Blog > Salesforce Payment Gateway Integration: Native vs. Third-Party Solutions

Salesforce Payment Gateway Integration: Native vs. Third-Party Solutions

Getting paid should be the simplest part of running a business, yet anyone who has worked in finance or operations knows it can be surprisingly complicated. In Salesforce, where many teams already handle quoting, contracts, and customer data, the missing piece is often payments. That’s where Salesforce payment gateway integration comes in. The right setup ensures that when a deal closes, the money flows securely and efficiently into your accounts without endless manual steps.

This article explores how Salesforce payment gateways fit into the Salesforce billing process. It will compare native integrations with third-party options, break down what each approach means for complexity and security, and highlight what to watch for when making a choice. The goal is to keep the conversation practical—something finance leaders, admins, and RevOps professionals can use as a guide rather than a sales pitch.

Understanding Salesforce Payment Gateways

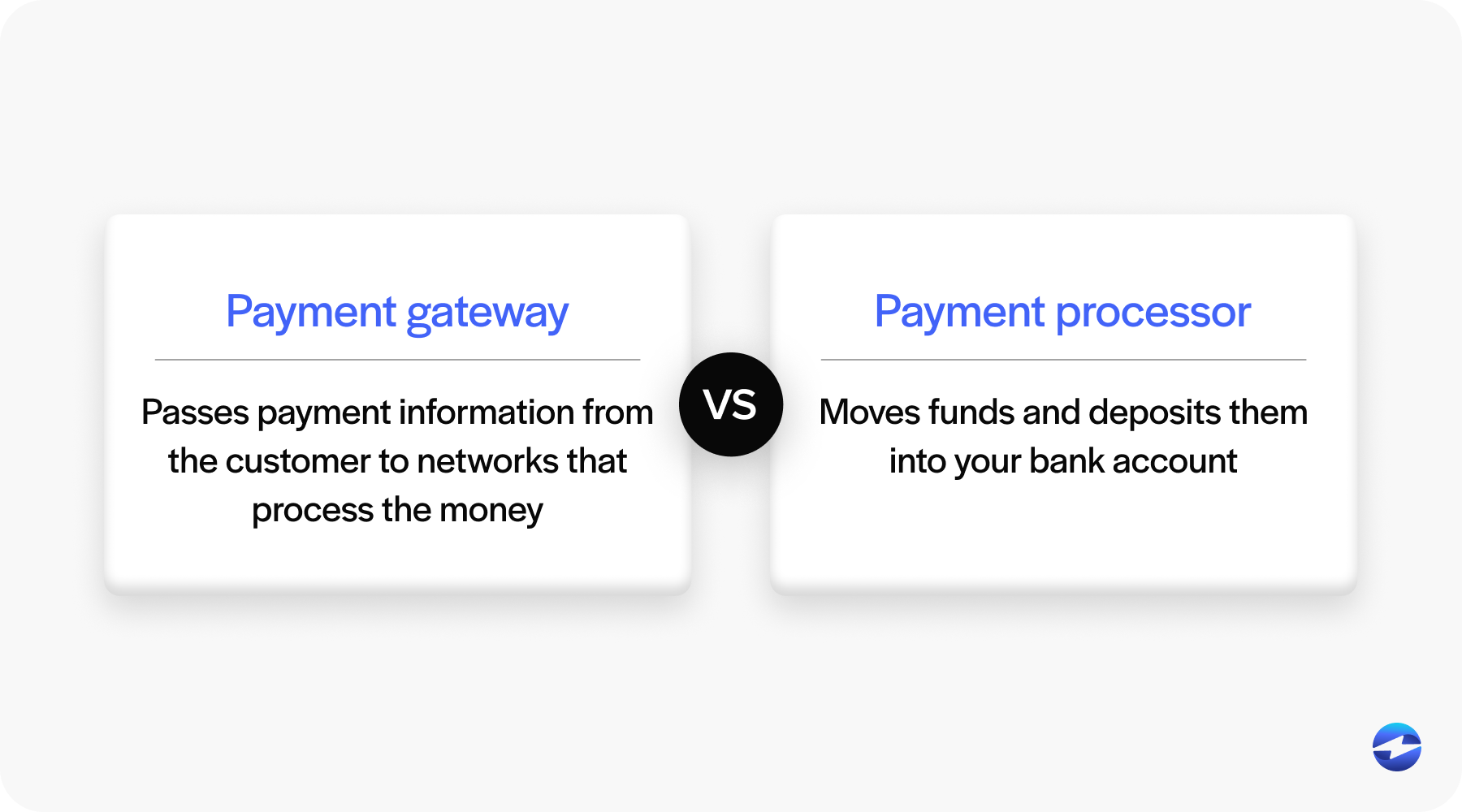

Before diving into the comparison, it helps to clarify what we mean by a Salesforce payment gateway. A payment gateway is essentially the secure technology that passes payment information—credit card numbers, ACH details, digital wallets—from the customer to the networks that process the money. A payment processor, on the other hand, is the service that actually moves the funds and deposits them into your bank account. Sometimes one provider does both, sometimes they’re separate.

When integrated with Salesforce billing, payment gateways connect directly to invoices, subscriptions, or eCommerce checkouts. That means customers can pay from an invoice link, through a portal, or during an order, and the Salesforce Billing Platform records the result. Without this connection, businesses often resort to manual reconciliation, importing CSV files, or relying on separate financial systems that don’t talk cleanly to Salesforce. Over time, those gaps create frustration and risk.

In short, Salesforce payment gateways are the bridge between the customer experience and the back-office need to record revenue accurately. That said, there are many payment gateway options available, so it’s important to do your research.

Native Gateway Capabilities

A “native” Salesforce payment gateway integration means payments happen directly inside Salesforce. There’s no hopping between platforms, no nightly sync jobs, and no separate reconciliation tools. The benefits add up quickly:

- Real-time posting: When a customer pays, the corresponding invoice in Salesforce billing flips to “Paid” instantly. Finance doesn’t wait for batch files or imports.

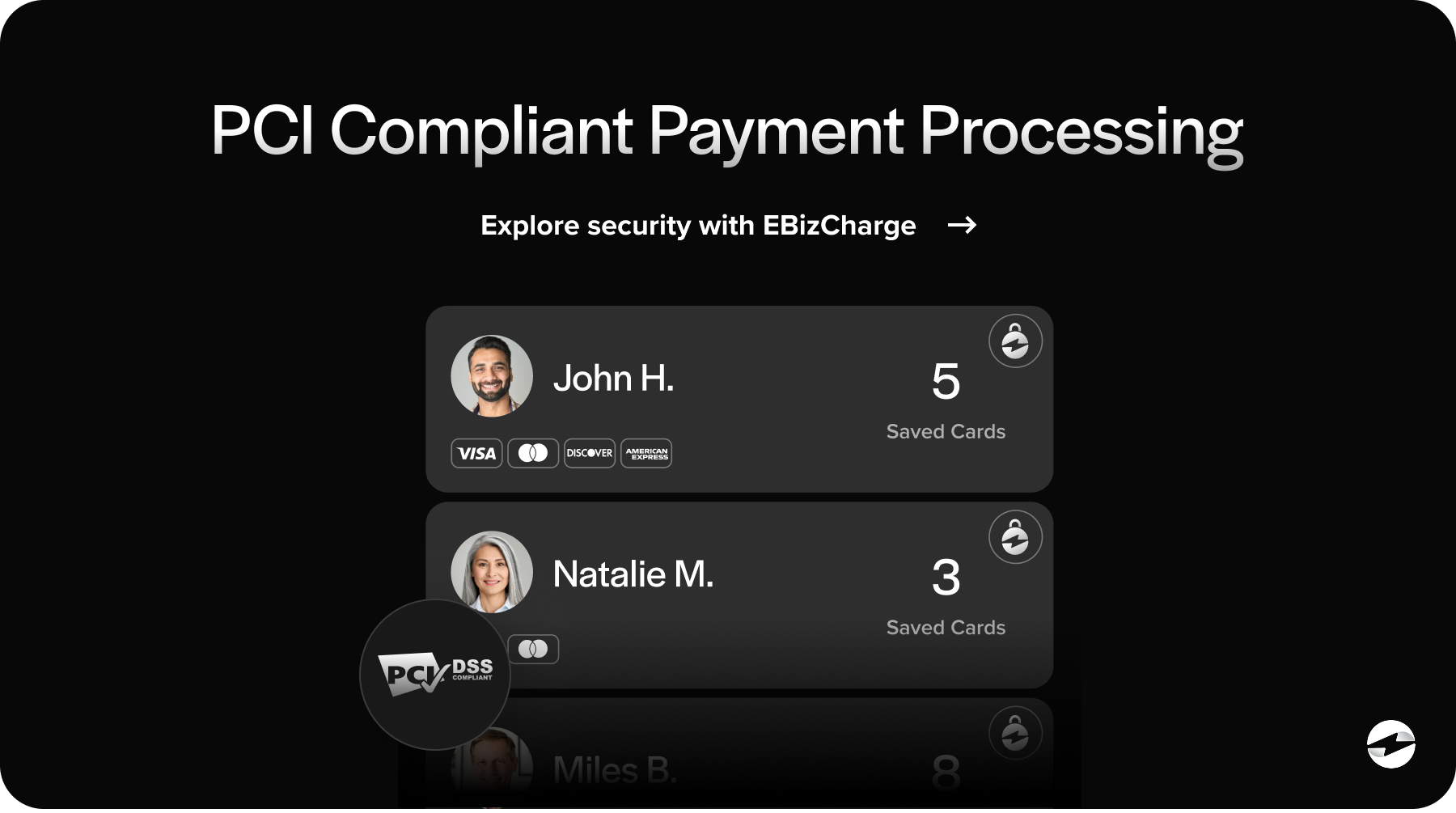

- Tokenization: Card and ACH details are tokenized and stored securely, adhering to PCI compliance standards and making renewals or repeat charges straightforward.

- Multiple methods supported: Native gateways often handle credit cards, ACH, and sometimes wallets without extra coding.

- Reduced manual work: Because payments and invoices live in the same Salesforce billing solution, reconciliation becomes a background task rather than a daily chore.

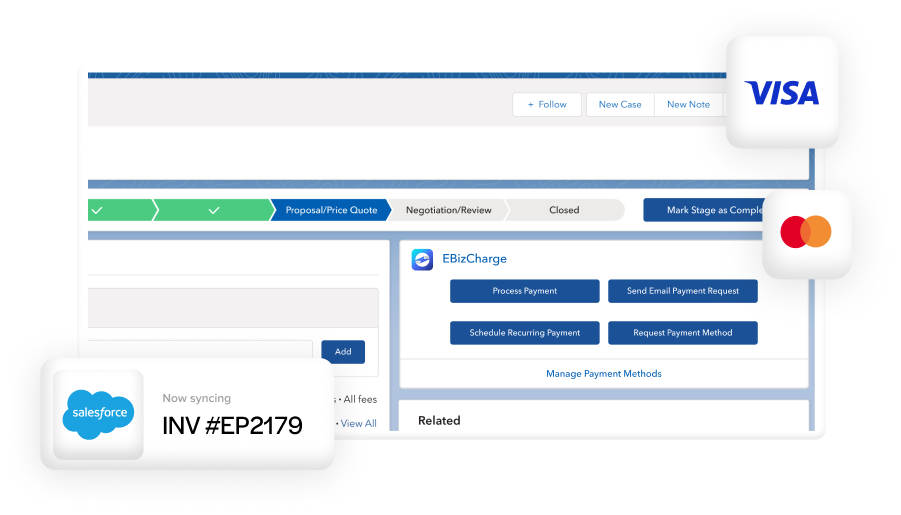

Solutions like EBizCharge are examples of native integrations that deliver this experience. For B2B companies that rely heavily on invoices and recurring payments, these capabilities make a big difference. Sales teams can promise flexible terms, while finance teams trust that billing and payment records will remain consistent. In other words, a native Salesforce billing solution helps everyone stay on the same page.

Third-Party Gateway Solutions

Not every business uses a native integration. Many turn to third-party payment gateways for Salesforce. These typically involve connecting an external system through application programming interfaces (APIs), middleware, or connectors. A third-party payment processor may already be in place for an eCommerce site or mobile app, so extending it to Salesforce feels like a logical step.

There are benefits to this route:

- Global coverage: Some third-party gateways support more international markets and alternative payment types.

- Developer flexibility: Businesses with custom checkouts may want direct control over the payment flow.

- Broader ecosystem: If most of your revenue comes from outside Salesforce, third-party tools can centralize reporting elsewhere.

But there are also drawbacks:

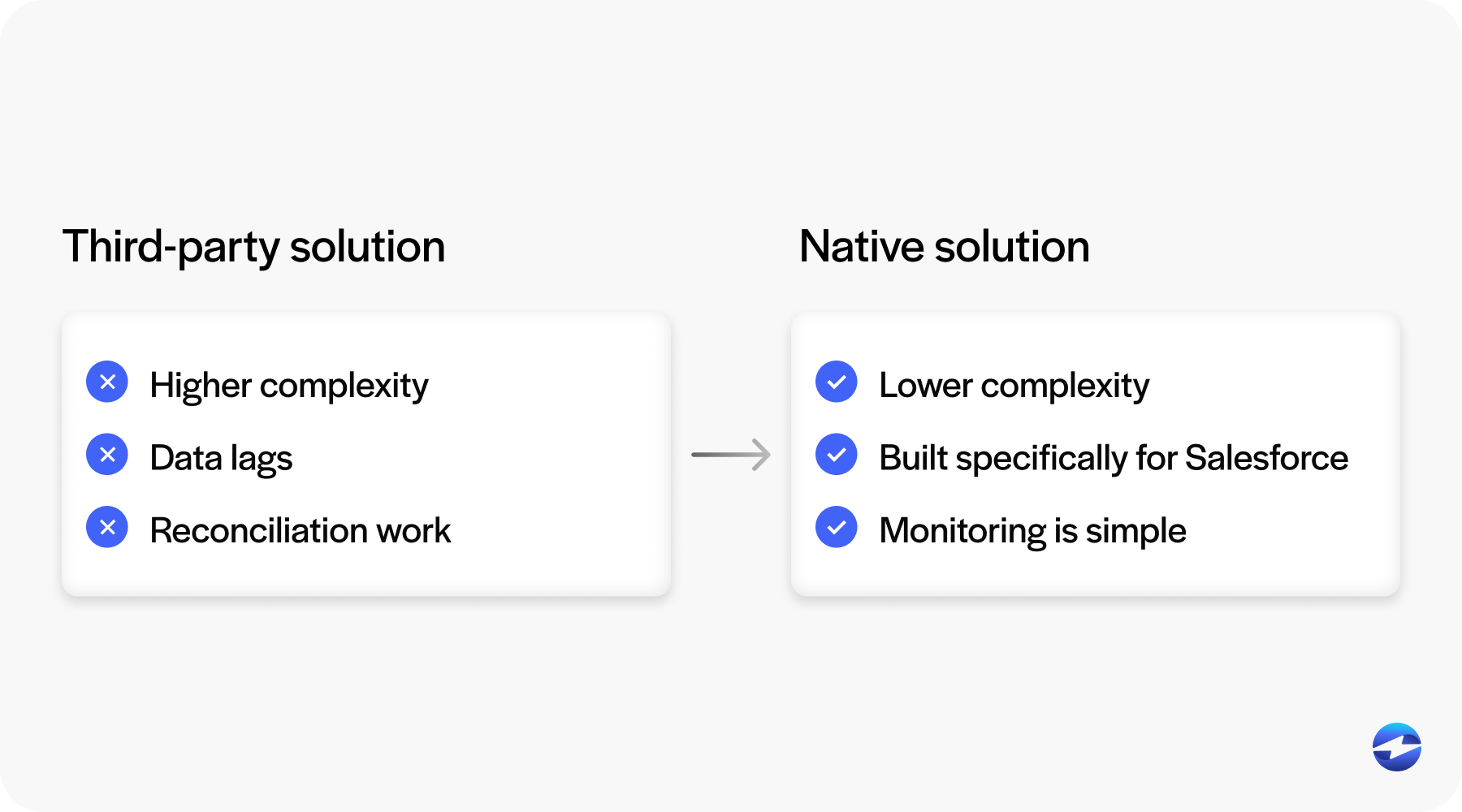

- Data lag: Payments may occur outside Salesforce and sync back later, which can create timing issues.

- Reconciliation work: Finance teams may need to manually match payments to invoices.

- More moving parts: With multiple systems in play, troubleshooting and maintenance require more expertise.

This doesn’t mean third-party payment processing solutions are bad choices. For some industries, they’re necessary. However, they often require stronger operational discipline to manage well.

Integration Complexity

Every Salesforce payment gateway integration comes with some level of complexity. The question is how much, and whether your team can realistically support it.

For native gateways, the complexity is lower. Because the integration was built specifically for Salesforce billing, payment records automatically tie to invoices, accounts, and the general ledger. Admins can configure much of the setup with clicks instead of custom code. Errors are fewer, and monitoring is simpler.

With third-party gateways, the complexity increases. Data has to be mapped carefully between Salesforce objects and the external payment processor. Timing matters. So, will updates flow in real time, or in daily batches? Exceptions must be caught, logged, and corrected, or else they risk slipping into month-end reporting. These integrations can work well, but they require planning and ongoing support.

For teams already stretched thin, the difference between managing a native integration versus a patchwork third-party connection is significant. Choosing the wrong level of complexity can turn into a daily grind of fixes and workarounds.

Security Considerations

Payments always bring compliance requirements. Whether you’re using a native Salesforce payment gateway or a third-party payment processor, the rules apply. The difference lies in how much of that burden falls on your team.

Native gateways reduce PCI DSS scope by handling tokenization inside Salesforce. They often provide hosted fields or secure components that mean sensitive data never touches your servers. This makes audits smoother and reduces liability. Add features like audit trails, permission sets, and fraud monitoring, and you have a strong baseline of protection built into your Salesforce Billing Platform.

Third-party gateways can still be secure, but the attack surface is wider. Payment data may pass through multiple systems before landing in Salesforce billing. Sync jobs can fail, exposing gaps. And because your organization has to prove compliance across more systems, the administrative overhead is higher. A good payment processing solution—whether native or third-party—should help you stay compliant, but native setups tend to simplify the picture.

Choosing the Right Approach

So how should you decide? The answer depends on your business model, transaction volume, and resources.

A native Salesforce payment gateway integration could be more beneficial if:

- Most of your revenue is quoted, invoiced, and collected inside Salesforce.

- You want real-time accuracy in your Salesforce billing solution.

- Your finance and operations teams need a system they can run without heavy engineering support.

A third-party payment processing solution could be beneficial if:

- Your primary checkout experience lives outside Salesforce (e.g., eCommerce site, mobile app).

- You need payment methods or global coverage not supported by native tools.

- You have developer resources to maintain the integration.

For many businesses that already depend on the Salesforce Billing Platform, native integrations like EBizCharge strike the best balance of capability, simplicity, and security. They let you keep critical processes inside Salesforce without introducing extra layers of reconciliation and risk.

Why EBizCharge Makes Sense for Salesforce Users

Salesforce billing isn’t complete without payments, and that’s where gateways play their role. Native Salesforce payment gateways provide real-time posting, reduced reconciliation, and simplified compliance. Third-party payment processors offer flexibility and global reach, but often at the cost of greater complexity and more manual work.

For Salesforce users, especially finance and RevOps professionals who rely on accurate data to make decisions, the choice often comes down to what feels sustainable. This is where EBizCharge stands out. As a native Salesforce billing solution, it posts payments directly to invoices, provides secure tokenization, supports multi-currency, and even offers customer portals – all inside the Salesforce Billing Platform. These features make payment operations easier, safer, and far more reliable than piecing together a patchwork of third-party tools.

Third-party options can still be useful for unique cases, but for most organizations running their revenue cycle through Salesforce, EBizCharge offers the cleanest path. It reduces manual effort, strengthens compliance, and gives finance teams the confidence that numbers line up.

Choosing a native tool like EBizCharge for your Salesforce payment gateway integration helps your business collect cash faster, with fewer errors and less hassle, allowing your teams to focus on growth instead of fixing payment problems.