Blog > Permanent vs Temporary Accounts: What’s the Difference?

Permanent vs Temporary Accounts: What’s the Difference?

As businesses grow, they often require more effective financial management methods. One way to achieve this is by examining which accounts are necessary for monitoring and maintaining financial transactions.

Financial management accounts can consist of assets, expenses, liability, equity, and revenue, all of which can be grouped into permanent and temporary accounts.

This article will compare permanent and temporary accounts to help you better understand the critical differences between the two to better manage them in the future.

Temporary accounts vs permanent accounts

While temporary and permanent accounts track financial transactions, they do so in different ways.

Here’s a quick breakdown of each account’s purposes and how they differ…

What are temporary accounts?

Temporary accounts or “nominal” accounts help monitor financial transactions like a business’s income. They’re typically used for short-term projects or temporarily holding funds until they can transfer to a permanent account.

Temporary accounts are beneficial for tracking economic activity, maintaining financial records, and establishing a transparent overview of a business’s profits or losses for small and large companies.

Businesses typically close these accounts at the end of the fiscal year or quarter, depending on what works best for them. By closing these accounts after a specified period, the business can separate financial data into periods that provide a clearer picture of its financial performance.

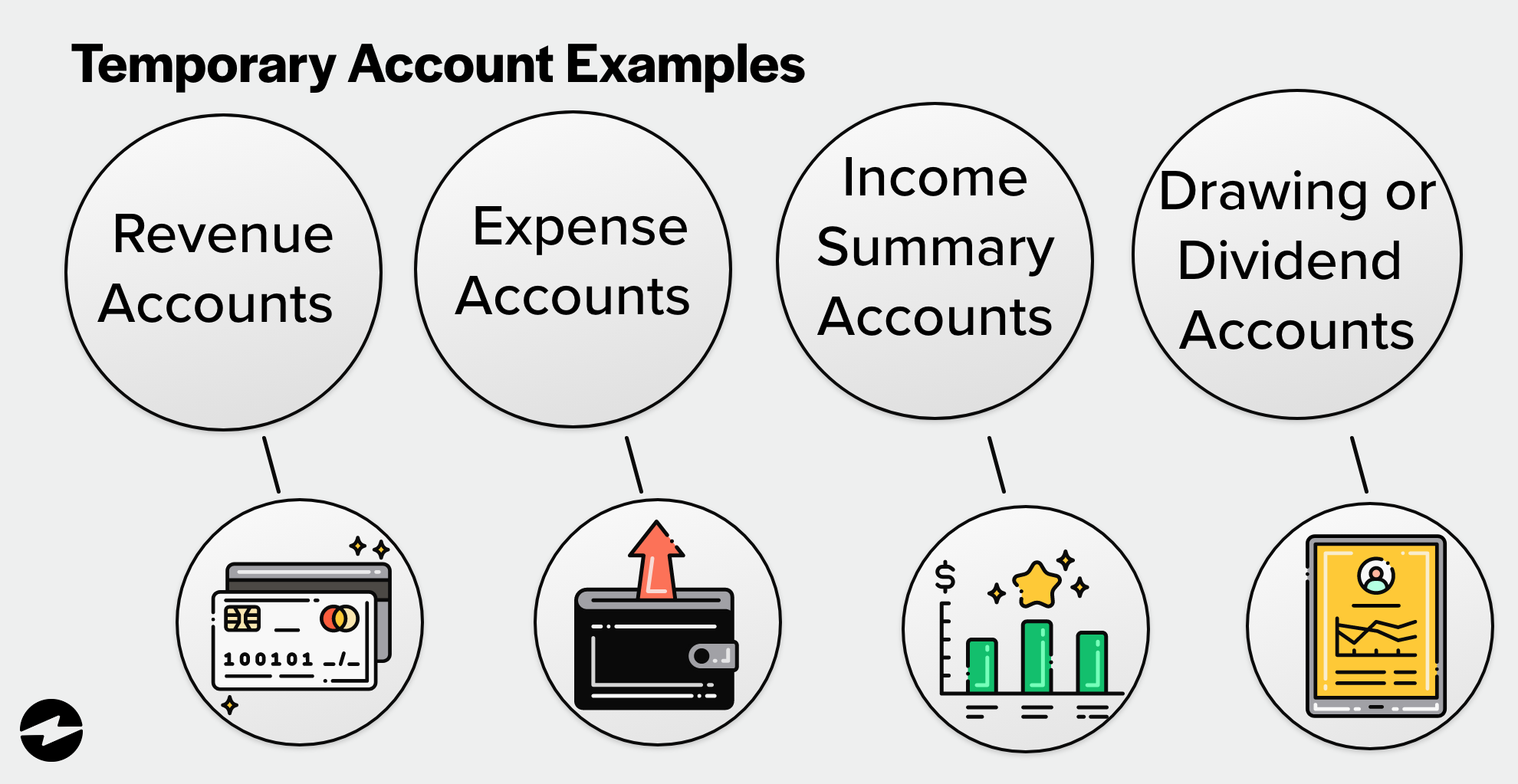

Several account types fall under the category of temporary accounts. These temporary accounts examples include:

- Revenue accounts

- Expense accounts

- Income summary accounts

- Drawing or dividend accounts

Revenue accounts

A revenue account is a temporary account used to track the money a business receives in exchange for the goods and services it provides to customers.

Revenue accounts serve as financial snapshots that provide a concise picture of how much money brought in and where these funds come from. This information lets businesses make more informed decisions on budgeting and investment strategies by giving them insight into estimated future earnings.

Some examples of revenue accounts include commission income, rental income, interest income, service revenue, and sales revenue.

Expense accounts

An expense account is a temporary account used to track the money a business spends on general costs such as rent, utilities, wages, and other necessary operational expenses.

At the end of the accounting period, expense accounts are closed and transferred to the income summary account.

Income summary accounts

An income summary account summarizes a business’s revenue and expenses within a given accounting period. This summary tracks the business’s profits and losses within that accounting period. Once the profits and losses are calculated, the final net income or loss is translated to the owner’s equity account.

The purpose of the income summary account is to simplify the closing process of revenue and expense accounts by transferring their respective balances into one account.

Drawing or dividend accounts

A dividend account is an investment account designed to receive regular dividend payments from stocks or mutual funds. Dividends are payments companies make to their shareholders to distribute a portion of their profits.

Dividend payments are often deposited into the investor’s dividend account automatically. Investors can then reinvest money back into the company or withdraw the funds for personal use.

What are permanent accounts?

Permanent accounts differ from temporary accounts as they are, as their name suggests, designed for long-term savings and investment goals rather than short-term initiatives.

Permanent accounts provide an overview of a business’s financial state during a given time and help inform financial decisions in the future.

A few accounts fall under the umbrella of permanent accounts and are not temporary accounts are:

- Asset accounts

- Liability accounts

- Equity accounts

Asset accounts

Asset accounts represent the collective resources owned or controlled by a company. This includes tangible property, such as inventory items, and intangible property, such as stocks.

Maintaining accurate asset records is crucial since they can secure loans or investments and play a key role in determining your business’s net worth.

Liability accounts

A liability account records and manages a business’s debts. These debts may include loans, mortgages, credit card balances, unpaid bills, and taxes.

Accurate liability records are imperative since they may influence a business’s credit rating and overall financial health.

Equity accounts

Equity accounts illustrate a company’s assets after liabilities are deducted. In other words, the equity account represents the portion of a company’s value that belongs to its shareholders, which is why it’s often referred to as “shareholder’s equity” or “owner’s equity.”

Understanding your business’s equity accounts is essential because they provide a clear picture of who has a stake in the company and how much they have invested.

How do temporary accounts differ from permanent accounts?

Temporary accounts differ from permanent accounts in that they track short-term financial data within specific timeframes, reset balances to zero at the end of each period, and are recorded in income statements.

Permanent accounts, however, provide ongoing insights into overall financial status, maintain cumulative balances, and are typically included in balance sheets.

Here is a closer look at the three main comparisons to better understand the difference between the two.

Tracking short-term vs long-term financial data

- Permanent accounts: These accounts provide an ongoing overview of a business’s financial standing, portraying its overall status without regard to specific timeframes.

- Temporary accounts: These accounts capture activity within defined fiscal periods, offering insights into performance over a set timeframe. They provide a snapshot of the business’s short-term financial performance.

For instance, a permanent account provides valuable insights into a company’s overall financial status, while a temporary account offers a snapshot of its performance over a specific timeframe.

Cumulative balances and resetting zero balances

- Permanent accounts: Balances in permanent accounts are cumulative, meaning they carry forward across fiscal periods. They reflect the business’s cumulative financial position.

- Temporary accounts: Balances in temporary accounts are reset to zero at the end of each accounting period. This reset ensures that each period’s financial activity is distinctly captured without carrying over balances from previous periods.

For example, suppose a company sets aside a certain percentage of earnings in a temporary account for quarterly taxes. The remaining balance must then be redistributed at the end of the quarter to avoid discrepancies in the general ledger.

Using balance sheets vs income statements to record accounts

- Permanent accounts: These accounts are typically included in balance sheets, which provide a snapshot of the business’s financial position at a specific point in time. Permanent accounts contribute to understanding a company’s assets, liabilities, and equity.

- Temporary accounts: These accounts are recorded in income statements, which showcase the company’s financial performance over a specified period, such as a month, quarter, or year. Temporary accounts help assess revenues, expenses, and net income or loss for the period.

A balance sheet reflects a company’s assets, liabilities, and equity at a specific time. While an income statement reflects a company’s revenues, expenses, and net income or loss for more extended periods. In other words, the balance sheet reflects what the company owns, owes, and how much it has invested whereas the income statement reflects the company’s earnings and how much it has spent.

The importance of understanding the distinction between financial accounts

Correctly managing temporary and permanent accounts is crucial, as any mistake can throw off a company’s financial management process.

Now that you understand the differences between the two temporary and permanent accounts and how to manage them, you can choose the correct account for your business.

Choosing the right account for your needs

When choosing an account, businesses should consider their short-term and long-term financial goals. If you’re looking for a convenient place to hold funds temporarily, a temporary account may be the right choice. However, a permanent account may be a more favorable option if your goal is to save in the long term.

It’s also important to consider the fees and restrictions, interest rates, and potential returns associated with each type of account. Companies should conduct thorough research to find an account that suits their unique financial needs.

Streamlining the process with accounts receivable automation

Whether saving for a short-term goal or planning for the future, there’s a temporary or permanent account that can meet your needs. However, tracking and closing accounts can be time-consuming and error-prone, especially when relying on manual accounting systems or spreadsheets.

With a fully automated accounts receivable operation, you can streamline this process, reduce the risk of derailing your company’s financials, and enhance your overall success.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.