Blog > Microsoft Dynamics GP Payment Processing: Complete Implementation Guide

Microsoft Dynamics GP Payment Processing: Complete Implementation Guide

Payment processing is one of those business functions that often flies under the radar until something goes wrong. For teams using Microsoft Dynamics GP, disconnected workflows can mean extra work, late reconciliations, and frustrated staff. The good news is that Microsoft Dynamics GP payment processing can be set up in a way that streamlines operations and gives you more control.

This guide is designed to walk you through the process in a practical, straightforward way. Whether you’re new to Dynamics GP or looking to optimize what you already have, we’ll cover the “why” behind integration, explore the core features, and outline best practices for a smoother implementation. We’ll also discuss how third-party options like EBizCharge can help extend what’s possible.

Why Integrate Payment Processing in Dynamics GP?

Microsoft Dynamics GP is a full enterprise resource planning (ERP) system that helps businesses manage accounting, inventory, sales, and operations in one place. It’s become a trusted solution for mid-sized companies that need strong financial management.

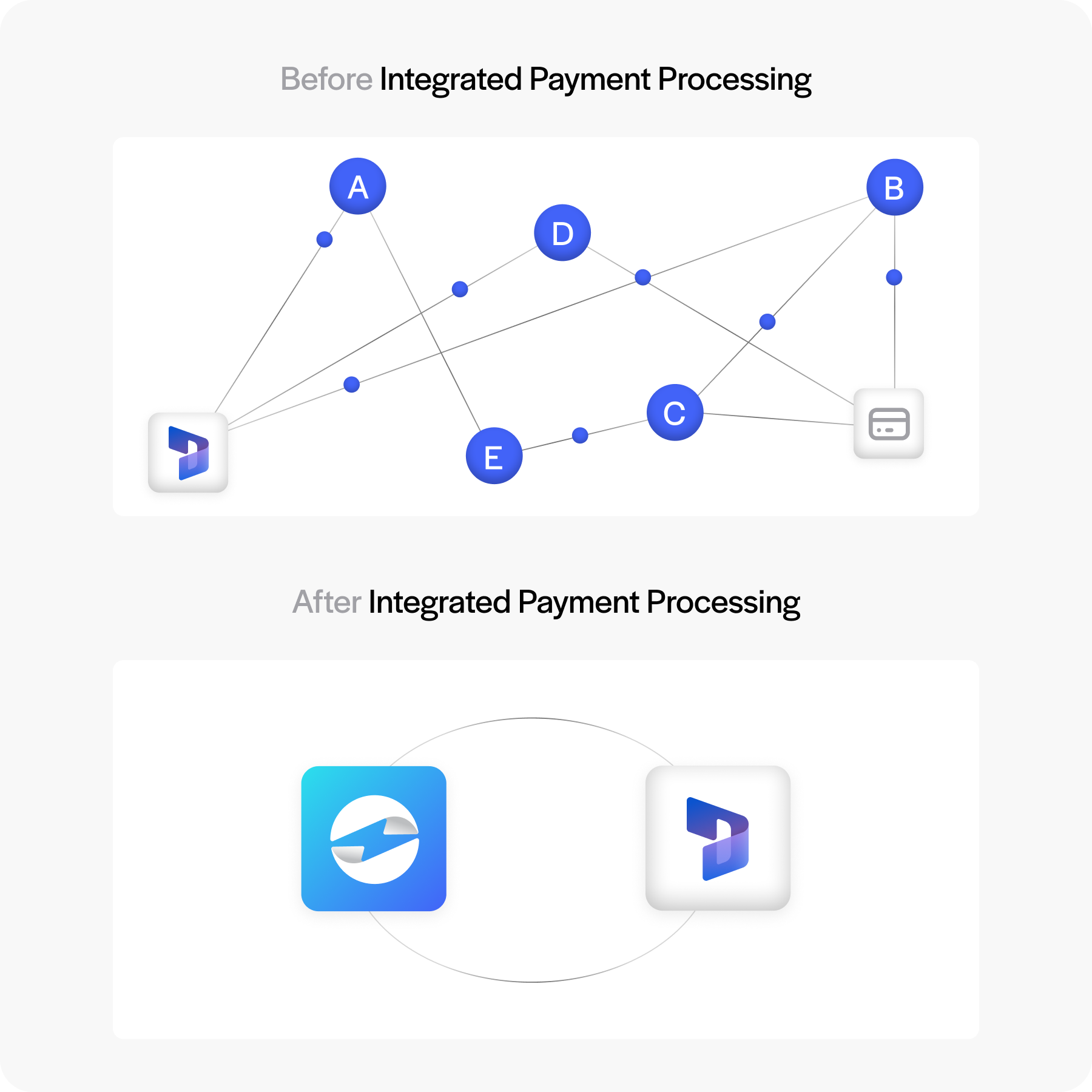

When payments are integrated, Dynamics GP doesn’t just track debits and credits – it connects the dots between invoicing, accounts receivable, and the general ledger. Done well, integration boosts accuracy, speeds up collections, and gives you a much clearer picture of your company’s finances.

Disconnected payment systems can be a real drain on time and energy. Anyone who has had to manually match up payments between a processor and an ERP knows how frustrating and error-prone that can be. Integration is about cutting out that extra busy work.

Key Capabilities of Dynamics GP Payment Processing

It helps to take a step back and look at what Dynamics GP offers once payment processing is fully integrated. These features aren’t just nice add-ons—they’re the tools that make the system practical and dependable for daily financial work.

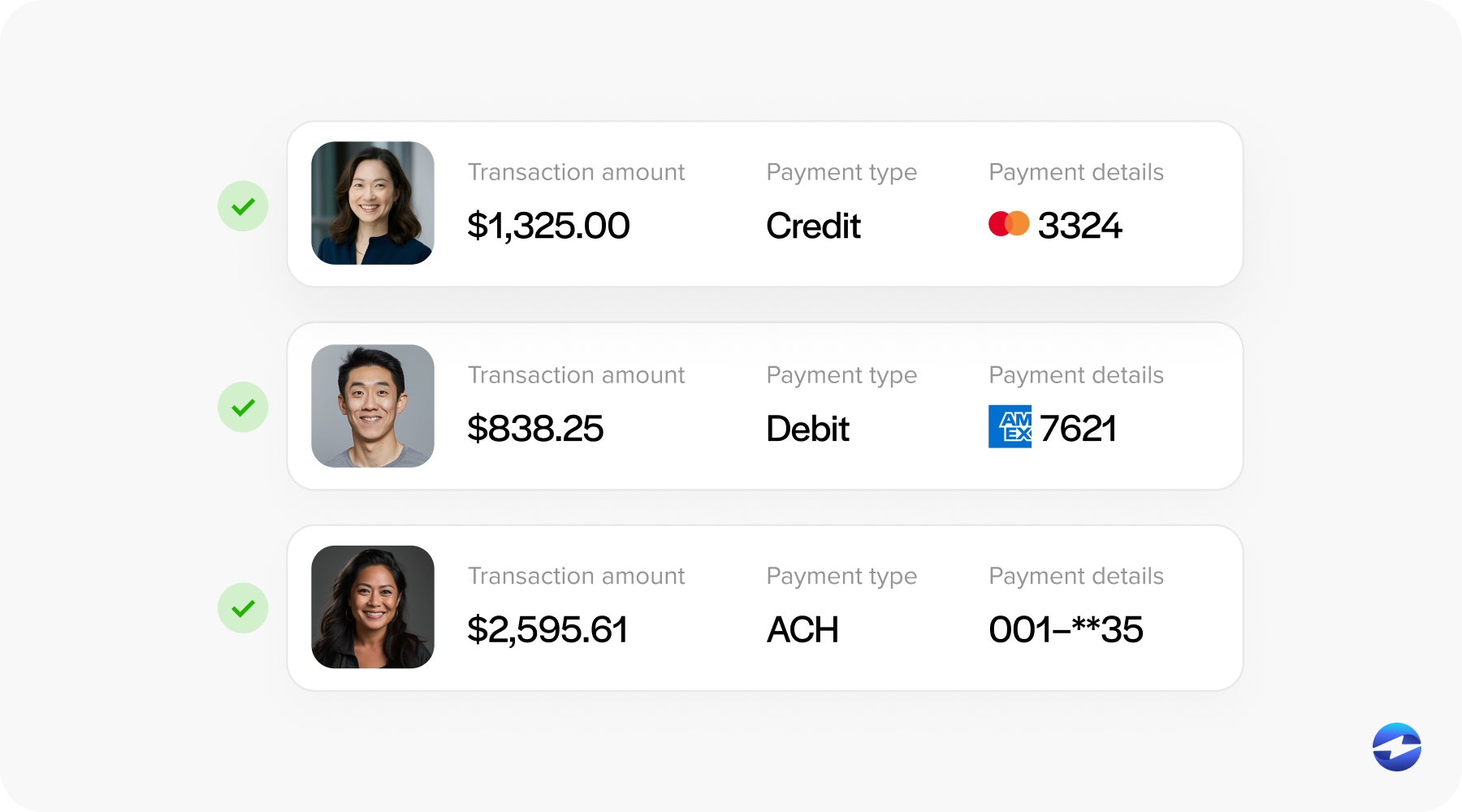

Flexible Payment Options

Today’s customers expect flexibility. With Dynamics GP credit card processing, you can accept both credit and debit cards, but you don’t have to stop there. ACH transfers and recurring billing options are available, too. This flexibility supports both B2B and B2C models, making your billing process more adaptable to customer needs.

Connected Financial Data

One of the most powerful aspects of Microsoft Dynamics GP payment processing is how seamlessly it integrates with existing modules. Every transaction flows directly into accounts receivable, the general ledger, and even order management. That kind of synchronization drastically reduces reconciliation issues and ensures everyone—from clerks to controllers—is working with the same up-to-date numbers.

Compliance and Risk Management

Security is always a concern when handling payments. With Dynamics GP, PCI compliant features like encryption are built into the process. Many payment processing solutions also include fraud prevention tools and access controls, giving your business a reliable way to protect both sensitive data and customer trust.

Insights Through Reporting

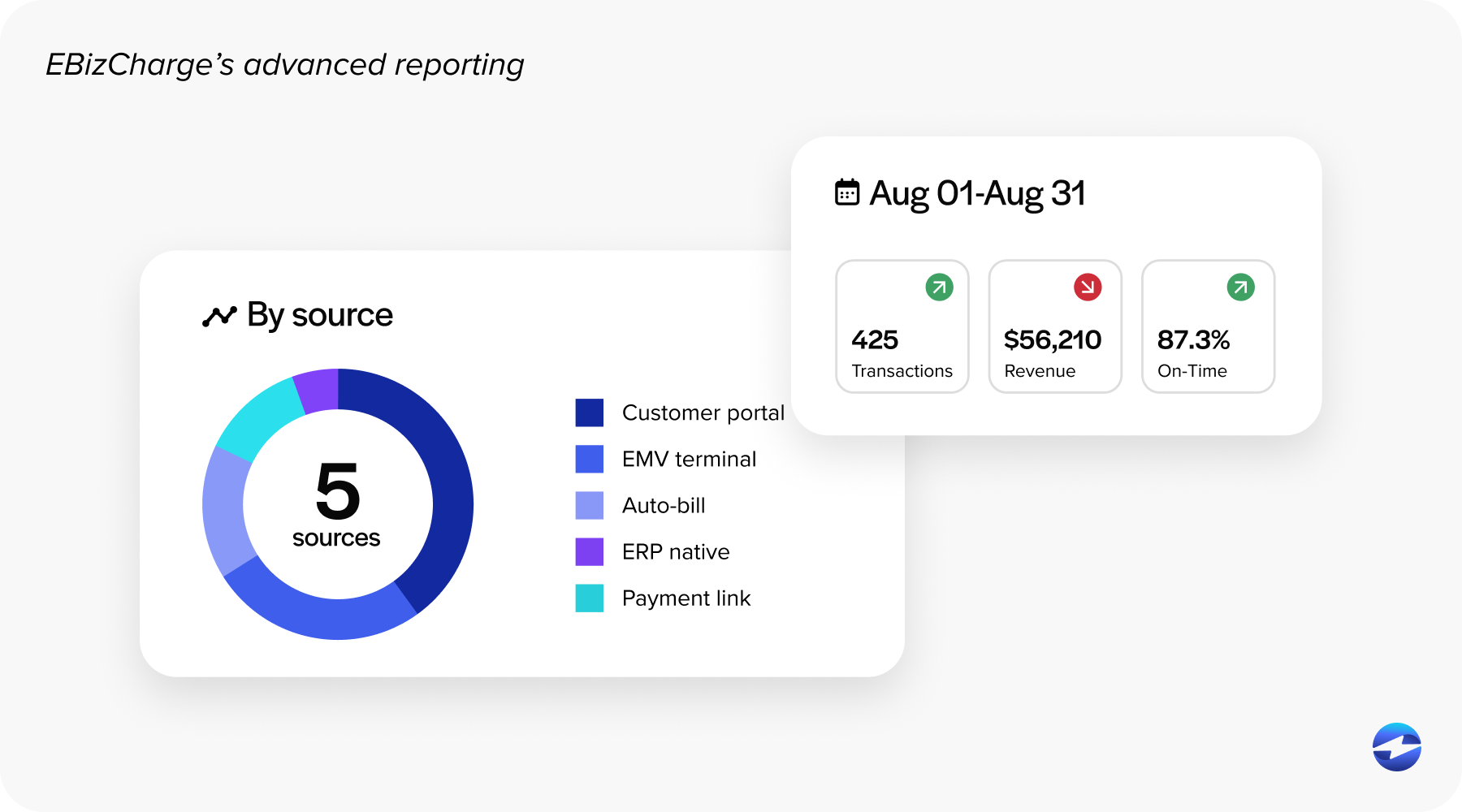

The real value comes from visibility. Dynamics GP allows you to leverage reporting dashboards that show payment activity in detail. With analytics, you can identify late payment patterns, spot trends in customer behavior, and forecast cash flow more accurately. Instead of treating payments as a back-office function, you can use them to make smarter business decisions.

Together, these capabilities highlight why Microsoft Dynamics GP payment processing is such a valuable addition. They bring clarity, speed, and confidence to your financial operations while reducing the friction that slows teams down.

Implementation Roadmap

Setting up payment processing in Dynamics GP doesn’t have to be overwhelming. Think of it as a roadmap: a series of clear steps that, when followed carefully, set your team up for success. Laying this groundwork helps ensure that payments flow smoothly once everything is live.

Preparing Your System

Before making changes, confirm that your Dynamics GP software is up to date and that you have the right user permissions. Map out your existing workflows so you know what needs improvement. A little preparation goes a long way in avoiding surprises during setup.

Enabling Payment Features

Within Dynamics GP, you’ll set up customer and vendor payment records, configure invoice templates, and enable the payment modules. These steps ensure that your Microsoft Dynamics GP payment processing environment is ready to handle transactions correctly.

Processor Connection Options

You can use Microsoft’s native tools, but many organizations benefit from a third-party payment solution. Providers like EBizCharge offer lower transaction fees, customer payment portals, and enhanced reporting. Choosing the right payment processor makes a big difference for both efficiency and cost.

Testing Before Launch

Never skip testing. Run sample invoices and payments to confirm everything posts correctly in accounts receivable and the general ledger. This step ensures that your Dynamics GP integration is working before it impacts live customer data.

Careful preparation, testing, and the right choices will set the stage for smoother day-to-day operations once your payment system goes live.

Best Practice Strategies

Getting the system up and running is only the first step. To get the most value from your setup, it helps to follow some proven strategies that keep things efficient, secure, and reliable over the long run.

Choosing the Right Partner

The payment processor you choose will have a lasting impact. Look for one that integrates smoothly with Dynamics GP, offers responsive support, and has a transparent fee structure. Scalability matters too—your payment solution should grow as your business grows.

Automating the Routine

Manual tasks slow everything down. Automating invoice reminders, payment capture, and reconciliations saves time and reduces errors. This makes Dynamics GP credit card processing and ACH handling much more efficient.

Keeping Security Tight

Stay proactive about compliance. Review user roles regularly, enforce strong password practices, and take advantage of fraud detection tools. Strong security ensures your Microsoft Dynamics GP payment processing setup is trustworthy and resilient.

Training and Support

A system is only as strong as the people using it. Make sure finance teams, sales reps, and managers are trained on the new workflows. Training reduces mistakes, builds confidence, and helps your team get the most out of Dynamics GP software.

Driving Value from Reporting

Don’t just collect payment data—use it. Reporting dashboards can highlight inefficiencies, track overdue accounts, and forecast revenue. This kind of analysis can guide process improvements and strengthen cash flow.

These best practices create a solid foundation for your payment operations. By putting them into place early and reviewing them regularly, you’ll set your team up for smoother processes and fewer surprises down the line.

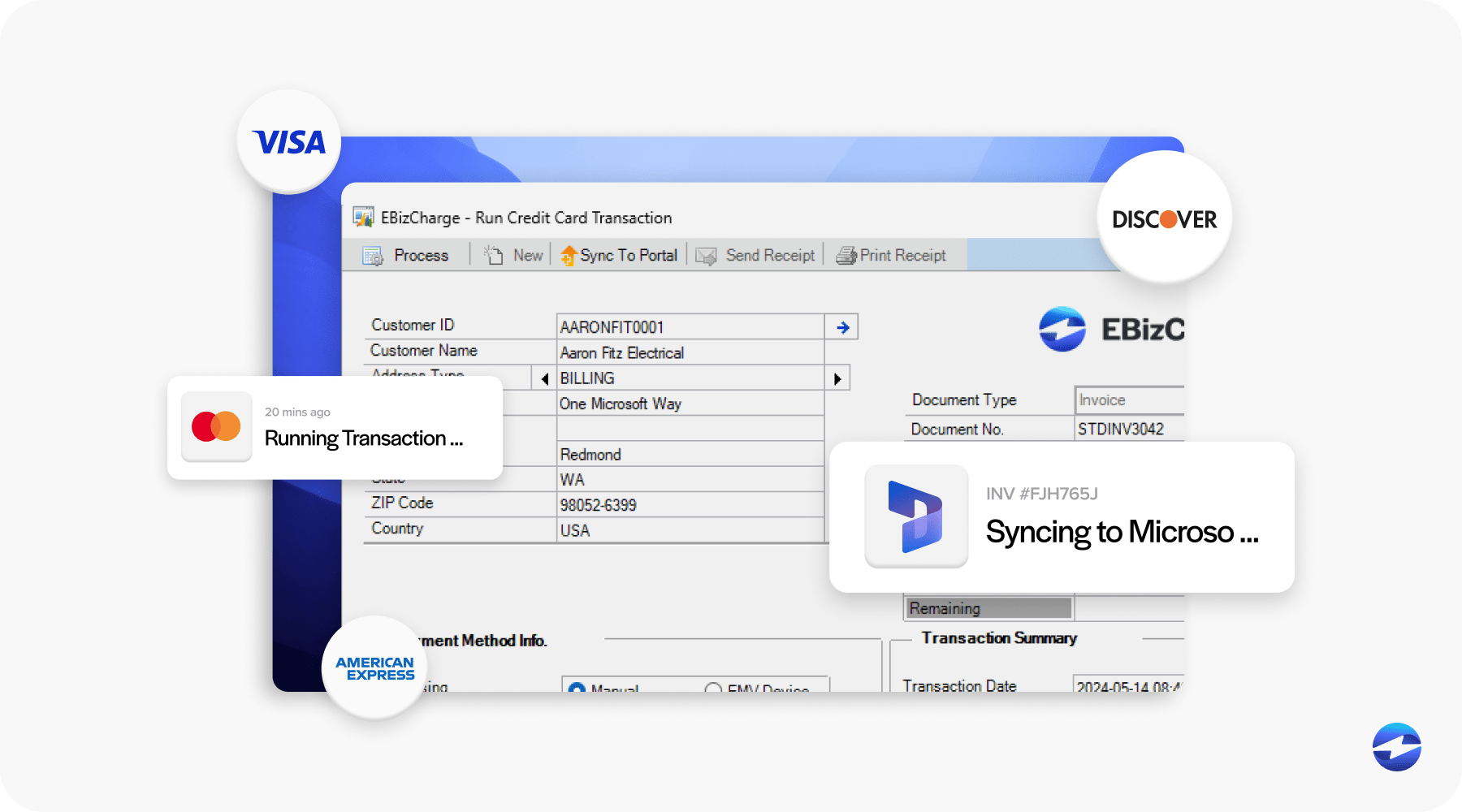

Why EBizCharge Makes Sense for Dynamics GP

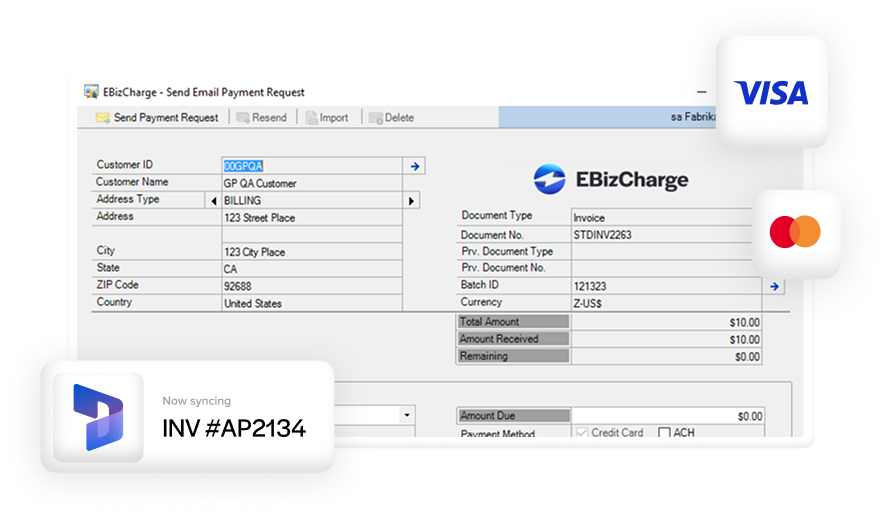

While Microsoft provides the framework, third-party providers like EBizCharge bring additional value to Microsoft Dynamics GP payment processing. EBizCharge integrates directly with Dynamics GP, so transactions can be completed without switching between platforms. The advantages include:

- Lower transaction fees compared to many standard processors.

- A customer portal that makes paying invoices easier and faster.

- Simplified reconciliation with payment data synced directly into GP.

- More robust reporting tools for better visibility.

By combining Dynamics GP integration with EBizCharge, you get a payment processing solution that reduces costs, saves time, and improves the customer experience.

Unlocking the Full Potential of Dynamics GP Payment Processing

Getting payments right is one of the simplest ways to keep your business running without constant roadblocks. With Microsoft Dynamics GP payment processing, you can cut out repetitive manual tasks, keep your records accurate, and make life easier for both your team and your customers. The basics still matter – choosing a dependable payment processor, automating recurring tasks, paying attention to security, and ensuring your staff are comfortable with the system all go a long way toward getting the most out of GP.

Even with the Microsoft Announcement of the end of support for GP, adding a third-party payment solution like EBizCharge can still help Dynamics GP credit card processing get even better. You’ll spend less time chasing payments, customers will have an easier way to pay, and your reporting will feel much more straightforward. Putting in the work upfront pays off with a payment setup that grows with your business and helps you stay focused on what matters most.