Blog > Mastering Payment Effective Dates: Key Insights for Businesses

Mastering Payment Effective Dates: Key Insights for Businesses

Since the timing of payments can directly impact if a business gets paid early, on the agreed-upon due date, or late, it’s essential to understand a payment’s effective date.

With payments moving across multiple systems that operate under different guidelines and timelines, varied effective dates can lead to confusion and unexpected delays.

This article will explain the intricacies of payment processing timelines, payment rails and their payment date variations, and scheduling challenges and provide practical tips for managing effective dates.

What is a payment effective date?

A payment effective date refers to the specific date when a transaction is considered complete, and funds are officially transferred or settled between parties.

In credit card settlements, the effective date is the day the processed funds are credited to the merchant’s account. This date may not always align with the transaction date or the date the funds appear in the merchant’s bank account due to processing times or banking holidays.

Understanding the effective date is vital for businesses as it affects cash flow management and financial forecasting. Delays in processing or discrepancies in effective dates can lead to unexpected cash flow shortages, impacting operational efficiency.

Merchants should regularly review their settlement reports to track these dates and ensure that all payments align with their financial planning.

Businesses can also mitigate delays by implementing a practical timeline to process payments. Mitigate delays with a payment processing timelineUnderstanding the payment processing timeline is crucial for merchants to effectively manage cash flow and generate more revenue.

Payment processing timelines typically involve several steps, including submission, authorization, and settlement, and each step must adhere to specific contract terms and prompt payment regulations.

While payment timelines can vary depending on the financial institution and transaction type, business days are typically when most payment activities occur since most don’t process payments on weekends or public holidays. Delays can lead to late payments or strict payment demands as a result of failing to comply with agreed-upon terms.

To mitigate payment delays and avoid payment interest penalties, understanding the constructive acceptance period and applicable agency procedures can ensure timely and efficient processing. By adhering to the defined payment procedures, businesses can avoid additional penalty payments and maintain smooth financial operations.

Payment rails and effective date variations to mitigate fees

Payment rails refer to the infrastructure and processes through which money is transferred between parties. Each payment rail typically has its own procedure and timeline for processing transactions, which can affect the payment’s effective date.

While the effective date indicates that a financial transaction is completed and funds are officially available or deducted, it’s important to understand that variations in these dates can occur depending on factors like the type of payment rail used (such as ACH transactions, credit cards, or wire transfers) and financial institutions’ policies. Merchants must understand these variations to avoid late payments or unexpected delays.

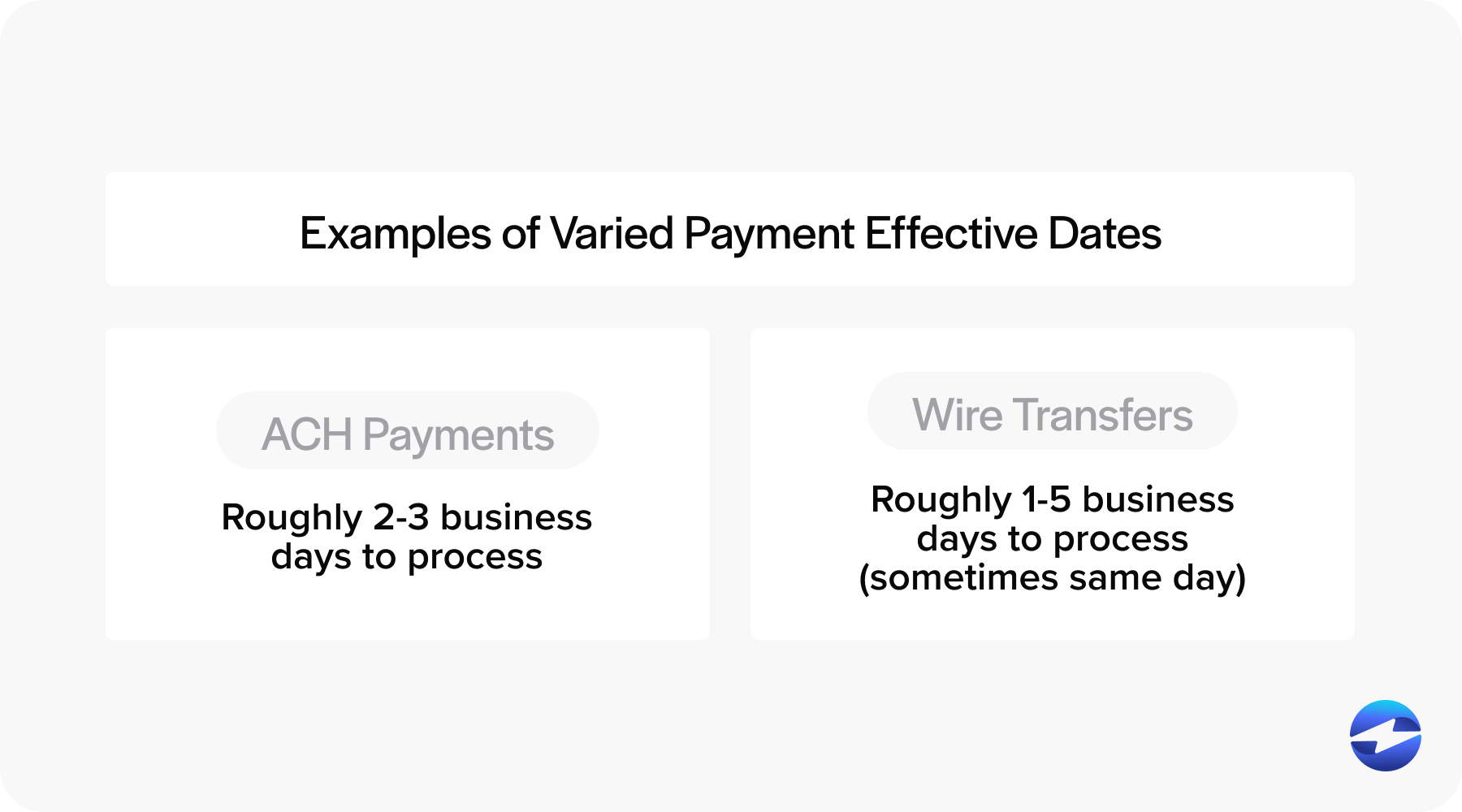

For example, ACH payments have an effective date of two to three business days post-transaction. In comparison, wire transfers typically take one to five business days (or more) but sometimes offer same-day fund availability.

Contract terms should also be carefully reviewed to ensure compliance with prompt payment regulations, and businesses should align their payment procedures with their financial institutions’ processing timelines. By doing so, they can mitigate the risk of additional penalty payments or interest penalties for overdue invoices.

Understanding these elements is essential for maintaining efficient cash flow and complying with contractual and regulatory obligations.

While efficient use of payment rails and effective date variations can help mitigating fees, there are some challenges associated with the overall payment scheduling.

Challenges in payment scheduling

Payment scheduling can present several challenges, impacting both businesses and consumers.

One primary issue is the variability in determining working days, which can impact the timing of payment processing. This often leads to payment delays, especially when scheduled on weekends or public holidays, resulting in payment interest penalties or additional penalty payments.

For businesses dealing with monthly or interim payments, aligning the effective date with prompt payment terms is crucial to maintaining cash flow and financial stability.

In some cases, payment scheduling must account for a constructive acceptance period, allowing time to formally accept delivered supplies. This requirement can be challenging as it adds an extra step before payments are processed, potentially delaying the payment cycle. Companies must carefully manage this period to avoid cash flow disruptions and ensure compliance with contractual terms.

Failure to properly account for the constructive acceptance period can lead to late payments, strained supplier relationships, and the risk of financial penalties or disputes. Balancing this period with timely payment processing demands precise coordination and effective communication between all parties involved.

To effectively schedule payments free of complications and delays, one must understand diverse financial institution timelines and contract requirements.

While payment scheduling brings some challenges, there are some practical tips you can follow to manage a payment’s effective date.

5 practical tips to proper manage a payment effective date

Effective payment management and transparent deadline procedures are critical to the success of your business. Therefore, looking for helpful tips and strategies to improve these operations is wise.

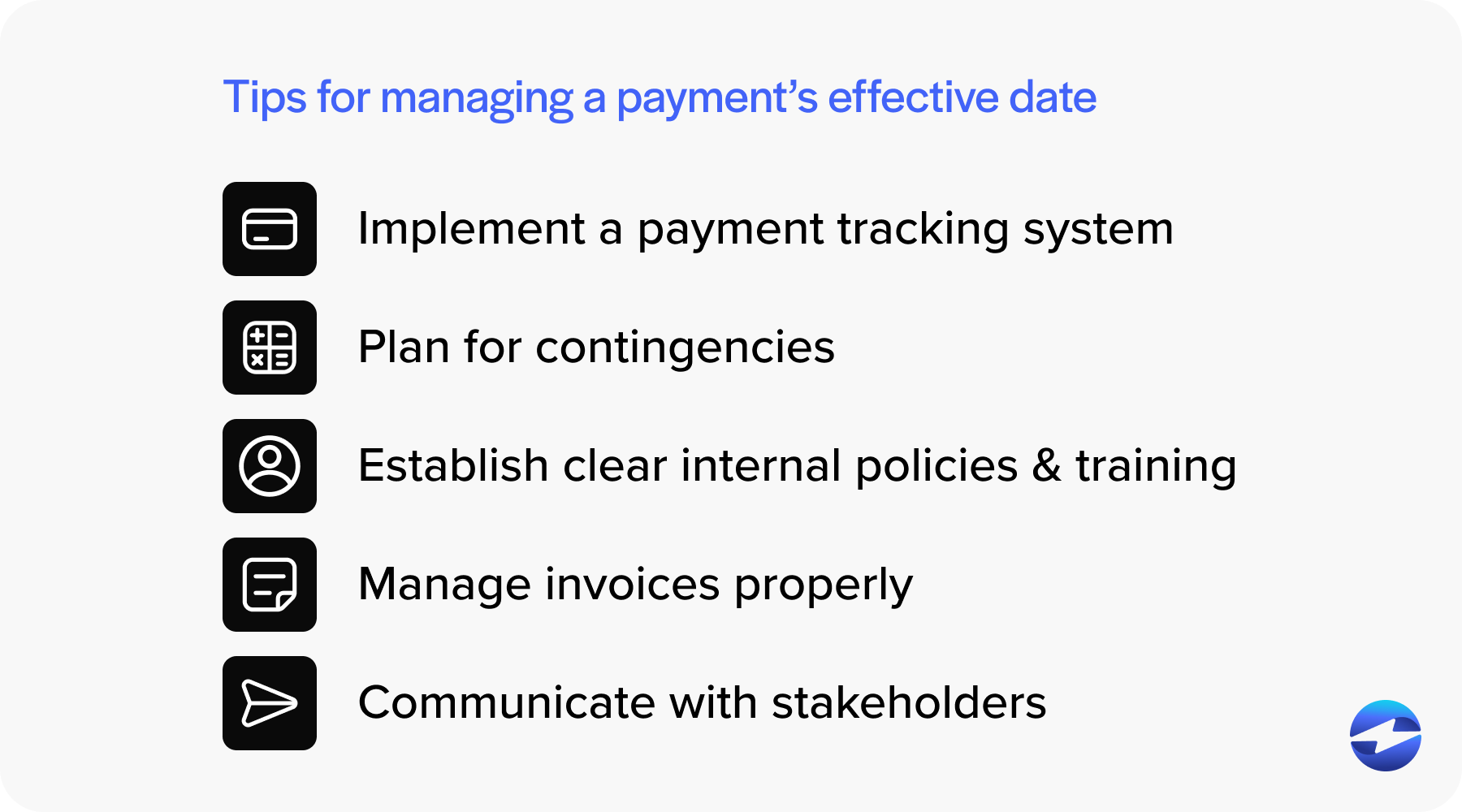

Here are five practical tips to help improve your management of effective dates:

- Implement a payment tracking system: Use software or tools to track payment schedules and effective dates. Automated reminders and dashboards can help monitor upcoming payments and ensure they’re processed on time, reducing the risk of missed deadlines and penalties.

- Plan for contingencies: Prepare for potential delays by building a buffer period within the payment process. Anticipate common issues such as holidays, system downtimes, or administrative processing delays that can affect a payment’s effective date and adjust schedules accordingly to ensure compliance.

- Establish clear internal policies and training: Create detailed internal policies that outline procedures for processing payments, including the steps needed to comply with effective dates. Ensure team members are trained on these policies to maintain consistency and reduce the risk of errors or late payments.

- Invoice management: Ensure invoices are clear and sent out promptly. Use online payments and set reminders for request payments to counteract payment delays.

- Communication with stakeholders: Maintain regular communication with stakeholders about future payment schedules and any potential demand for payment.

By understanding and applying these strategies, merchants can manage payment effective dates better, minimizing financial disruptions and ensuring compliance with contractual obligations.

How EBizCharge helps merchants master payment effective dates

EBizCharge is designed to streamline the payment processing experience for businesses by enhancing efficiency, reducing costs, and providing the tools to enforce payment deadlines effectively.

In addition to its efficient payment gateway and merchant services, EBizCharge integrates with over 100 enterprise resource planning (ERP), accounting, customer relationship management (CRM), and eCommerce systems to ensure payments are processed swiftly and without manual errors, leading to faster transaction times.

The EBizCharge payment software’s automated billing and diverse payment options encourage timely payments by making it easier for customers to pay on their preferred schedule. With real-time payment processing and detailed reporting features, merchants can closely monitor due dates and payment statuses, allowing them to take proactive steps to avoid late payments and maintain healthy cash flow.

EBizCharge also offers robust security features, including tokenization and encryption, to protect sensitive payment information. This reduces the risk of data breaches and ensures compliance with industry standards, such as the Payment Card Industry Data Security Standard (PCI DSS).

EBizCharge users can also access advanced reporting tools to analyze detailed reports, enabling them to monitor payment trends and adjust their strategies accordingly.

With EBizCharge, merchants can leverage a powerful, comprehensive suite of features and functionality to mitigate late payments and the associated interest penalties and optimize their overall financial operations.