Next Day Funding: What Is It and Why Does It Matter?

Next Day Funding: What Is It and Why Does It Matter?

EBizCharge offers next-day funding options and is rated 5-stars by customers.

In the fast-paced world of commerce, waiting for payments to be processed can feel like watching paint dry. Luckily, there are methods for getting your money faster.

Transitioning from traditional payment methods to next day funding can be the key to faster payments, decreasing the typical payment processing wait times from days to a mere 24 hours.

With many businesses facing similar issues with cash flow, understanding this payment mechanism becomes an integral part of modern payment processing.

What is next day funding?

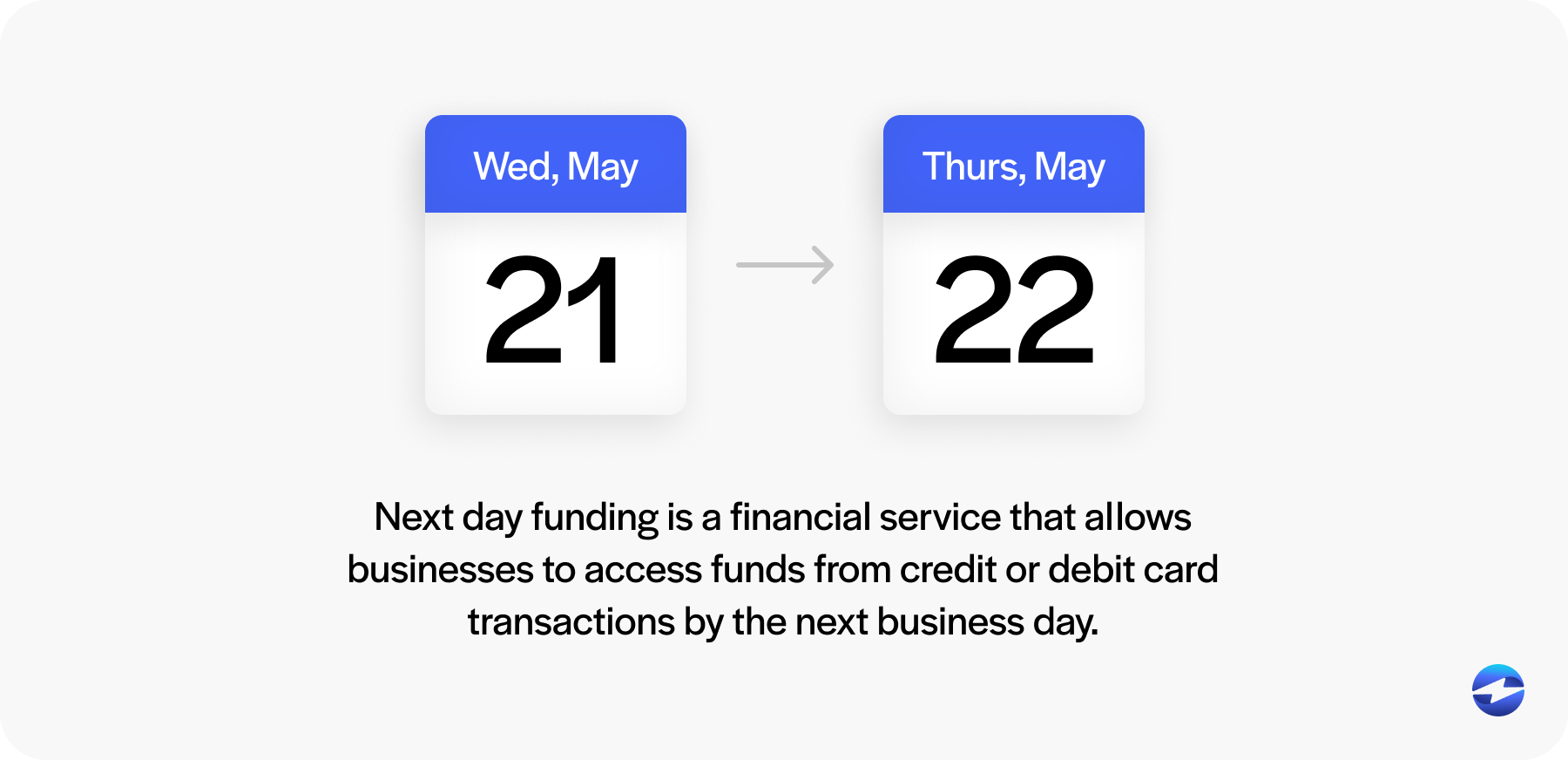

Next day funding is a financial service that allows businesses to access funds from credit or debit card transactions by the next business day.

This service improves cash flow by reducing the waiting time to receive payments. It’s especially useful for businesses that rely on daily operations and face time-sensitive opportunities.

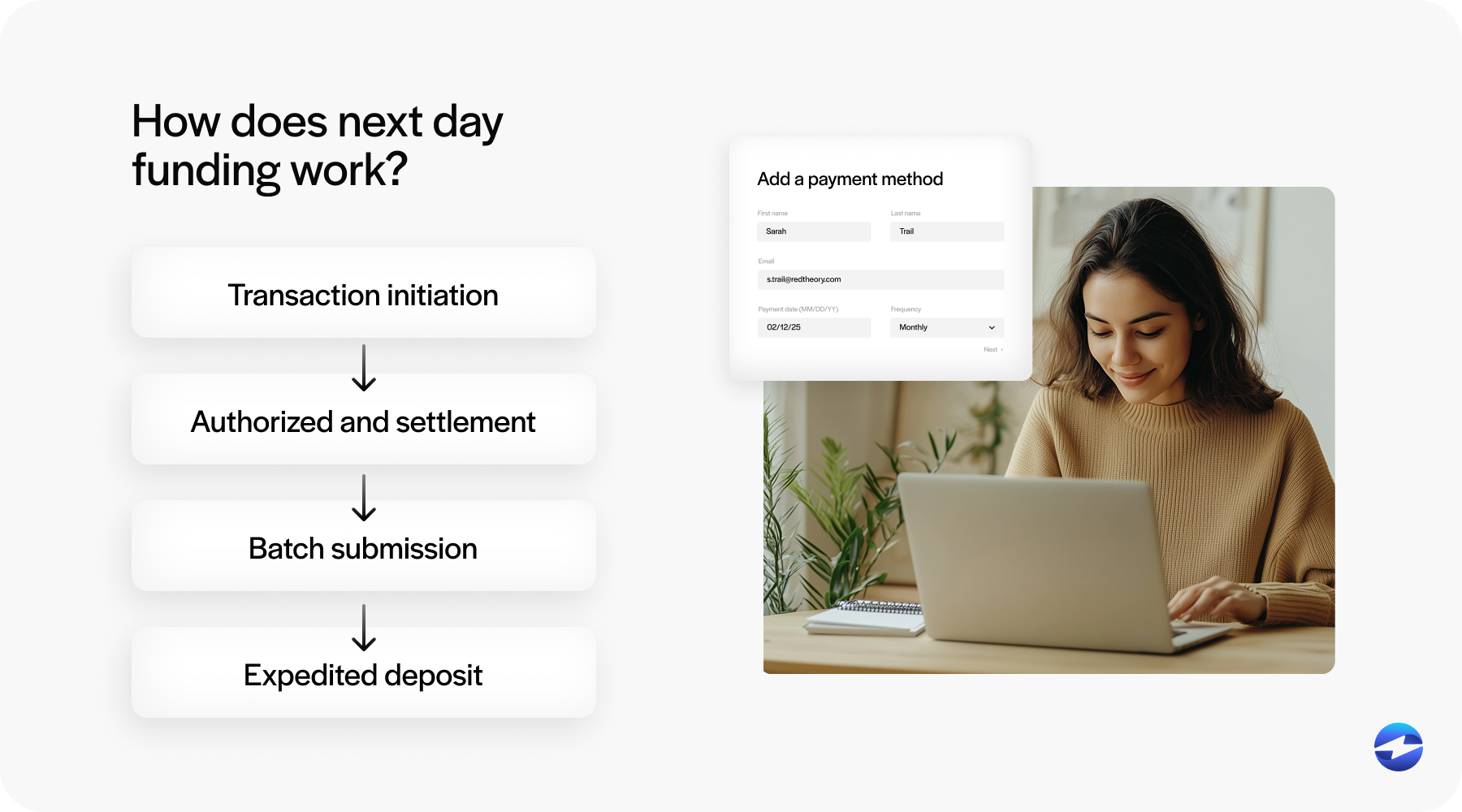

Here’s how the next day funding process works:

- Transaction initiation: A customer makes a purchase using a credit or debit card. This transaction is then captured via a payment terminal, virtual terminal, or integrated payment gateway.

- Authorized and settlement: The payment processor quickly verifies transaction details, authorizes the payment, and batches the day’s transactions at a pre-set cutoff time (typically in the late afternoon or evening).

- Batch submission: Once batched, the processor submits the transactions to the acquiring bank and relevant card networks for settlement.

- Expedited deposit: Instead of waiting multiple days for the settlement cycle to complete, next day funding enables the payment processor to advance the funds to your company’s bank account as soon as the following business day.

Several factors make this process quicker, such as efficient batch processing, optimizing settlement schedules, and strong banking relationships that facilitate the rapid movement of funds. These features allow next day funding to bypass common barriers in traditional systems.

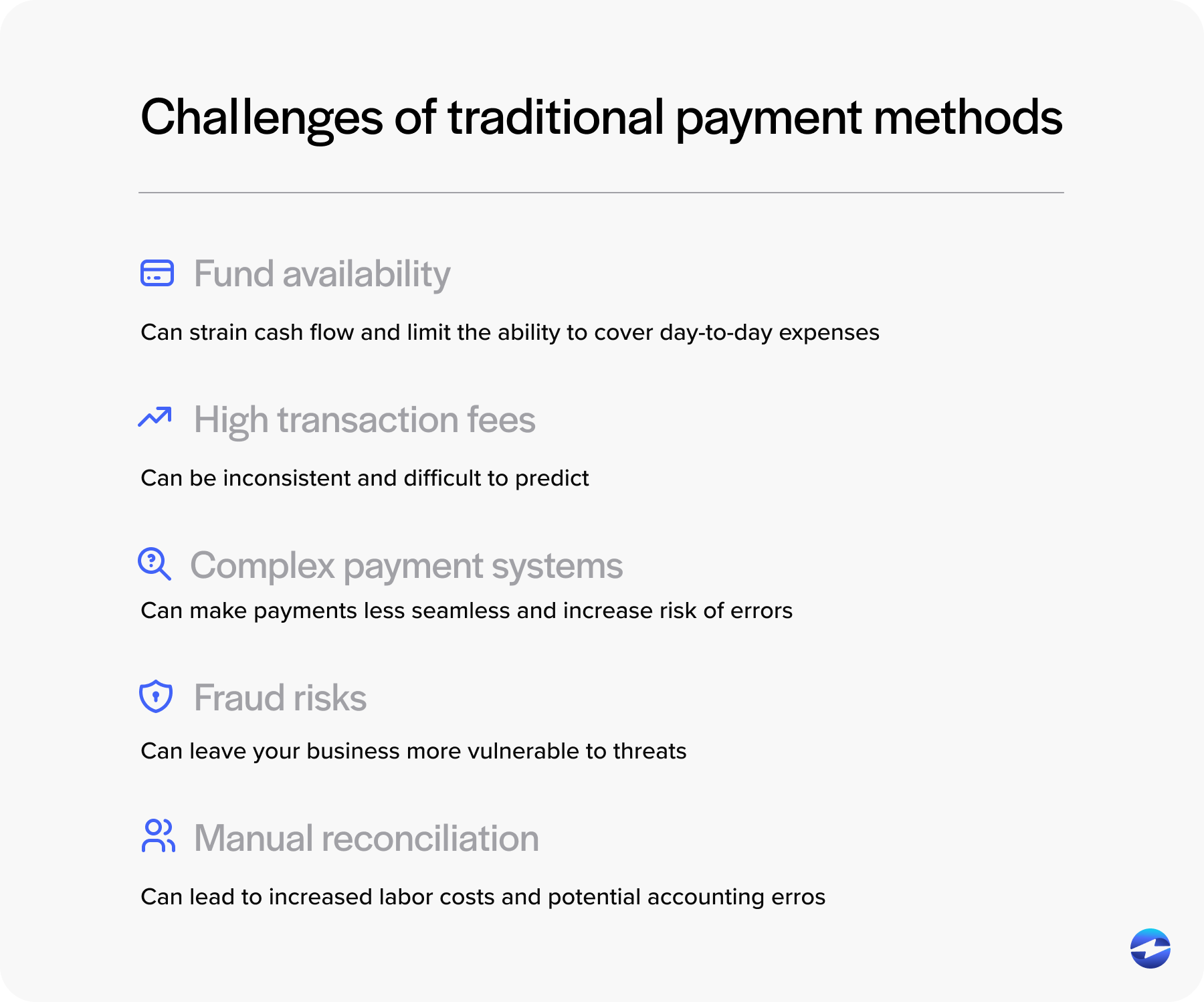

Common challenges of traditional payment processing

Traditional payment processing can present various challenges that hinder a business’s ability to operate efficiently and maintain healthy financial stability.

From delayed funds to increased operational burdens, these issues can add up and negatively impact overall performance.

Here are five challenges of traditional payment methods:

- Fund availability: Payments often take several business days to clear, which can strain cash flow and limit the ability to cover day-to-day expenses.

- High transaction fees: Credit card transactions typically come with fees that reduce profit margins. If not managed properly, these costs can be inconsistent and difficult to predict.

- Complex payment systems: Many traditional systems lack integrations with other business tools, making payments less seamless and increasing the risk of inefficiencies and errors.

- Fraud risks: Traditional methods may leave businesses without advanced security and fraud prevention tools more vulnerable to threats.

- Manual reconciliation: Reconciling payments manually can be time-consuming and prone to mistakes, leading to increased labor costs and potential accounting errors.

Luckily, reliable payment processors like EBizCharge provide businesses with a modern payment solution to overcome these challenges, with features like next day funding, enhanced security, and streamlined integrations. These advancements improve access to funds and support more efficient and secure operations.

Benefits of EBizCharge’s next day funding solution

EBizCharge’s next day funding solution offers a powerful way for businesses to access their funds faster and avoid the limitations of traditional payment processing.

With EBizCharge’s powerful next day funding options, merchants can enhance cash flow management, financial planning, and their competitive edge in the market.

Better cash flow management

Next day business funding can dramatically improve cash flow management by providing faster access to funds.

Unlike traditional payment processes, which may take several business days, EBizCharge’s next day funding deposits money from credit card sales almost immediately into bank accounts. Accelerated access means business owners can address operational expenses more promptly, thus improving cash flow and allowing for more flexibility to handle payroll and inventory purchases with ease.

By minimizing the gap between sales and actual cash in hand, companies can seize time-sensitive opportunities swiftly. In turn, this efficiency aids in preventing cash shortages that can hinder business operations.

Enhanced financial planning

The faster funding timelines associated with EBizCharge’s next day business funding can enhance your company’s financial planning.

Next day funding allows for more cash flow predictability, making it easier to create accurate financial forecasts. When money from transactions is available more quickly, businesses can plan their budgets with more certainty. This allows for better allocation of resources and smarter investment choices. Merchants can also project their earnings more accurately and assess their needs for external financing, such as credit lines.

Additionally, improved financial planning means better preparation for unexpected costs and emergencies.

With next day funding, businesses can align their financial strategies closely with their operational goals, fostering long-term success.

Competitive edge in the market

Embracing next day funding offers businesses a notable competitive edge over those using slower, traditional methods.

Quick access to funds enables your company to respond rapidly to market dynamics, such as bulk purchasing opportunities or urgent investments. This speed can lead to lower costs and increased profit margins.

Faster funding capabilities can also improve customer service, fostering greater consumer loyalty and satisfaction. When companies process payments quickly, they also demonstrate reliability and efficiency, two traits that attract and retain clients.

With EBizCharge’s next day funding, merchants position themselves as forward-thinking, which can lead to enhanced brand reputation and expanded market presence. This allows for more adaptability in times of uncertainty, whether from competition or consumer demand, ensuring the business remains viable and thriving.

Thanks to the improved cash flow, budgeting accuracy, and responsiveness to market opportunities that next day funding provides, businesses can operate more confidently and efficiently and position themselves for more long-term success and resilience.

Who should consider next day funding?

Working with payment processors like EBizCharge that offer effective next day funding options can be a game changer, as these systems enable merchants to maintain a steady and reliable cash flow that leads to more productive operations.

Next day funding is especially beneficial for those operating on tight margins or in fast-paced environments where quick access to working capital can make a significant difference.

Here are five types of merchants that should consider next day funding:

- Small to mid-sized businesses: These companies often face cash flow constraints and can benefit from swifter fund access to handle payroll, restock inventory, and cover daily operational costs.

- Retailers, restaurants, and service providers: High transaction volumes and regular operational demands make faster funding essential to generate more business continuity.

- Seasonal businesses: Companies that experience revenue spikes during specific times of the year can use next day funding to manage peak periods more efficiently and prepare for off-season slowdowns.

- Opportunity-driven business: Businesses looking to capitalize on time-sensitive opportunities, such as bulk inventory discounts or flash marketing campaigns, can benefit from having funds readily available.

- Businesses with cash flow disruptions: Merchants that face delays in revenue collection or want to reduce dependence on credit lines can improve financial predictability and resilience with next day funding.

Next day funding is ideal for companies seeking faster, more predictable access to their earnings. Whether the goal is to improve cash flow, respond more quickly to market changes, or reduce financial stress, adopting next day funding can provide the flexibility and control needed to enhance functionality.

EBizCharge makes setting up next day funding is a straightforward process designed to integrate smoothly into your existing payment workflow.

How to set up next day funding with EBizCharge

EBizCharge enables merchants to incorporate next day funding options into their infrastructures by following a few simple steps to ensure a seamless transition with minimal disruption to their operations.

The first step is to contact the EBizCharge team to discuss your business needs and determine eligibility. An EBizCharge representative will guide you through the setup process, ensuring that next day funding is configured correctly based on your transaction volume, industry type, and banking requirements.

Once approved, EBizCharge will work with you to activate next day funding in your merchant account, which may involve verifying your bank account details and ensuring your payment processing schedule aligns with cutoff times to guarantee timely deposits.

The EBizCharge platform is designed for flexibility and ease of use, so there’s no need to overhaul your current systems. EBizCharge integrates with a wide range of accounting, enterprise resource management (ERP), and customer relationship management (CRM) software, which helps ensure the next day funding feature works effortlessly within your existing infrastructure.

Once the effortless setup process is complete, merchants’ funds from credit card transactions will be deposited into their bank account as soon as the next business day for faster access to working capital.

EBizCharge’s top-rated next day funding solution

EBizCharge’s next day funding solution offers more than a faster way to access your money — it reflects a broader commitment to security, compliance, and cost-conscious service.

EBizCharge maintains the highest data protection standards, with robust security and Payment Card Industry (PCI) validation to ensure that every transaction is processed safely and responsibly.

Additionally, the platform is designed with affordability in mind, offering transparent pricing and low transaction costs to help businesses maximize their revenue.

By prioritizing financial efficiency and operational integrity, EBizCharge promotes more business growth for its merchants, knowing they have a secure, compliant, and cost-effective payment solution supporting them every step of the way.