Blog > Nonprofit Payment Management in Sage Intacct: Donor Tracking & More

Nonprofit Payment Management in Sage Intacct: Donor Tracking & More

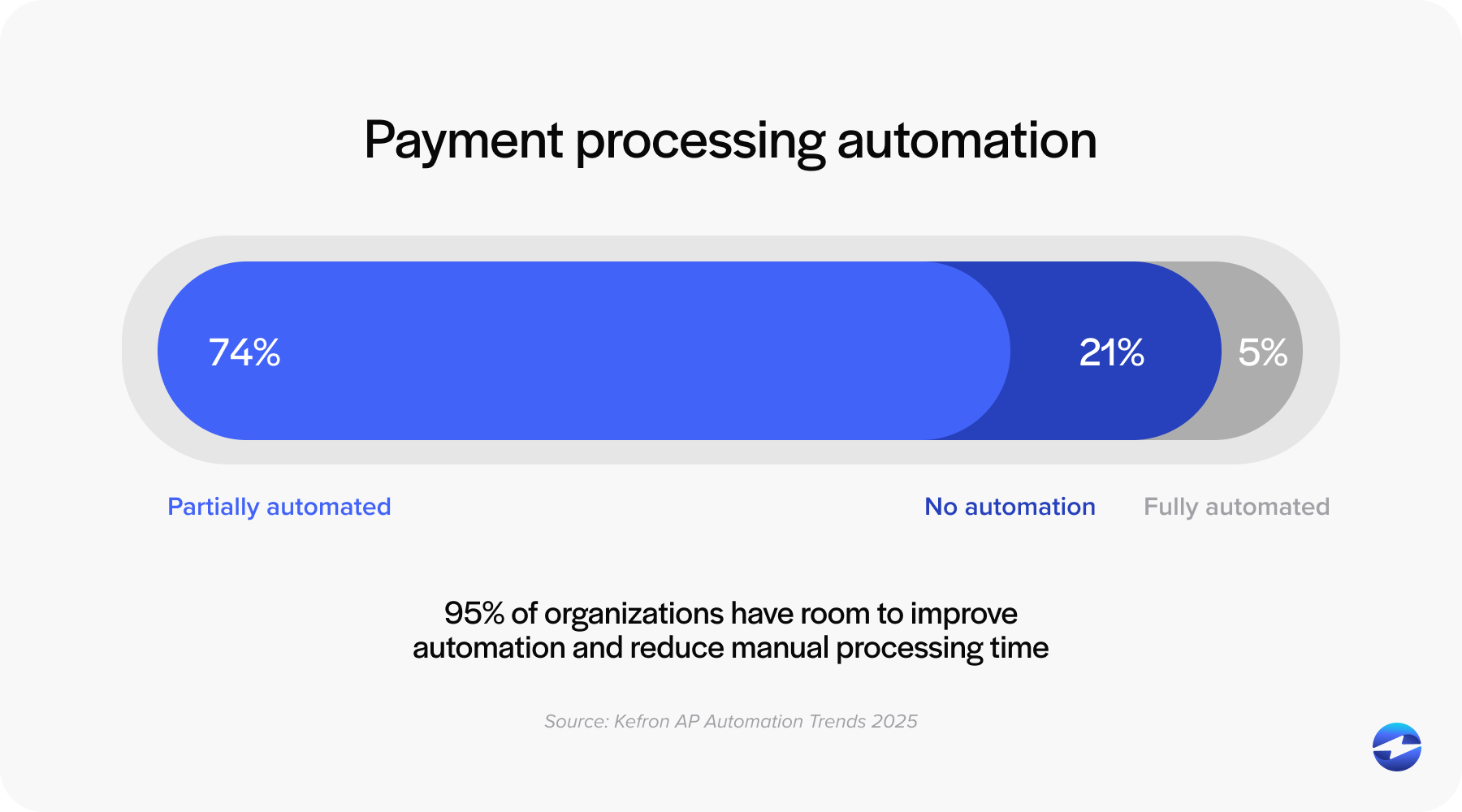

Running a nonprofit is rewarding work, but managing its finances can feel like a constant balancing act. Between donations, grants, recurring pledges, and program expenses, there’s a steady stream of transactions that need to be tracked, categorized, and reported accurately. Add the pressure of compliance requirements and limited administrative resources, and it’s easy to see why so many nonprofit finance teams are turning to automation.

That’s where Sage Intacct for nonprofit organizations comes in. As a leading cloud-based financial platform, Sage Intacct ERP is designed to handle the complexities of nonprofit accounting—helping teams keep their finances transparent, their data accurate, and their reporting effortless. For nonprofits managing diverse funding streams, Sage Intacct payment processing makes the process of tracking donations and payments more consistent and less manual, freeing up more time to focus on mission-driven work.

Understanding the Financial Challenges of Nonprofits

Nonprofits don’t operate like traditional businesses. They depend on multiple funding sources—individual donors, grants, sponsorships, and government contracts—that each come with different reporting and compliance requirements. Keeping all of this organized can be difficult, especially when payments are handled across several disconnected systems.

Many organizations still rely on spreadsheets and manual data entry to manage donor contributions and grant payments. This approach might work when the organization is small, but as donation volume grows, so does the risk of errors and inefficiencies. Delayed reconciliations, missing payment records, and incomplete reports can make it harder to build donor trust and provide accurate financial statements for boards or auditors.

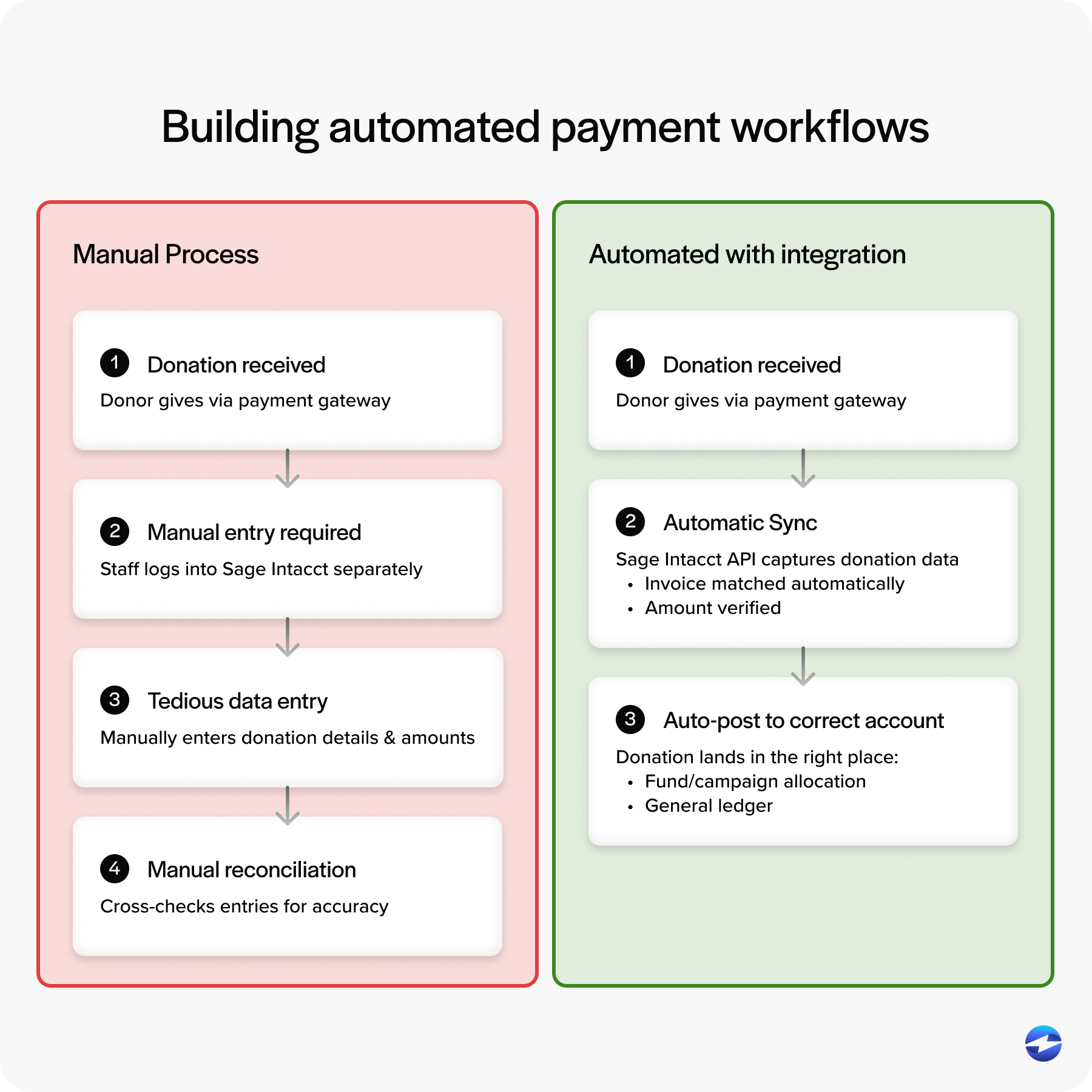

Automation changes this dynamic. With Sage Intacct, nonprofits can process donations, track grants, and manage recurring payments all within one centralized system. Instead of reconciling multiple spreadsheets or importing data from third-party systems, everything flows automatically through a single platform.

How Sage Intacct Simplifies Nonprofit Payment Management

Sage Intacct nonprofit tools are designed to simplify every part of your financial process. With Sage Intacct integration, you can connect your fundraising and donor systems directly to your accounting environment, so data moves automatically between them. Donations appear in the general ledger as soon as they’re received, and payments are linked to the right donor profiles without any manual effort.

Picture a donor who makes a donation every month through your website. Using Sage Intacct payment processing, their contribution posts instantly, gets reconciled, and is applied to the correct fund or campaign – all automatically. There’s no waiting until month’s end to make adjustments or balance reports. The automation quietly handles the details, allowing your staff to focus on more meaningful tasks.

You can also rely on Sage Intacct invoicing for the rest of your financial activity, from grant reimbursements to vendor payments. Automated invoicing keeps every dollar aligned with the right fund and makes it easy to see where money is coming from and where it’s going. Real-time dashboards give finance leaders a clear picture of payment activity and the overall financial health of each program.

Donor Tracking and Engagement in Sage Intacct

Donor relationships are built on transparency and trust, and Sage Intacct ERP gives nonprofits the tools to maintain both. Within the system, organizations can track donor pledges, recurring contributions, and one-time gifts with full visibility. Each donation is connected to a donor profile that includes history, payment records, and allocation details.

Integrating Sage Intacct with donor management software ensures that campaign results and financial data always match. When a donation is made, it automatically flows into the accounting system—no duplicate data entry or lag time. For development teams, this means faster insights into fundraising performance. For finance teams, it means cleaner books and fewer discrepancies between systems.

This level of connection not only simplifies operations but also strengthens relationships. When donors can receive accurate, timely receipts and see the impact of their contributions, their trust and loyalty grow.

Automating Payments and Invoicing for Nonprofits

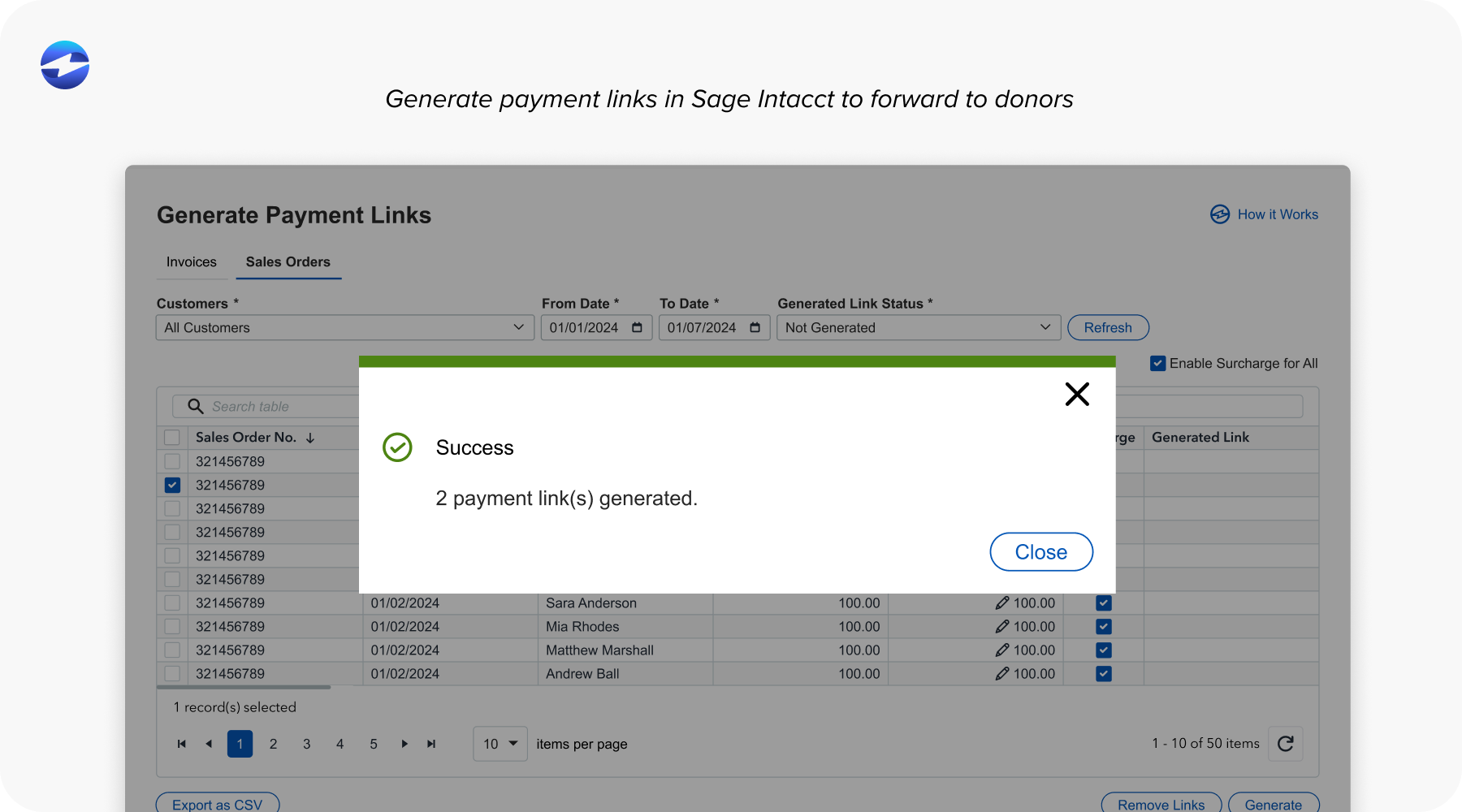

Manual invoicing and payment approval processes are often the biggest drains on a nonprofit’s time. Sage Intacct invoicing automates those workflows, handling recurring payments, reimbursements, and grant-related transactions with ease. Whether you’re managing payments to vendors or billing for program fees, the system routes approvals, generates reminders, and ensures compliance with donor or grant restrictions.

Automation also reduces the chance of missed payments or duplicate entries. For example, recurring donor contributions or membership renewals can be set to process automatically on a schedule, posting directly to the appropriate fund. For finance teams managing large volumes of transactions, this saves countless hours of manual work and minimizes errors.

Understanding Sage Intacct Payment Processing Costs

Processing payments always comes with a cost, and for nonprofits, keeping fees low is essential. Sage Intacct nonprofit pricing is structured to provide scalability and transparency for organizations of all sizes. The platform integrates seamlessly with trusted payment processors, allowing nonprofits to manage credit card, ACH, and online payments directly in the ERP.

Using a connected payment processing solution like EBizCharge helps reduce fees through interchange optimization. This means each transaction is routed through the lowest-cost category automatically, saving money on processing costs without adding administrative work. Combined with Sage Intacct payment processing, it also ensures that every payment posts instantly, eliminating delays and reducing the need for reconciliation.

With a clear view of transaction costs and revenue, finance teams can make better budgeting and fundraising decisions. Cost visibility also allows organizations to accurately report on overhead and ensure donor funds are used responsibly.

Why Sage Intacct Is a Strong Fit for Nonprofit Finance Teams

Nonprofits require systems that can adapt as they grow. Sage Intacct for nonprofit organizations supports multiple entities, funds, and currencies within a single platform, making it ideal for organizations with complex funding structures. Automation reduces the need for manual input while keeping compliance front and center.

Because Sage Intacct ERP integrates easily with fundraising, payroll, and reporting tools, finance teams gain real-time visibility across every department. Reports that once took hours to compile can be generated instantly with accurate data from across the organization. This transparency simplifies board reporting and strengthens donor confidence.

At its core, Sage Intacct helps nonprofits achieve what matters most: clarity, efficiency, and accountability. Whether you’re managing a small community fund or a national organization, the platform gives you the structure to scale without adding administrative overhead.

Why EBizCharge Is a Great Fit for Sage Intacct Integration

EBizCharge is a natural complement to Sage Intacct integration, offering a seamless way for nonprofits to process payments securely within their existing ERP. The integration allows donations, grants, and recurring payments to be processed and reconciled in real time, without switching between systems or importing data manually.

By embedding payment functionality directly inside Sage Intacct ERP, EBizCharge reduces friction in every step of the payment journey. Donations are automatically posted to donor accounts, refunds and adjustments are tracked, and financial records remain accurate and up to date. The system is PCI compliant, ensuring that donor data stays secure at every stage.

EBizCharge also helps nonprofits manage costs. Through optimized routing, it lowers processing fees and gives finance teams full visibility into transactions. Together, EBizCharge and Sage Intacct payment processing provide a complete financial management solution—one that’s efficient, secure, and designed for organizations focused on impact rather than paperwork.

Building a Sustainable Financial Future

Nonprofit finance professionals wear a lot of hats – accountant, auditor, compliance officer, and strategist all at once. It’s a challenging balance, and that’s why tools like Sage Intacct and EBizCharge make such a difference. They alleviate pressure by automating the most repetitive parts of financial management, keeping data accurate, and making sure everything runs smoothly behind the scenes.

When payments flow easily and reports are reliable, it’s easier for finance teams to stay focused on what matters most – supporting the mission. Investing in the right systems builds a financial foundation that’s steady today and flexible enough for tomorrow. With Sage Intacct nonprofit pricing and integrations that scale as you grow, organizations can plan confidently for the future. The best financial systems don’t just process payments – they create space for teams to make a bigger impact.