occurs, webhooks can instantly notify the system so staff can take immediate action. Automated reconciliation through integrations ensures that accounts receivable and general ledger entries in NetSuite remain accurate, closing the gap between online checkout and financial reporting.

In practice, this means fewer delays, fewer errors, and fewer late nights spent tracking down mismatched records.

Best Practices for Secure Transaction Processing

Security isn’t only about technology—it’s also about habits and preparation. Here are some best practices SuiteCommerce users should follow:

Start by training staff to recognize suspicious activity. Human error is often the weakest link, and education helps close that gap. Keep SuiteCommerce integrations and NetSuite software updated regularly so you’re not exposed to vulnerabilities that patches have already been fixed.

Monitoring payment logs is another key step. Setting up alerts for unusual activity—such as multiple failed payment attempts or sudden spikes in transaction volume—gives teams time to react before problems escalate. Testing data synchronization ensures that what shows up in SuiteCommerce also matches your ERP records, which is essential for compliance and accurate reporting.

Finally, limit access controls. Not every employee needs to see or handle payment data. By restricting access to only those who truly need it, you reduce exposure and create a safer environment for both your business and your customers. Larger organizations may even benefit from role-based access models, where permissions are tied to responsibilities.

It’s also smart to run periodic security audits. These can be internal reviews or third-party assessments that verify your system is working as intended. Audits often uncover issues before they become problems, allowing you to fix vulnerabilities proactively.

EBizCharge in SuiteCommerce Security

One example of a solution built with payment security in mind is EBizCharge. As a third-party payment processor, it provides PCI-compliant tokenization right out of the box. Its fraud monitoring tools are tailored for high-volume merchants using SuiteCommerce NetSuite, giving finance teams the ability to identify and block suspicious transactions before they cause harm.

Because EBizCharge integrates directly with NetSuite, reconciliation happens securely within accounts receivable and the general ledger. This ensures that not only are transactions processed safely, but financial data remains accurate and protected inside NetSuite software. Customer portals also give buyers a safe place to pay invoices online, combining convenience with peace of mind.

In other words, EBizCharge doesn’t just act as a payment processor—it functions as a full payment processing solution, one that strengthens both security and usability for businesses relying on SuiteCommerce. The platform scales as transaction volumes grow, so businesses don’t outgrow their security infrastructure as they expand.

Simplyfing Security in SuiteCommerce

Payment security is no longer optional—it’s a central part of running a reliable online business. For NetSuite SuiteCommerce B2B merchants, where transaction values are higher and financial integrations deeper, the need is even greater. The good news is that strong practices, combined with the right integrations, make it possible to protect customers while still offering fast, seamless checkouts.

By focusing on PCI compliance, tokenization, fraud detection, and secure integrations, merchants can turn payment security into a competitive advantage. SuiteCommerce, paired with secure processes and a trusted third-party payment processor, ensures that transactions are not only completed efficiently but also handled safely.

For finance teams and business leaders alike, the takeaway is simple: treat security as an ongoing commitment. Security doesn’t end at implementation—it requires regular updates, training, and monitoring. When you make it part of your culture, SuiteCommerce NetSuite becomes not just a platform for selling, but a foundation for growth built on trust, accuracy, and resilience.