Blog > Oracle Fusion ERP Payment Integration: Transforming Financial Operations Across All Modules

Oracle Fusion ERP Payment Integration: Transforming Financial Operations Across All Modules

For many finance and operations teams, the way payments are handled can make or break efficiency. Oracle Fusion ERP is already known as a powerful enterprise resource planning tool, but without integrated payments, even the best system can leave gaps. Payment data might live outside your ERP software, slowing down reconciliation and adding unnecessary manual work. In today’s environment, where speed and accuracy matter more than ever, that simply doesn’t cut it.

That’s where payment integration comes in. By embedding payments into Oracle Fusion modules, businesses can streamline cash flow, keep records accurate, and improve the customer and vendor experience. This article takes a deep dive into Oracle Fusion ERP, the benefits of integrated payments, and how third-party payment processors like EBizCharge can take your workflows to the next level.

Understanding Oracle Fusion ERP

At its core, Oracle Fusion ERP is a comprehensive enterprise resource planning platform designed for modern businesses. Unlike older systems, Oracle Fusion was built with cloud-first functionality, making it scalable and accessible from anywhere. Organizations ranging from midsize companies to large enterprises rely on it to unify operations and financial data.

The system’s modular design is one of its biggest strengths. With Oracle Fusion modules covering areas like finance, procurement, HR, and supply chain, businesses can tailor the ERP software to their needs. These modules don’t operate in isolation—they work together. A sales order in one module, for instance, can trigger updates in accounts receivable, procurement, and the general ledger. This interconnected design is why Oracle Fusion continues to be a trusted choice for enterprises seeking an adaptable and scalable system.

Why Payment Integration Matters in ERP

Even with all its strengths, Oracle Fusion ERP isn’t designed to handle every payment scenario out of the box. Many businesses find themselves juggling Oracle Fusion billing inside the ERP while running credit card transactions or ACH payments in separate platforms. That creates silos and slows down the financial process.

Integrating a payment processing solution closes those gaps. Instead of manually entering payment data or reconciling across multiple systems, payments post directly to accounts receivable and the general ledger. Errors are reduced, reporting is more accurate, and teams gain valuable time back. For decision-makers, this also means better visibility into real-time cash flow. Payment integration isn’t just about speed—it’s about making smarter, more reliable financial decisions.

Key Oracle Fusion ERP Modules That Benefit Most from Payment Integration

Not every part of Oracle Fusion ERP needs payments flowing through it. But for certain Oracle Fusion modules, payment integration is a game-changer.

- Accounts Receivable (AR): By integrating a payment processor, businesses can speed up collections, automatically reconcile payments, and reduce days sales outstanding (DSO). Payments, whether through Oracle Fusion credit card processing or ACH, post instantly to AR.

- Accounts Payable (AP): Vendors expect to be paid on time. Payment integration ensures timely disbursements, automated approvals, and stronger fraud prevention measures.

- General Ledger (GL): Real-time posting means your general ledger always reflects the latest activity. That makes for more accurate reporting and better audit readiness.

- Procurement: When vendor payment workflows are connected directly with procurement cycles, you minimize delays and strengthen supplier relationships.

- Expenses/HR: Employees benefit too. Integrated systems can automate reimbursements, improving both speed and accuracy.

Each of these areas benefits not only from time savings but also from increased accuracy, compliance, and confidence in reporting.

Technologies Behind Oracle Fusion ERP Payment Integration

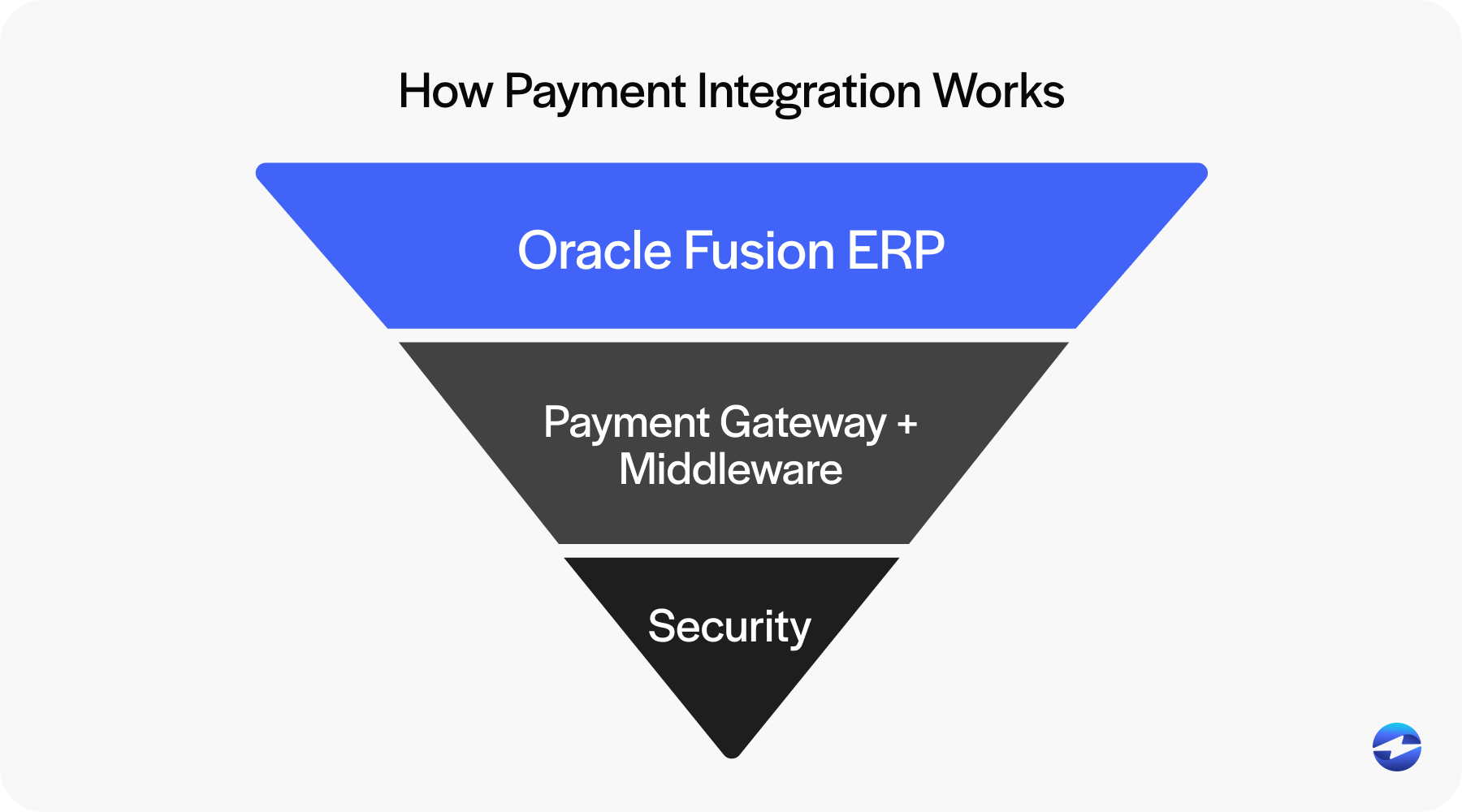

So how does all of this work in practice? Integration relies on a mix of technologies that connect payments with Oracle Fusion software. Payment gateways and APIs serve as the backbone, enabling data to move between the ERP and external systems without manual intervention.

Middleware often plays a role, too, acting as the connector that ensures Oracle Fusion ERP speaks the same language as your payment processor. Security is another crucial piece. Features like PCI DSS compliance, tokenization, and encryption are non-negotiable when handling sensitive data. With cloud-native design, Oracle Fusion ERP also ensures scalability, uptime, and global access.

Best Practices for Successful Integration

Integrating payments into Oracle Fusion ERP isn’t something to rush. To get it right, you’ll need preparation and planning. Start with a system audit to identify bottlenecks and opportunities. Clean up your financial data and establish governance policies to ensure consistency.

Collaboration is key. Involve your finance, IT, and compliance teams early in the process to ensure all perspectives are covered. Pilot testing can highlight issues before they become widespread, while phased rollouts allow you to adjust along the way. Finally, don’t stop once the system is live—ongoing monitoring and reporting help ensure your integration continues to support your business as it grows.

Role of Third-Party Payment Processors Like EBizCharge

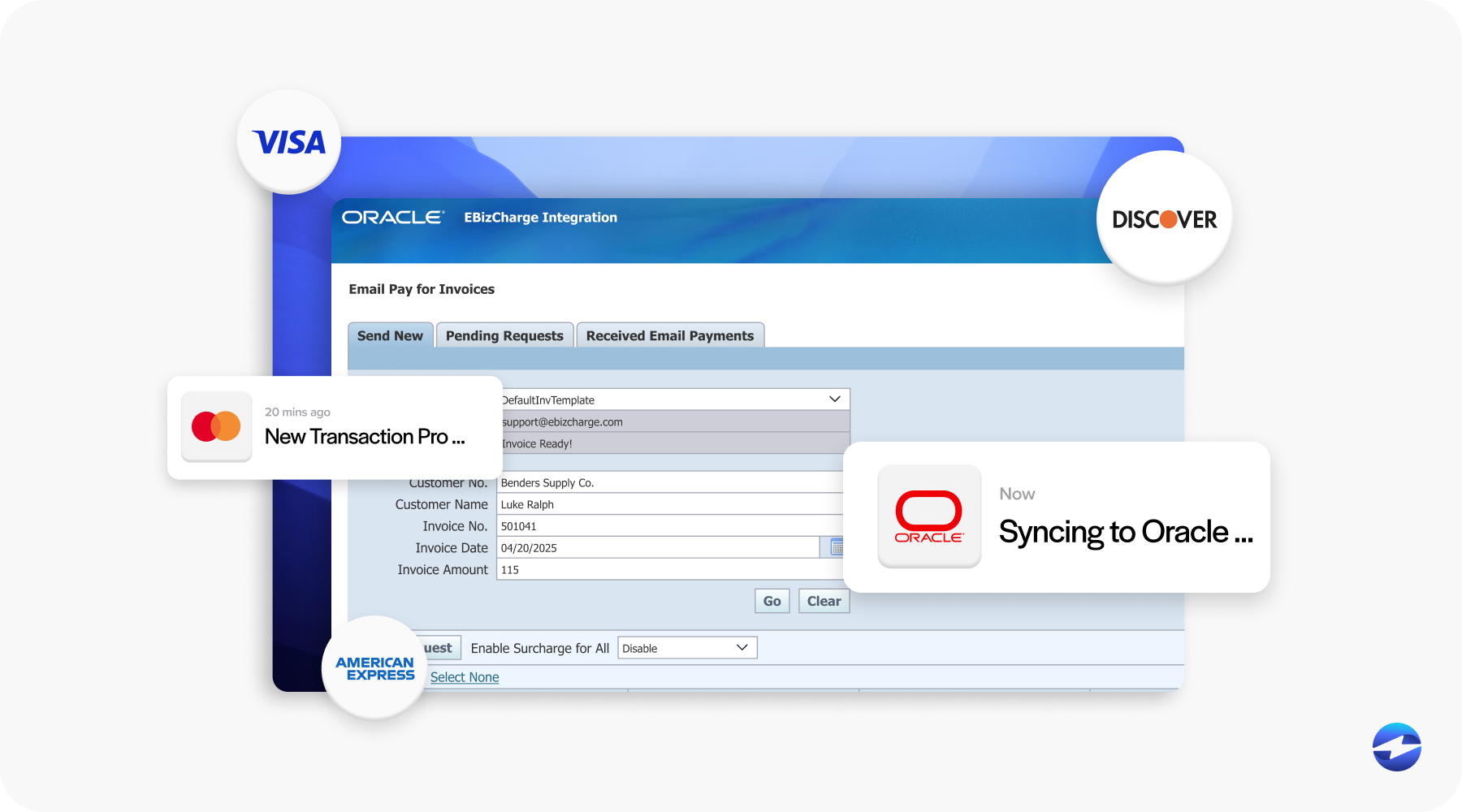

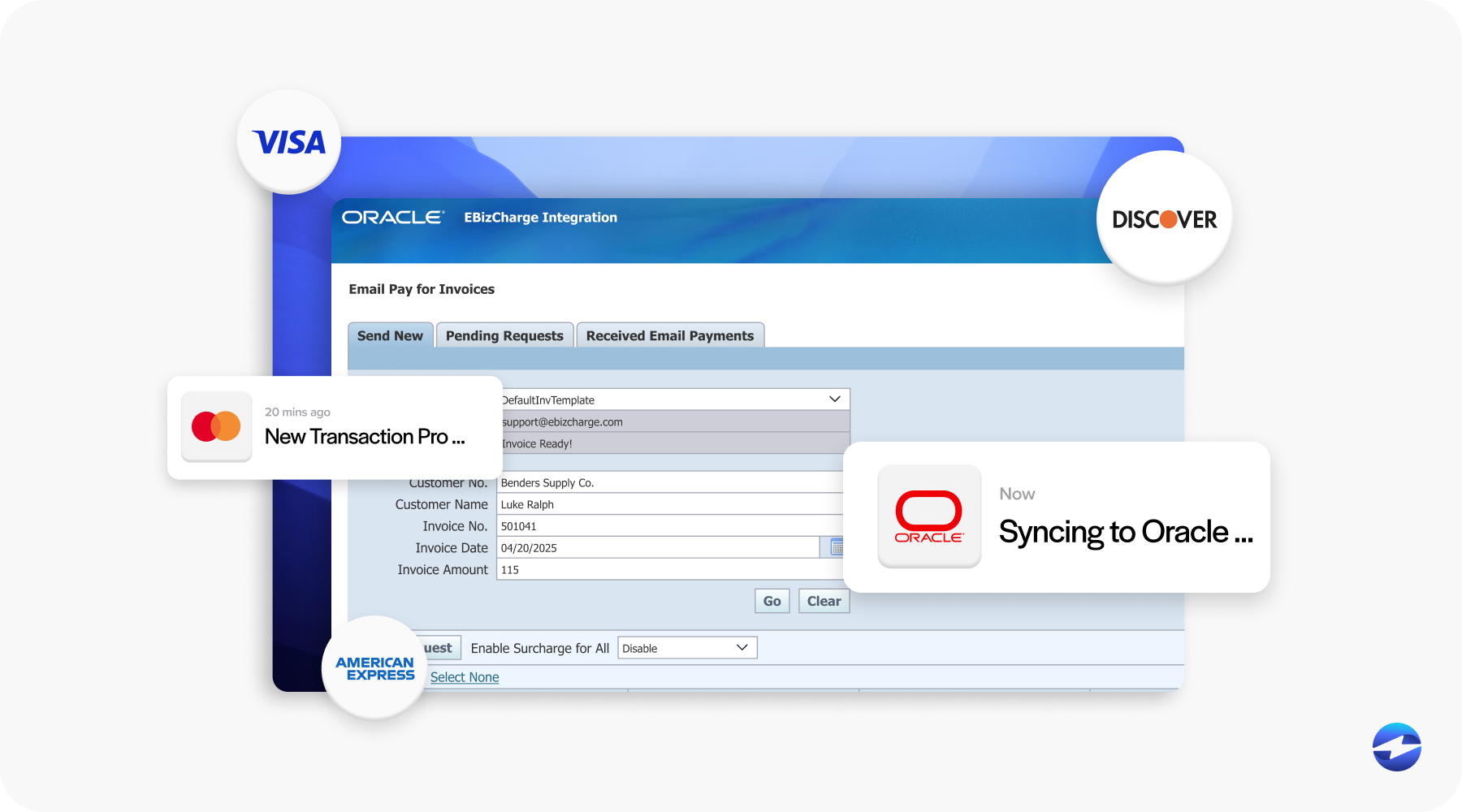

While Oracle Fusion ERP has strong native features, many businesses find even greater value by adding a third-party payment processor. Solutions like EBizCharge integrate directly with Oracle Fusion modules to provide advanced functionality that isn’t included out of the box.

For example, EBizCharge extends Oracle Fusion billing capabilities with online customer portals, making it easier for clients to pay invoices at their convenience. Advanced reporting tools give finance teams a clearer picture of trends and performance, while lower transaction fees reduce costs. These third-party payment processors also scale with your business, handling everything from a few dozen transactions to thousands each day. For companies using Oracle Fusion credit card processing, adding a comprehensive third-party tool is often the simplest way to modernize payments.

Transforming Financial Operations with Oracle Fusion ERP Payment Integration

When payments are fully integrated into Oracle Fusion ERP, financial operations stop being a source of frustration and start being a source of strength. Accounts receivable teams collect faster. Accounts payable teams reduce errors. General ledger accuracy improves, and procurement and HR workflows are smoother.

The ripple effects are real. Stronger cash flow, more reliable compliance, and improved customer and vendor relationships all come from eliminating the manual, disconnected processes of the past. By combining Oracle Fusion ERP with a reliable payment processing solution, businesses build a financial foundation that can support growth for years to come.

If your organization is still juggling payments outside of Oracle Fusion software, now is the time to rethink that approach. Integrated payments aren’t just a convenience—they’re a strategy for staying competitive. Pairing Oracle Fusion ERP with the right payment processor gives you the accuracy, speed, and scalability you need to thrive in today’s fast-paced environment.

- Understanding Oracle Fusion ERP

- Why Payment Integration Matters in ERP

- Key Oracle Fusion ERP Modules That Benefit Most from Payment Integration

- Technologies Behind Oracle Fusion ERP Payment Integration

- Best Practices for Successful Integration

- Role of Third-Party Payment Processors Like EBizCharge

- Transforming Financial Operations with Oracle Fusion ERP Payment Integration