Blog > Navigating the ACH Landscape: Understanding Payment Types and Payment Codes

Navigating the ACH Landscape: Understanding Payment Types and Payment Codes

Automated Clearing House (ACH) transactions are revolutionizing how businesses and consumers transfer money, offering a variety of payment types to meet diverse needs.

Recognizing the different types of ACH payments and their relevant codes is crucial for navigating this complex landscape. By doing so, businesses can enhance their operations, and consumers can make more informed financial decisions.

What are ACH payments?

ACH payments refer to electronic funds transfers (EFTs) between financial institutions using the ACH network. This system allows businesses and consumers to move money between bank accounts, either within the same institution or across different financial institutions.

ACH payments offer a secure, reliable, and cost-effective way to transfer funds for payroll, recurring bill payments, direct deposits, and other routine transactions.

These transactions are processed in batches, making them more efficient and less costly than wire transfers or card payments. Additionally, ACH payments can be processed on the same day or within a few business days, offering flexibility based on urgency and cost considerations.

With the growing shift to digital transactions, understanding ACH payments is crucial for optimizing financial operations and ensuring smooth, secure money transfers.

The importance of understanding different payment types

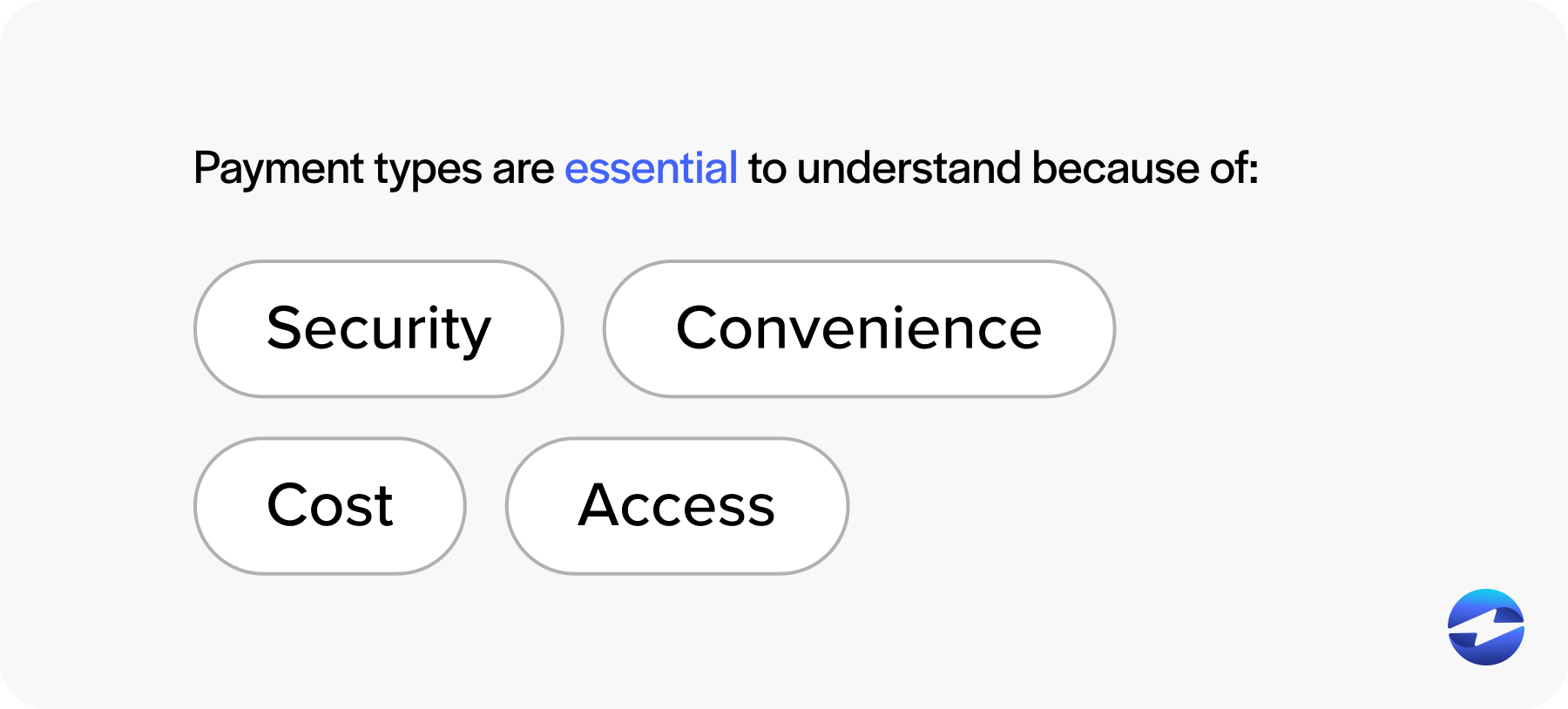

Understanding different payment types, alongside ACH, is crucial for making informed decisions about how to handle transactions. It helps ensure security, convenience, and cost-effectiveness, whether managing personal finances or running a business.

Here are several other reasons why payment types are essential to understand:

- Security: Different payment methods offer varying levels of protection. Knowing how to use them safely can help protect against fraud and theft.

- Convenience: Some payment types are better suited for certain transactions than others. Therefore, selecting the proper payment methods can improve the ease and speed of transactions.

- Cost: Each payment method has different transaction fees that can increase over time. Merchants must understand these costs to manage finances effectively.

- Access: Not all payment methods are available to everyone, so understanding what’s accessible can help you plan for payment or receipt of funds.

Knowing the various payment methods and what they entail will enable businesses to choose the most appropriate options for their needs and consumers.

Merchants that offer ACH payments to their customers should also familiarize themselves with the associated codes that come along with these transactions.

What are ACH payment codes?

Payment codes are vital in facilitating the seamless movement of funds through the ACH network. These codes are included in transaction details and guide how transactions should be processed, providing more clarity about the type of ACH transfer being processed for financial institutions.

Understanding payment codes is essential for anyone handling ACH transactions, whether you’re a business owner managing cash flow or an individual handling personal finances.

ACH payment codes ensure that transactions are correctly categorized, promoting better operational efficiency within the EFT system. Users can avoid potential errors or delays in processing by using the correct payment codes. This is particularly important when dealing with time-sensitive transactions where funds must be available by a specific date, such as payroll direct deposits or bill payments.

Now that you understand why payment codes are essential, the following section will dive deeper into the main ACH payment types that utilize these codes.

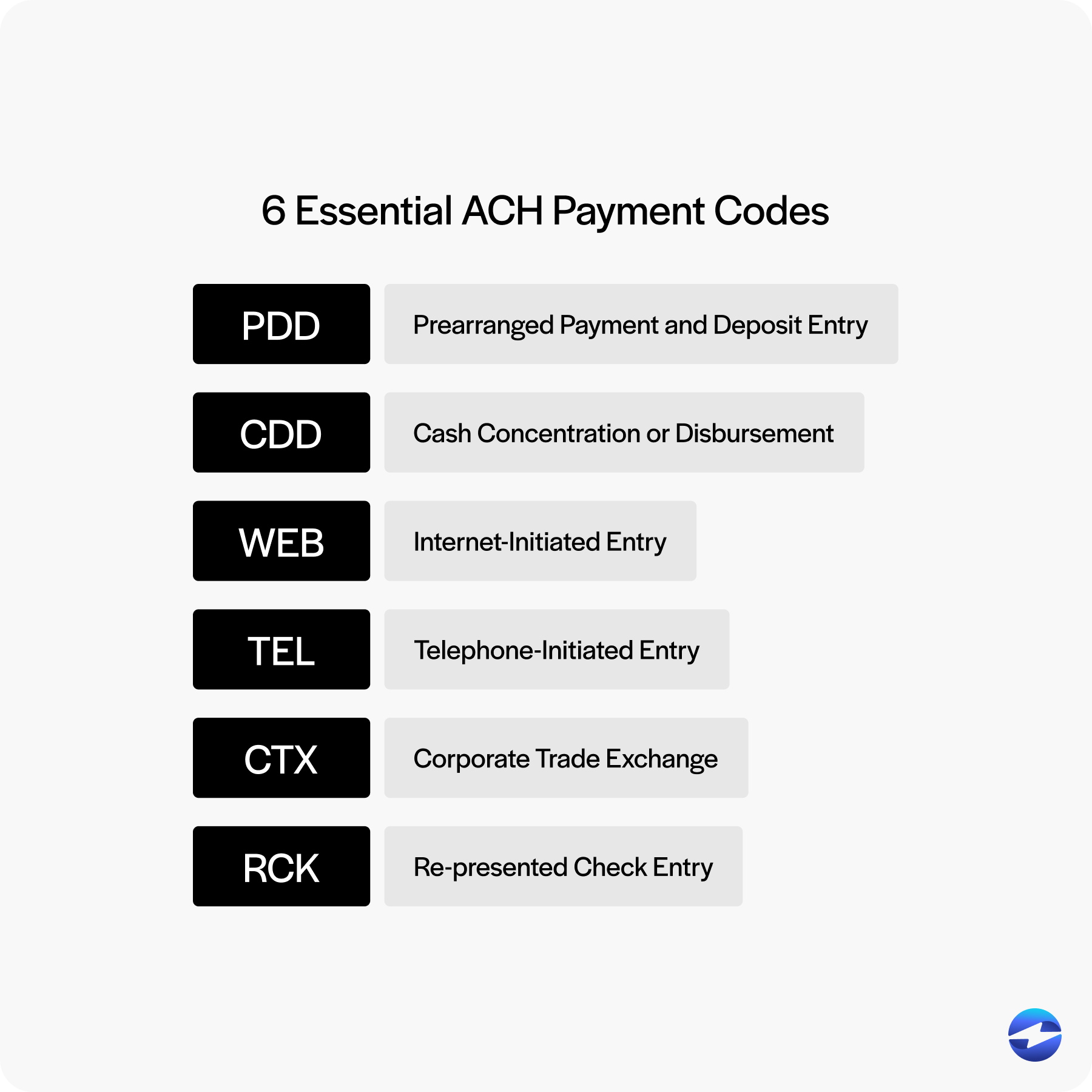

Top 6 ACH payment codes

It’s important to understand popular ACH payment codes since each serves a specific purpose and helps businesses and individuals effectively manage their payments for more secure and efficient online transactions.

Here are six essential ACH payment codes to know:

- PPD (Prearranged Payment and Deposit Entry): PPD codes are used primarily for direct deposit. They facilitate payroll, pension payments, or any recurring direct deposit to an individual’s bank account.

- CCD (Cash Concentration or Disbursement): The CCD code is designed for business-to-business transactions. Businesses use CCD to transfer funds between accounts or to pay suppliers and vendors.

- WEB (Internet-Initiated Entry): WEB codes apply to electronic payments initiated over the Internet. Any transaction where the consumer initiates payment via a web-based platform would use A WEB code, such as online bill pay services, eCommerce purchases, subscription payments, and payments made through mobile banking apps or digital wallets like PayPal or Apple Pay.

- TEL (Telephone-Initiated Entry): TEL codes are used for payments authorized via telephone. This likely involves a customer providing their bank account details over the phone to make a payment.

- CTX (Corporate Trade Exchange): CTX codes facilitate transactions involving multiple payments between companies, such as consolidated vendor payments. It allows for additional remittance information to be included with the payment instructions.

- RCK (Re-presented Check Entry): When a paper check is returned due to insufficient funds, the RCK code allows the check amount to be re-submitted electronically for payment.

Understanding and utilizing the correct ACH payment codes is essential for ensuring that funds are transferred securely, efficiently, and with suitable processing characteristics for the specific payment type. By familiarizing themselves with these codes, individuals and business owners can enhance their financial operations and manage their electronic transactions more effectively.

Payment code glossary

In addition to familiarizing yourself with the top six ACH payment codes above, you can reference the following glossary to understand other codes and manage electronic transactions more efficiently.

Each ACH payment code serves a specific purpose, from direct deposits to international payments, ensuring secure and accurate processing for businesses and consumers alike.

Here are the other ACH payment codes to know:

- ARC (Accounts Receivable Entry): ARC entries occur when a check mailed to the originator is converted into an ACH debit. The signed check serves as authorization for the transaction, and the check number appears in the entry description. Large companies with AR departments commonly use this code.

- BOC (Back Office Conversion Entry): BOC entries are similar to ARC, but the check must be presented in person, either at a point of sale (POS) system or at a staffed bill payment location, before being converted into an ACH transaction.

- CIE (Customer-Initiated Entry): CIE entries are credit entries made by consumers to pay billers. Bill-pay services often use CIE entries on behalf of a consumer after the successful completion of a PPD or WEB debit.

- IAT (International ACH Transaction): IAT entries are used for international ACH transactions. For an entry to be marked as IAT, it must be a payment instruction, involve a financial institution outside the U.S., and be processed through the ACH network in some capacity.

- POP (Point of Purchase Entry): POP entries convert checks presented in person into ACH debits immediately. Unlike BOC entries, the check must be scanned and converted at the point of sale, with no option to process it later. The check doesn’t need to be signed, as the routing and account numbers are captured from the MICR (Magnetic Ink Character Recognition)

Along with processing payments via the ACH network, these payment codes can yield numerous benefits for businesses and their customers.

Benefits of payment codes and the ACH network

Payment codes and the ACH landscape offer several benefits related to transaction efficiency and cost-effectiveness.

The ACH system facilitates secure electronic payments, moving funds from one bank account to another through a centralized system governed by the National Automated Clearing House Association (NACHA). This eliminates the need for paper checks and enables financial institutions to manage high transaction volumes better.

Additionally, ACH payments usually incur lower transaction fees than other payment methods like credit and debit cards. This significantly benefits business owners by reducing operational costs.

The ACH network’s ability to process EFTs can allow for same-day ACH payments, further enhancing the speed and convenience of consumer and business transactions. This efficiency is crucial for direct deposit of payroll and government benefits, ensuring timely and reliable payment delivery.

The utilization of payment codes in the ACH network simplifies the transaction process by providing a unique identifier for each payment, enhancing accuracy, accelerating processing times, eliminating manual entry, and reducing errors.

| Code | Explanation |

|---|---|

| PPD | Prearranged Payment and Deposit Entry |

| CCD | Cash Concentration or Disbursement |

| WEB | Internet-Initiated Entry |

| TEL | Telephone-Initiated Entry |

| CTX | Corporate Trade Exchange |

| RCK | Re-presented Check Entry |

| ARC | Accounts Receivable Entry |

| BOC | Back Office Conversion Entry |

| CIE | Customer-Initiated Entry |

| IAT | International ACH Transaction |

| POP | Point of Purchase Entry |

Overall, the ACH network and ACH payment codes encourage a more streamlined and cost-effective means of managing electronic payments and financial operations.

How you can optimize transactions using ACH payments and codes

Understanding the ACH landscape and the various payment types and codes is essential for navigating today’s digital financial world.

Whether you’re a business looking to streamline operations or a consumer seeking to make informed choices, recognizing how ACH payments and their associated codes work will enable you to optimize your transactions, reduce errors, and enhance overall financial management.

EBizCharge is the most robust ACH/eCheck solution on the market. Start collecting payments today.

EBizCharge is the most robust ACH/eCheck solution on the market. Start collecting payments today.