Blog > How to Accept the 10 Most Popular Forms of Payment

How to Accept the 10 Most Popular Forms of Payment

In an age where the tap of a smartphone or even your palm can seal a purchase, the way we pay evolves daily. As a business owner, adapting to these changes is essential to staying afloat.

Before exploring different types of payment methods, it’s important to understand the basic components of payment processing. Two vital components are a merchant account and payment processing hardware, allowing you to accept and process payments. Armed with the right tools, your business can become a formidable contender in the competitive market.

What do businesses need to start accepting payments?

Nowadays, businesses need a robust system to accept different payment methods to stay competitive and meet customer expectations. Whether it’s traditional choices like cash, checks, cards, or new modern digital transactions, the payment landscape continues to expand.

To accomplish this, your company will need a merchant account and reliable software to provide convenient customer payment options and effectively manage funds.

Apply for a merchant account

A merchant account is typically set up through a payment processor or acquiring bank. This account serves as an intermediary between the business and the payment processor or acquiring bank, facilitating the secure processing of credit and debit card transactions, among other forms of payment.

Merchant accounts provide a secure channel for handling sensitive financial information, such as cardholder data, in compliance with industry standards like the Payment Card Industry Data Security Standard (PCI DSS).

Additionally, merchant accounts enable businesses to access essential payment processing equipment and services as well as fraud prevention tools.

Utilize payment processing hardware

Businesses require several essential pieces of technology to facilitate smooth and secure transactions before they can start accepting payments.

A point of sale (POS) system is the backbone of in-person payments, consisting of hardware such as a cash register, touchscreen monitor, barcode scanner, receipt printer, and card reader. This system is integrated with payment processing software that facilitates secure transactions and tracks sales data. A reliable internet connection is vital for real-time transaction authorization with this hardware.

Card readers or terminals are necessary to accept physical debit and credit cards, including chip-enabled and contactless payments. Cash registers and bill counters may also be required if your business handles cash.

With the right payment technology and hardware, businesses can effectively manage transactions, enhance customer service, and uphold data security standards.

Now that you understand what’s needed to start accepting payments, you can familiarize yourself with the most common forms of payment.

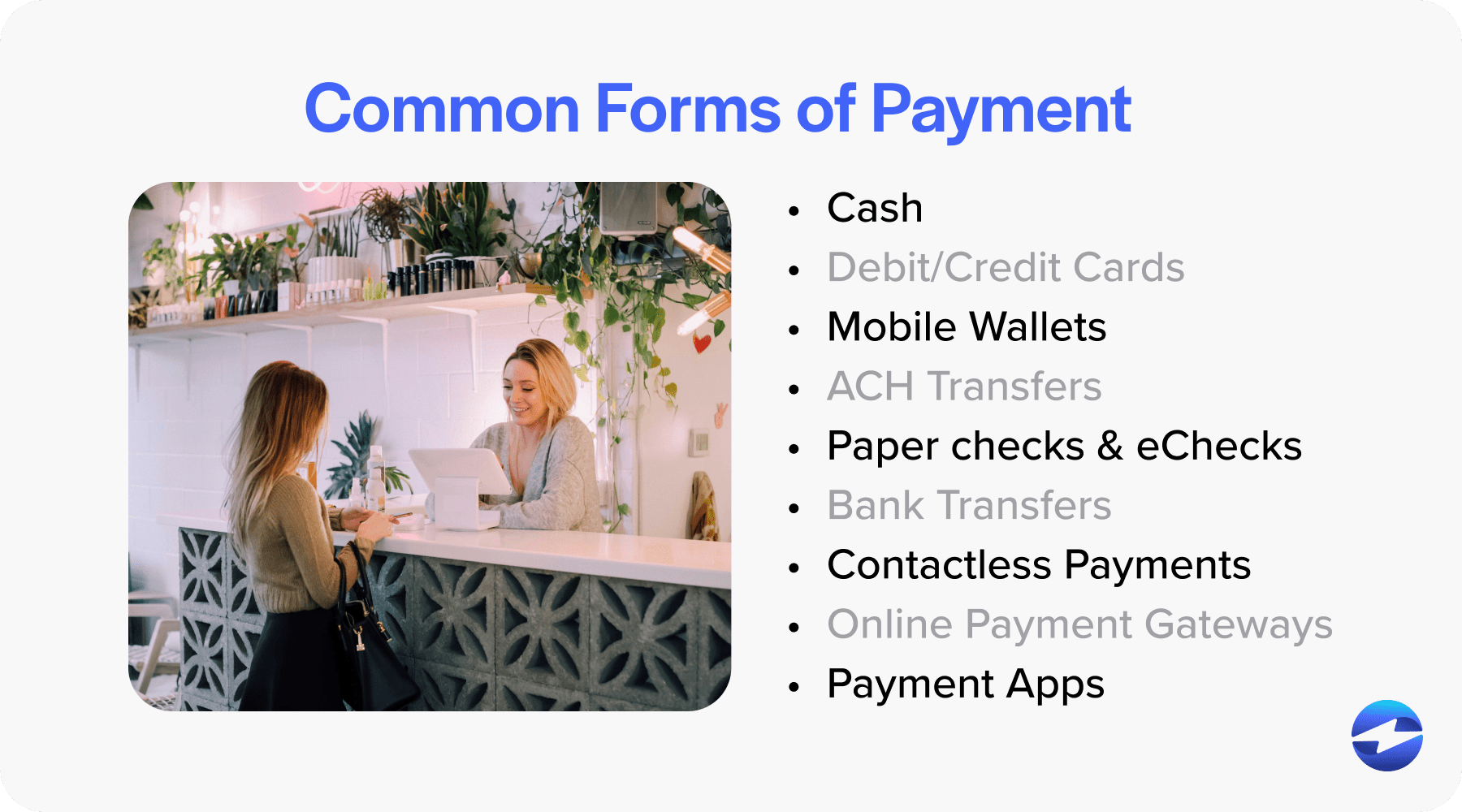

10 most commonly accepted forms of payment

Numerous payment methods offering different levels of convenience and security are available to consumers for various uses. Therefore, businesses are increasingly adopting methods that meet customer needs.

The 10 most commonly accepted types of payment methods are:

- Cash

- Debit cards

- Credit cards

- Mobile wallets

- ACH transfers

- Paper checks and eChecks

- Bank transfers

- Contactless payments

- Online payment gateways

- Payment apps

1. Cash

Cash remains a popular form of payment since it offers a sense of tangibility and immediacy that other modes of payment may lack.

Cash is also widely accepted and accessible, especially in regions with limited banking infrastructure or internet connectivity. This universality is why cash remains a reliable payment method on a global scale for millions of consumers.

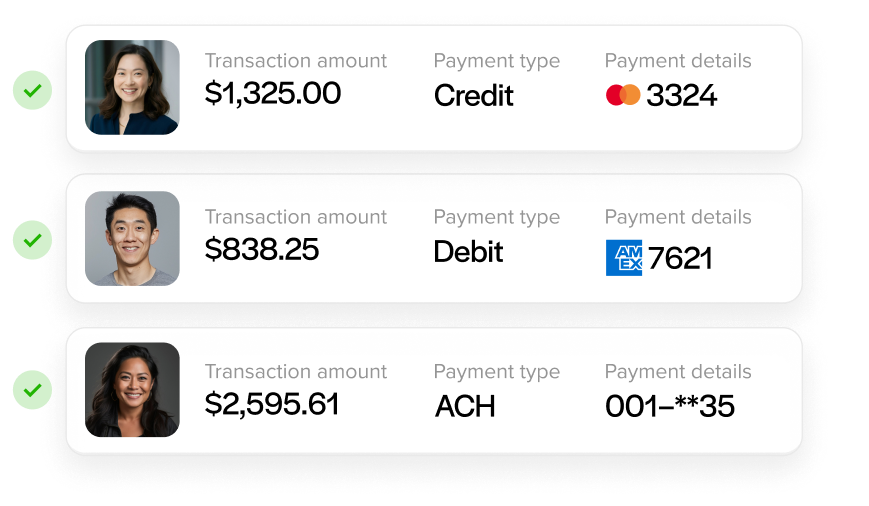

2. Debit cards

Debit cards are widely accepted, both online and in-person, making them a versatile payment option for various transactions.

Debit cards are linked directly to a person’s bank account, allowing immediate access to funds without needing credit checks or approval processes. This accessibility makes debit cards an attractive choice for individuals who may not qualify for credit cards or prefer to avoid accumulating debt.

3. Credit cards

Credit cards help consumers manage their finances more effectively by allowing them to make payments over time, which can be especially useful for large-ticket purchases or unexpected expenses.

When used responsibly, credit cards can help build credit history and improve credit scores, which can be beneficial for obtaining loans, mortgages, or other forms of credit in the future. These cards also provide a layer of security, as they offer protection against fraudulent transactions and unauthorized charges.

Many credit cards come with rewards programs, offering incentives such as cashback, travel miles, or discounts on purchases, which can further incentivize their use. They also

The widespread acceptance of credit cards, both online and in-person, makes them a convenient and versatile payment option for consumers worldwide.

4. Mobile wallets

Mobile wallets offer unparalleled convenience by allowing users to store multiple payment methods, such as credit cards, debit cards, and even loyalty cards, all within a single app on their smartphones.

This type of payment eliminates the need to carry physical cards, streamlines transactions, and reduces the risk of loss or theft.

Mobile wallets also leverage advanced security features such as tokenization and biometric authentication to protect financial information better.

5. ACH transfers

ACH transfers, unlike traditional paper checks, allow funds to be electronically transferred between bank accounts quickly and securely. This payment type eliminates the need for physical transportation of checks and reduces processing times.

ACH transfers are cost-effective, with lower transaction fees than other payment methods such as wire transfers or credit card transaction

Due to their added convenience, savings, and efficiency, ACH transfers are a preferred payment method for businesses and individuals.

6. Paper checks and eChecks

Paper checks are still used today since they offer a tangible record of transactions, providing both the payer and the payee with a physical document detailing the payment.

Paper checks can be beneficial for record-keeping and reconciliation purposes, especially for businesses and individuals who prefer hard-copy trails for their financial transactions.

On the other hand, eChecks offer more convenience since they allow users to initiate digital transactions from their computers or mobile devices without needing physical checks or visits to the bank. Their electronic nature also facilitates faster payment processing than traditional checks, enabling quicker access to funds for both the payer and the payee.

7. Bank transfers

Bank transfers involve the direct transfer of funds from one bank account to another, typically through electronic means, which reduces the risk of loss or theft associated with carrying cash or using paper-based payment methods.

Bank transfers provide a clear audit trail, with detailed records of transactions available through online banking platforms and high security and reliability. This makes them ideal for businesses and individuals prioritizing financial transparency and accountability.

These transfers often have lower transaction fees than other modes of payment, such as wire transfers or checks, making them a cost-effective option for transferring funds domestically or intentionally.

8. Contactless payments

Contactless payments have become increasingly popular due to their unparalleled convenience and speed compared to other payment methods. This payment method allows consumers to simply tap their payment card or mobile device on a contactless-enabled terminal to complete transactions swiftly without inserting a card or entering a PIN.

Contactless payments are also highly secure. They employ advanced encryption technology to protect sensitive payment information, reducing the risk of fraud and unauthorized transactions. These payments also incorporate tokenization, replacing card details with unique tokens for each transaction, further enhancing security.

9. Online payment gateways

Online payment gateways are a secure intermediary between a merchant’s website and financial institutions that facilitate transactions electronically.

These gateways collect and encrypt payment information (card numbers and other sensitive data) to ensure its security during transmission. The encrypted data is sent to the relevant financial institution for authorization, which verifies the customer’s payment details and confirms the availability of funds. Many gateways also offer two-factor authentication and fraud detection systems, further enhancing the safety of online transactions.

Online payment gateways streamline the checkout process and reduce abandoned carts by seamlessly integrating with eCommerce platforms and websites, allowing for a smooth and user-friendly purchasing experience, which can help businesses increase conversion rates and drive sales.

10. Payment apps

Mobile payment applications, or payment apps, allow users to make financial transactions on smartphones or other mobile devices.

Payment apps can include additional features and functionality to enhance the user experience, such as transaction history tracking, budgeting tools, rewards programs, and promotional offers. These features also provide added value and incentives for consumers to pay with these apps.

These apps typically provide convenient options for users to pay via credit and debit cards, bank transfers, and other payment methods. Many apps can also integrate with services and platforms for consumers to use for various purposes like shopping and dining, utility bills, peer-to-peer transfers, and more.

Currently, some of the most popular mobile payment apps include Venmo, Zelle, Google Pay, and Apple Pay.

When deciding which forms of payment to incorporate, businesses should consider multiple online payment methods to meet growing demand.

Choosing the best payment methods for your business

When determining which payment methods to accept, your company should assess the preferences and needs of its target market, relevant industry standards, associated costs, security, and other factors.

Certain industries may have specific payment methods widely accepted or preferred by customers, so businesses should align their payment types to remain competitive. In a recent in-house survey of over 200 business professionals, we found that 81% of customers prefer paying using credit cards, debit cards, eChecks, and ACH payments. It’s also important to factor in the costs associated with various payment methods, such as transaction fees, equipment, and ongoing maintenance expenses.

In addition to costs, payment security is of the utmost importance. Therefore, businesses should consider the risks associated with each payment method and their security features to ensure they implement appropriate measures to protect sensitive data.

Businesses can also simplify payment acceptance by connecting their payment tools to the software they already use. A NetSuite payment gateway allows finance teams to process and reconcile multiple payment types directly within their ERP, while Salesforce payment processing lets sales teams collect payments without leaving their CRM. When your payment system is built into your existing workflows, accepting a wider range of payment methods becomes much easier to manage.

Seamlessly accept payments with EBizCharge

Integrating a payment processing solution like EBizCharge simplifies the complexity of accepting customer payments. EBizCharge provides an efficient online payment platform that integrates with your existing systems to deliver a seamless transaction experience for businesses and customers.

EBizCharge is a versatile payment service provider that supports multiple payment options while also helping reduce transaction fees. The EBizCharge payment processing platform offers tools like virtual terminals, secure email payment links, a branded customer portal, recurring billing, mobile pay, POS systems, and more.

Thanks to its powerful payment software and features, EBizCharge enables merchants to automate their accounts receivable (AR) process, optimize their payment management, and create an unmatched customer experience.