Blog > NetSuite Customer Deposits: Best Practices and Setup

NetSuite Customer Deposits: Best Practices and Setup

If your business accepts money upfront—whether for custom orders, project-based work, or high-ticket items—you’re likely already familiar with customer deposits. However, managing them in NetSuite can feel murky if you don’t have a standardized system in place.

This guide breaks down how to set up and manage NetSuite customer deposits the right way. It’ll share a clear, practical walkthrough along with best practices that make things easier for everyone, especially finance teams, NetSuite administrators, and accountants who manage the day-to-day. If you’re involved in NetSuite billing, payment processing, or just want to reduce errors and manual rework, this one’s for you.

What Are Customer Deposits in NetSuite?

A customer deposit in NetSuite is a payment received before goods or services are delivered. It sits on the books as a liability – money you’ve collected but haven’t earned yet.

Customer deposits are common in industries like manufacturing, wholesale distribution, custom services, and software, where orders require upfront payment. Whether it’s a deposit for a future software license or a down payment for a large equipment order, customer deposits help secure the transaction and provide working capital. That said, not all early payments are treated equally in NetSuite, and it’s essential to understand the difference to avoid misclassification.

It’s important to be able to distinguish customer deposits from prepayments. NetSuite customer deposits are linked to a sales order, whereas a customer prepayment isn’t. If you’re collecting money against a specific order, you should be using the customer deposit flow.

Why Proper Setup Matters

When deposits are recorded accurately, you have better visibility into incoming cash and a tighter grip on revenue forecasting. It also keeps your liability balances clean and accurate.

Mishandling deposits can create issues with revenue recognition and even result in duplicate revenue entries. It’s not just a bookkeeping inconvenience—it can lead to compliance issues or misrepresented financials.

If you rely on NetSuite billing tools or use NetSuite payment processing to collect deposits, having a clean process is even more important. This ensures customer trust and smooth operations across your payment processor and accounting workflows.

Step-by-Step: Setting Up Customer Deposits in NetSuite

Setting up customer deposits in NetSuite isn’t complicated, but it does require careful attention to detail. Each step builds on the last, and skipping one can create confusion down the line – for your team and your customers. The goal is to build a smooth, repeatable process that makes collecting and managing deposits easy to maintain, audit-ready, and aligned with how your business operates.

Here’s a quick walk-through of how to set up customer deposits in NetSuite:

1. Enable Required Features

Start by enabling the right modules in your account:

- Go to Setup > Company > Enable Features

- Under the Transactions tab, check the boxes for Customer Deposits and Sales Orders

Without both, you won’t be able to tie deposits to sales orders properly.

2. Create a Sales Order

Before you can take a deposit status, you need a sales order. This anchor transaction is for tracking and applying payments and formally recording the customer’s intent to buy. Without this anchor, it’s hard to tie financial activity to specific goods or services.

Review the terms, approval status, and any routing rules. These settings will impact how the deposit is tied to the invoice later and when fulfillment can begin. Be mindful of internal controls here – sales orders may need to be reviewed or approved, especially if they exceed certain thresholds or have custom terms. Clear documentation here will set the tone for smooth NetSuite billing and payment processing.

3. Record the Customer Deposit

Once the sales order is approved, go to Transactions > Customers > Record Customer Deposit. Choose the customer and the relevant sales order. If you’re using NetSuite credit card processing or another payment processing solution, you’ll also choose your payment method here.

Make sure to fill in all key fields:

- Amount

- Customer

- Linked Sales Order

If you’re integrated with a payment processor, your deposit may populate automatically after the payment is collected. This helps reduce manual entry and errors.

4. Apply Deposits to Invoices

Once you’re ready to invoice the customer, you can apply the deposit by:

- Going to the invoice

- Clicking Apply next to the available customer deposit

NetSuite does the math for you. If the deposit only covers part of the invoice, NetSuite will show the remaining balance.

Automation tools like SuiteFlow can make this even easier if you process hundreds of transactions a month.

5. Reporting and Reconciliation

Don’t forget about reporting. Set up saved searches to track unapplied customer deposits. Some companies have a dashboard KPI to track deposit aging.

When doing bank reconciliations, make sure customer deposits are matched against your cash account deposits. If you’re using NetSuite payment processing or an integrated payment solution, this setup is usually faster and more reliable.

Best Practices

Getting customer deposits right in NetSuite isn’t just about setup – it’s about consistency, clarity, and building habits that prevent headaches down the line. Whether you handle a few deposits a month or hundreds as part of a larger operation, a consistent process will save time, reduce manual error, and keep your team aligned.

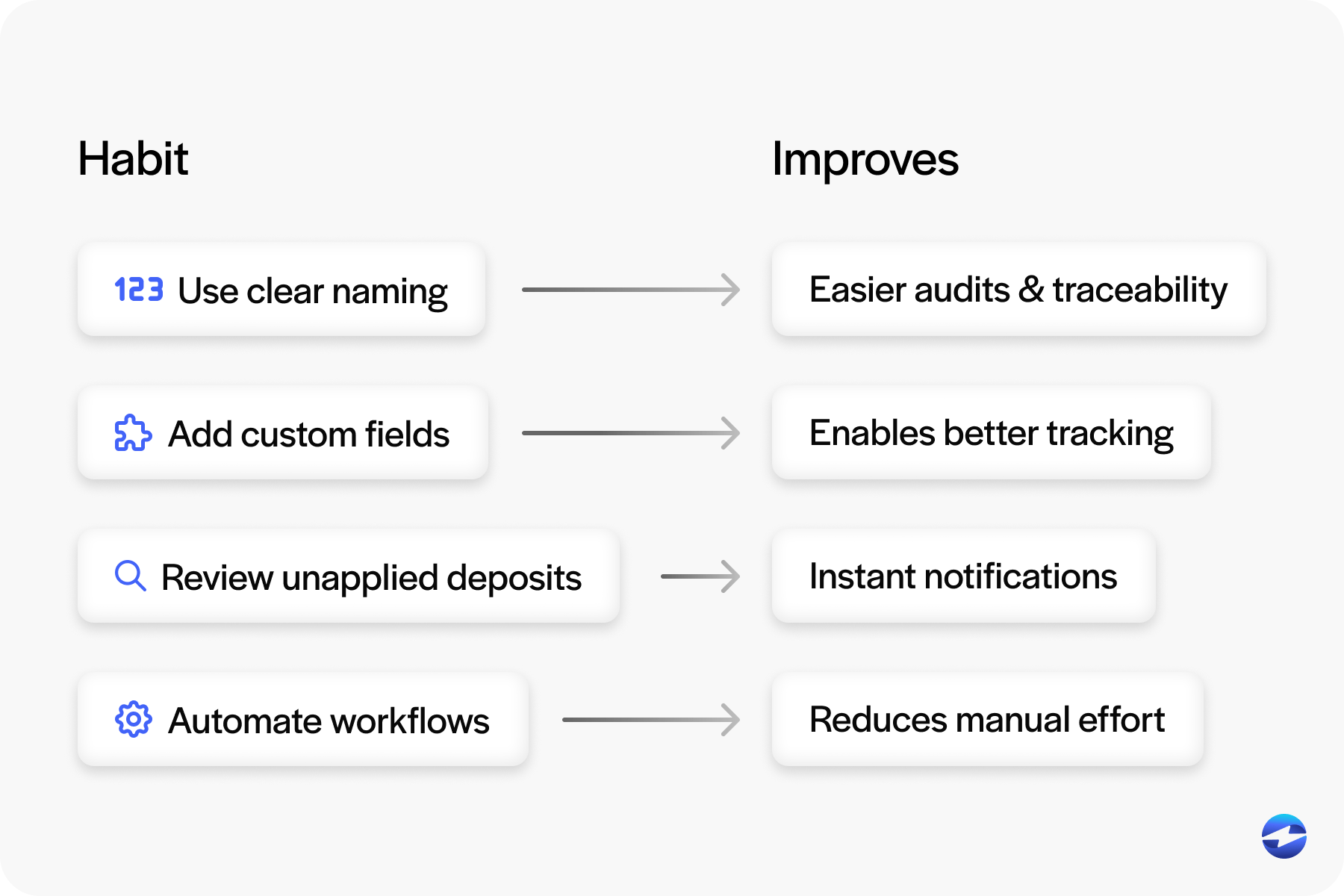

Here are some habits to build:

- Use clear naming conventions and fill out memos so auditors (and future you) know what the transaction is.

- Add custom fields to track deposits by project, region, or rep.

- Review unapplied deposits regularly so you don’t miss applying them when you invoice.

- Automate workflows like deposit approvals or reminders with SuiteFlow to avoid bottlenecks.

Many businesses also set up alerts for unlinked deposits, which can help spot errors before they get out of control. These small checks can make a big difference in keeping your NetSuite customer deposit process clean and audit-ready.

Common Pitfalls and How to Avoid Them

Even experienced NetSuite users fall into deposit handling traps, often due to small oversights that add up over time. It’s easy to assume that once a deposit is received, it’s been accounted for – but in reality, there are more ways things can go wrong. The more complex your sales process or payment terms, the more important it is to build guardrails around these common pitfalls.

Some common mistakes include:

- Not applying deposits to invoices, leaving money floating unlinked, and overstating liabilities.

- Double-counting revenue by recording the deposit and then invoicing without applying it, which messes up financial reports.

- Refunding deposits without reversing the transaction, creating accounting noise, and messy audit trails.

To avoid these traps, use NetSuite’s automation and visibility tools. Create workflows or dashboards that flag incomplete or misapplied transactions and schedule regular reviews of unapplied deposits. Give your team checklists and training, and make sure your payment processing solution integrates with your deposit process, so nothing gets lost between systems. A little attention to detail here goes a long way to clean books and reporting.

Integrations and Customizations

If your business uses an ecommerce platform, CRM, or third-party payment solution, you’ll want your NetSuite customer deposit flow to integrate seamlessly.

- Connect to your payment gateway so that payments flow automatically into NetSuite.

- Use SuiteScript or SuiteFlow to add logic like auto-approvals or conditional routing.

- If you’re using NetSuite credit card processing, be sure to configure deposit triggers to avoid duplicate entries.

The smoother your integration, the more reliable your customer deposit NetSuite data will be.

EBizCharge: Making Customer Deposits Work For You

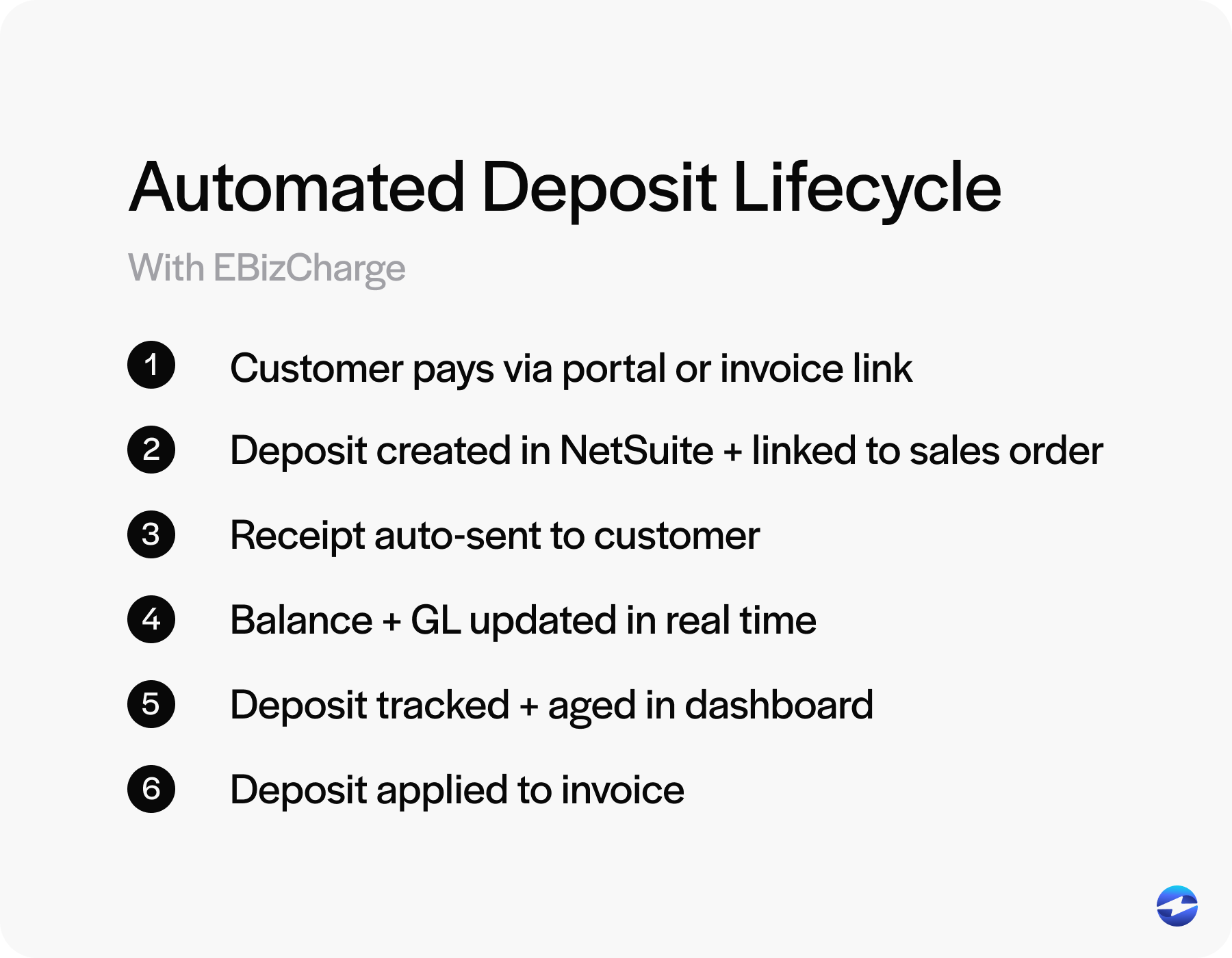

When managed well, NetSuite customer deposits can reduce risk, increase visibility, and ease the load on the finance team. But it’s even more efficient when paired with a purpose-built payment processing solution like EBizCharge.

EBizCharge integrates with NetSuite to streamline the deposit collection, recording, and application process. It automates deposit creation, reconciliation, and invoice application, so there are fewer manual entries and fewer errors. Deposits made by credit card or ACH are automatically tied to the correct sales orders, so records are clean and customers are happy.

With features like branded payment portals, automated email receipts, real-time payment updates, and advanced reporting, EBizCharge simplifies the entire deposit process. It enhances both NetSuite billing and NetSuite credit card processing so your team can work faster and more accurately.

For any business that handles large orders or recurring payments, EBizCharge turns customer deposits from a manual headache into a scalable process that fits into your NetSuite environment.