Blog > How to Calculate Liabilities on Your Balance Sheet: In-Depth Guide

How to Calculate Liabilities on Your Balance Sheet: In-Depth Guide

When evaluating your company’s balance sheet, you may wonder if your business is on shaky ground or has solid financial footing. Looking at components like liabilities is crucial in determining this standing, as they represent what your business owes.

From loans and mortgages to money owed to suppliers, it’s essential to grasp what liabilities entail before diving into their calculations. Your business can maintain a clear corporate vision by gaining the full financial scope of its infrastructure.

What are liabilities?

Liabilities encompass a company’s financial obligations, meaning everything it owes now and in the future. These obligations typically arise during business operations and may include loans, accounts payable (AP), mortgages, deferred revenues, bonds, warranties, and accrued expenses. Essentially, liabilities are the sums of money a business needs to settle with lenders, vendors, and other creditors.

Liabilities can be categorized on balance sheets as current liabilities (obligations due within one fiscal year) and long-term liabilities (obligations due beyond one year). Another type of liability that should be considered is contingent liability, which refers to potential obligations that may arise depending on the outcome of future events, such as legal disputes or warranty claims.

Common examples of current liabilities are short-term debt, such as notes payable, credit card balances, wages payable, and unearned revenue representing services or products yet to be delivered despite being paid for.

Meanwhile, non-current or long-term liabilities include long-term loans, bonds payable that mature in over a year, or deferred tax liabilities.

Different types of liabilities

Since there are various liabilities, each reflecting the nature and timing of the commitments, you can categorize them into three different types:

| Types | Examples |

|---|---|

| Current Liabilities | Accounts payable, Short-term loans |

| Long-Term Liabilities | Bonds payable, Long-term loans |

| Contingent Liabilities | Pending lawsuits, Warranty obligations |

- Current liabilities: Current liabilities are short-term debts expected to be settled within an accounting period (usually a year). Examples include AP, wages payable, notes payable, unearned revenue, and short-term loans.

- Long-term liabilities: Unlike current liabilities, long-term liabilities are due beyond a year. Joint long-term liabilities are bonds payable, loans, leases, and pension liabilities.

- Contingent liabilities: Contingent liabilities are potential liabilities that may arise from past events, pending the outcome of uncertain future events. For instance, a pending lawsuit against the company could lead to a contingent liability if the loss is possible and the amount can be reasonably estimated.

Maintaining an accurate account of these liabilities is essential for business owners to assess financial health and for potential investors to gauge financial stability.

When calculating total liabilities, a balance sheet includes current and long-term liabilities to help business leaders and potential investors grasp a company’s economic standing within an accounting period. This tally assists in informing critical decisions and gauging long-term financial health.

Why is it important to stay on top of your liabilities?

Managing your liabilities and knowing how to calculate them is vital to financial planning. By calculating all its liabilities, your business can verify that it has sufficient cash equivalents or marketable securities to cover short-term expenses and a strategy is in place to fulfill long-term debts.

This proactive approach helps maintain liquidity and supports creditworthiness and financial stability, allowing your business to seize growth opportunities and navigate economic fluctuations confidently. Staying on top of liabilities can also prevent costly penalties and interest charges, further safeguarding the company’s financial health.

How to calculate liabilities

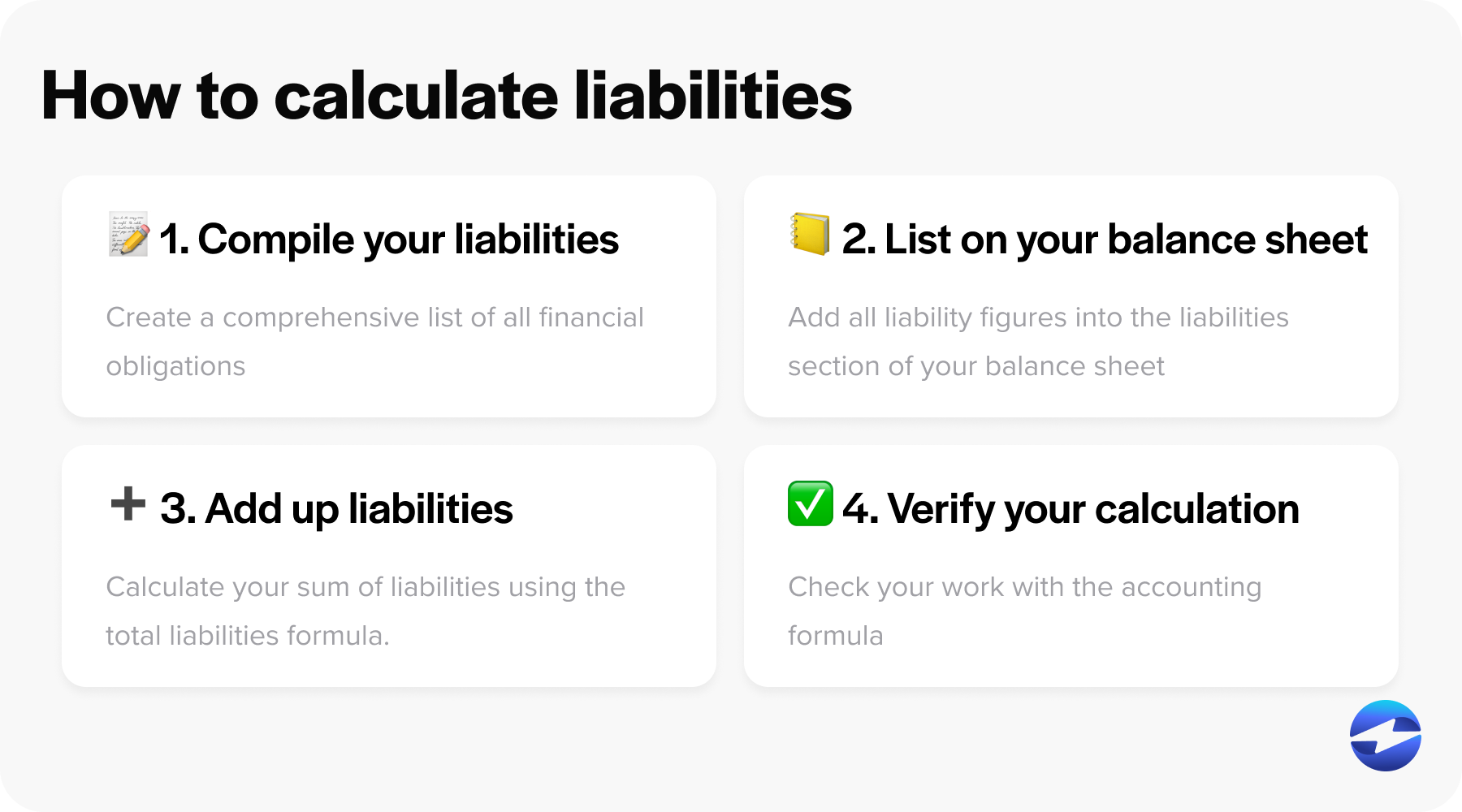

Calculating liabilities is a step-by-step process that involves identifying, documenting, and summing up all the obligations a business entity owes to outside parties.

Companies can follow four simple steps to calculate all their liabilities:

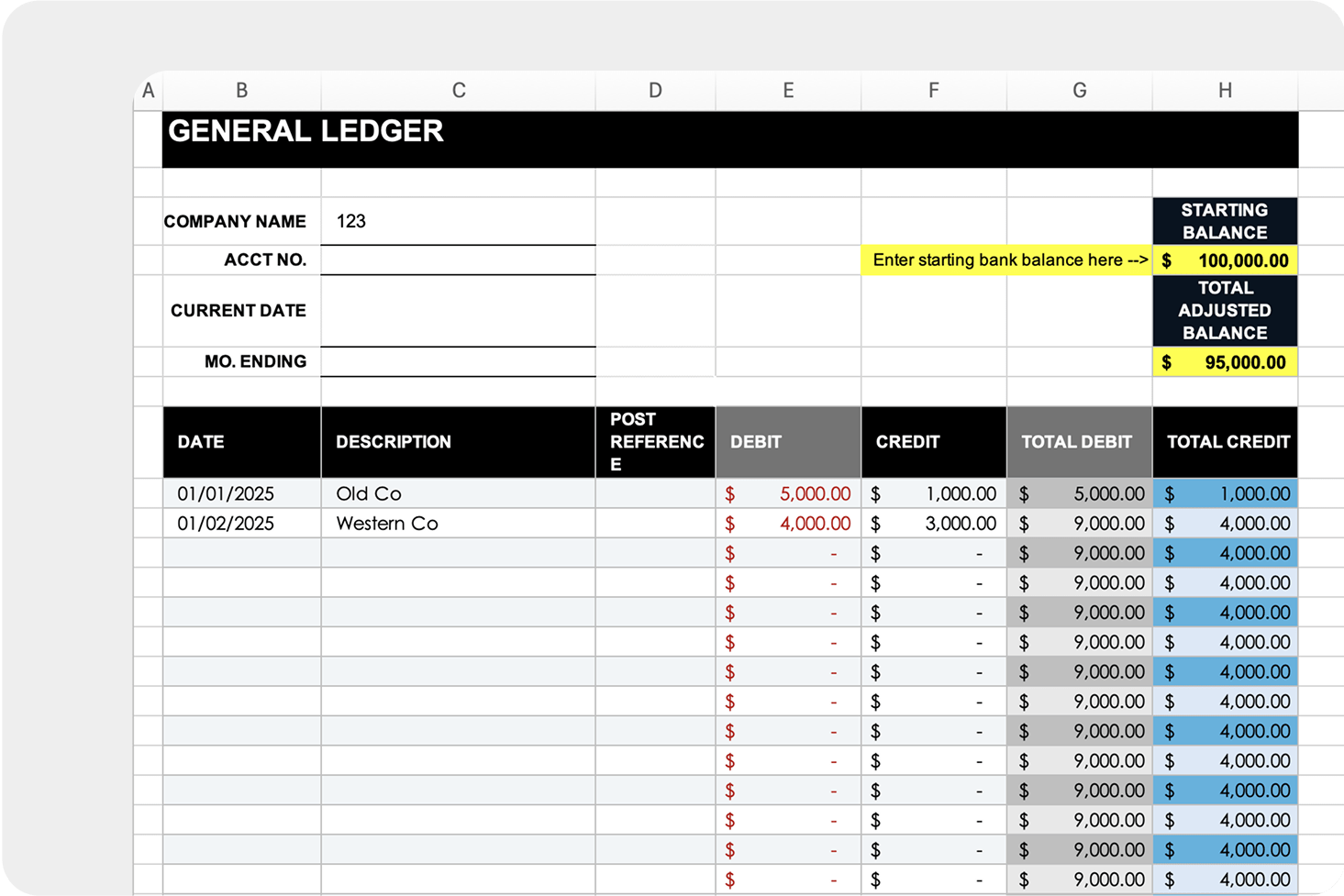

- Compile your liabilities: Create a comprehensive list of all financial obligations. For categorization purposes, separate liabilities into two categories: current liabilities and non-current liabilities.

- List all liabilities on the balance sheet: Add all liability figures into the liabilities section of your balance sheet. The balance sheet should list all current liabilities first, followed by non-current liabilities. Each line item on the balance sheet provides a precise value for each liability, presenting the total sum a business must pay.

- Add up your liabilities: Calculate your cumulative sum of liabilities using the total liabilities formula (below) to add the amounts of all listed liabilities. The sum of current liabilities and the sum of non-current liabilities each generates a subtotal. Adding both subtotals yields the total liabilities figure prominently displayed on the lower portion of the balance sheet under the liabilities section.

- Use the accounting formula to verify your calculations: Double-checking your work with the accounting formula (below) helps prevent errors, enhances financial decision-making, maintains compliance with accounting standards, and ensures accurate financial reporting.

Understanding how to calculate liabilities and the associated accounting practices is fundamental for precise financial statements and crucial for maintaining a transparent business balance sheet.

3 liability formulas you need to know

In addition to following the steps above, your company must familiarize itself with the various formulas associated with calculating liabilities.

These include the current liabilities formula, total liabilities formula, and accounting formula.

Current liabilities formula

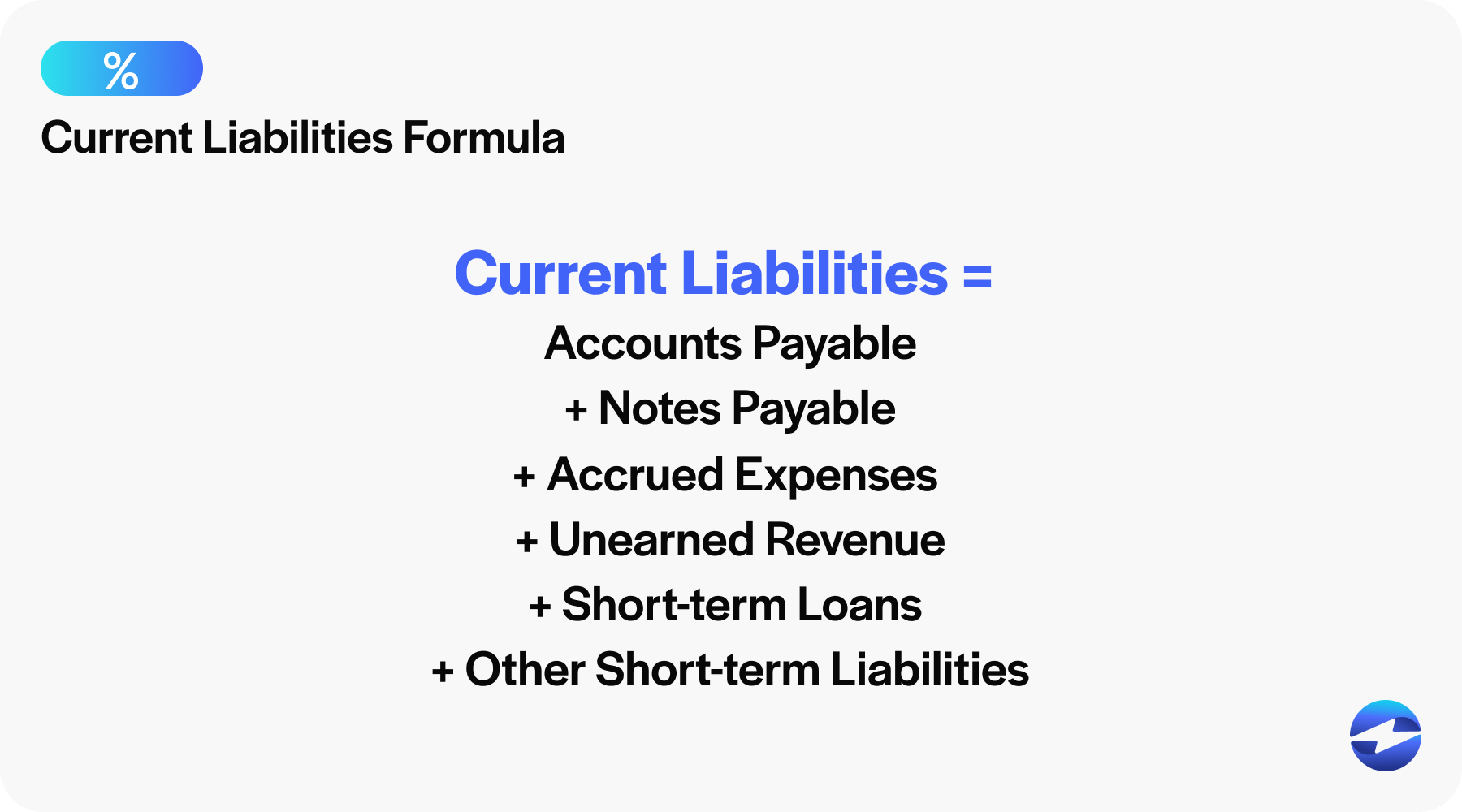

The current liabilities formula is a simple summation of all company obligations due within the next accounting period (within a year).

Current liabilities typically include:

- AP: Money owed to suppliers for goods and services received.

- Notes payable: Short-term debts or IOUs due within the year.

- Accrued liabilities: Expenses like wages or taxes that have been incurred but have yet to be paid.

- Unearned revenue: Money received for services or products yet to be delivered.

- Short-term debt: Debts (lines of credit, business loans, etc.) due within the year.

You can plug these amounts into the current liabilities formula below:

Current Liabilities = Accounts Payable + Notes Payable + Accrued Expenses + Unearned Revenue + Short-term Loans + Other Short-term Liabilities

For better clarity, businesses often detail this information in a table on their financial statements to show the breakdown of their short-term financial obligations. This figure is pivotal for liquidity analysis and helps businesses maintain adequate working capital to meet their obligations.

Total liabilities formula

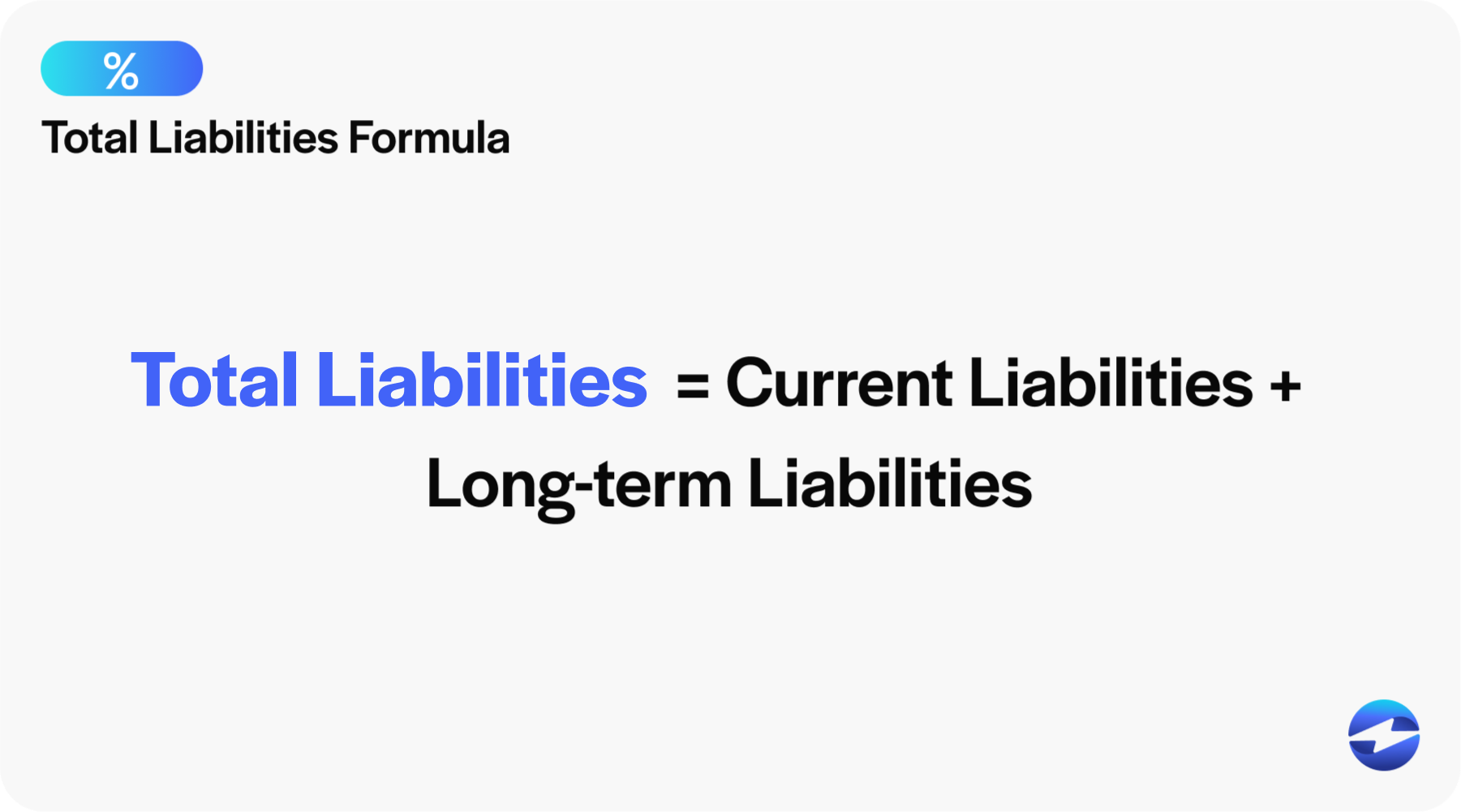

To calculate total liabilities, a comprehensive review of all current liability and non-current liability amounts owed is necessary. This means you’ll need to identify current liabilities and their amounts, identify long-term liabilities and their amounts, and add these values together.

You can plug these amounts into the total liabilities formula below:

Total Liabilities = Current Liabilities + Long-term Liabilities

Here’s a real-world example of the total liabilities formula in use:

- Current liabilities: credit card balances ($5,000), wages payable ($3,000)

- Long-term liabilities: long-term debt ($10,000)

- Total liabilities = $5,000 + $3,000 + $10,000 = $18,000

Gathering this information from a company’s financial statements provides a high-level overview of all its liabilities.

Accounting formula

The accounting formula measures the sum of a company’s shareholders’ equity and liabilities to equal its total assets:

Total assets represent ownership of value that a business or an individual can convert into cash. Like liabilities, assets can be classified as current and non-current.

- Current assets include cash and cash equivalents (liquid funds, currency, demand deposits, and marketable securities), receivables for outstanding invoices, inventory, and prepaid expenses (for future services or products).

- Non-current assets include property, plant, and equipment (PPE) such as machinery and buildings, intangible (non-physical) assets (I.e., patents and trademarks), long-term investments, and deferred tax assets.

When listed on a balance sheet, assets are typically balanced against liabilities and equity according to the basic accounting equation.

Liabilities represent debts and obligations owed by a company from past transactions or events that are settled over time by transferring money, goods, or services.

Shareholder’s equity, often called owner’s equity, represents a company’s total assets that its shareholders can claim after all debts and other liabilities have been settled. Essentially, this is a company’s net or ‘book value’ to its owners.

One must subtract total liabilities from total assets to calculate shareholder’s equity. Here’s a basic formula:

Shareholder’s Equity = Total Assets – Total Liabilities

On balance sheets, shareholder’s equity is often split into three components:

- Paid-in capital: The total amount invested by shareholders in exchange for stock.

- Retained earnings: Profits reinvested in a company rather than paid as dividends.

- Treasury shares: Stock that a company has repurchased from investors.

Understanding shareholder’s equity is crucial for business owners and potential investors to gain insight into a company’s financial health. It also helps assess financial ratios like the debt-to-equity ratio, which shows the proportion of financing that comes from borrowed funds versus owner equity in supporting the company’s assets.

What is the purpose of calculating liabilities?

Calculating liabilities on a balance sheet provides an accurate depiction of what a business owes in the short and long term. This enables business owners, investors, and creditors to understand a company’s financial health.

Accurately calculating liabilities is essential for determining key financial ratios, like the equity ratio, which stakeholders use to evaluate a company’s leverage and risk level.

Streamline your expense management with EBizCharge

Liabilities are critical for effective expense management and a healthy financial future for any business. Integrating an embedded payment solution like EBizCharge into financial practices can significantly simplify and streamline the expense management process.

Using EBizCharge, companies can reduce processing fees and improve their bottom line. With QuickBooks credit card integration and a Sage Intacct payment gateway, every transaction posts to your accounting software automatically, keeping your liabilities, accounts payable, and financial records accurate without manual data entry. Key benefits include simplified reconciliation, improved cash flow, and enhanced security features. These advantages allow for better management of cash equivalents and current liabilities.