Blog > NetSuite Payment Methods: The Collection Tools That Actually Work

NetSuite Payment Methods: The Collection Tools That Actually Work

NetSuite, a leading cloud-based business management software, supports various payment methods to cater to diverse business needs. From credit card payments to electronic funds transfers, knowing which methods to implement can significantly impact a company’s financial health.

This article will explore the payment methods available in NetSuite and the most effective collection tools they offer.

Understanding NetSuite payment processing

NetSuite is a versatile enterprise resource planning (ERP) platform that helps businesses manage financial transactions.

When integrated with a trusted payment gateway, businesses can process transactions, manage invoices, and reconcile payments inside NetSuite without switching between multiple platforms. This integration enhances efficiency by automating payment workflows, reducing manual data entry, and minimizing errors.

NetSuite can seamlessly integrate numerous payment methods like Automated Clearing House or ACH transfers, credit card payments, and other digital payment methods.

ECommerce and brick-and-mortar stores alike depend on diverse payment options to operate efficiently.

A thorough understanding of these methods is essential for businesses wanting to optimize financial operations.

4 common payment methods in NetSuite

NetSuite- integrated solutions support multiple methods of payment to enhance flexibility and convenience for both businesses and their customers. These methods cater to diverse customer preferences and business needs, ensuring a seamless payment experience.

Four common payment methods in NetSuite include:

- Credit and debit cards: Credit and debit cards are popular NetSuite payment methods due to their convenience and speed. Customers can make payments quickly, and businesses can process these transactions without hassle. Credit cards can also be used as stored payment methods for recurring payments to simplify the accounts receivable (AR) process.

- Electronic funds transfers (EFTs): Like ACH payments, EFTs are commonly used in NetSuite for their efficiency since they enable direct money transfers from one account to another. ACH payments are cost-effective EFTs, typically incurring lower fees than credit cards, that offer seamless transactions and minimize manual intervention. EFTs reduce the need for physical checks, speeding up payable processes and improving cash flow.

- Wire transfers: Wire transfers are a reliable method for large sums or international payments in NetSuite since they offer fast and secure transactions, making them ideal for businesses dealing with significant volumes. These transfers also help merchants maintain control over financial processes.

- Buy now, pay later (BNPL): BNPL is gaining popularity since it allows customers to make purchases and pay over a more extended period. BNPL can boost sales by offering more payment options, driving customer satisfaction and business growth.

Selecting the right mix of payment methods can optimize your financial management and efficiency. NetSuite integrations also offer common collection tools that streamline accounts receivable.

5 powerful collection tools available in NetSuite

Merchants can work with a reliable payment provider that syncs into NetSuite to support multiple payment collection tools that streamline transactions and improve financial operations.

Here are five payment collection tools you can integrate into NetSuite:

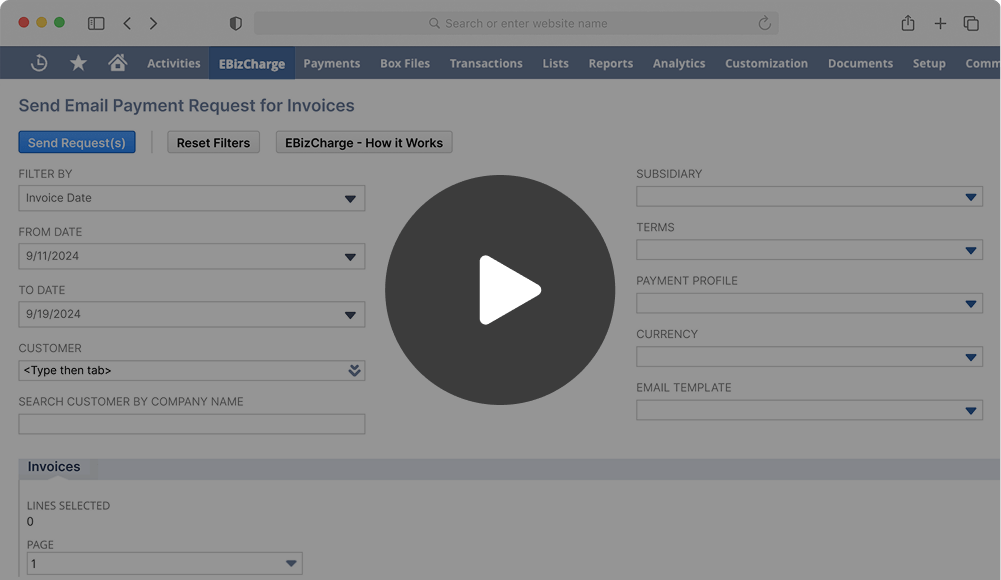

- Email pay enables merchants to send invoices directly to customers with embedded payment links so recipients can make quick, secure payments without logging into a separate platform. This can reduce delays and increase on-time payments.

- Customer bill pay portals offer a centralized online solution to manage payments where customers can conveniently log in and settle bills. This self-service option supports many accepted payment methods to improve customer interactions and service. It can also reduce late payments for better cash flow.

- Automatic payments allow recurring billing for subscriptions or repeat services to reduce manual workload and ensure more prompt payments. It easily syncs with NetSuite’s financial reports for better insights into financial management.

- Billing and subscription management tools can handle more complex needs by managing various subscription models and customized billing cycles. They provide real-time access to customer records and custom fields, ensuring flexibility for business requirements. Effective billing operations can enhance customer relations and satisfaction.

- Batch processing is another powerful tool for simplifying collections since it allows merchants to process multiple transactions simultaneously. This method is ideal for handling large volumes of data, as it ensures quicker and more efficient payments.

Payment collection tools can be applied to your NetSuite system to improve cash flow, leverage valuable financial insights for more informed strategic decisions, streamline financial operations, and drive growth.

With these benefits in mind, it’s essential to choose the most advantageous payment methods for your business.

How to choose the best payment methods for your business

Finding the best integrated payment methods for your NetSuite integration requires careful consideration of your unique operational needs, customer preferences, and industry requirements.

When choosing a provider to integrate payments into your NetSuite system, you should consider your transaction volume, customer preferences, associated costs, and more.

Merchants with high-volume or recurring transactions may benefit from ACH payments or automatic billing, while those in eCommerce or retail can prioritize credit cards, digital wallets, and BNPL options to enhance customer convenience.

Another critical factor is customer preference. Understanding how customers prefer to pay can help your business select integrated payment methods that improve satisfaction, reduce cart abandonment, and garner more brand loyalty.

Processing costs and fees should also be evaluated, as different payment methods vary in transaction fees. For example, ACH payments and direct bank transfers generally accrue lower fees than credit cards, making them ideal for high-value transactions. Businesses should compare processing rates to leverage cost-effective methods without sacrificing user experience and convenience.

By carefully evaluating these factors, you can select the most suitable payment methods for your payment integration inside NetSuite for a more enhanced and customer-friendly payment experience.

After determining which payment methods you need, finding a reliable and robust payment gateway that provides these desired methods while seamlessly syncing with your NetSuite system is vital.

Integrating payment gateways with NetSuite

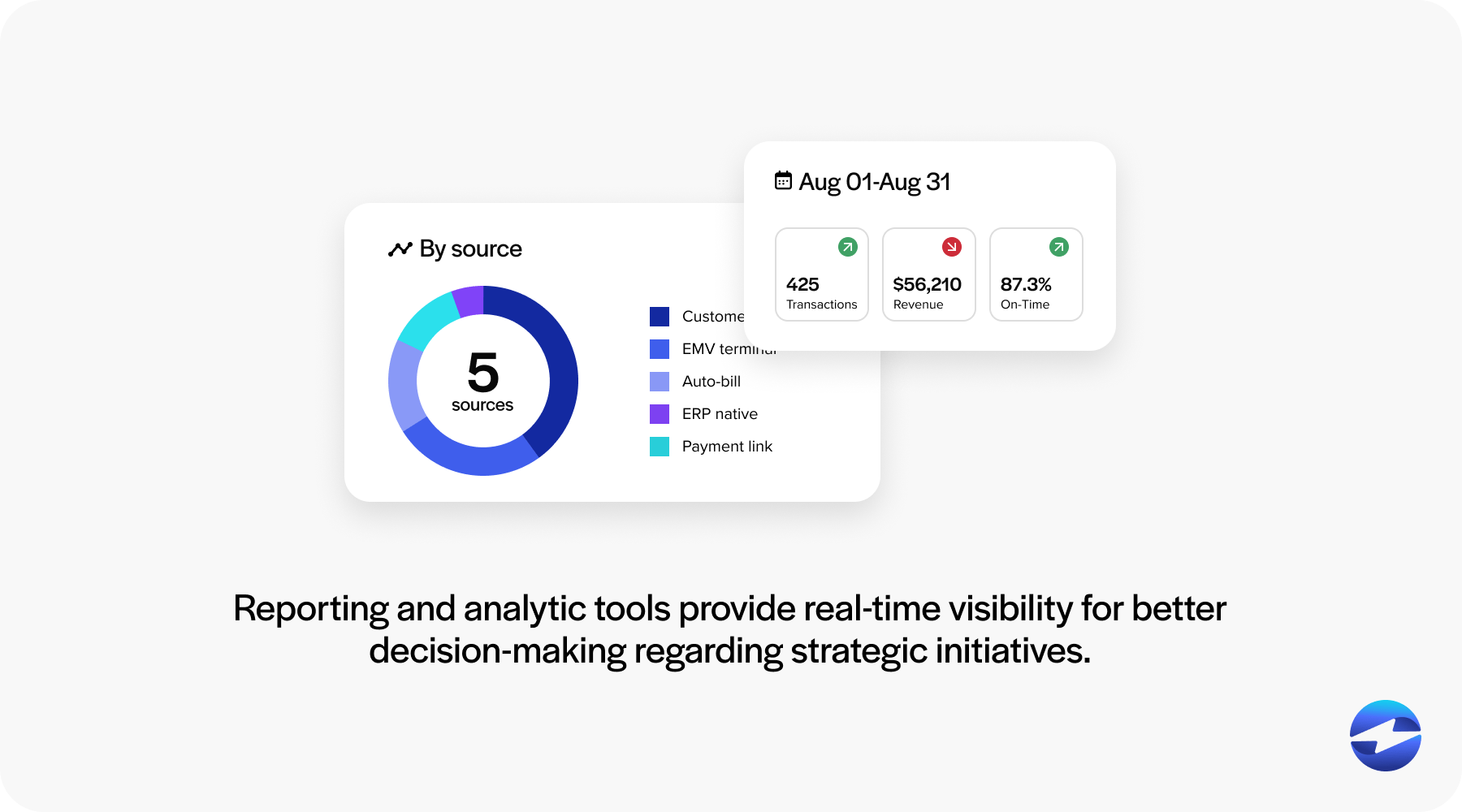

Integrating a high-powered payment gateway with NetSuite can provide your business with several key features to transform your finances and payment processing operations. The chosen payment solution should seamlessly integrate with NetSuite’s accounting, invoicing, and reporting tools to streamline reconciliation and cash flow management.

A well-integrated payment gateway simplifies transactions in NetSuite by automating payment acceptance, reconciliation, and reporting. Reporting and analytic tools provide real-time visibility for better decision-making regarding strategic initiatives, while customizable records and fields allow companies to tailor their systems to meet diverse needs.

A high-quality NetSuite payment solution will enhance ERP capabilities by enabling seamless financial management and marketing automation for businesses to streamline data and payment processing and improve financial records for deeper insights.

Security and compliance are another benefit of integrating payment gateways with NetSuite. Businesses must ensure their chosen option complies with Payment Card Industry Data Security Standards (PCI DSS) and other regulatory requirements, particularly when handling sensitive financial data. Solutions that offer tokenization and encryption can help reduce fraud risks and protect customer information.

Finally, businesses should consider integration capabilities and automation features when selecting a gateway. Payment gateways that offer real-time reporting, batch processing, and automated payment reminders can significantly improve efficiency.

With a reliable NetSuite payment gateway, companies can optimize payment workflows, efficiency, and operational performance while promoting growth and financial stability.

Working with a top-rated NetSuite payment gateway like EBizCharge

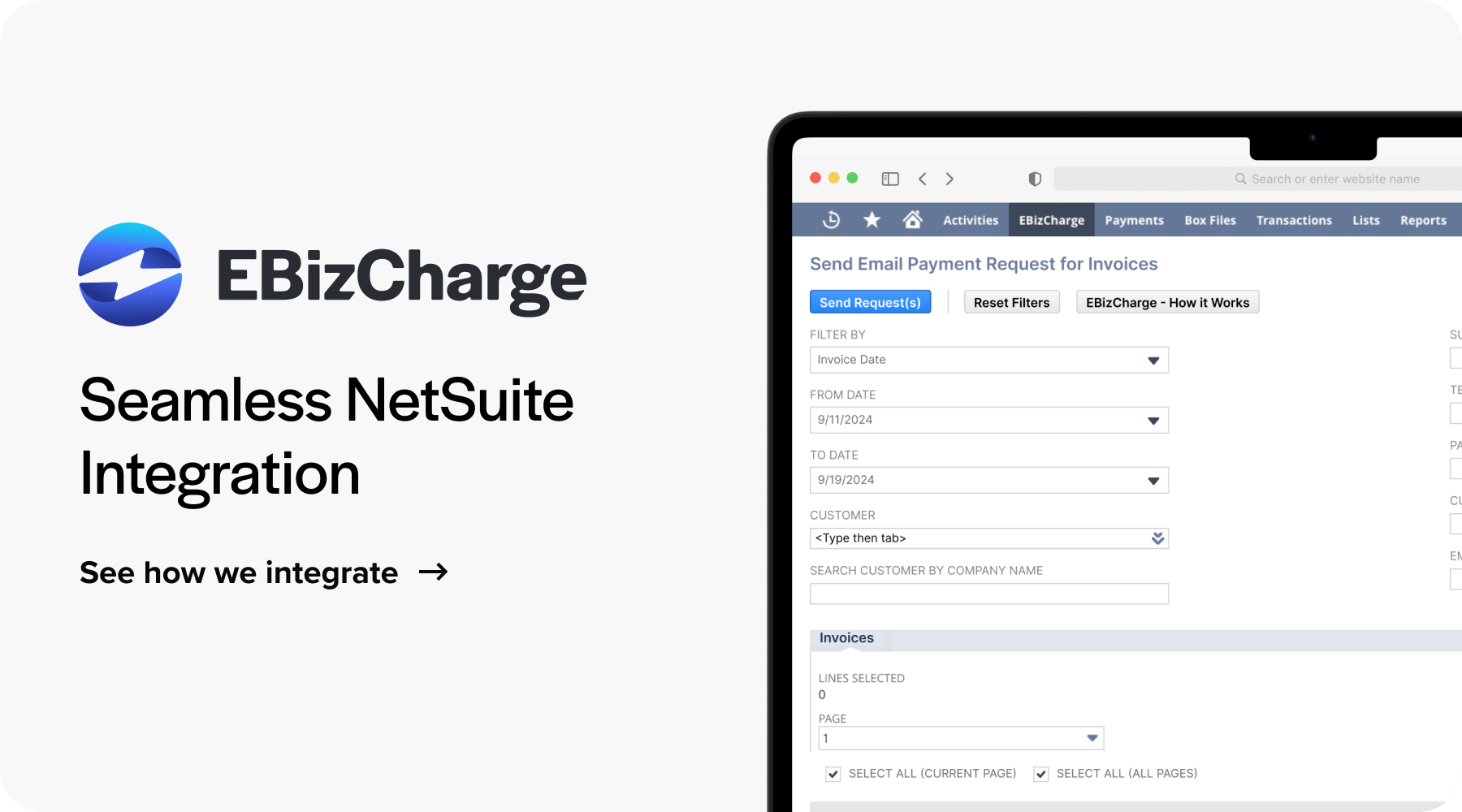

The EBizCharge for NetSuite payment integration simplifies customer payments with its powerful collection tools, advanced features, and numerous payment methods.

By seamlessly integrating with NetSuite, EBizCharge allows merchants to quickly process and manage payments inside this system. The EBizCharge payment software ensures this by immediately syncing and updating payment data in NetSuite for real-time visibility.

EBizCharge consists of a robust suite of payment collection tools that include automated payment reminders to reduce the time spent on manual follow-ups and encourage early or on-time payments. It also offers a customer payment portal that allows clients to securely and conveniently view and pay invoices online at their convenience.

EBizCharge supports numerous payment methods like integrated payment links on invoices and emails. It also grants access to detailed financial reports that can assist you in generating more revenue and addressing payment gaps or discrepancies.

The fully PCI-compliant EBizCharge payment processing solution provides advanced security that includes tokenization, encryption, off-site data storage, 3D Secure, and other features to safeguard payments. It also offers instant access to financial data, flexible customization options, payment automation tools, and more.

With competitive pricing options and top-notch security, EBizCharge is a top-rated payment software provider that gives merchants everything they need to effortlessly accept and manage payments inside NetSuite.