Blog > What are Payment Links? Optimizing Payment Links for Your Business

What are Payment Links? Optimizing Payment Links for Your Business

Payment links revolutionize how businesses interact with customers by simplifying the payment process with a few clicks.

This article will dive into the very fabric of payment links — exploring their types, functionality, security, and the scenarios they’re best suited for — to help you optimize them for your business.

What is a payment link?

Payment links are web addresses that, when clicked, take the payer to a secure payment portal to complete their purchase. These links offer a streamlined solution for businesses and individuals looking to facilitate transactions.

Your business can benefit from payment links since they don’t involve technical requirements for the payer and offer versatile payment links such as credit cards, electronic payments, and mobile payment options. These links also provide safer and faster fund transfers and work well with various payment service providers.

Payment links have become an essential tool for digital payments, streamlining transactions between parties without the need for complex infrastructure. Therefore, it’s beneficial to know the various types of payment links merchants use.

What are the different types of payment links?

Payment links cater to diverse business models and transaction scenarios. From quick retail checkouts to personalized billing, each link type is designed to enhance transactional efficiency.

Some of the most common payment links include eCommerce, website or web app buttons, text links, and email pay.

eCommerce payment links

eCommerce payment links

ECommerce payment links are the cornerstone of digital shopping, ensuring a seamless checkout process for customers. When shoppers finalize their online cart selections, they’re often redirected to a secure payment page via a link.

ECommerce payment links offer alternative flows for declined payments or prompt users if an item is out of stock. These links maintain the continuity of the eCommerce shopping experience despite network glitches or inventory issues, ultimately bolstering customer satisfaction.

Website or web app buttons

Website or web app buttons

Payment buttons are embedded directly into websites and web applications (apps), serving as a direct call-to-action (CTA) for customers to make a purchase. They’re integral for scenarios where the primary actor is engaged in an online interaction, such as ordering from an eCommerce platform or initiating a service through a food delivery app.

By condensing the transaction process to a single click, payment buttons meet the technical and functional requirements for a host of online transactions, enhancing the ease and efficiency for users and financial institutions processing electronic payments.

Text payment links

Text payment links

Thanks to mobile-first strategies, payment links via text message are becoming invaluable.

Text payment links allow businesses to instantly deliver a direct link to a secure payment system, facilitating immediate action without customers needing to navigate through a website or app. This payment option is particularly effective for on-the-go transactions, where speed and convenience are essential.

Email payment links

Email payment links

Email payment links bring transactional precision to the user’s inbox, guiding them through tailored pathways to complete a payment. These links accomplish this by enabling businesses to send secure links directly to customers’ email inboxes to pay invoices.

Integrating payment links into email communications allows businesses to create customized payment flows tailored to users’ needs and preferences. This enhances convenience and fosters stronger connections with customers, elevating the overall payment experience to new heights of satisfaction and efficiency.

Since there are many ways to send payment links to customers, it’s important to understand how these links work.

How do payment links work?

Payment links simplify the process of exchanging monetary value by providing digital requests for payment that can be shared through multiple channels.

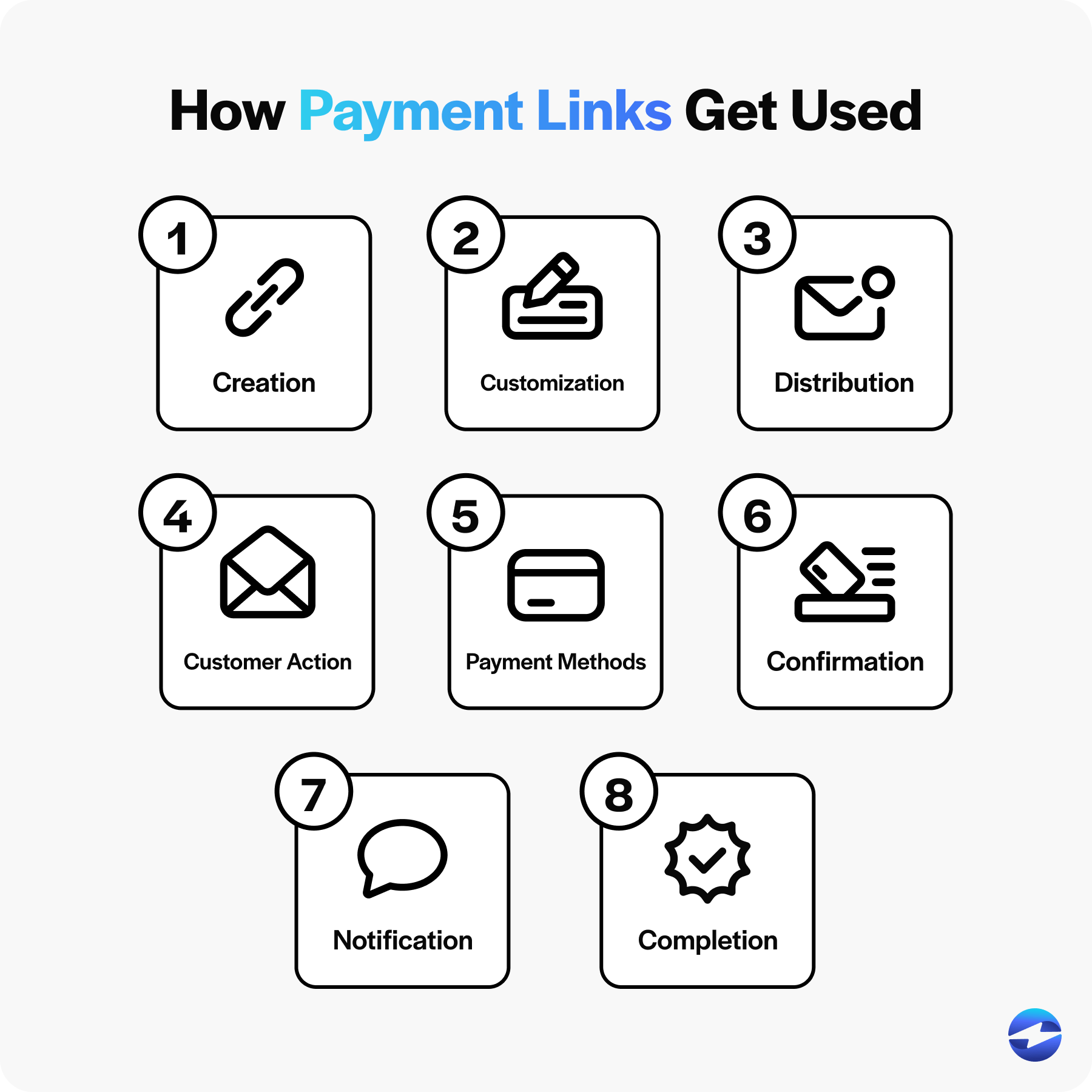

Here’s a guide on how payment links are used:

- Creation: The primary actor, typically a merchant, utilizes a payment service provider’s platform to generate a unique payment link.

- Customization: If necessary, the merchant sets the payment amount and adds customer details and due dates to the link.

- Distribution: The payment link is sent to the customer via email, SMS, or other messaging platforms.

- Action by customer: Upon receiving the link, the customer clicks on it to be directed to a secure payment gateway.

- Payment methods: The customer selects from various payment options, including credit cards, digital wallets, or bank accounts.

- Confirmation: After entering payment details, the customer approves the transfer of funds.

- Notification: The merchant receives instant notification of the payment status.

- Completion: The financial institution processes the electronic payment and completes the transaction.

These steps offer a clear pathway for customers and businesses to easily facilitate online transactions. Payment processors can also integrate and offer these links to merchants to streamline customer payments.

With so much going on within the process of payment links, it’s easy to second-guess how secure those links are.

How secure are payment links?

Payment links employ enhanced security to protect customer information, making them a trustworthy choice for digital payments.

Despite rising cyber threats, the comprehensive security system embedded in payment links offers reassurance. Security measures like tokenization and encryption safeguard credit card details from unauthorized third parties when using payment links. This security gives consumers and businesses peace of mind, knowing their financial information is being preserved.

Now that you know payment links are secure, you can learn more about when and for which companies they work best.

What payment links will work best for your business?

Payment links often work best when traditional payment methods, like credit cards or bank accounts, are impractical or businesses must issue a payment request instantly without a payment gateway.

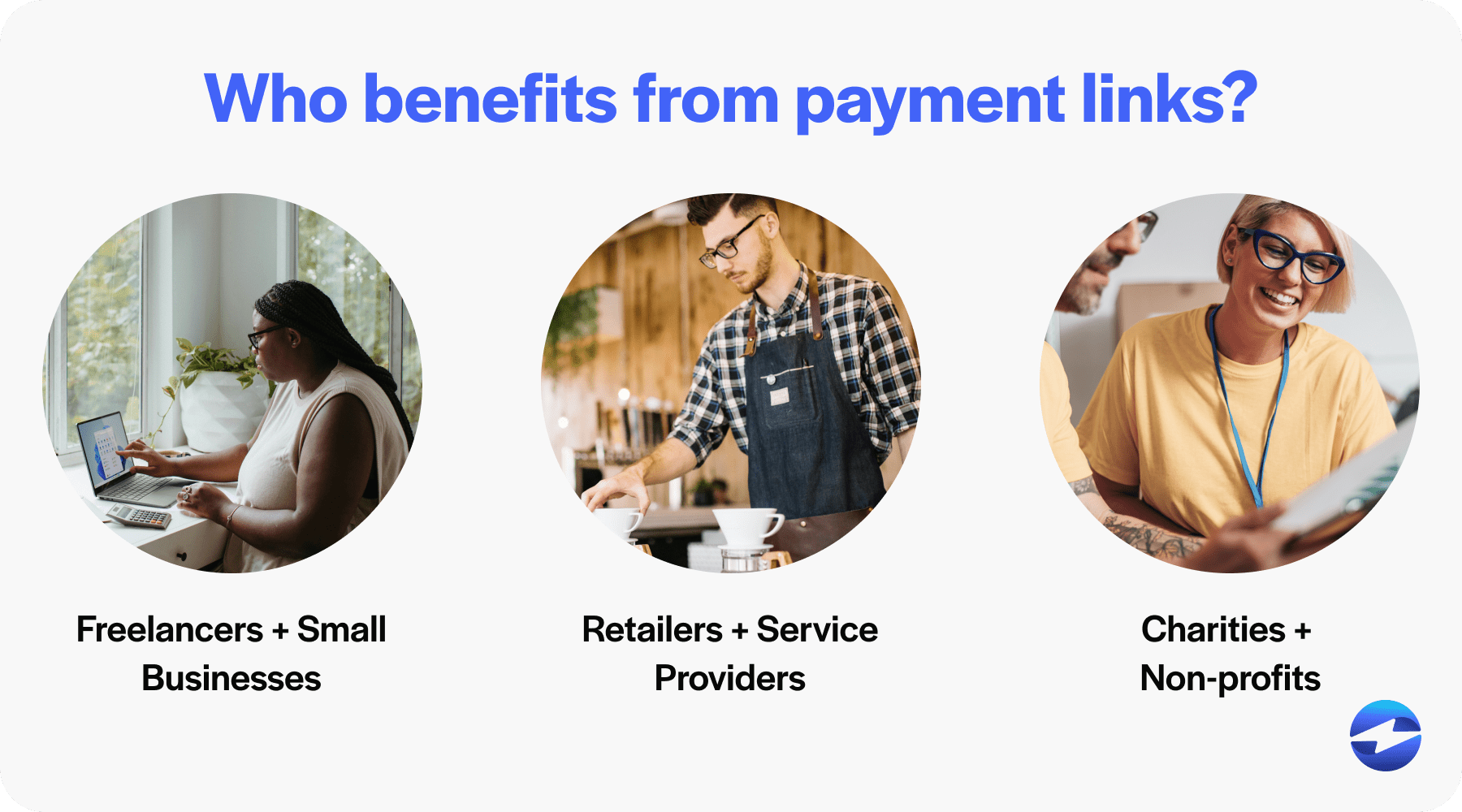

Below are some of the businesses that benefit the most from utilizing payment links:

- Payment links benefit freelancers and small businesses immensely. They can securely invoice clients without extensive technical requirements, such as integrating a full-fledged payment processor. This makes the payment process swift and direct.

- Retailers and service providers conducting business over social media or messaging platforms find payment links particularly useful. They supply the link accompanying product information or quotes, allowing customers to complete transactions immediately.

- Charities and non-profit organizations leverage payment links during fundraising campaigns. Instead of conventional means, they share links across digital platforms to collect donations efficiently and effectively.

In addition to these entities, businesses can look to reliable payment providers that provide various payment link options to enhance their operations.

Merchant service providers that offer payment links

Various merchant service providers have emerged as reliable platforms offering payment link services, each bringing distinct features and benefits.

These providers make it convenient for businesses and individuals to request and receive payments without complex setup processes.

Notable providers like EBizCharge, PayPal, Stripe, and Square provide payment link capabilities, allowing for seamless payments across various industries.

EBizCharge

EBizCharge is the ultimate payment powerhouse designed with businesses in mind, offering a secure and seamless solution for all your payment processing needs.

The EBizCharge platform provides payment links for companies to send to customers for quick and easy payments. One of the leading payment links features EBizCharge offers is email pay, which allows merchants to provide an easy link to redirect their customers to a secure browser to pay for an invoice. EBizCharge also offers a hosted checkout experience where customers can click a payment link to instantly and securely purchase products or services.

With over 100 accounting, ERP, CRM, and eCommerce payment integrations, EBizCharge offers a seamless experience for businesses to streamline payment collections and reconciliation processes.

With EBizCharge, users can embrace a new era of payment efficiency and security, creating a smooth and stress-free payment experience for their businesses and valued customers.

PayPal

PayPal, one of the original pioneers in online payments, also offers a payment link service known as PayPal.Me.

With a simple and personalized PayPal.Me link, businesses, freelancers, and even personal users can request payment for services rendered or goods sold. Customers can pay through these links using their PayPal accounts or by entering their payment details directly. This capability significantly reduces the friction in online transactions, making it especially valuable for merchants and service providers who operate internationally or want to leverage PayPal’s vast user base.

Stripe

Stripe is a payment service provider known for its developer-friendly approach and robust payment infrastructure.

Stripe offers payment links that enable businesses to create fully branded and customized payment pages without any coding required. These payment pages can then be shared as links, accepting various forms of digital payments, including credit cards and electronic payments.

Stripe also supports alternative flows, such as subscription models, making it a versatile choice for online businesses.

Square

Square is a provider that caters to small and medium-sized businesses with various payment solutions, including payment links.

Square allows users to quickly create and share custom payment links, which can be sent to customers through email, social media, or text. These links allow customers to choose their preferred payment methods, including credit and debit cards and mobile payments.

With Square, businesses can manage their sales, track inventory, and receive payments in one integrated platform.

While these payment service platforms offer powerful payment link options to simplify your transactions, businesses should choose the one that best meets their needs.

Enhancing the user experience with reliable payment links

Payment links offer a dynamic and straightforward solution for businesses and individuals to eliminate the stress of collecting payments.

Whether leveraging credit cards, bank accounts, or alternative methods of transferring funds, payment links provide a reliable interface with minimal technical requirements to transform your payment collections.

5 common FAQs about payment links

5 common FAQs about payment links

Summary

- What is a payment link?

- What are the different types of payment links?

- How do payment links work?

- How secure are payment links?

- What payment links will work best for your business?

- Merchant service providers that offer payment links

- Enhancing the user experience with reliable payment links

- 5 common FAQs about payment links

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.