Blog > Salesforce Payment Processing: Why You Need It and Benefits

Salesforce Payment Processing: Why You Need It and Benefits

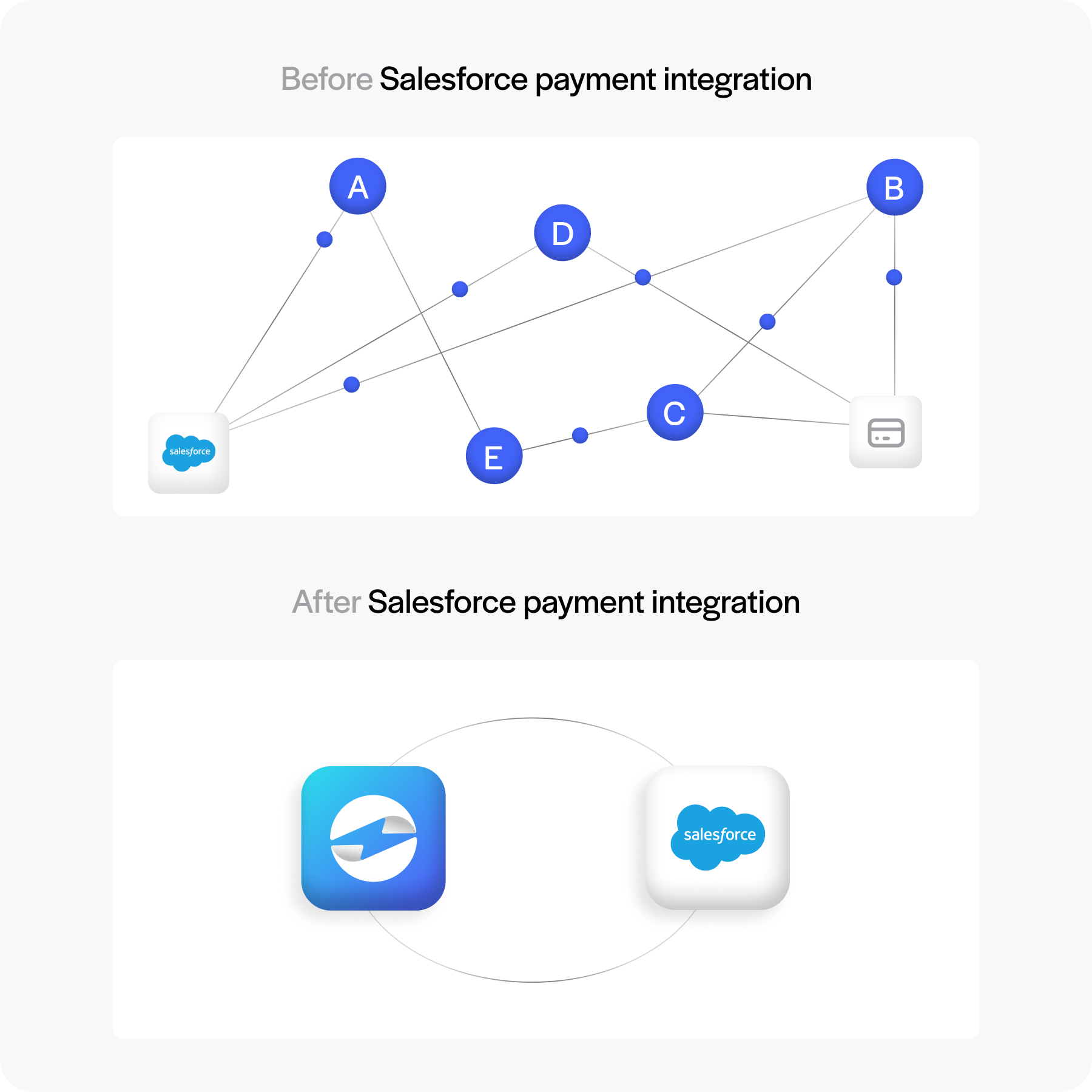

Running payments directly through Salesforce is no longer a nice-to-have feature. For many companies, it’s become essential. Salesforce is often the central hub for sales, billing, and customer data. If payments are managed outside of that hub, teams end up chasing information across systems, fixing reconciliation errors, or re-entering data manually. That’s why Salesforce payment processing matters—it’s about keeping everything connected, accurate, and efficient.

This article will explore how Salesforce payment processing works, what costs and fees to consider, and the real advantages of using a native system. We’ll also touch on subscription billing, Payment Card Industry (PCI) compliance, and compare Stripe with EBizCharge so you can see where the differences lie. This isn’t about hype—it’s about giving finance and IT professionals practical insight into choosing the right payment processing solution.

Processing Fundamentals

At its core, Salesforce payment processing is simple: a customer makes a purchase, a Salesforce payment gateway routes the transaction securely, the payment processor approves it, and funds are settled into your account. But when this happens inside Salesforce, it unlocks additional benefits.

With a Salesforce payment gateway, payments can flow directly into Salesforce records. That means when someone pays an invoice or makes a purchase through a connected terminal or portal, Salesforce credit card processing posts the result in real time to the right account. You’re not just accepting money—you’re updating your entire system of records.

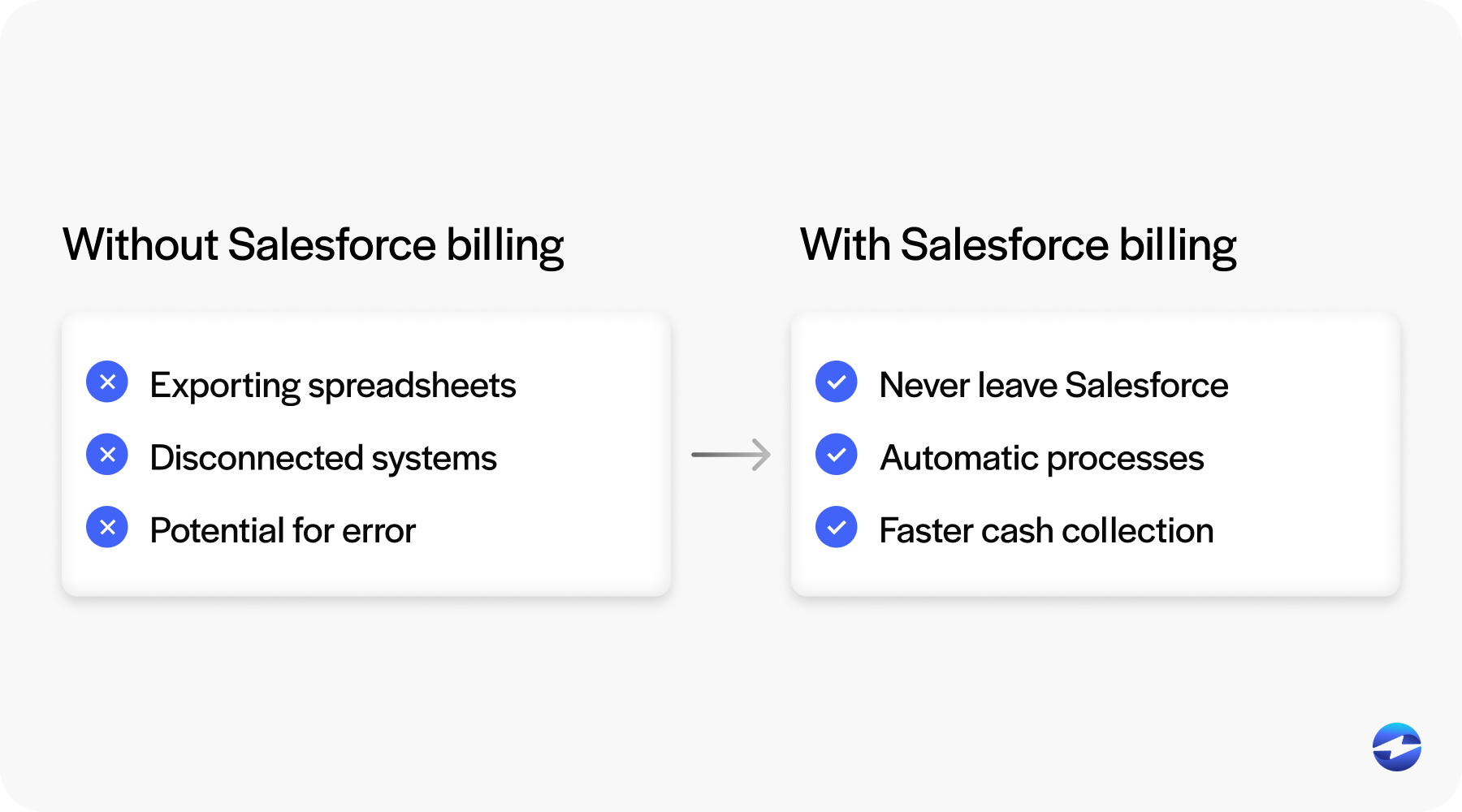

The fundamentals matter because they dictate how smooth the rest of your workflow will be. If Salesforce merchant services are handled outside the platform, teams spend extra hours pulling reports, matching line items, and reconciling transactions. When Salesforce integration is native, all of that busy work disappears.

Cost Analysis

The cost of payment processing often comes down to two buckets: fixed costs and variable costs. Fixed costs might include account setup or monthly gateway fees. Variable costs are tied to the transactions themselves, like percentages charged on credit card payments or ACH transfers.

With Salesforce payment processing, costs also include the hidden time spent managing reconciliation if you don’t have a native setup. Think about the hours finance teams lose re-entering data or adjusting records when systems don’t sync. That’s real money.

A native Salesforce billing platform can reduce those hidden costs. Payments are posted directly to invoices, and records stay accurate across the board. While transaction fees still apply, the overall return comes from the time and errors you avoid. In this way, the cost analysis isn’t just about what you pay to a payment processor—it’s also about what you save by not needing manual workarounds.

Transaction Fees

Every business knows transaction fees add up. Whether it’s a standard 2.9% for credit card transactions or a lower fee for ACH, those small percentages matter when scaled across hundreds or thousands of payments. Understanding those fees is crucial when evaluating a payment processing solution.

Stripe, for example, is transparent with fees and easy to model. But businesses sometimes discover that advanced features—fraud tools, recurring billing, or multi-currency support—come at an added cost. On the other hand, solutions like EBizCharge bundle many of these tools into the core package, so the effective transaction cost can be lower.

For Salesforce credit card processing, transparency is key. Finance teams need to know exactly how fees impact margins and how Salesforce payment options like ACH, credit cards, and digital wallets stack up. Choosing the right payment processor isn’t just about rates—it’s about predictability and fitting with Salesforce billing.

Subscription Billing

Subscription billing is one of the areas where Salesforce billing really shines. With Salesforce payment processing built in, renewals can be automated, failed payments retried, and dunning processes triggered without manual steps. That means smoother cash flow and fewer surprises for finance teams.

This capability is especially valuable for companies running subscription-based business models, whether in SaaS, memberships, or recurring service industries. By tying recurring revenue directly into the Salesforce billing platform, finance teams can forecast with greater accuracy, and sales teams can track lifecycles without juggling multiple tools.

Native Advantages and PCI Compliance

The real strength of Salesforce payment processing comes from native processing. When your Salesforce billing platform includes payment functionality, invoices, accounts, and contracts update instantly. That’s less time spent on manual reconciliation and fewer errors slipping into customer records.

Native Salesforce merchant services also mean less IT overhead. Without the need for middleware or custom connectors, the Salesforce integration is simpler to maintain. For IT teams, that’s less firefighting and more focus on strategic projects.

Security and compliance are also major advantages. A native solution typically comes with tokenization and PCI compliance built in. Sensitive data isn’t stored directly in Salesforce, which reduces your risk. This matters to finance leaders and IT managers who need confidence in how data is handled. When a Salesforce payment gateway takes care of security at the processing level, you avoid unnecessary exposure.

Stripe vs. EBizCharge

Stripe has strong developer tools, global reach, and flexibility across industries. However, when it comes to Salesforce merchant services, Stripe requires a connector or custom integration. That means more work for IT and more opportunities for sync issues.

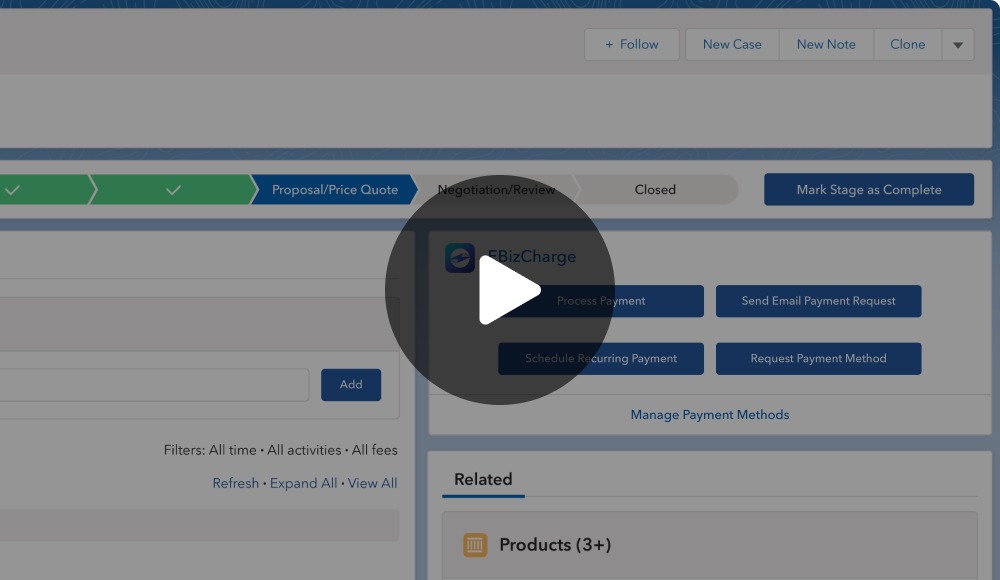

EBizCharge, by comparison, was designed to be Salesforce-native. Payments are posted directly into Salesforce billing without extra layers. Features like fraud detection, tokenization, and customer portals are bundled in. And because it doubles as a Salesforce payment gateway and processor, businesses avoid juggling multiple services.

When comparing the two, Stripe’s flexibility is impressive, but EBizCharge edges ahead for organizations that live inside Salesforce. The lower overhead, simpler Salesforce integration, and bundled features make it a more efficient payment processing solution for many companies.

Finding the Right Fit

So, why do you need Salesforce payment processing? Because it keeps your most important systems aligned. Payments connect directly to your Salesforce billing platform, transactions sync in real time, and finance teams gain clarity instead of confusion.

For businesses, the benefits are clear: fewer manual errors, better compliance, and stronger customer trust. For IT teams, the value lies in less maintenance and cleaner integrations. For leadership, it’s about ROI and ensuring Salesforce payment options align with the company’s strategy.

Both Stripe and EBizCharge can handle payments, but the question is how well they fit into Salesforce. Stripe is flexible but demands more work. EBizCharge delivers a native experience with less friction. For many Salesforce-driven organizations, that makes the difference.

As professionals who depend on Salesforce to keep operations running, you know the value of clean workflows and reliable data. The payment processor you choose should support that, not add complexity. A strong Salesforce integration ensures your payment services aren’t just functional—they’re strategic.

Choosing a Payment Path That Strengthens Salesforce

Salesforce payment processing isn’t just about accepting payments. It’s about integrating billing, compliance, and customer records in one ecosystem. From processing fundamentals to transaction fees and subscription billing to PCI compliance, the right setup drives efficiency and trust.

While Stripe brings flexibility, EBizCharge brings simplicity and Salesforce-native advantages. Whichever payment processor you choose, ensure it fits your Salesforce billing platform and delivers the clarity your teams need.

At the end of the day, Salesforce merchant services are about more than transactions. They’re about building a foundation for growth, accuracy, and efficiency in the systems you use every day.