Blog > SAP Payment Integration: Configuration Best Practices and Setup Guide

SAP Payment Integration: Configuration Best Practices and Setup Guide

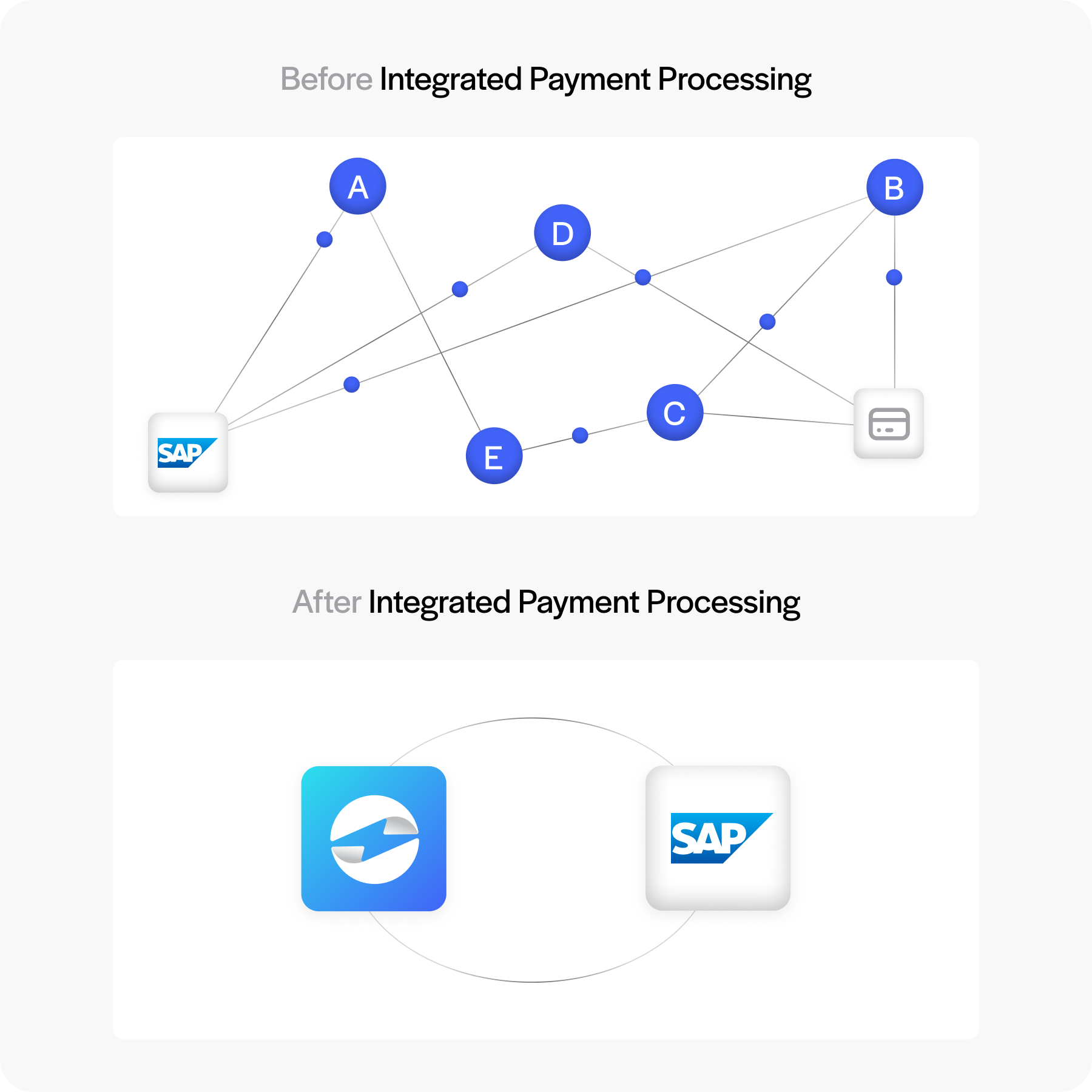

For companies running on SAP, getting payments right is more than just a back-office task—it’s a crucial part of keeping operations smooth and customers satisfied. When payment processes are disconnected or handled manually, issues pile up quickly. Inaccurate records, delayed cash flow, and wasted hours on reconciliation become routine headaches. Many finance teams know this struggle all too well.

That’s why SAP payment integration matters. By bringing payment functions directly into your enterprise resource planning (ERP) system, you can replace scattered, error-prone workflows with a process that’s connected, secure, and reliable.

This article walks through the essentials of SAP payment gateway integration, from understanding key features to configuration steps and best practices. It’ll also explore how third-party tools like EBizCharge can help you take payment workflows even further.

Understanding SAP Payment Integration

At its core, SAP (Systems, Applications & Products in Data Processing) provides a wide range of ERP financial modules that handle everything from invoicing to the general ledger. Integrating payments into these modules ensures transactions flow seamlessly through accounts receivable, accounts payable, and the general ledger. Instead of juggling spreadsheets or switching between platforms, SAP payments become part of the same ecosystem you already use for reporting and billing.

This kind of integration brings clear benefits: fewer errors, faster posting times, and more accurate reporting. Customers benefit as well since payments can be processed more quickly and securely. For finance teams, integrated SAP payment processing removes many of the manual steps that slow things down. Ultimately, it creates an environment where billing and payments are connected end to end.

Key Features of SAP Payment Integration

Before setting up integration, it helps to understand what makes SAP’s payment tools valuable in the first place. These features highlight how SAP handles different aspects of payment processing, from supporting varied methods to keeping data secure.

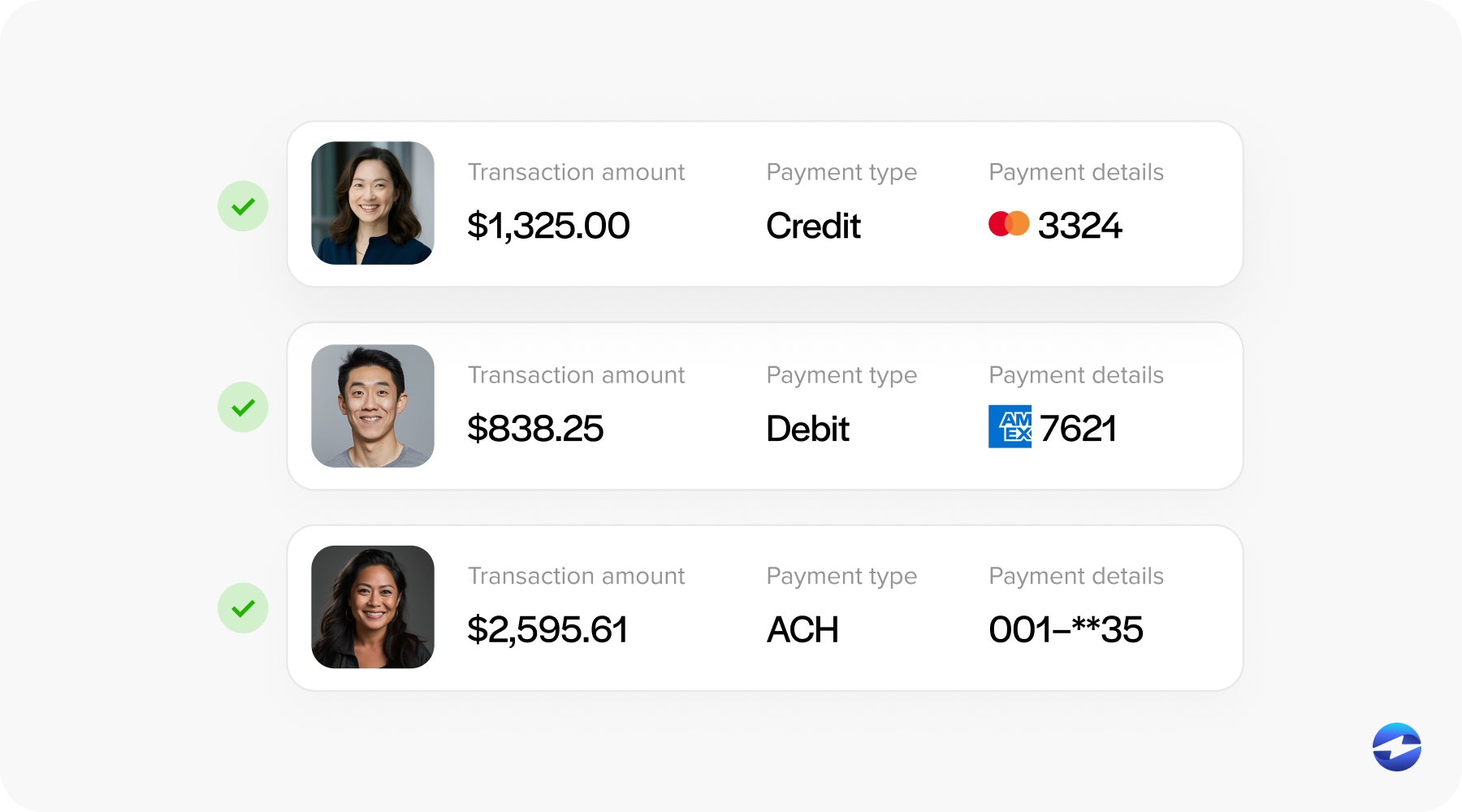

Multi-Method Payment Support

Modern businesses need to accept more than just checks. With the right setup, SAP supports multiple payment methods, including credit cards, ACH transfers, wire payments, and even digital wallets. Whether you’re billing customers domestically or internationally, integrated SAP billing software gives you the flexibility to adapt. For recurring billing or subscription-based models, SAP credit card processing configuration ensures payments are collected automatically, reducing delays and improving consistency.

Real-Time Posting

One of the most useful aspects of SAP payment integration is how quickly it records payments. As soon as money comes in, it’s logged directly into accounts receivable and the general ledger without waiting for manual updates. This quick posting keeps your books accurate, shortens the gap between processing and reporting, and helps prevent reconciliation headaches. For companies that deal with a high number of transactions, having payments flow in real time can make a huge difference in efficiency and peace of mind.

Security and Compliance

Payment data is sensitive, and keeping it secure should always be a priority. SAP supports PCI compliance, including security features like tokenization and fraud monitoring tools to help protect data. Role-based access controls also ensure only the right people handle payment information. Building strong security into your SAP payment process not only protects your business but also builds trust with customers.

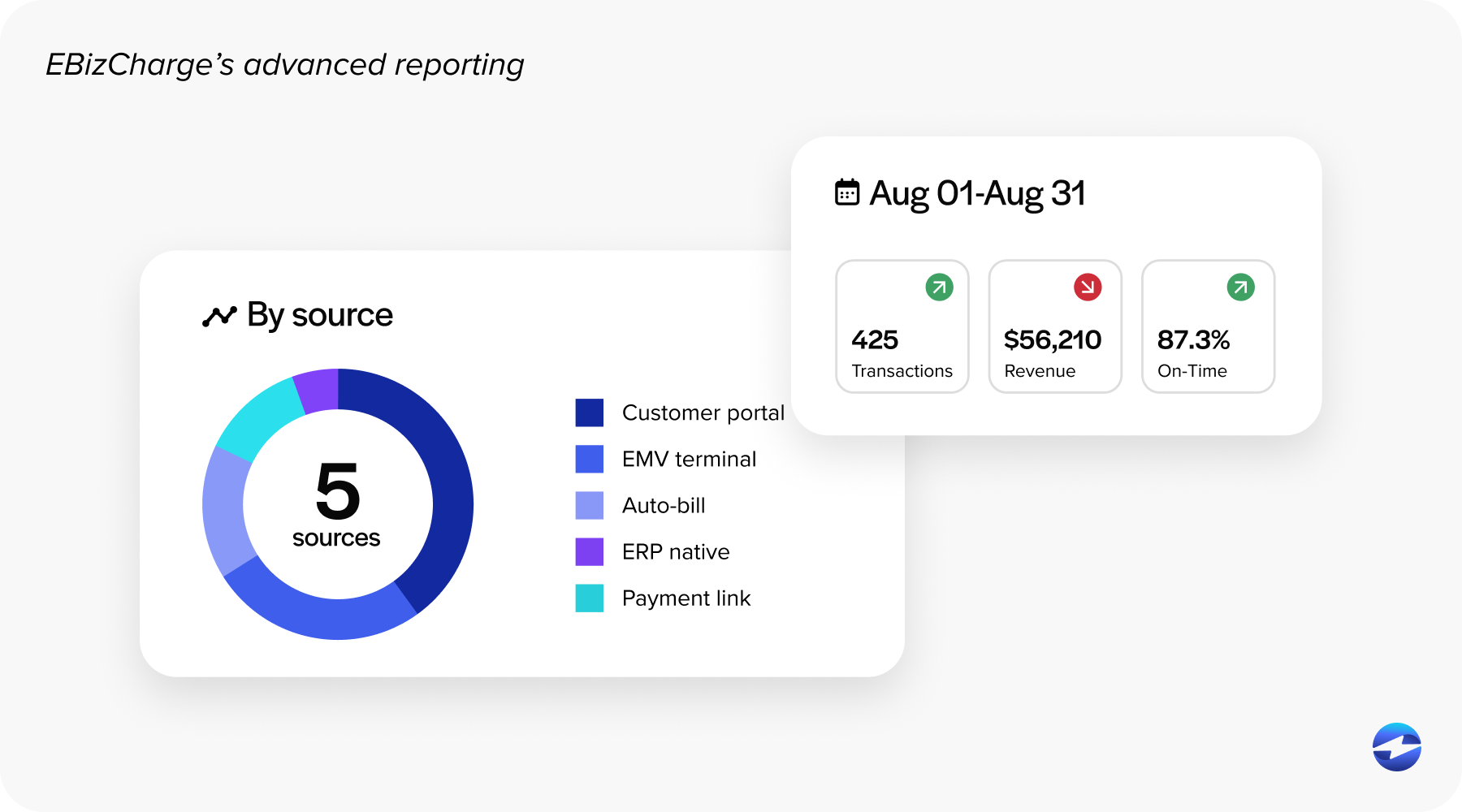

Reporting and Analytics

Integrated payments also unlock stronger reporting. Instead of piecing together information from different sources, all data flows into SAP’s dashboard. Finance teams can track late payments, analyze customer trends, and forecast cash flow with confidence. Having payment data built into the same system you use for accounting makes reporting much more reliable.

Together, these features show how SAP turns payments into more than just transactions. They give businesses the tools to save time, stay secure, and make smarter financial decisions.

Setup Guide for SAP Payment Integration

Before taking advantage of integrated payments, you’ll need to go through some setup steps in SAP. Think of this as laying the groundwork—once these pieces are in place, your payment workflows will be far more reliable and easier to manage.

System Prerequisites

Before configuring payments, confirm you have the right SAP modules and licenses in place. Infrastructure should also be checked to ensure your system can support real-time updates and secure connections.

Configuring Payment Methods

When you reach this step, you’ll want to set up SAP payment methods to reflect how your customers and vendors actually pay. That means adding options like credit cards, ACH transfers, or wire payments. Once those methods are in place, you can switch on the payment features in SAP so they connect directly with your financial workflows. Many businesses also add automated reminders here, which is a simple way to keep collections moving without a constant manual follow-up.

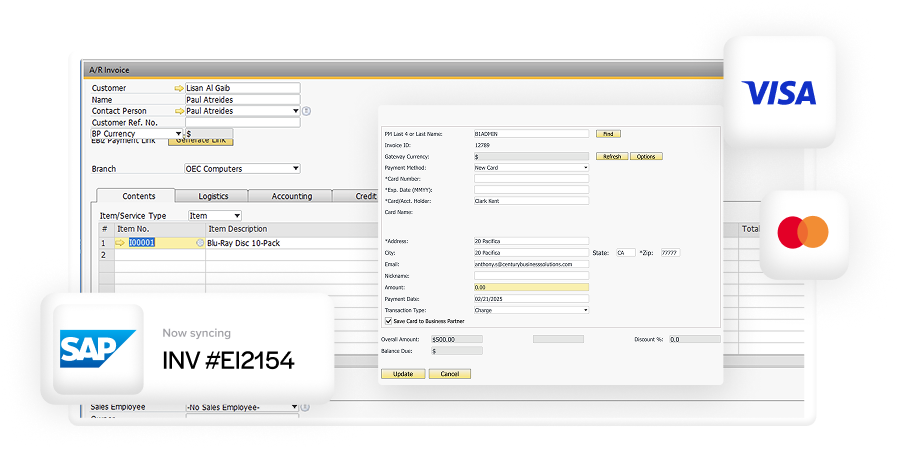

Connecting to a Payment Processor

This is one of the most important steps. You’ll need to decide whether to use SAP’s native options or work with a third-party payment processor. When making this decision, consider factors like integration compatibility, transaction costs, customer support, and scalability. The right payment processing solution should not only work with SAP but also help your business grow over time.

Testing Transactions

Never skip testing. Before going live, run sample invoices and payments to ensure they post correctly into accounts receivable and the general ledger. This step confirms your SAP credit card processing configuration is accurate and that reconciliation works as expected. Testing early prevents bigger issues later.

By carefully following these steps, businesses can feel confident that their SAP payment integration is built on solid ground. A little extra time upfront ensures the system will work smoothly once it’s live, reducing errors and saving effort in the long run.

Best Practices for SAP Payment Integration

Before diving into setup, it’s helpful to step back and look at habits that make integration more effective.

Here are a few best practices to consider:

- Automate whenever possible. Set up payment runs, reminders, and reconciliation to reduce manual entry. Automation makes your SAP billing process smoother and less error-prone.

- Keep customer and vendor records clean. Outdated or duplicate records can disrupt workflows. Regular audits keep SAP payments accurate.

- Train finance and IT staff. People need to understand not just how to use the system, but why integration matters. Training builds confidence and prevents errors.

- Stay compliant. Regular reviews of PCI requirements and security practices keep your system trustworthy.

- Use reporting as a guide. Dashboards and analytics aren’t just numbers—they’re tools for spotting trends, predicting cash flow, and improving your strategy.

Together, these practices help you get more from your SAP payment integration. They make day-to-day work easier and ensure the system continues to support your business as it grows.

Benefits of Using EBizCharge with SAP

SAP has strong capabilities on its own, but many businesses enhance them with a third-party payment processor like EBizCharge. Direct integration with SAP reduces manual entry and posts payments automatically, making the entire process faster and less error-prone.

EBizCharge also offers customer-facing portals, so clients can pay invoices online at their convenience. This often speeds up collections and improves customer satisfaction. Lower transaction costs are another benefit, saving businesses money while improving efficiency.

Advanced reporting adds another layer of visibility, giving finance teams clearer insights into cash flow and customer behavior. As a scalable SAP payment solution, EBizCharge grows with your business, whether you’re processing a handful of transactions or thousands each day.

Unlocking the Full Potential of SAP Payment Integration

Integrating payments into SAP isn’t just about technology—it’s about creating a smoother, more reliable process for your team and your customers. By understanding the features of SAP payment gateway integration, following a structured setup process, and sticking to best practices, businesses can eliminate inefficiencies and reduce risk.

When paired with a partner like EBizCharge, your SAP billing software and payment workflows become even more powerful. From customer portals to lower fees, the right integration creates a system that’s efficient, secure, and scalable. For businesses ready to take control of their financial operations, now is the time to strengthen your SAP payment processing setup and build a foundation for long-term success.