Blog > Microsoft Dynamics 365 Point of Sale: Payment Integration Strategies and Best Practices

Microsoft Dynamics 365 Point of Sale: Payment Integration Strategies and Best Practices

Payments are the lifeblood of any retail or multi-channel business. A fast, reliable checkout experience not only keeps customers happy but also keeps your cash flow steady. When payment systems don’t connect with your ERP, you end up with delays, reconciliation headaches, and a higher chance of errors. That’s why integrating payments into Microsoft Dynamics point-of-sale systems is so important. It’s about more than just swiping a card—it’s about building a smoother process that benefits both your team and your customers.

This article will walk through the role of Dynamics 365 point-of-sale in payment management, explain why integration matters, and cover strategies and best practices for getting the most out of your setup. We’ll also explore how a solution like EBizCharge can enhance the process with added flexibility and control.

Understanding Microsoft Dynamics 365 Point of Sale

The Microsoft Dynamics 365 platform includes point-of-sale (POS) tools that help businesses handle in-store and online transactions. Unlike older standalone POS systems, Dynamics 365 POS ties directly into the rest of your enterprise resource planning (ERP). This means payments, inventory, and customer data all connect in one place. The result is better visibility and fewer silos across departments.

Key features include real-time transaction posting, customer account tracking, and integration with loyalty programs. Unlike traditional POS setups that often require separate reconciliation, Dynamics 365 payment processing feeds directly into your financial system. This saves time and reduces the chance of mismatched records.

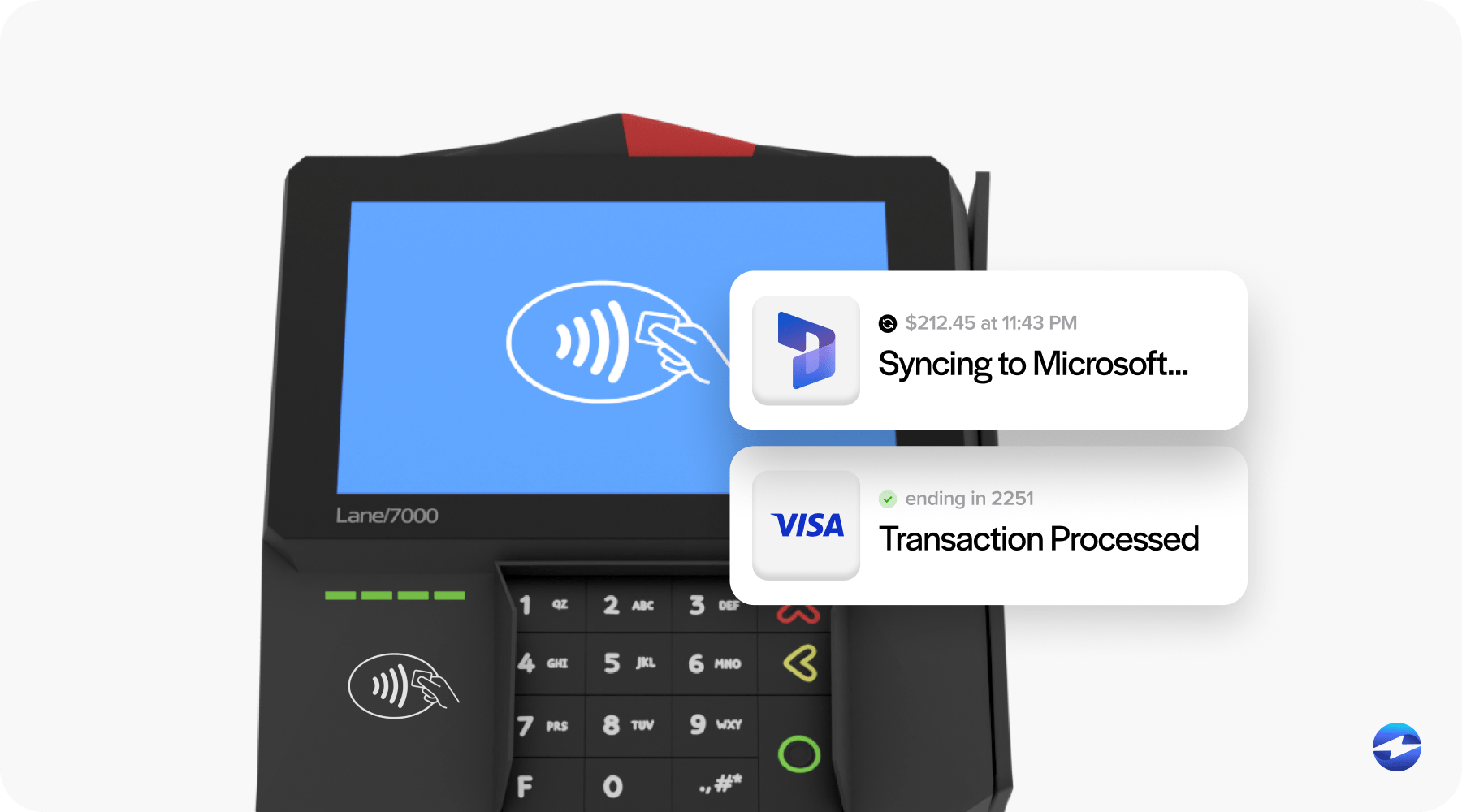

It’s also worth noting that Microsoft Dynamics 365 POS was built to handle the realities of modern commerce. From contactless payments to mobile checkout options, it keeps pace with how customers want to buy. For growing companies, this flexibility can make the difference between a frustrating checkout line and a positive customer experience that keeps people coming back.

Why Payment Integration Matters

Integrating payments with POS isn’t just about speed. It impacts nearly every part of the business. Customers notice the difference when checkout is seamless. Employees notice it too, since fewer manual steps mean fewer errors and less stress.

On the accounting side, integrated payments improve reconciliation and reduce the need for after-hours number crunching. For leadership, accurate data from Microsoft Dynamics payment processing creates better insight into sales trends and cash flow. Without integration, companies often face duplicate data entry, delays in reporting, and increased compliance risks. With integration, you get a single, trusted view of your transactions.

Think of it this way: every payment flows through multiple touchpoints—customer, cashier, bank, and ERP. If those links don’t connect, something is bound to get lost or delayed. Dynamics 365 payment integration reduces that risk by making sure each step is tied together. The result is smoother operations and better business decisions.

Core Strategies for Payment Integration

Before diving into specific tactics, it’s worth pausing to think about why strategies matter in the first place. Payment integration influences everything —from how smooth the checkout feels for customers to how easily your accounting team balances the books. Taking time to create a clear plan helps prevent gaps and ensures your Dynamics 365 point-of-sale system delivers value daily.

Align Payment Processor with Business Needs

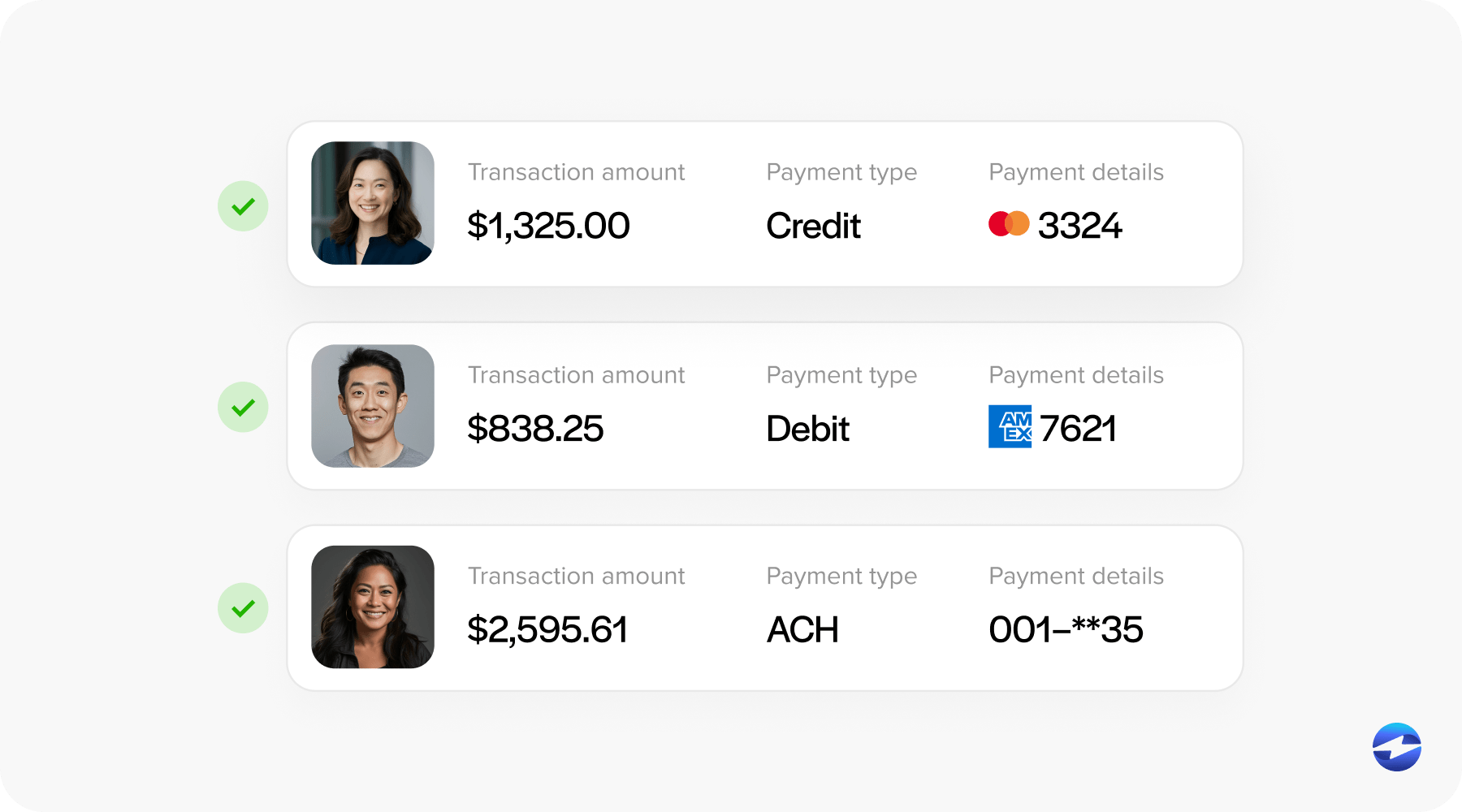

Not every payment processor is a good fit. The best choice is one that supports the your customers’ payment preferences, whether that’s credit cards, debit cards, or contactless payments. Pay attention to transaction fees, customer support, and scalability. The right processor isn’t just about price—it’s about dependability.

When evaluating options, consider how your customers pay today and how they might pay tomorrow. For example, are you seeing more contactless transactions? Do you have business clients who prefer ACH? A flexible payment processing solution will help you meet those needs without constantly changing providers.

Ensure Seamless Dynamics 365 Integration

Integration should feel invisible. With strong Dynamics 365 payment integration, transactions automatically flow into inventory, accounts receivable, and the general ledger. That means your books stay up to date without manual entry, and employees spend less time chasing numbers.

The payoff here is speed and accuracy. Imagine processing hundreds of transactions a day. Without proper integration, that’s hundreds of chances for mistakes. With integration, every payment is captured correctly and your reporting stays consistent.

Prioritize Security and Compliance

Every payment is sensitive data in motion. Compliance with Payment Card Industry Data Security Standards (PCI-DSS) is essential, including security practices like tokenization and encryption methods when securing payment data. A secure payment processing solution reduces the risk of fraud while keeping your customers’ trust intact. Building security from the start is easier than fixing problems after the fact.

Fraud prevention isn’t just about protecting your company—it’s about protecting your customers too. A single breach can damage trust for years. By choosing a third-party payment processor or gateway that prioritizes compliance, you safeguard both your reputation and your revenue.

Optimize for Omnichannel Operations

Today’s businesses don’t just sell in one place. Customers expect the same smooth payment experience whether they buy online, in-store, or over the phone. Unified payments across all channels create consistency and convenience. For companies using Dynamics 365 point-of-sale, that means tying everything together in one system.

A connected system also makes it easier to track customer behavior. For example, if someone buys online but returns in-store, your records should match. Integrated payments keep those details aligned, making both customer service and reporting much easier.

Invest in Staff Training

Even the best tools won’t work if employees don’t know how to use them. Training staff on new workflows ensures smoother adoption and fewer errors. Ongoing refreshers keep everyone up to speed, which pays off during busy seasons when mistakes are most costly.

Training isn’t just about how to use the system—it’s about why it matters. When employees understand how Microsoft Dynamics 365 connects payments to the broader ERP, they can see how their work contributes to the bigger picture.

Together, these strategies create a roadmap for smoother payments and better operations. By focusing on both the technical side and the human side, businesses can get the most from their Microsoft Dynamics payment processing setup.

Best Practices for Successful Payment Integration

Rolling out Microsoft Dynamics payment processing across your business should be planned carefully. Start with a pilot program, testing the system on a smaller scale before deploying it everywhere. This helps identify gaps early.

Use dashboards and reports to maintain visibility. Payment data is valuable—review it often to track trends, find issues, and improve collections. Regular reviews also keep you compliant and efficient. Collaboration between IT, finance, and operations ensures smoother adoption and fewer silos. Payment workflows touch every corner of the company, so teamwork is essential.

Another best practice is to revisit your payment setup regularly. Businesses grow, and customer expectations change. What worked last year may not be enough today. By checking in on your Dynamics 365 payment gateway configuration, you can stay ahead of those shifts and avoid falling behind competitors.

Why EBizCharge Is a Strong Integration Option

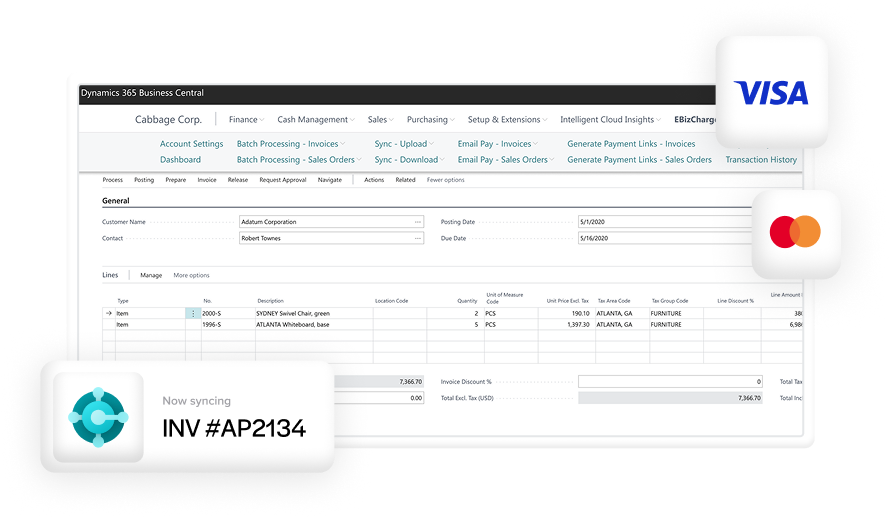

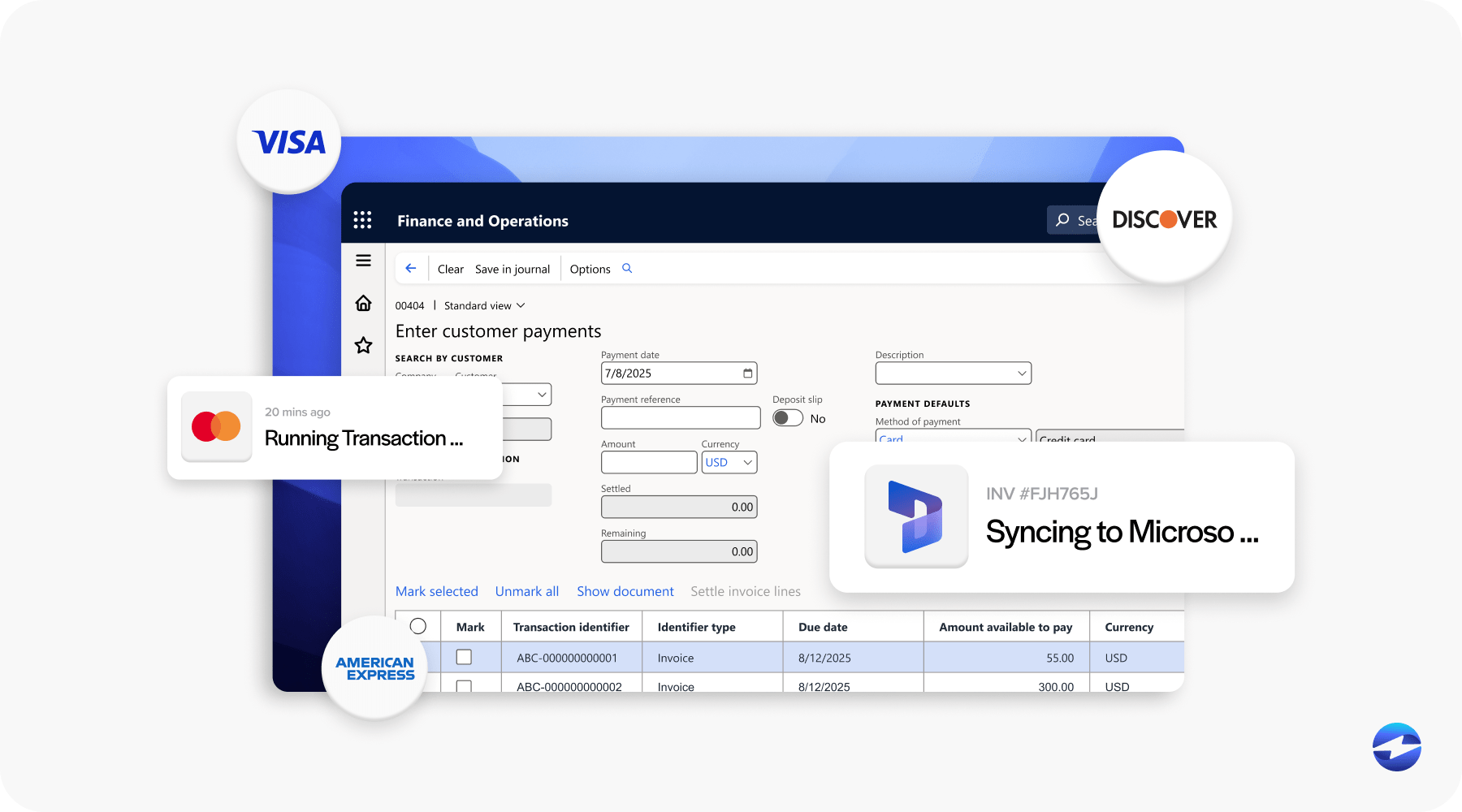

While Dynamics 365 POS provides a solid foundation, many businesses find that a third-party payment processor like EBizCharge takes things to the next level. EBizCharge integrates directly with Dynamics 365 POS, reducing manual entry and speeding up reconciliation. Payments post straight into accounts receivable and the general ledger, so your books stay accurate without extra effort.

EBizCharge also offers secure customer portals, letting clients pay invoices quickly online. Lower transaction costs and advanced reporting features give finance teams more control. This top-rated payment processing solution provides flexibility for companies of all sizes, making it easier to scale as your business grows. In short, EBizCharge helps make Microsoft Dynamics 365 point-of-sale more efficient, customer-friendly, and reliable.

Beyond day-to-day improvements, EBizCharge gives companies more freedom to adapt. If you expand into new channels or start handling more complex billing, the system scales with you. That flexibility makes it an ideal choice for growing businesses that want more than just the basics from their Microsoft Dynamics 365 setup.

Building Smarter Payments with Dynamics 365 POS

Strong payment integration isn’t just nice to have —it’s essential. With Dynamics 365 point-of-sale, you can bring all your payment channels together, improve security, and get a clearer view of your financials. Simple steps like choosing the right payment processor, setting up automated workflows, and ensuring staff are trained can make daily operations run much smoother.

Adding a third-party payment processor like EBizCharge can take it even further. Features such as customer portals, lower transaction costs, and built-in reporting tools give your business extra flexibility as it grows. By putting good integration practices in place now, you’ll be building a system that’s efficient, reliable, and ready for the future with Microsoft Dynamics 365.