Blog > Salesforce Billing Platform: Complete Solution Comparison Guide

Salesforce Billing Platform: Complete Solution Comparison Guide

Choosing the right billing system is one of the most important technology decisions finance and IT leaders can make. If billing runs smoothly, payments flow in, reports are accurate, and customers get a consistent experience. If it doesn’t, reconciliation errors pile up, cash flow slows, and teams spend their days fixing problems instead of growing the business. The Salesforce billing platform has become a popular choice because it ties billing into the larger Salesforce ecosystem, but it’s not the only option out there. This guide takes a closer look at capabilities, pricing, ROI, and comparisons with competitors.

Platform Capabilities

The Salesforce billing platform is designed to connect billing with sales, service, and customer management. Instead of having invoices live in a separate system, billing is woven into the same environment where quotes, orders, and contracts are managed. This makes the entire order-to-cash cycle more transparent.

Core capabilities include automated invoicing, subscription billing, and recurring payments. For businesses running complex revenue models, the platform supports advanced revenue recognition tools and compliance reporting. Finance teams can build customizable workflows for discounts, approvals, or contract amendments. Dashboards allow leadership to see cash flow, accounts receivable, and recurring revenue in one place.

One of the strongest benefits is Salesforce integration. Because billing is native, it connects seamlessly with CRM and CPQ. Data doesn’t need to be duplicated or manually transferred. This also makes it easier to extend billing with third-party apps when needed.

Pricing Models

Understanding Salesforce billing pricing is important because costs vary based on how your business is structured. Salesforce generally follows a tiered licensing model. Some businesses pay per user, while others use a usage-based structure tied to transaction volume. Additional features—like revenue recognition or advanced reporting—may come at an extra cost.

Compared to other billing solutions, Salesforce sits in the mid-to-high price range. Zuora, for example, uses modular pricing where you pay for specific add-ons, while NetSuite Billing often comes packaged within a larger ERP license. Chargebee, a simpler solution, prices more aggressively for mid-market companies.

What sets the Salesforce billing platform apart is that pricing ties into the broader Salesforce environment. Businesses already using Salesforce CRM may find that the integration value outweighs a higher licensing fee. Several Salesforce billing reviews highlight that while upfront costs can be significant, the reduction in manual work and the native connection to Salesforce data create long-term savings.

ROI Analysis

When evaluating billing software, return on investment goes beyond licensing costs. With Salesforce billing, ROI often comes from time saved and errors avoided. Automating invoicing reduces the hours staff spend on manual data entry. Faster invoice-to-cash cycles improve cash flow. Built-in revenue recognition reduces compliance risk, particularly for companies working under ASC 606 standards.

Consider a company managing recurring contracts across multiple regions. Without strong integration, finance teams might spend days reconciling payments between systems. With Salesforce ERP integration, payments feed directly into the billing and ERP layers, eliminating much of that work. The upfront investment may be higher, but over time, the savings in staff hours and improved accuracy typically outweigh the cost.

For many finance leaders, the decision comes down to reducing complexity. If billing is disconnected, reports are incomplete and audits become stressful. With Salesforce billing, the idea is to give you one reliable place to see all your data – a single source of truth.

Competitor Overview

Before committing to a billing platform, it helps to understand how Salesforce billing compares to others in the market.

Here is a brief overview:

- Zuora: Excellent subscription billing depth but weaker Salesforce integration.

- NetSuite Billing: Ideal for Oracle/NetSuite users but less seamless for Salesforce customers.

- Chargebee: Affordable and agile but not as enterprise-ready as Salesforce Billing.

The key advantage of the Salesforce billing platform is for businesses already using Salesforce heavily. Instead of adding another silo, it enhances the ecosystem you already rely on. Multiple Salesforce billing reviews point out that the unified data view is a decisive factor for choosing Salesforce over competitors.

Solution Comparison

In most Salesforce billing reviews, users praise the native integration with CRM as a standout feature. While some note that customization can take time, the benefit of not relying on connectors outweighs the learning curve. An important consideration is payment workflows. Without a strong Salesforce payment gateway, businesses may still need to stitch together external tools.

Integration Considerations

Integration is at the heart of a successful billing strategy. The Salesforce billing platform benefits from being native, but many businesses still need to connect with ERPs, external accounting systems, or custom apps. Salesforce ERP integration ensures financial data flows consistently between systems, reducing reconciliation errors.

For IT teams, the extensibility of application programming interfaces (APIs) and webhooks allows Salesforce billing to connect with proprietary tools. This is especially helpful for organizations that need specialized workflows or want to trigger updates in other systems whenever a payment posts. While integration is smoother than with non-native platforms, challenges can still arise with legacy systems that weren’t designed to connect to Salesforce.

Why EBizCharge is a Good Fit for Salesforce Integration

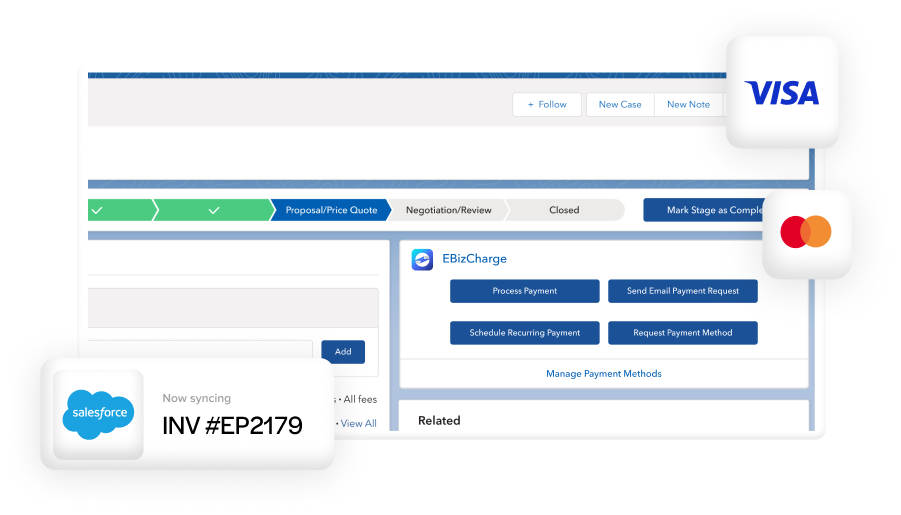

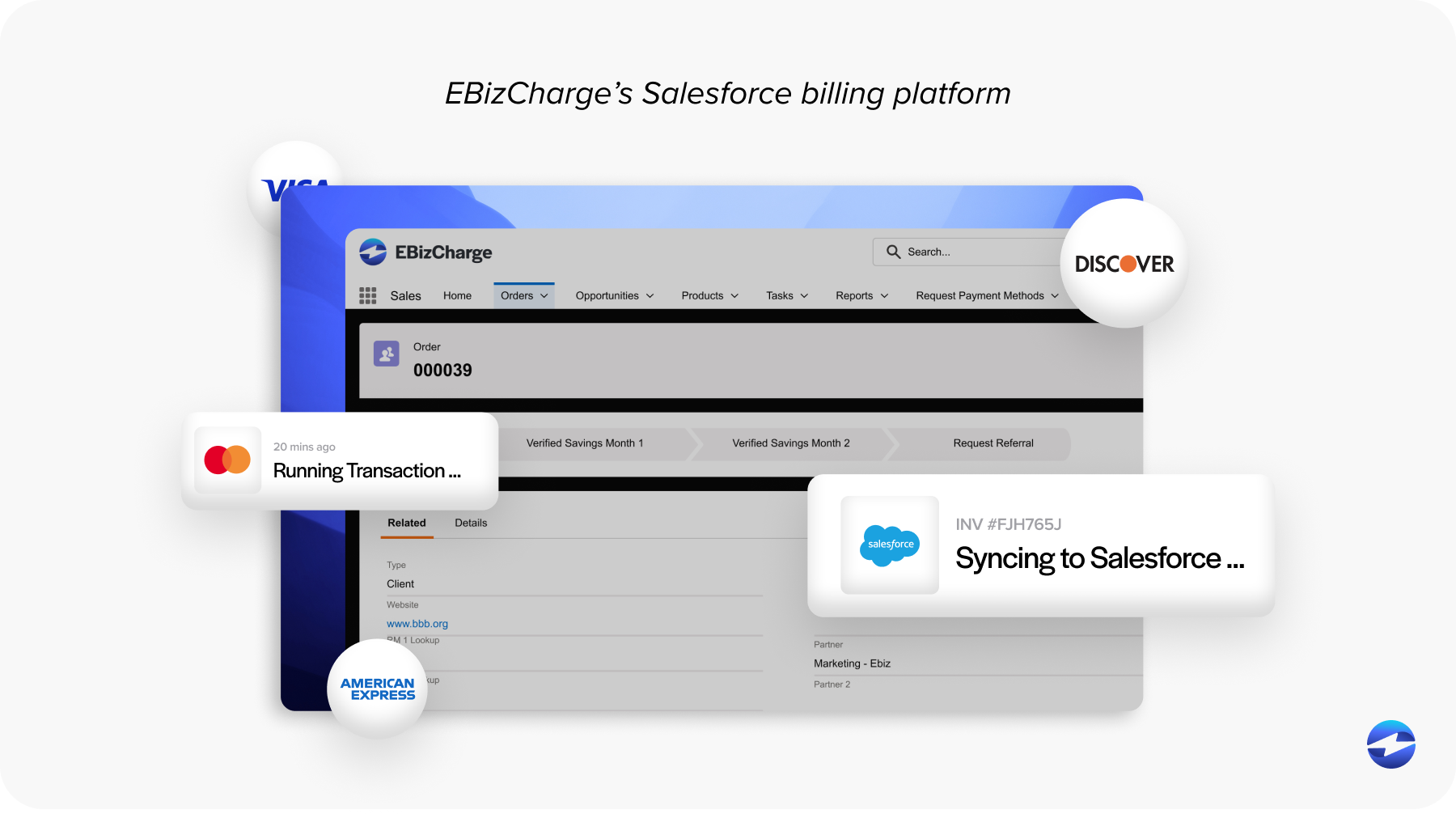

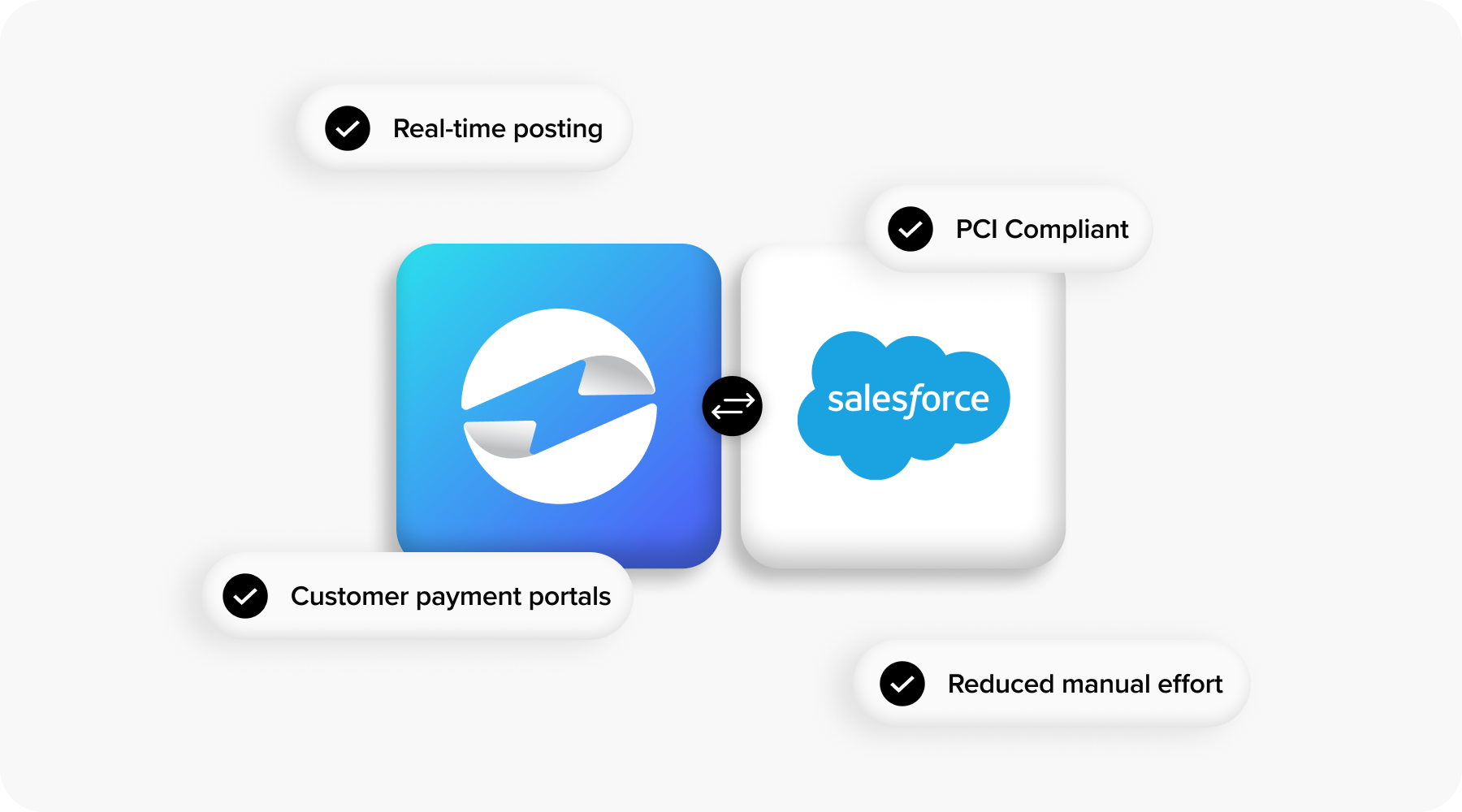

Among the many options for connecting payments to Salesforce, EBizCharge consistently stands out. It was designed to work directly inside Salesforce, meaning it reduces the need for middleware or complex connectors. For organizations that depend on Salesforce billing integration, this simplicity matters.

Payments made through EBizCharge post instantly to invoices, accounts, and opportunities in Salesforce. That real-time accuracy supports cleaner records and faster reconciliation. Because it functions as both a Salesforce payment gateway and a payment processor, it simplifies the overall payment stack. Businesses don’t have to juggle multiple vendors or reconcile across different systems.

EBizCharge also brings bundled features such as tokenization, fraud prevention, and customer payment portals. These tools strengthen Salesforce payment processing without requiring additional add-ons. For finance and IT professionals, it represents a payment processing solution that blends security with convenience. In many cases, this alignment with Salesforce’s native design makes EBizCharge the preferred companion for the Salesforce billing platform.

Making Salesforce Work Seamlessly for Your Payments

Evaluating billing software isn’t just about feature checklists. It’s about how well the system fits your existing workflows, your team’s capacity, and your long-term growth plans. The Salesforce billing platform offers a strong blend of capabilities, though costs and complexity need to be weighed carefully. Competitors like Zuora, NetSuite Billing, and Chargebee offer valid alternatives depending on your environment, but if Salesforce is already central to your operations, the native advantage is hard to ignore.

Solutions like EBizCharge show how the right payment processing solution can make Salesforce billing even more powerful. By combining a Salesforce payment gateway with a trusted payment processor, businesses gain clarity, reduce manual work, and build trust with their customers. For professionals tasked with making these choices, the priority should be clear: choose the platform and partner that makes Salesforce billing integration seamless, secure, and sustainable.