Blog > Salesforce PCI Compliance: Security Requirements for Payment Processing

Salesforce PCI Compliance: Security Requirements for Payment Processing

Handling payments in Salesforce comes with both opportunity and responsibility. Customers expect fast, seamless transactions, while regulators demand strict security standards. This is where PCI compliance enters the picture. The Payment Card Industry Data Security Standard (PCI DSS) sets rules that every business handling card payments must follow. For teams working inside Salesforce, questions often arise: Is Salesforce PCI compliant by default? What parts fall on the platform, and what parts fall on the business?

The reality is that Salesforce provides the tools, but the responsibility to configure, integrate, and monitor lies heavily with your organization. This article will unpack the essentials of Salesforce PCI compliance, explain responsibilities, highlight best practices, and explore how solutions like EBizCharge can simplify the process while keeping payment data secure.

Understanding PCI DSS in Salesforce

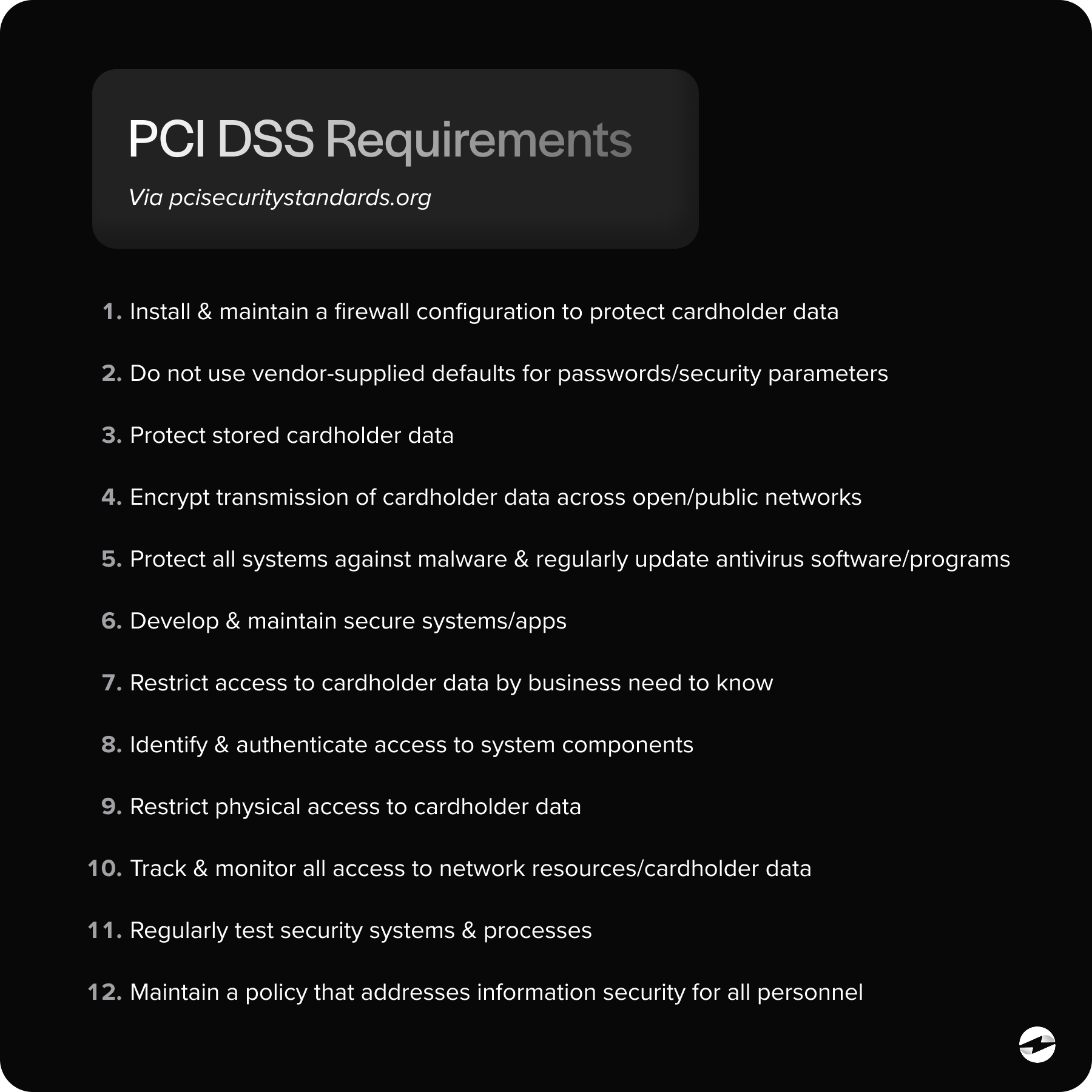

Payment Card Industry Data Security Standards (PCI DSS) was created to protect cardholder data. It includes 12 core requirements, ranging from encrypting sensitive information to monitoring network activity. In a Salesforce environment, these requirements translate into how invoices, orders, and payments are managed within the Salesforce billing platform.

Salesforce itself provides a secure infrastructure, but that doesn’t mean businesses can assume compliance is handled for them. While Salesforce is a trusted platform with strong security, is Salesforce PCI compliant on its own? Not entirely. The answer lies in the shared responsibility model. Salesforce manages the foundation—servers, infrastructure, and built-in security controls. Businesses, on the other hand, must ensure their configurations, integrations, and data handling meet PCI DSS standards.

PCI Compliance Responsibilities

Compliance in Salesforce is shared across multiple players: the platform, the business, and any connected payment processor or Salesforce payment gateway.

Salesforce handles platform-level protections, such as physical security and system-wide encryption. But it’s up to businesses to manage how data is entered, who can access it, and what integrations are in place. For example, if your team builds custom objects to store payment details, that’s your responsibility to secure. Likewise, when you connect a payment processing solution to Salesforce, you need to verify that the provider itself is PCI compliant.

This is where Salesforce payment integration decisions matter. Using a native, PCI-compliant gateway often reduces the scope of responsibility for IT and finance teams, while relying on loosely connected third-party tools can increase the compliance burden.

Security Requirements for Payment Processing in Salesforce

The heart of PCI DSS in Salesforce is how you protect sensitive payment information. That includes:

- Encryption and tokenization: Raw cardholder data should never be stored in Salesforce. Tokenization replaces sensitive data with secure tokens, while encryption ensures data in transit stays safe.

- Access control: Only authorized users should be able to view or manage payment data. Salesforce role hierarchies and permission sets play a big role here.

- Logging and monitoring: Tracking who accessed or modified data is a PCI requirement. Salesforce event monitoring can help provide these logs.

- Vulnerability management: Staying current with patches, updates, and periodic security testing is essential.

When combined, these practices help businesses build a billing environment that protects customers and avoids regulatory penalties.

Best Practices for Maintaining PCI Compliance in Salesforce

IT and finance teams working in Salesforce need to take proactive steps to stay compliant. Some proven practices include:

- Avoid storing raw cardholder data anywhere in Salesforce custom fields.

- Choose PCI-compliant Salesforce payment gateways that handle sensitive data securely.

- Automate regular audits, penetration tests, and compliance checks.

- Require strong user authentication, such as multi-factor authentication (MFA), for anyone accessing payment records.

- Provide ongoing staff training so everyone understands their compliance responsibilities.

These actions not only improve security but also reduce the stress of annual PCI audits.

Role of Payment Gateways and Payment Processors

A Salesforce payment gateway serves as the secure bridge for transmitting card data. A payment processor moves the money and settles transactions in your account. Together, they are the backbone of any payment processing solution.

Gateways are especially important because they can minimize PCI scope. When a PCI-compliant gateway handles sensitive information, Salesforce never stores raw card data, which reduces risk dramatically. Choosing the right provider for Salesforce payment integration is one of the biggest decisions IT and finance teams face. Native integrations often simplify compliance, while API-heavy or third-party systems can increase oversight requirements.

Common Pitfalls and How to Avoid Them

Even well-meaning teams can make mistakes. Some of the most common pitfalls include:

- Storing unencrypted payment details in custom objects, which immediately breaks PCI rules.

- Assuming Salesforce alone guarantees PCI compliance, rather than recognizing it as a shared responsibility.

- Overlooking third-party integrations that may transmit or store sensitive data outside your control.

The best way to avoid these issues is to clearly document responsibilities, test integrations regularly, and partner with PCI-compliant providers who understand the Salesforce ecosystem.

Why EBizCharge is a Good Fit

Among the many solutions available, EBizCharge stands out as a good fit for Salesforce users focused on PCI compliance. Because it is fully PCI compliant, businesses don’t need to carry the heavy burden of managing raw cardholder data within Salesforce. Instead, sensitive information is tokenized and secured automatically, keeping compliance scope smaller and easier to manage.

EBizCharge’s native Salesforce integration also offers real-time posting of payments directly into invoices and accounts, simplifying reconciliation. Multi-currency support is built in, making it easier for companies operating internationally. Customer portals provide buyers with a secure, convenient way to pay online. Fraud monitoring and Level 2/3 data support help reduce risks and costs at the same time.

In other words, EBizCharge isn’t just a payment processor but a payment processing solution that makes Salesforce payment integration easier and safer. For IT and finance teams managing Salesforce billing, this combination of PCI compliance and native integration is a significant advantage.

Conclusion

Ensuring Salesforce PCI compliance is about more than checking boxes—it’s about building trust with customers and protecting your business from avoidable risks. While Salesforce provides a secure foundation, businesses must take ownership of how payment data is handled, which gateways are chosen, and how integrations are managed.

Native tools like EBizCharge simplify this process by providing a fully PCI-compliant Salesforce payment gateway that aligns with the Salesforce billing platform. Stripe and other API-driven tools can be strong options in certain cases, but they often require more custom oversight. For most organizations, especially those relying heavily on Salesforce for revenue operations, EBizCharge delivers the compliance, simplicity, and security that IT and finance teams need.

For IT managers, finance leaders, and eCommerce professionals, the takeaway is simple: PCI compliance isn’t optional, and the right tools make it far less of a burden. With thoughtful planning and the right partners, Salesforce can be the hub of a secure, compliant, and efficient revenue cycle.

- Understanding PCI DSS in Salesforce

- PCI Compliance Responsibilities

- Security Requirements for Payment Processing in Salesforce

- Best Practices for Maintaining PCI Compliance in Salesforce

- Role of Payment Gateways and Payment Processors

- Common Pitfalls and How to Avoid Them

- Why EBizCharge is a Good Fit

- Conclusion