How to Set Up Credit Card Processing for Small Businesses

How to Set Up Credit Card Processing for Small Businesses

EBizCharge is the #1 customer-rated credit card processing solution.

While the process of setting up credit card processing for small businesses may seem challenging, it’s much easier than it sounds.

Credit card usage rose an impressive 15% between 2020 to 2021 and in 2022, roughly 83% of American consumers had a credit card — this percentage continues to increase. Thus, proving that credit card processing has become an essential component of running a small business.

Small businesses that aren’t capitalizing on credit card sales are missing a huge financial opportunity. With the majority of modern consumers using credit cards, your company would be wise to have systems in place to accommodate the high volume of credit card transactions.

To set up online payment processors for small businesses, you’ll need to evaluate the many credit card processing services available and choose the best solution for your business.

Understand your company’s credit card processing needs

Before getting started with credit card processing, it’s important to understand the needs of your small business. Narrowing down your credit card processing requirements will allow you to evaluate processing companies more efficiently to figure out the best choice for your company.

The next sections will provide answers to critical questions that will help your small business narrow down its needs and select a credit card processing company that fulfills these needs.

What types of credit card brands should your company accept?

Researching the many credit card brands on the market is crucial for your small business and its customers since each credit card brand has its own rates and fees which can add up and be costly.

As a business owner, you have the choice of which credit card brands you want to accept which is why understanding all the credit card brands out there and knowing which rates you can comfortably afford is crucial.

Visa and Mastercard are standard credit card brands for businesses to accept across all industries but it’s a bonus if you also accept American Express and Discover. The more options you offer to your customers, the happier they’ll be.

While American Express payments account for a smaller amount of the total payment pool when compared to other cards, AMEX transactions are 40 percent larger than other brands. Businesses are reluctant to offer American Express and Discover to their customers because those brands charge higher transactional fees than Visa and Mastercard. So, choosing to offer American Express or Discover for your customers relies on whether or not you want to take on the fees associated with these brands.

How will you accept payments from your customers?

Before setting up credit card processing, your business should decide which methods it will utilize to accept credit card payments.

Will you be accepting payments in-person or online? Will you allow Apple Pay? Questions like these are important to ask before setting up a credit card processor, as they can help your company identify the necessary systems it needs to accept and process credit cards.

For example, suppose you’re primarily an eCommerce business. In that case, you won’t need to invest in a physical credit card terminal since a credit card reader is only necessary for in-person transactions. By performing these transactions online, your small business won’t be required to purchase a credit card machine and as a result, can save money. Therefore, online businesses should find payment processors that integrate directly into their eCommerce shopping carts to allow them to accept payments on their websites.

Whether you want to accept credit cards in-person or solely online, depends on your business model and your customer base. Luckily, payment processing companies provide small businesses with a variety of options to accept payments from their customers.

After determining the credit card types to accept and the methods to use to accept these payments, you can learn how to choose the right payment gateway and set up credit card processing in your small business.

Steps to setting up credit card processing for your small business

Setting up a payment system for small businesses is not as difficult as it sounds and follows three simple steps:

- Choose a payment gateway with all the necessary functions you require.

- Set up a merchant account for your small business.

- Find a credit card processor that allows you to easily accept credit card payments.

Step 1: Choose the right payment gateway

The first step to small business credit card processing is opening up a payment gateway account. The payment gateway differs from a merchant account in that the payment gateway facilitates online transactions and allows you to process credit card payments. Whereas, the merchant account serves as a holding account where the payments first appear before being deposited into your company’s bank account.

All of your company’s transactions, no matter what type, are processed through a payment gateway. The payment gateway’s purpose is to approve or decline a transaction.

Here’s how a payment gateway works:

- The customer purchases a good or service with their credit card.

- The authorization of the credit card transaction needs to be verified.

- The transaction will now be verified. The customer’s bank either denies or accepts the transaction and passes the information back to the credit card processor.

- The credit card processor passes the information to the customer and the merchant.

- If the customer’s card is accepted, the goods or services are delivered and the transaction is marked as complete.

- The customer’s bank transfers the necessary funds to the credit card processor. The payment processor transfers the funds to the merchant’s bank.

After researching the many payment gateway options available, select the one that’s best for your small business. Be sure to select a payment gateway that contains all of the following features:

- SSL (Secure Socket Layer)

- eCommerce integration

- Accounting ERP integration

- Report generation

- Customer support

- PCI DSS compliant

Once you’ve chosen the best payment gateway for your small business, you can set up a merchant account.

Step 2: Set up your merchant account

The next step to set up small business credit card processing is to acquire a merchant account (also known as a payment processor). The merchant account is the holding account where credit card payments first arrive before being transferred into your business’s bank account.

Some payment gateway providers make it easy by including merchant services but be careful not to select a gateway strictly on the basis of its convenience. Payment processors may also have gateway services of their own or have partnerships with companies that provide gateway services.

It’s important to do your due diligence and explore the market before deciding how your business will conduct its credit card processing. When it comes down to it, your company should find a payment processor that meets all of your business’s requirements while being at an acceptable rate. Ultimately, the goal is to find a payment processor that has all the credit card processing solutions with the best rates and capabilities for their services.

Step 3: Accept credit card payments

Once your merchant account and payment gateway are set up, your company is ready to start accepting credit card payments.

Many payment processors will provide software that integrates into your account ERP software, allowing you to accept payments directly inside your ERP. Once this software and your merchant account are installed, you’ll simply log in and enter your customers’ payment information to start the payment automation process.

If you decide to accept credit card payments in-person, you’ll need a credit card terminal to process these payments. These credit card devices (also known as POS terminals) allow your customers to pay in person at your physical storefront.

How to set up a credit card machine

Setting up a credit card machine for your small business involves several steps. First, you need to evaluate different credit card processing services to find the right solution for your business. Consider factors such as fees, range of payment options, customer support, and equipment compatibility. Once you’ve chosen a processing service, you can then begin the process of getting a credit card machine. This typically involves filling out an application and providing some basic information about your business.

As a small business, it’s important to accommodate the high volume of credit card transactions, so it’s important to choose a credit card machine that is capable of handling your expected volume. Some businesses may need a basic terminal, while others may benefit from a more advanced point-of-sale system that can integrate with other business management tools.

Here are some of the best small business credit card machines:

- Square

- Ingenico

- Castles Technology

- Helcim

- Toast

- Clover

It’s important to ensure that your chosen credit card processing service is secure and compliant with industry standards. Setting up a credit card machine for your small business involves careful evaluation of different services and selecting a solution that meets your business’s needs for processing credit card transactions efficiently and securely.

What is the best payment processing solution for a small business?

When it comes to small business credit card processing, there is no clear option. The best credit card service for a small business depends on multiple factors such as transaction volume, specific business needs, the industry, and many others. Each payment processor comes with its own advantages. Figuring out which features benefit your company the most is a huge determinant of choosing the right payment processing company.

Below are important features to consider when selecting a payment processing company for your small business:

- Low transaction fees with a favorable pricing structure. When meeting with payment processing companies, ask about their pricing model. What kind of fees do they have? What percentage of each transaction do they take? Ideally, you want your payment processor to have transparent pricing and be transparent with their fees.

- Fraud protection. You want a safe and secure PCI-compliant provider that helps prevent fraudulent transactions from occurring.

Digital application and quick setup time. It’s important to find a payment processor that has a quick account and hardware setup process. In addition, you want a provider that offers 24/7 support to resolve any payment processing issues quickly. - Payment integrations to automate credit card processing. Depending on your company’s needs, this can include integration with accounting or ERP software, eCommerce platforms, or physical POS systems.

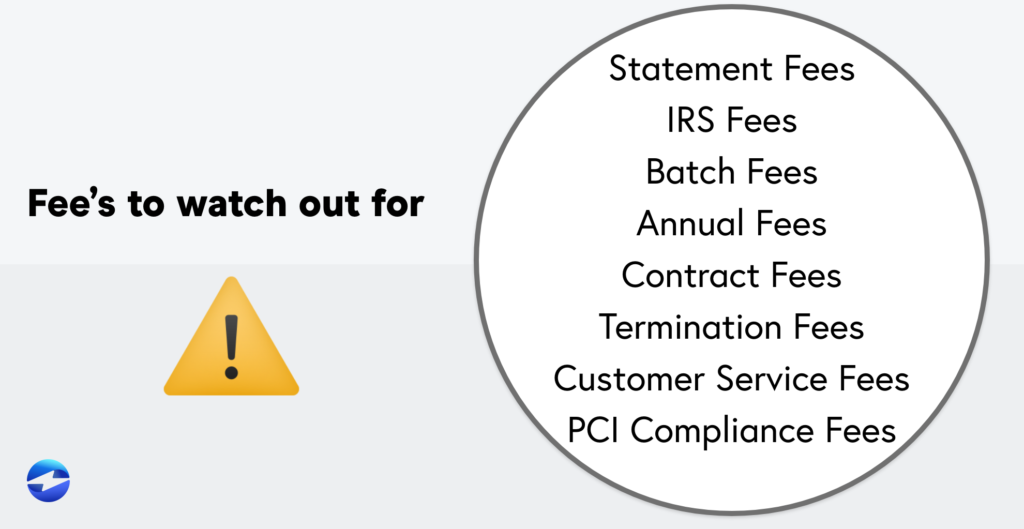

- No hidden fees. This last one is crucial to look out for. Many companies will give you clear, upfront pricing, but when you’re finalizing the sale you find out that there are contract fees, termination fees, and setup fees. So, be clear with your discussion and make sure there are no hidden fees.

Fees you should watch out for include:

- Statement fees

- IRS fees

- Batch fees

- Annual fees

- Contract fees

- Termination fees

- Customer service fees

- PCI compliance fees

If your payment processing services aren’t meeting your standards, it should be a simple process to switch payment processors, unless you signed a contract with the company. Many contracts for payment processors include a hefty termination fee that you’ll be aware of before signing — try to avoid companies with termination fees or large contracts.

To get you started, EBizCharge, Square, Paypal, and Stripe are some great options to look into. These payment solutions allow you to efficiently process transactions, offer diverse payment methods, access user-friendly interfaces, and provide valuable features such as analytics and chargeback protection, catering to the specific needs of your small business.

Ready to get started accepting credit cards for your small business?

If you’re ready to accept credit card payments and select a payment processor for your small business, EBizCharge is an excellent option with 100+ integrations and many payment features to allow your company to accept credit cards.

EBizCharge can help your company get paid on time from its customers which can lower your Days Sales Outstanding (DSO), improve your overall cash inflow, and allow you to invest more money in other endeavors. Therefore, EBizCharge is a no-brainer to start accepting credit cards for your small business.