Blog > Magento Credit Card Processing: Set Up and Finding the Right Payment Gateway

Magento Credit Card Processing: Set Up and Finding the Right Payment Gateway

Magento is a pillar in the eCommerce space known for its flexibility and customization capabilities. It powers thousands of online stores, enabling merchants to offer various Magento payment options and enhance the customer payment experience.

This article will guide you through the process of setting up Magento payment processing, choosing a trustworthy payment processor, and syncing payments into additional business software.

What is Magento?

Magento, now Adobe Commerce, is an eCommerce platform that provides online merchants with a flexible shopping cart system, as well as control over the look, content, and functionality of their online store. This robust system offers powerful marketing, search engine optimization, and catalog management tools.

Magento’s key features include customizable design options for a personalized storefront, a vast array of plugins and themes to extend functionality, and an open-source ecosystem that supports Magento payment integration with third-party services.

Magento also has robust inventory management capabilities, comprehensive customer service and management features, search engine optimization (SEO) efficiency for better search rankings, and a dedicated community for support and development.

As eCommerce continues to advance, Magento stands out by consistently evolving to meet the complex needs of retailers and brands, ensuring its continued competitiveness in the digital marketplace.

Why do I need to set up credit card processing in Magento?

Setting up credit card processing in Magento is essential, as it allows merchants to leverage this technology to advance their payment processing operations and provide a better user experience for customers.

Credit card processing in Magento enables your online store to accept payments from a wide range of customers, significantly increasing your potential customer base and sales. It enhances the shopping experience by providing secure and efficient payment options, leading to higher customer satisfaction and repeat business.

Integrating payment processing in Magento also allows for automated and streamlined transaction management, reducing manual errors and saving time for customers and store administrators. With a reliable payment processing system, merchants can improve their credibility and trustworthiness, as customers feel more confident when they see familiar and secure payment options.

Overall, setting up credit card processing in Magento is crucial for maximizing sales, enhancing customer experience, and ensuring smooth and secure transaction management.

Now that you know the necessity of credit card processing in Magento, here’s a quick rundown of how to set it up.

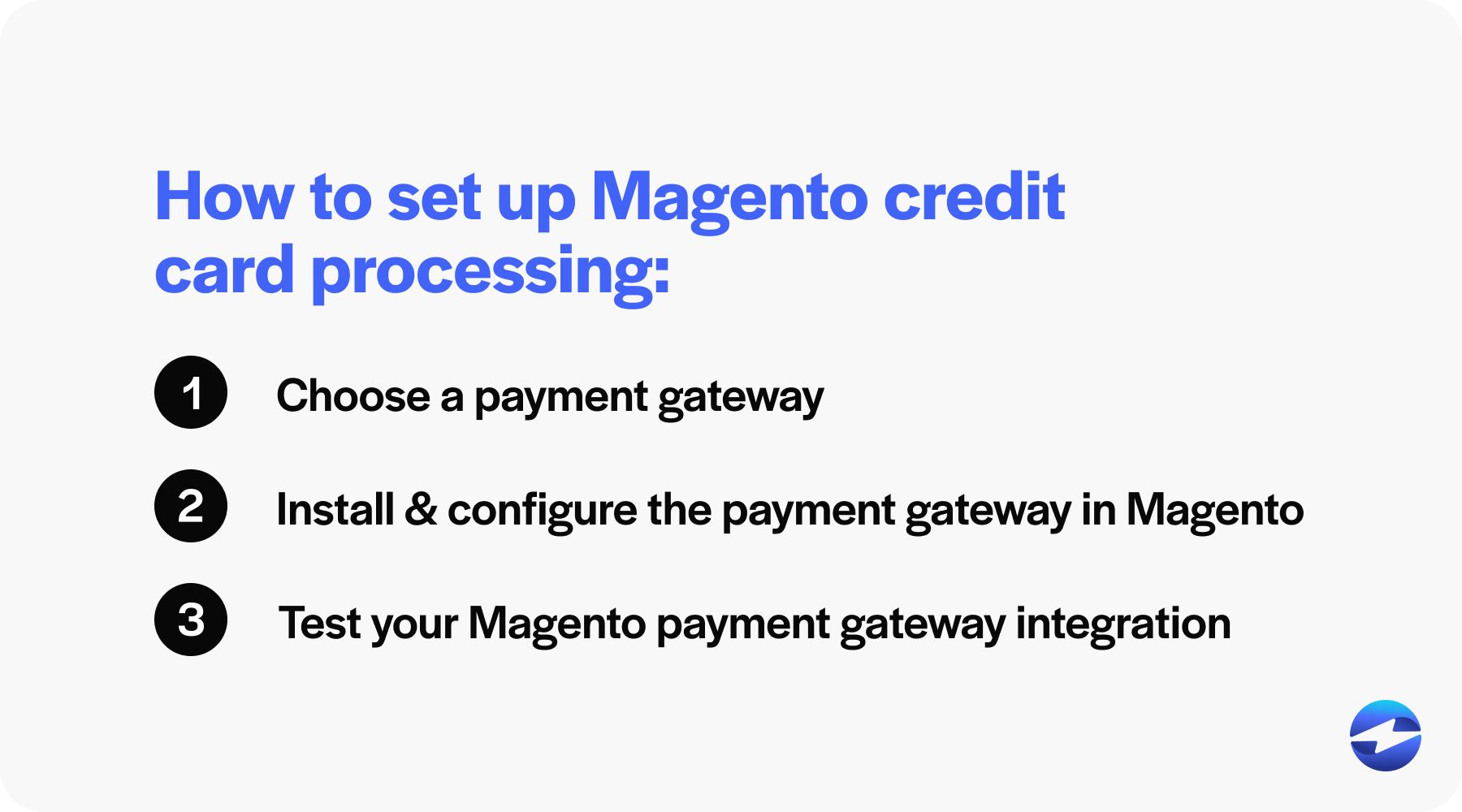

3 steps to set up Magento credit card processing

Implementing credit card processing on a Magento site involves several critical steps to ensure that transactions are handled securely and efficiently.

Your business can set up Magento credit card processing by following three steps:

- Choose a payment gateway

- Install and configure the payment gateway in Magento

- Test the Magento payment gateway integration

1. Choose a payment gateway

Choosing a payment gateway is crucial for Magento stores to facilitate credit card processing. A payment gateway acts as a bridge between your eCommerce platform and the payment processor, authorizing and managing the exchange of funds.

When selecting a payment gateway, it’s essential to consider compatibility with Magento, the types of supported credit and debit cards (such as Visa, MasterCard, and American Express), and the ability to handle digital wallets and mobile payments. Additionally, support for international transactions and multiple currencies is vital, along with being mindful of fees and transaction costs, including recurring or per-transaction charges.

Ensuring robust security features and compliance with Payment Card Industry (PCI) standards is critical, as is the availability of fraud prevention tools and chargeback management. The customer experience should also be prioritized, focusing on offering a streamlined checkout process and one-click Magento payments.

The right payment gateway will align with your business needs and provide a seamless payment experience for customers, encouraging more conversions and loyalty.

2. Install and configure the payment gateway in Magento

Installing and configuring a payment gateway for credit card processing in Magento involves several vital tasks to ensure seamless integration.

Initially, you need to access the Magento Admin Panel to manage the Magento payment methods settings. This process may include selecting a pre-supported Magento payment gateway or installing a specific extension or plugin for your chosen gateway.

Once installed, you’ll need to enter the credentials provided by your Magento payment gateway provider, such as application programming interface (API) keys, usernames, and passwords. Configuring the gateway settings is also necessary to tailor the transaction types, payment actions, and accepted currencies according to your business needs.

Additionally, you’ll need to test the Magento payment gateway integration using sandbox or test modes to verify the payment process and correct any errors before going live.

3. Test the Magento payment gateway integration

Merchants should always perform tests to ensure their Magento payment gateway integration works correctly before going live.

Testing your Magento payment integration will allow your business to review the entire payment process from cart to completion, detect any issues or errors during the payment flow, ensure the security measures are optional, and confirm that transaction details are correctly logged within Magento. It will also allow you to guarantee an efficient customer experience and ease of use.

You can use your payment gateway’s sandbox or test mode to conduct tests, which simulate transactions without processing real Magento payments. Run tests with multiple card types and consider the different checkout scenarios your customers might experience. Only once you’re satisfied with the test results should you enable the payment gateway in live mode for your customers.

By carefully selecting, installing, configuring, and testing your Magento payment gateway, you establish a robust foundation for processing credit card payments, contributing to the growth and success of your online storefront.

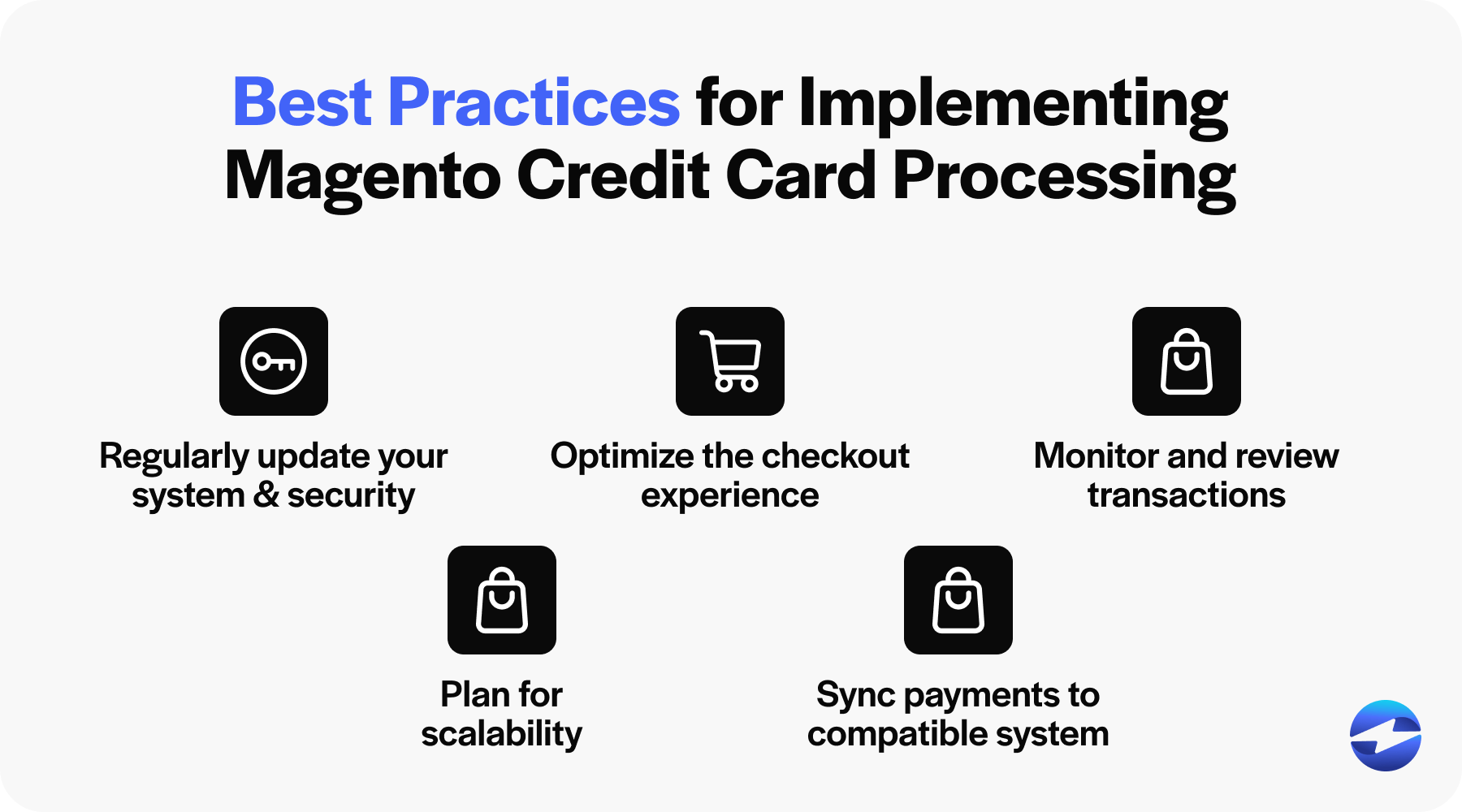

Best practices for implementing Magento credit card processing

Adhering to best practices is not just a recommendation when implementing Magento credit card processing; it’s essential.

Familiarizing yourself with these best practices helps prevent security breaches, improve conversion rates, and ensure compliance with PCI regulations.

Regularly update your system and its security

Keeping your Magento system and its security measures up to date is critical for protecting sensitive credit card information.

Regularly update your system, patch vulnerabilities, fortify payment security, and maintain PCI compliance, which dictates stringent guidelines for handling and storing credit card data. Cyber threats evolve rapidly, and an out-of-date system can be an easy target for attackers.

Updated systems may include enhancements that streamline payment processing, thereby improving the reliability and speed of your transactions.

Optimize the checkout experience

The checkout experience is the pinnacle of the customer’s shopping journey; making it seamless can significantly impact your conversion rates.

Optimizing this experience involves simplifying forms, providing multiple payment options, and integrating a one-click checkout process.

To support Magento credit card processing, ensure that the user interface is intuitive and that instructions are clear. Reducing the steps needed to complete a transaction can decrease cart abandonment rates and make it more likely for a customer to return for future purchases.

Monitor and review transactions

Regularly monitoring and reviewing transactions is paramount in identifying and addressing suspicious activities early on. Efficiently spotting anomalies can prevent fraudulent transactions and reduce the likelihood of chargebacks, which can be costly and time-consuming.

Monitoring transactions also provides valuable insights into payment patterns and trends, helping you refine your fraud prevention strategies and tailor the payment process to better suit your customers’ needs and preferences. Employing a payment gateway with robust fraud prevention tools is an asset in these efforts.

Plan for scalability

Planning for scalability ensures your Magento payment processing capabilities can grow with your business. Consider both current needs and future growth, as the payment gateway you choose must be able to handle an increased volume of transactions without sacrificing performance or security.

Scalability also demands adaptability to emerging payment technologies and the flexibility to accommodate international transactions. Selecting a payment processor that offers straightforward upgrades and integration with additional Magento payment methods will allow your business to expand easily without unnecessary interruptions.

Sync payments to an ERP or accounting system

Syncing payments in Magento to an enterprise resource planning (ERP) or accounting system involves choosing a compatible system like QuickBooks, NetSuite, or SAP and using dedicated plugins or extensions to facilitate the integration.

After installing the integration tool, configure it by entering API credentials and mapping data fields between Magento and your ERP or accounting system. Determine which data points to sync, such as orders, invoices, customer information, and payment transactions, and set up automatic sync schedules or triggers to keep the data updated regularly.

Following these best practices can significantly improve your Magento payment processing experience. For an even more streamlined experience, consider using a top-rated payment solution like EBizCharge.

How EBizCharge can enhance Magento payment processing

EBizCharge is a top-rated payment gateway that significantly enhances Magento payment processing by streamlining the transaction experience for merchants and customers.

With its seamless Magento payment integration, EBizCharge stands out by offering competitive rates to lower processing costs and advanced security measures that incorporate robust fraud prevention tools and adhere to PCI standards to protect payment details.

EBizCharge offers a no-code payment gateway into the Magento shopping cart to ensure a simplified checkout experience with fewer steps to reduce cart abandonment. It also provides multiple Magento payment options to cater to a broader customer base, and integrated reporting within Magento with detailed transaction reports so your business can better understand its payment processing operations.

By implementing EBizCharge, Magento users can enjoy a more efficient, secure, and cost-effective payment gateway integration that enhances their eCommerce platform and performance.