Blog > SAP Payment Processing: Getting Started and Essential Requirements

SAP Payment Processing: Getting Started and Essential Requirements

Getting payments right is one of the most important parts of keeping your business running smoothly. For companies working in SAP, payments are woven into nearly every financial process—whether it’s accounts receivable, accounts payable, or the general ledger. Without a well-structured system, things get messy quickly. Manual reconciliations, duplicate data entry, and delays in processing can slow down even the strongest finance teams.

That’s where SAP payment processing comes in. When set up properly, SAP offers a streamlined way to handle all types of transactions directly inside the ERP. This article is designed to walk you through the essentials of payment processing in SAP—from the core features and requirements to best practices and third-party integrations like EBizCharge. If you’re responsible for your company’s financial operations, you’ll find practical steps here to make the SAP payment process more reliable and efficient.

Understanding SAP Payment Processing

At its core, SAP is an enterprise resource planning (ERP) platform that ties together financials, operations, and reporting. Within that framework, SAP payments play a critical role in keeping money flowing in and out of the business. The system supports both accounts receivable (AR) and accounts payable (AP), making it a central hub for managing cash flow.

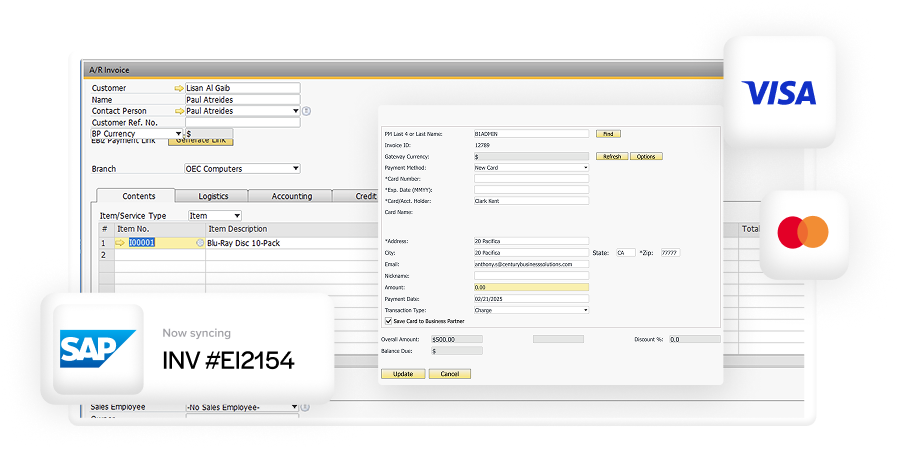

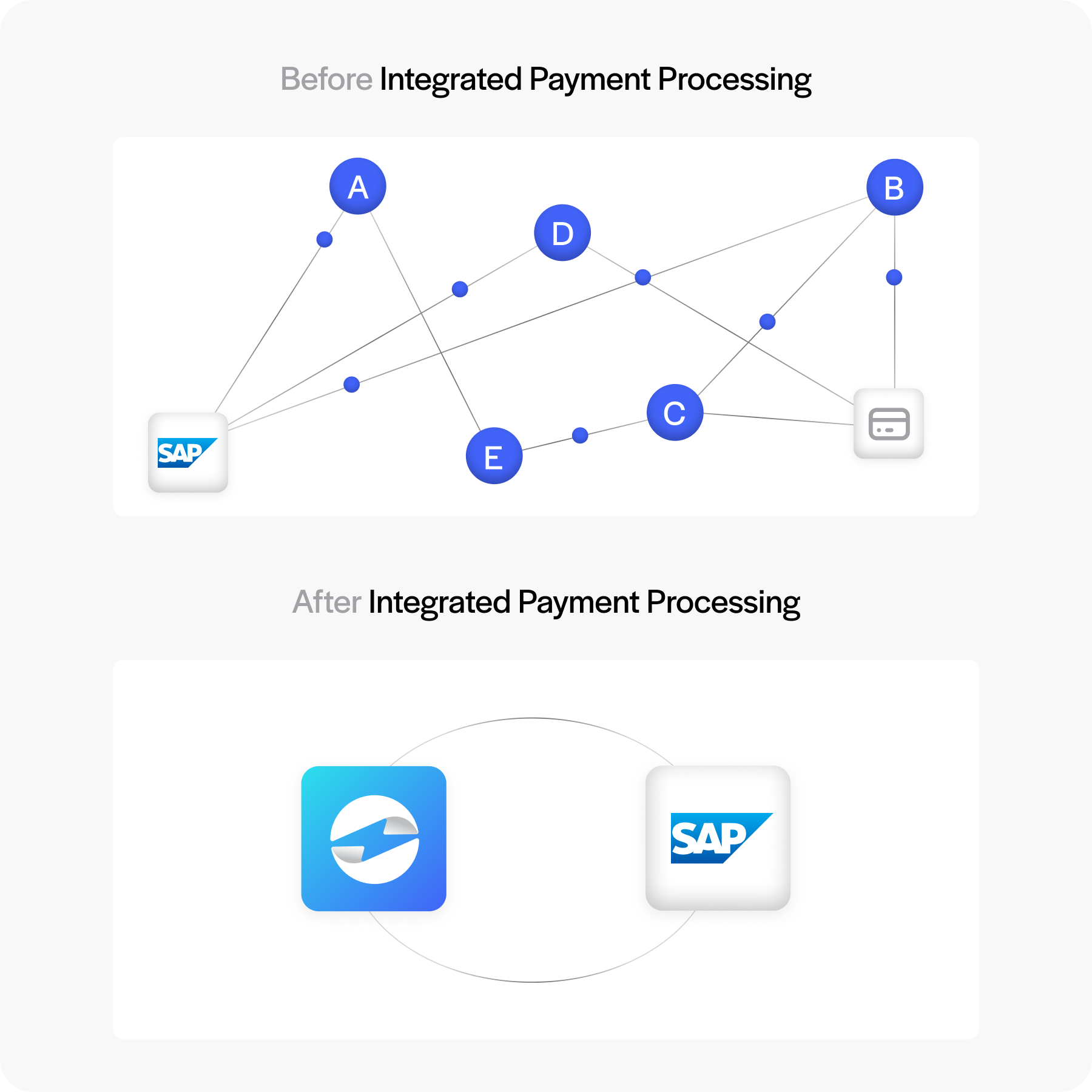

Integrating payment workflows directly into SAP has clear benefits. Instead of running payments on one platform and trying to reconcile them in another, everything happens in one place. That means fewer errors, faster processing times, and cleaner records. The result is a system where every SAP payment method you use—whether it’s credit card, ACH, or wire transfer—ties seamlessly back to your accounting records.

Core Features of SAP Payment Processing

Before diving into setup, it helps to understand what SAP actually brings to the table when it comes to payments. These features explain how the system makes payment management easier, safer, and more accurate for finance teams.

Multi-Method Payment Support

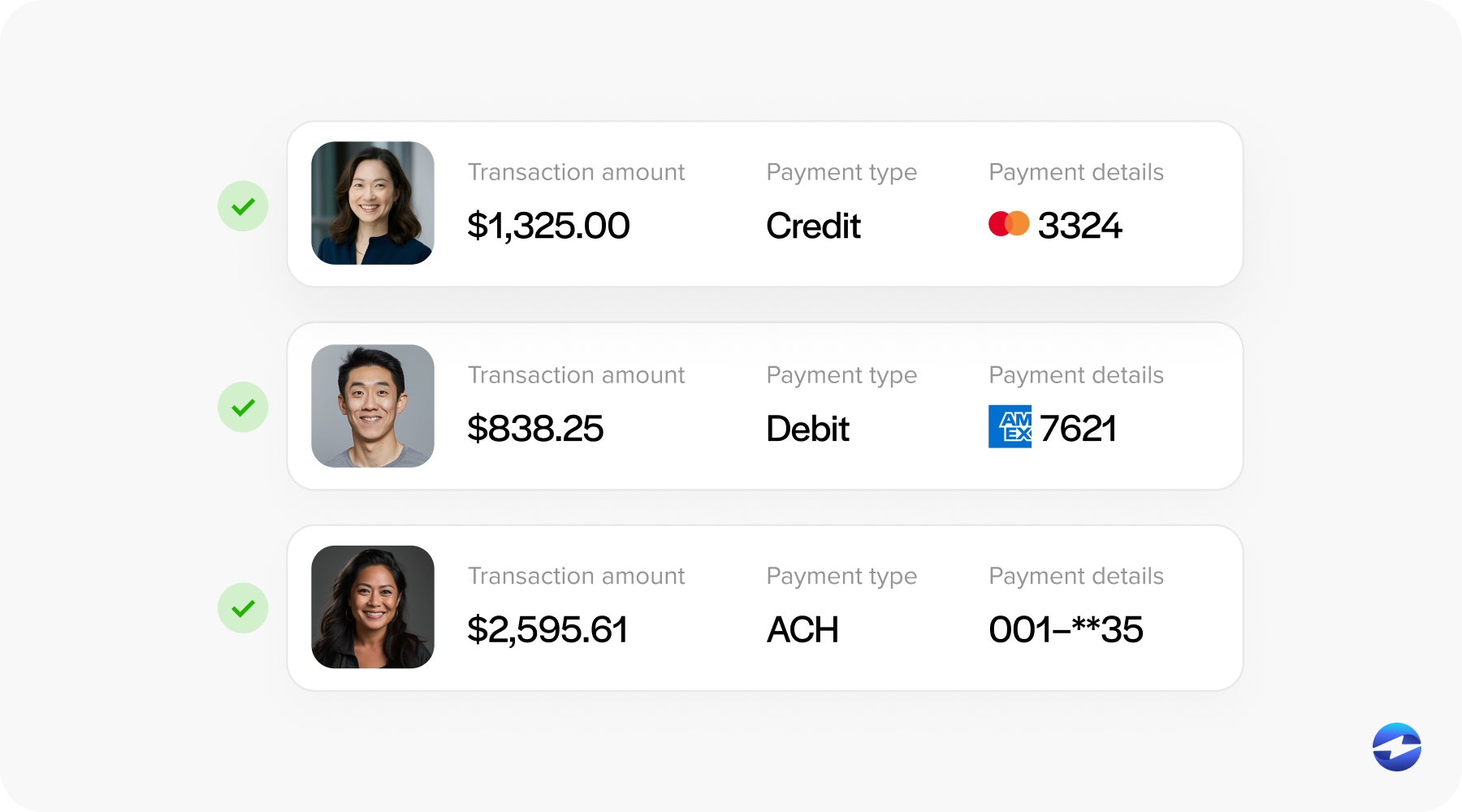

Businesses don’t rely on a single way to get paid, and neither should your ERP. SAP payment methods include credit cards, ACH, wire transfers, and even digital wallets. This flexibility supports both domestic and international customers, making SAP credit card processing and alternative payments easy to manage under one roof.

For companies that deal with subscriptions or long-term contracts, SAP payment card processing also makes recurring billing possible. Supporting multiple payment types is more than convenience—it’s about giving your customers the freedom to pay in the way that works best for them.

Real-Time Integration with SAP Modules

One of the best features of SAP payment processing is how it connects with other parts of the ERP. Payments post automatically to accounts receivable, accounts payable, and the general ledger. That means reconciliation happens faster and financial reporting is more accurate.

Think about the time saved when hundreds of payments a week no longer require manual updates. With SAP payment solutions built into your workflows, what used to be hours of manual work becomes an automated process.

Security and Compliance

Handling payments comes with responsibility. SAP systems support Payment Card Industry (PCI) compliance, meaning they leverage security features like encryption and fraud monitoring, which ensure sensitive data is protected at every step. Audit trails also give finance teams a clear record of who did what and when, which is critical for compliance reviews.

Security isn’t just about ticking boxes for regulators—it’s about building trust with customers who rely on you to handle their information safely.

Reporting and Analytics

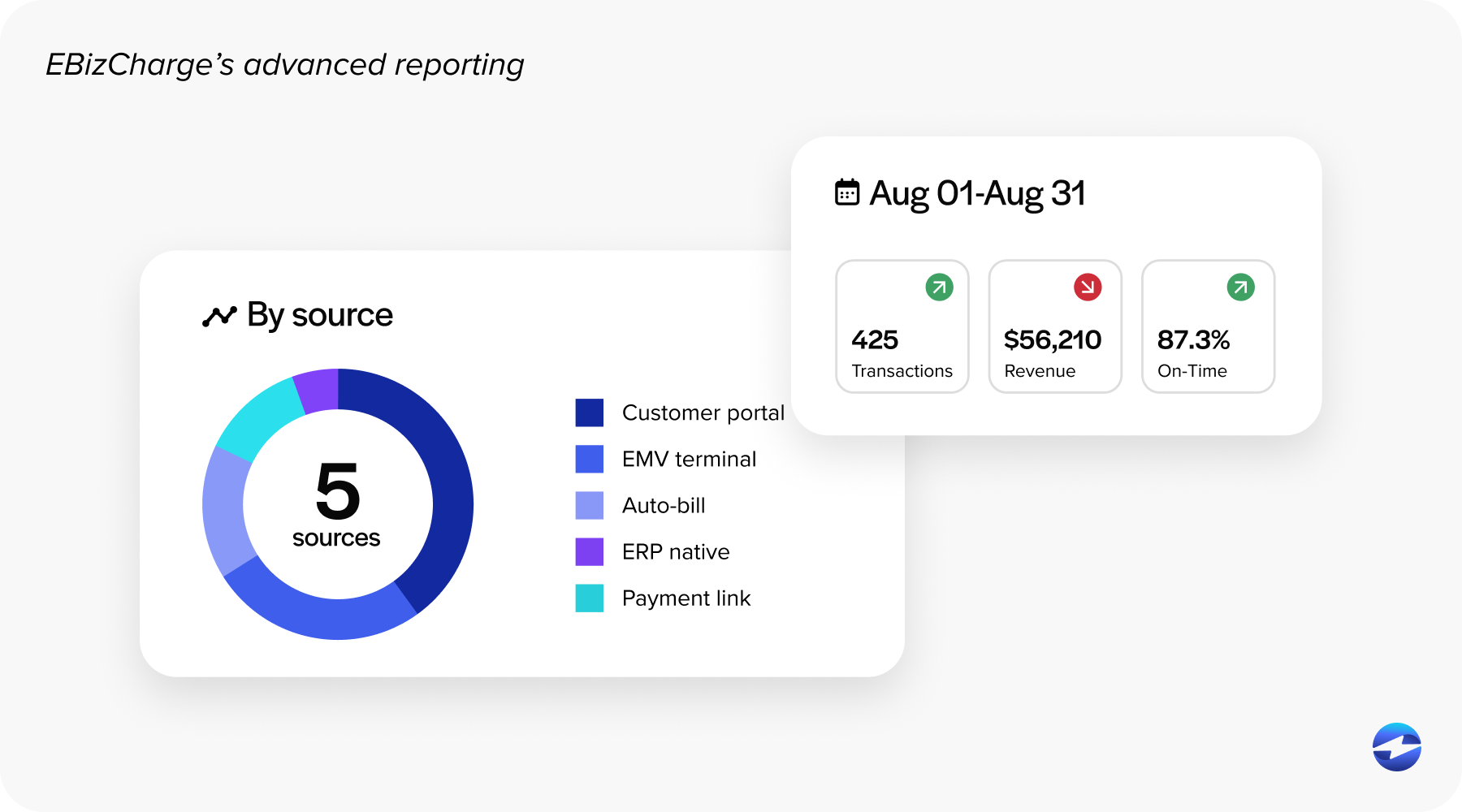

With payments feeding directly into SAP, reporting becomes much more powerful. Finance teams can see transactions in real time, use dashboards to monitor cash flow, and forecast revenue with greater confidence. This visibility helps identify late payments, track customer trends, and spot bottlenecks in the SAP payment process before they become bigger problems.

Together, these features show how SAP makes payment processing more than just a back-office task. They create a system that helps businesses save time, strengthen security, and gain the kind of insight that supports smarter financial decisions.

Essential Requirements for Setting Up SAP Payment Processing

Before diving into configuration and setup, it’s worth understanding why these requirements matter. They form the foundation for reliable and efficient SAP payment processing, ensuring your system is ready to handle day-to-day financial activity without unnecessary risks.

System Prerequisites

Before implementing SAP payments, make sure you have the right SAP modules and licensing in place. Verify your infrastructure and connectivity, too—payment integration depends on reliable systems.

Choosing a Payment Processor

The payment partner you choose makes a big difference. Not every payment processor integrates smoothly with SAP, so compatibility should be your top priority. Beyond that, consider transaction fees, customer support, and scalability. The right SAP payment gateway should grow with your business.

Configuration Steps

Setting up the SAP payment process requires some planning. You’ll need to configure customer and vendor payment methods, activate payment features, and test postings to make sure everything flows correctly into accounts receivable, accounts payable, and the general ledger. Running test transactions is an important step—better to catch errors early than after the system goes live.

Security Setup

Strong security is a requirement, not an option. Enforce role-based access controls so only the right people can access sensitive financial data. Regular compliance checks should also be part of your routine to make sure your SAP payment solution stays secure.

By covering these requirements upfront, businesses can avoid common pitfalls and set themselves up for smoother SAP payments in the long run. Think of them as the groundwork that supports all of your payment workflows moving forward.

Best Practices for SAP Payment Processing

Before jumping into specific recommendations, it’s worth remembering that even the best system depends on how it’s used. Following a few simple best practices can make the difference between just getting by and really getting value from your SAP payment processing setup.

- Automate routine tasks. Use SAP’s automation tools to schedule payment reminders, and reconciliations. The less manual input, the lower the risk of errors.

- Keep data clean. Outdated or duplicate customer/vendor records cause problems down the line. Regularly audit your data to keep SAP payments accurate.

- Train your teams. Finance and IT staff should be comfortable with how payment workflows function in SAP. Good training reduces mistakes and increases confidence.

- Leverage reports. Don’t just process payments—use the data to spot trends, improve collections, and forecast more effectively.

These practices keep your SAP payment processing running smoothly and help you get the most value out of your ERP.

Benefits of Integrating EBizCharge with SAP

While SAP provides a strong foundation, many businesses enhance it with a third-party payment processor like EBizCharge. This integration removes the need for duplicate data entry and speeds up reconciliation by posting payments directly into accounts receivable and the general ledger. That means fewer errors and less manual work for your team.

EBizCharge also provides customer-facing payment portals, making it easier for clients to pay invoices online—a simple improvement that often leads to faster collections. Lower transaction fees are another benefit, helping companies cut costs without sacrificing performance.

Advanced reporting tools add another layer of visibility, giving finance teams more control over cash flow. And because EBizCharge scales with your business, it supports both current needs and future growth. For companies looking to strengthen their SAP credit card processing setup, EBizCharge is a practical, proven option.

Optimizing SAP Payment Processing

Payments touch every part of a business, from customer satisfaction to accurate reporting. That’s why getting SAP payment processing right is so important. By understanding the features SAP offers, meeting the essential requirements, and following best practices, you set the stage for smoother operations and stronger financial control.

And when you’re ready to go beyond the basics, adding a partner like EBizCharge can make the SAP payment process even more efficient. From lowering costs to providing online portals, it’s a way to build a stronger, more scalable SAP payment solution. For growing businesses, that combination can be the difference between constantly playing catch-up and staying ahead of the curve.