Blog > Small Business Guide to No-Fee Credit Card Processing

Small Business Guide to No-Fee Credit Card Processing

If you’re running a small business, you know the drill: every card swipe chips away at your bottom line. Those credit card processing fees—often 2% to 4% per transaction—may not sound like much at first, but over time, they add up. For a business working with slim margins, that’s real money.

That’s why more and more business owners are asking about no-cost credit card processing. Also known as surcharging or zero-cost processing, this model shifts the cost of accepting credit cards away from the business and back onto the customer. But is it a good fit for everyone? Not always.

In this guide, we’ll break down what free credit card processing for small businesses really means, how it works, the rules you need to follow, and how to find a trustworthy payment processor if you’re considering this route.

What Is No-Fee Credit Card Processing?

In short, no-cost credit card processing means your business doesn’t pay the processing fees—your customers do. When someone pays with a credit card, your system adds a small surcharge (typically around 3%) to their total. That amount covers the fee your payment processor would normally take from you.

It’s important to distinguish this from discounts or promotions. This isn’t about cutting prices—it’s about clearly passing along a cost.

In this setup:

- Surcharge programs add a fee to credit card purchases.

- Cash discounting offers a lower price for cash or debit payments.

In both cases, you’re taking control of credit card processing fees rather than silently absorbing them into your pricing.

How It Works in Practice

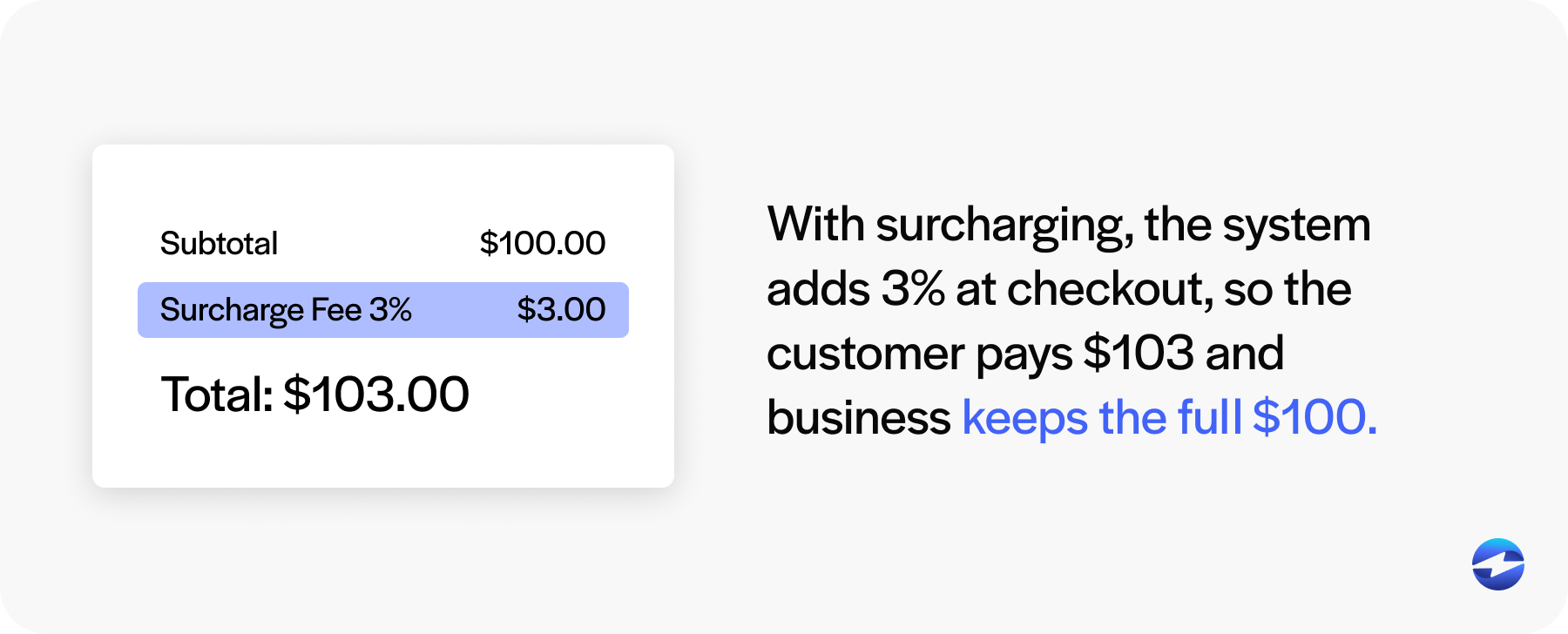

Let’s say you sell a $100 product. If your payment processor charges a 3% fee, you’d normally take home $97. With surcharging, the system adds that 3% at checkout, so the customer pays $103, and you get to keep the full $100.

It sounds simple, but it requires the right tools. Your payment solution—whether it’s a POS system in a shop or an online checkout for an eCommerce site—must be set up to:

- Apply the surcharge only to credit card transactions (debit surcharges are not permitted).

- Display the fee clearly before the customer completes the transaction.

- Show the surcharge as a separate line item on receipts.

The experience needs to be transparent. No surprises, no confusion. The more upfront you are, the better it lands with your customers.

Legal and Card Network Rules

Here’s where things get serious. While surcharging is allowed at the federal level in the U.S., some states still have restrictions. For example, small business credit card surcharge rules in states like Connecticut and Massachusetts prohibit or heavily regulate this practice.

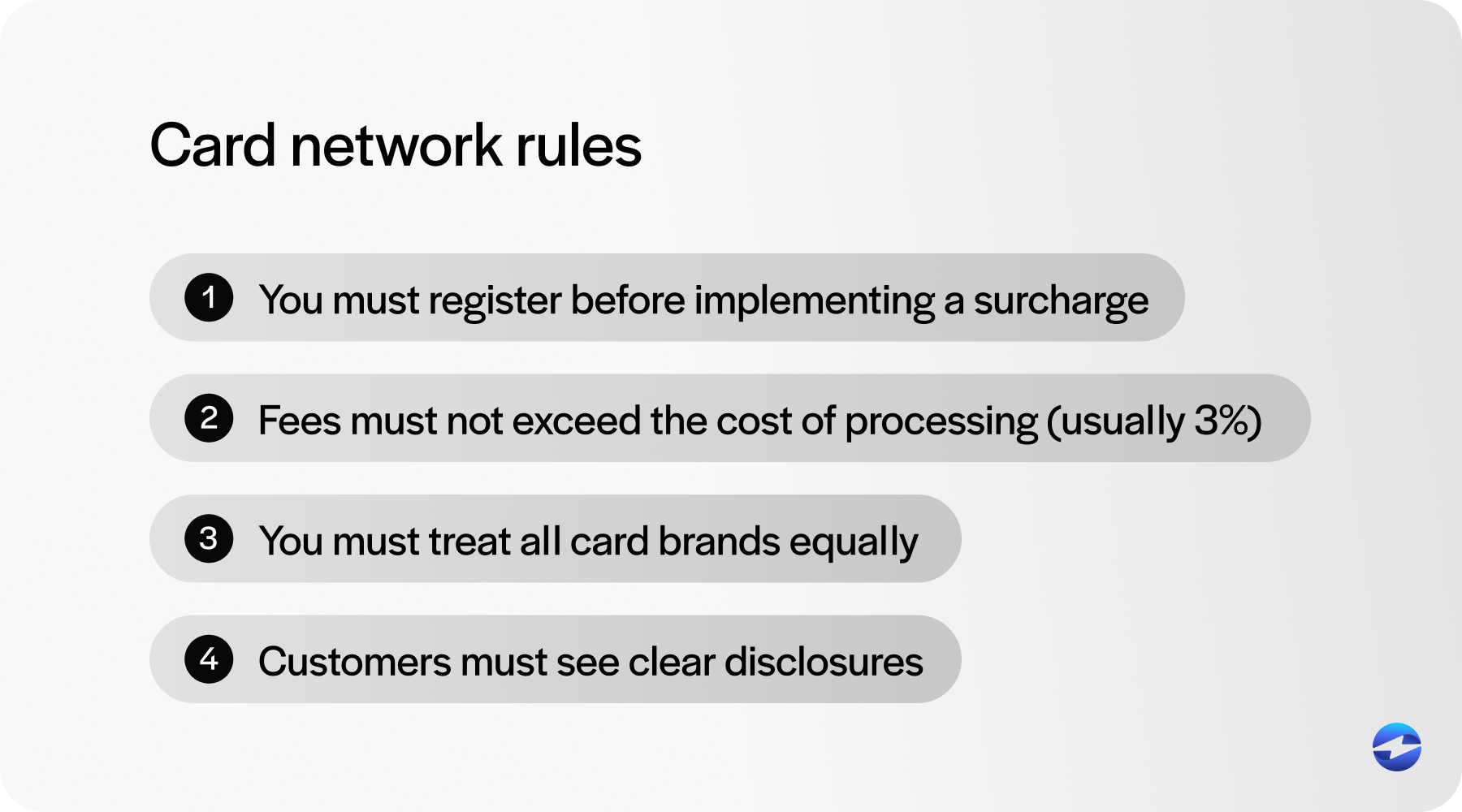

Even in states where it’s legal, card networks like Visa and Mastercard have their own rules:

- You must register before implementing a surcharge.

- Fees must not exceed the cost of credit card processing (typically capped at 3%).

- You must treat all card brands equally—no singling out one provider.

- Customers must see clear disclosures at the entrance (for physical stores) and on the payment page (for online sales).

It’s not enough to just flip a switch. You need to make sure your payment processor supports compliance and updates your systems accordingly.

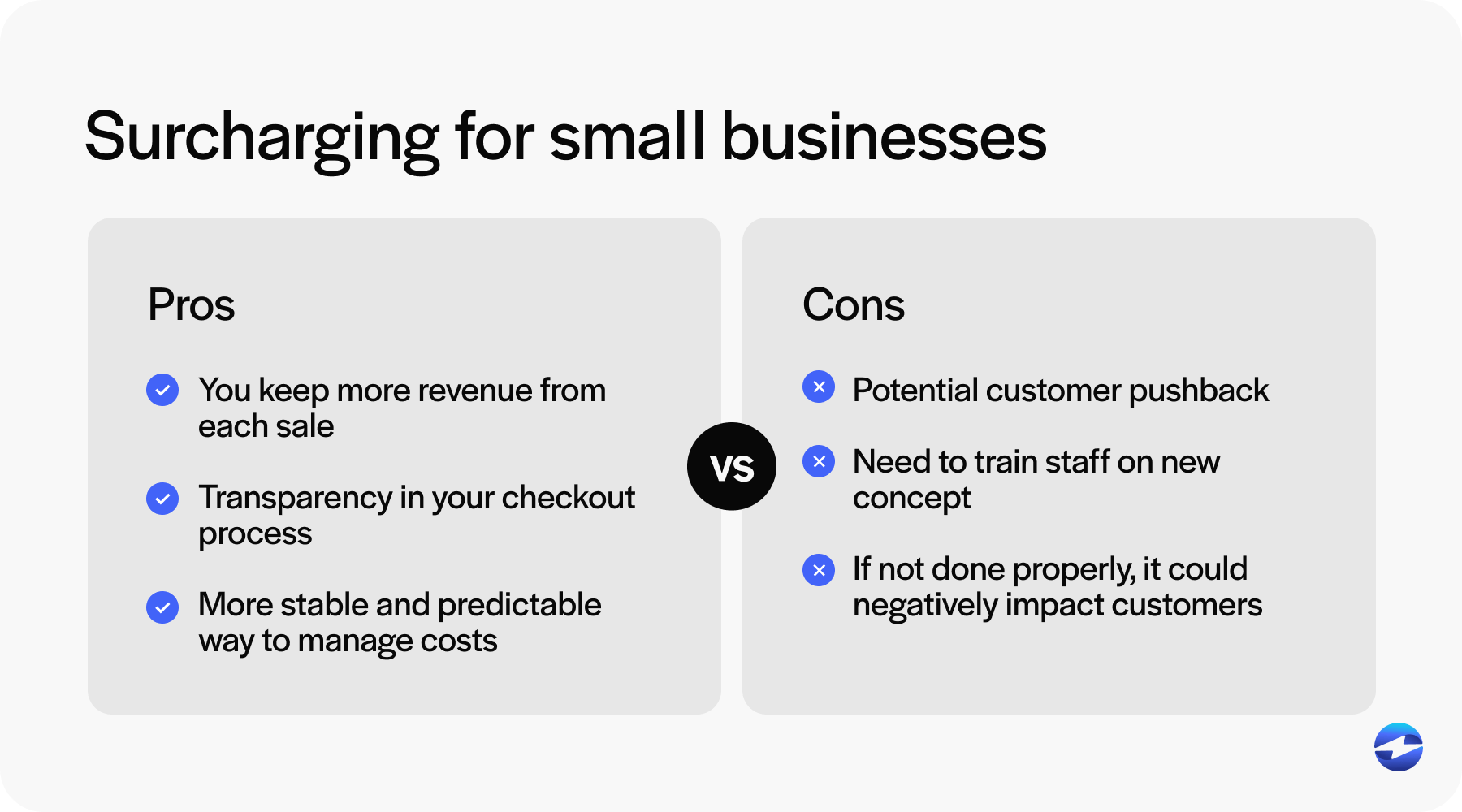

Pros and Cons for Small Businesses

Free credit card processing for small businesses sounds like a win—and in many ways, it is. When done correctly, it can reduce overhead and boost margins without forcing you to

increase prices across the board. But it’s not a silver bullet, and it won’t suit every business equally. Here’s a breakdown of what to expect:

Pros:

- You keep more of your revenue, especially on high-volume credit card transactions where small percentages quickly add up.

- It introduces transparency to your checkout process—customers see exactly what they’re being charged and why.

- For businesses with tight margins, it provides a more stable and predictable way to manage payment-related costs.

But there are trade-offs:

Cons:

- Some customers may feel nickel-and-dimed by surcharging, particularly if they’re not used to seeing those fees.

- You’ll need to train your staff to clearly explain the surcharge policy and confidently respond to concerns or complaints.

- If the change is introduced without sufficient communication or context, it could negatively impact customer trust or brand perception.

This is why small business credit card surcharge programs need to be implemented thoughtfully. With careful planning and clear communication, it can be a financial win. But if rushed or poorly explained, it could create more problems than it solves.

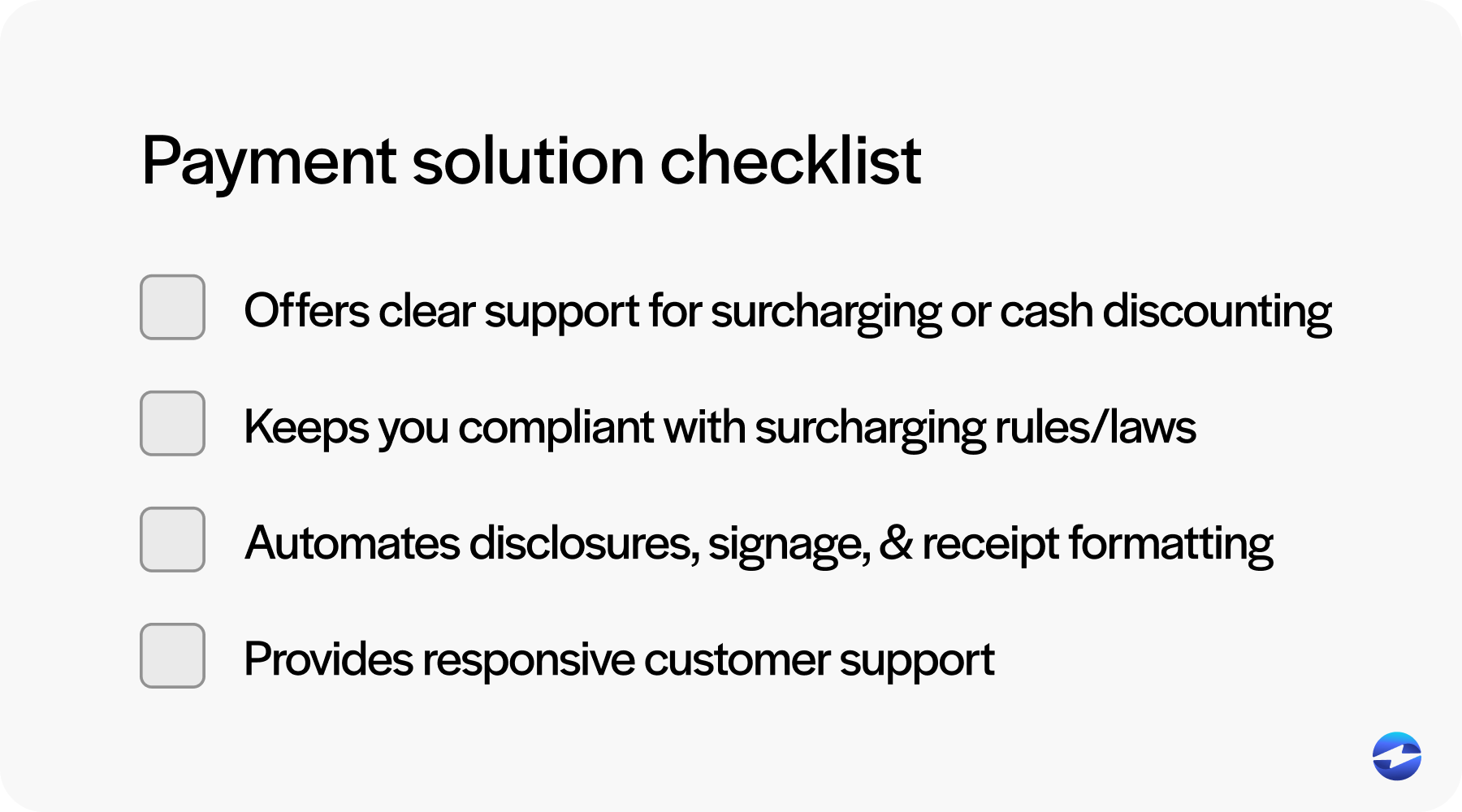

How to Choose a No-Fee Processing Provider

If you’re exploring no-cost credit card processing, the provider you choose matters—a lot. You’re not just picking a tool—you’re choosing a partner that helps you stay compliant, transparent, and efficient. Not all payment processors are built the same, and the last thing you want is to roll out a small business credit card surcharge program only to find yourself out of compliance or facing angry customers.

Look for a payment solution that:

- Offers clear support for surcharging or cash discounting with easy-to-use features

- Keeps you compliant with state laws and card brand rules, including registration assistance and automatic fee caps

- Automates disclosures, signage, and receipt formatting so you don’t have to manage those manually

- Provides responsive customer service that understands the compliance landscape and can guide you through setup and ongoing changes

It’s also smart to dig into the provider’s pricing and contract terms. Ask about:

- Monthly service fees or hidden costs

- Contract length and early termination fees

- Required hardware or software subscriptions

A good payment processor will be upfront and provide you with everything you need to get started confidently—not just the technology but the training and support to use it correctly. If they can’t answer compliance questions or offer practical advice for your specific business, keep looking.

EBizCharge: A Leading Solution for No-Fee Processing

If you’re looking for a provider who truly understands the pressures of running a small business, EBizCharge is a standout option. It’s a top-rated payment processing solution built to help businesses of all sizes manage costs, reduce complexity, and stay ahead of compliance requirements.

EBizCharge simplifies no-cost credit card processing by offering a seamless way to implement surcharging—both in-store and online. Its system automates every step, from registering with card networks to applying fee caps and managing real-time disclosures. This takes the guesswork and manual effort out of the equation, which is especially valuable for small teams with limited bandwidth.

What makes EBizCharge particularly effective for small businesses is its focus on user-friendly tools, transparent pricing, and highly responsive customer support. Whether you’re just getting started with a small business credit card surcharge program or optimizing an existing setup, EBizCharge gives you the infrastructure and guidance to do it right.

At the end of the day, it’s not just about technology—it’s about peace of mind. With EBizCharge, you get a partner who’s invested in your success and knows how to help you navigate credit card processing fees with confidence and control.