Blog > Salesforce Billing Integration: Connecting Your Payment Stack

Salesforce Billing Integration: Connecting Your Payment Stack

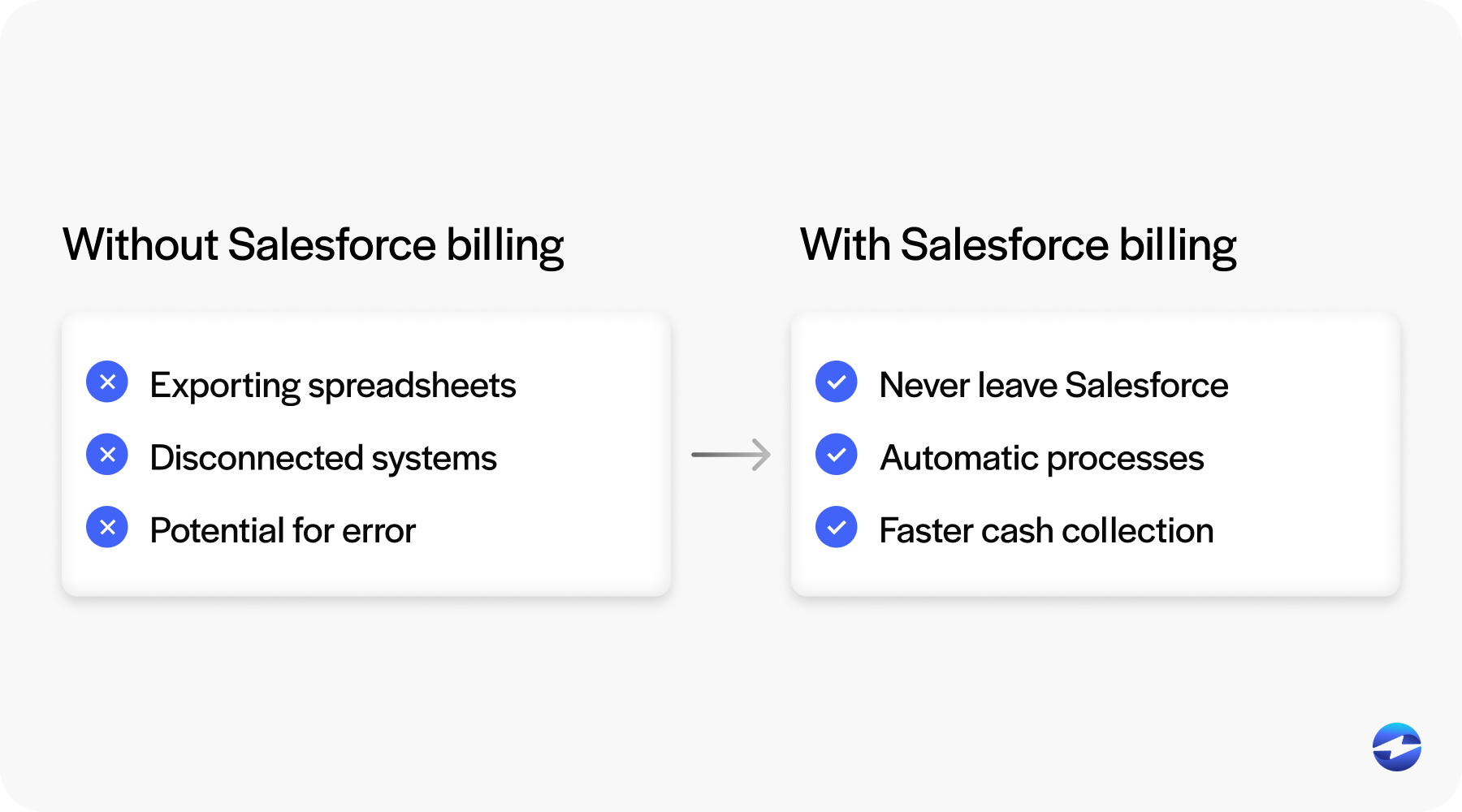

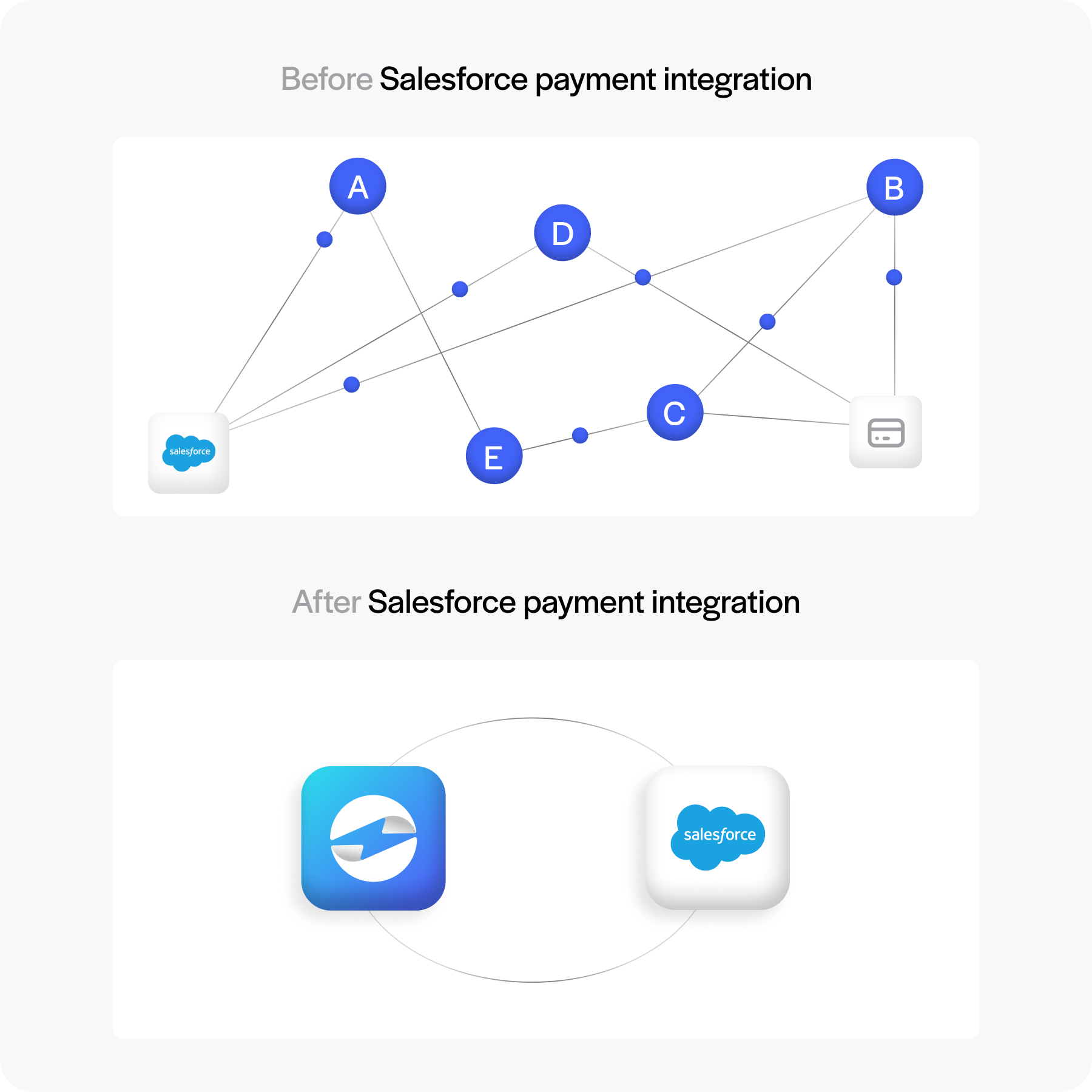

Integrating your payment systems with Salesforce is more than just a technical exercise – it’s about creating a smooth and reliable workflow for finance, IT, and operations. Salesforce billing integration ties together how money moves through your business with the records that drive decision-making. If payments, billing, and ERP tools don’t talk to each other, your teams spend unnecessary time reconciling differences or patching together reports.

This article will explore why Salesforce billing integration matters, how it connects to ERP systems, what role data synchronization plays, and how webhooks and application programming interfaces (APIs) expand flexibility. We’ll also touch on payment integration, advanced features, and why EBizCharge is often a strong fit for Salesforce integration.

ERP Connections

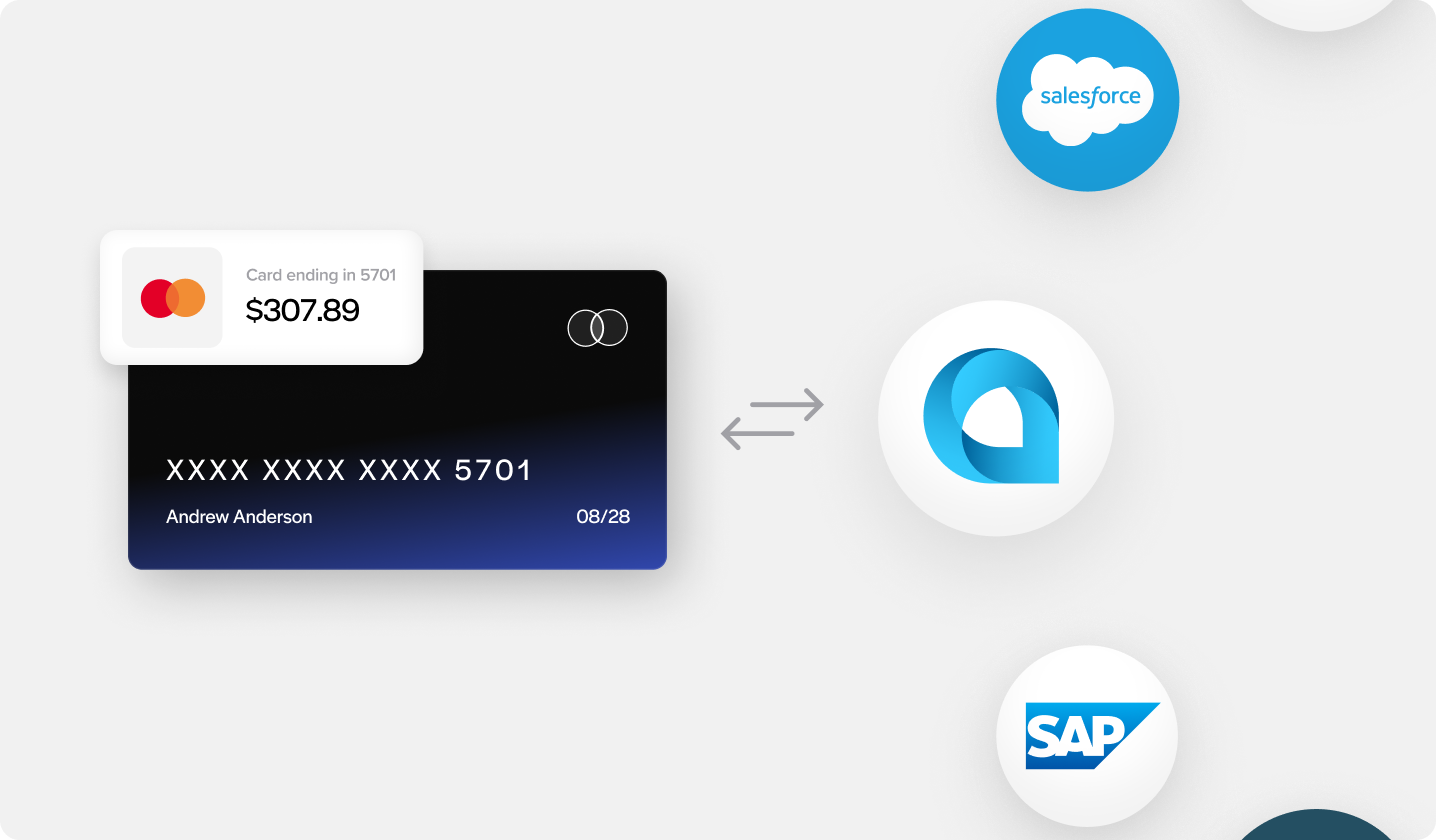

Many organizations run sophisticated ERP systems like NetSuite, SAP, or Oracle alongside Salesforce. These systems manage core accounting, inventory, and supply chain processes. Without Salesforce ERP integration, payments can end up in silos. Finance may have data in the ERP, while sales is looking at Salesforce billing, and neither side sees the full picture in real time.

Connecting Salesforce billing to your ERP closes this gap. This means when a payment clears through a Salesforce payment gateway, the result updates not only the customer’s account in Salesforce but also the financial reporting in your ERP. That unified view allows for faster month-end closes, fewer manual adjustments, and clearer order-to-cash workflows. A practical example is handling credits or refunds: when Salesforce billing integration is in place, adjustments automatically flow back to the ERP, saving your team from duplicate work.

Data Synchronization

Data is only as useful as its consistency. Fragmented records between billing platforms, CRM, and ERP systems lead to errors and wasted time. Salesforce billing integration helps by synchronizing accounts, invoices, and payments across systems.

Think about how many times a finance team might manually re-enter payment details when a system isn’t connected. Each manual entry is a chance for errors, which leads to headaches later. With proper Salesforce integration, those payments move seamlessly. Advanced features like automated sync schedules and built-in error detection provide further peace of mind. The result is fewer discrepancies and more reliable financial data.

For professionals managing Salesforce credit card processing or ACH transactions, this consistency matters. When Salesforce merchant services are properly integrated, both front-line sales staff and back-office finance teams work from the same set of accurate records.

Webhook and API Capabilities

Not every business uses Salesforce the same way. That’s where webhook and application programming interface (API) tools come in. Webhooks allow Salesforce billing to send real-time notifications when something important happens – like when a payment is received or a subscription renews. This keeps connected systems instantly updated without waiting for batch processes.

APIs provide even more flexibility. Developers and IT teams can use Salesforce integration APIs to connect proprietary applications or third-party systems directly to the Salesforce billing platform. That means you can tailor Salesforce payment processing to your unique workflows. For example, you might want to trigger a shipping update whenever a payment is posted or send data to a custom analytics platform. With robust webhook and API options, Salesforce billing integration adapts to the business, not the other way around.

Payment Integration

Payment integration is about making sure the transactions your customers complete flow directly into the systems your teams depend on. With Salesforce billing connected to a Salesforce payment gateway, you can handle credit cards, ACH transfers, and even digital wallets without needing to juggle separate portals or spreadsheets. Everything stays in Salesforce where it belongs.

The advantage of having Salesforce payment processing built into the billing platform is that it keeps things fast and accurate. As soon as a payment is made, the invoice and account updates automatically. There’s no delay, and finance teams don’t waste time chasing balances that are already settled.

Native Salesforce credit card processing also makes life easier when it comes to reporting. Instead of piecing together numbers from different tools, finance leaders can see revenue, outstanding invoices, and payment activity in one place, giving them a clear and timely view of the business.

Advanced Features

Salesforce billing integration isn’t just about linking invoices to payments – it also brings a range of advanced capabilities that make day-to-day finance work smoother. Revenue recognition tools, for example, help teams stay aligned with accounting standards without adding extra manual checks. Automated dunning features take the pressure off collections by retrying failed payments and sending reminders automatically, which is especially useful for companies running on subscription billing.

Support for multiple currencies makes it easier to serve customers around the world, while built-in dashboards in the Salesforce billing platform give finance leaders a clear snapshot of performance whenever they need it. Together, these features transform Salesforce billing from a straightforward invoicing system into a capable payment processing solution that helps businesses handle complexity with less effort.

Why EBizCharge Fits Salesforce Integration

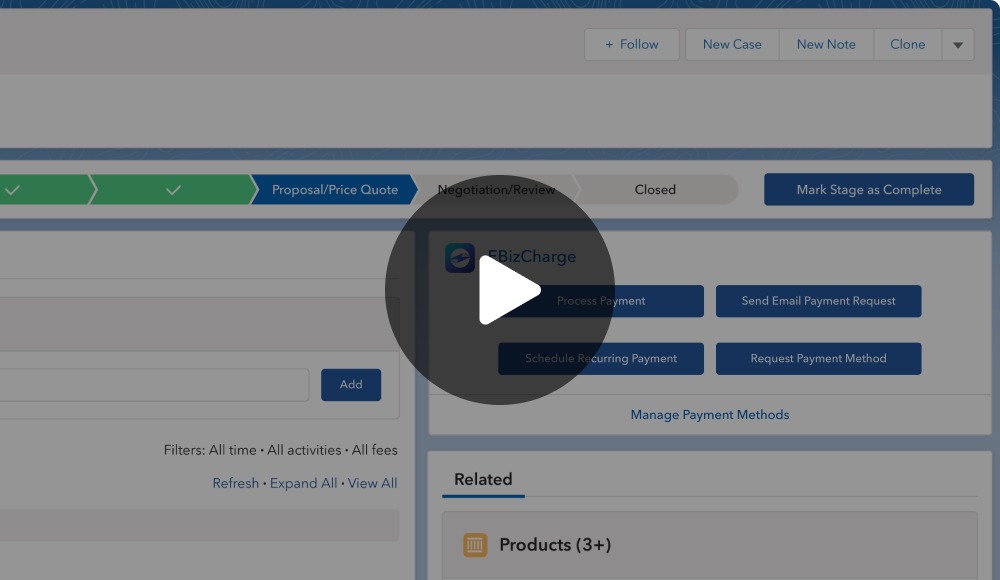

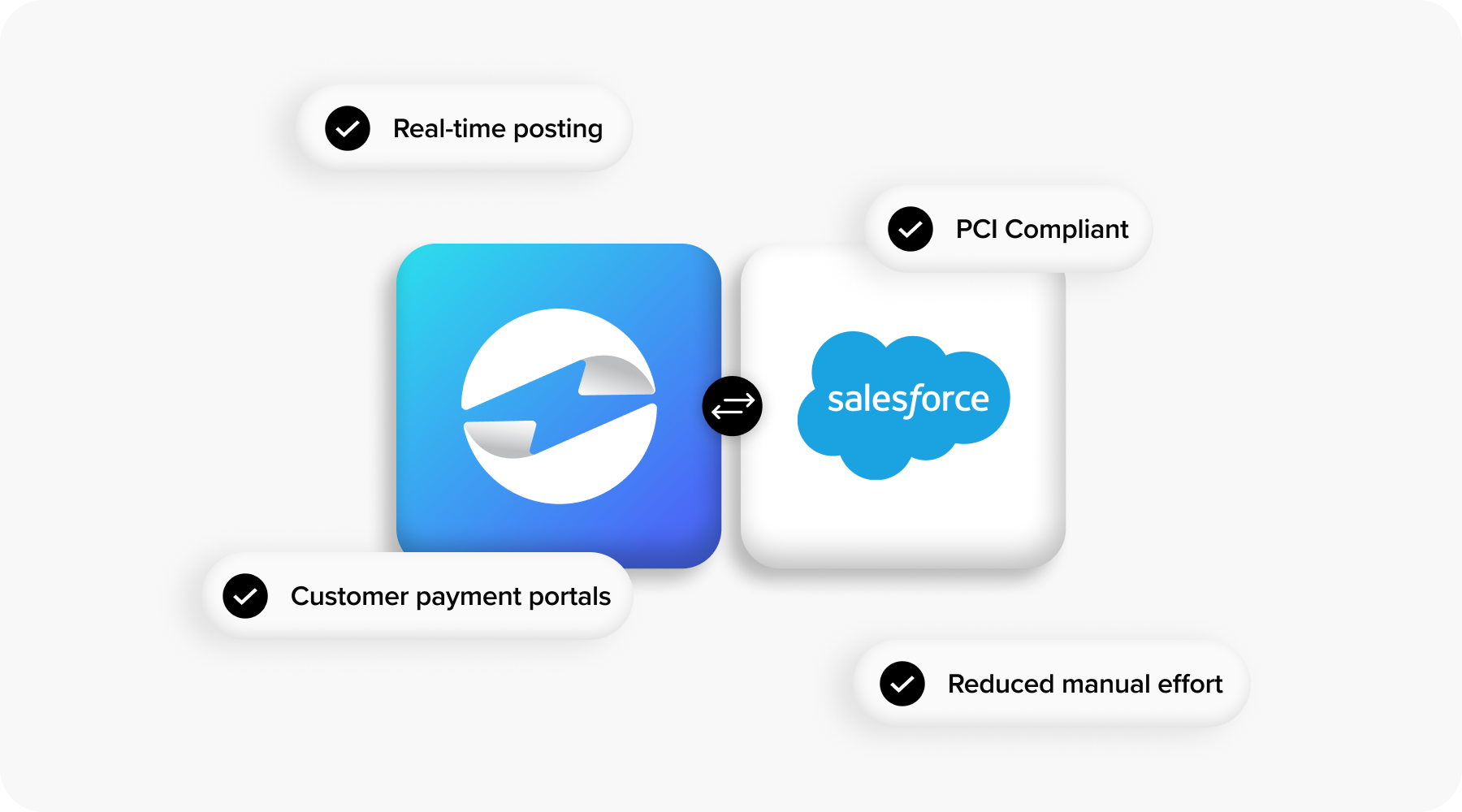

Among the payment processors that can connect with Salesforce, EBizCharge is a great fit. Its native Salesforce integration means it avoids the need for heavy middleware or custom-built connectors. For businesses, that translates to lower IT overhead and less risk of sync issues.

Payments handled through EBizCharge are posted directly to Salesforce invoices, accounts, and opportunities. This real-time accuracy supports cleaner records and faster reconciliation. Because it functions as both a Salesforce payment gateway and a processor, EBizCharge reduces complexity by consolidating services.

It also comes bundled with advanced features like tokenization, fraud prevention, and customer payment portals. These tools strengthen Salesforce payment processing without requiring extra add-ons. For finance and IT professionals, EBizCharge represents a payment processing solution that blends security, simplicity, and efficiency – all while keeping Salesforce billing integration at the center.

Making Salesforce Work Seamlessly for Your Payments

Salesforce billing integration is about creating an ecosystem where payments, billing, and data flow seamlessly. By connecting with ERP systems, synchronizing data, and using webhook and API tools, businesses ensure accuracy and agility. Layer in real-time payment integration and advanced features, and the Salesforce billing platform becomes a reliable foundation for growth.

Solutions like EBizCharge show what happens when a payment processor is built with Salesforce integration in mind. They simplify Salesforce credit card processing, strengthen compliance, and reduce the manual work that slows teams down. For organizations that rely on Salesforce billing every day, the right integration isn’t just convenient – it’s essential.