Blog > How Do You Get a Business License?

How Do You Get a Business License?

While starting a new business is an exhilarating journey, it comes with numerous responsibilities, including acquiring a business license to legally sell products or services.

In addition to explaining how to obtain a license for your company, this article will explore the various business licenses and types of internal business structures to help you better understand these documents and all they entail.

What are business licenses?

A business license is an official government-issued permit that authorizes individuals or companies to conduct business within the government’s jurisdiction.

Business licenses are a form of tax registration that permits companies to operate legally in specific locations and are typically required for home-based businesses and commercial establishments.

Business license types can vary depending on your internal activities, structure, and location.

While some exceptions exist, most businesses require a license to operate.

What kinds of businesses require business licenses?

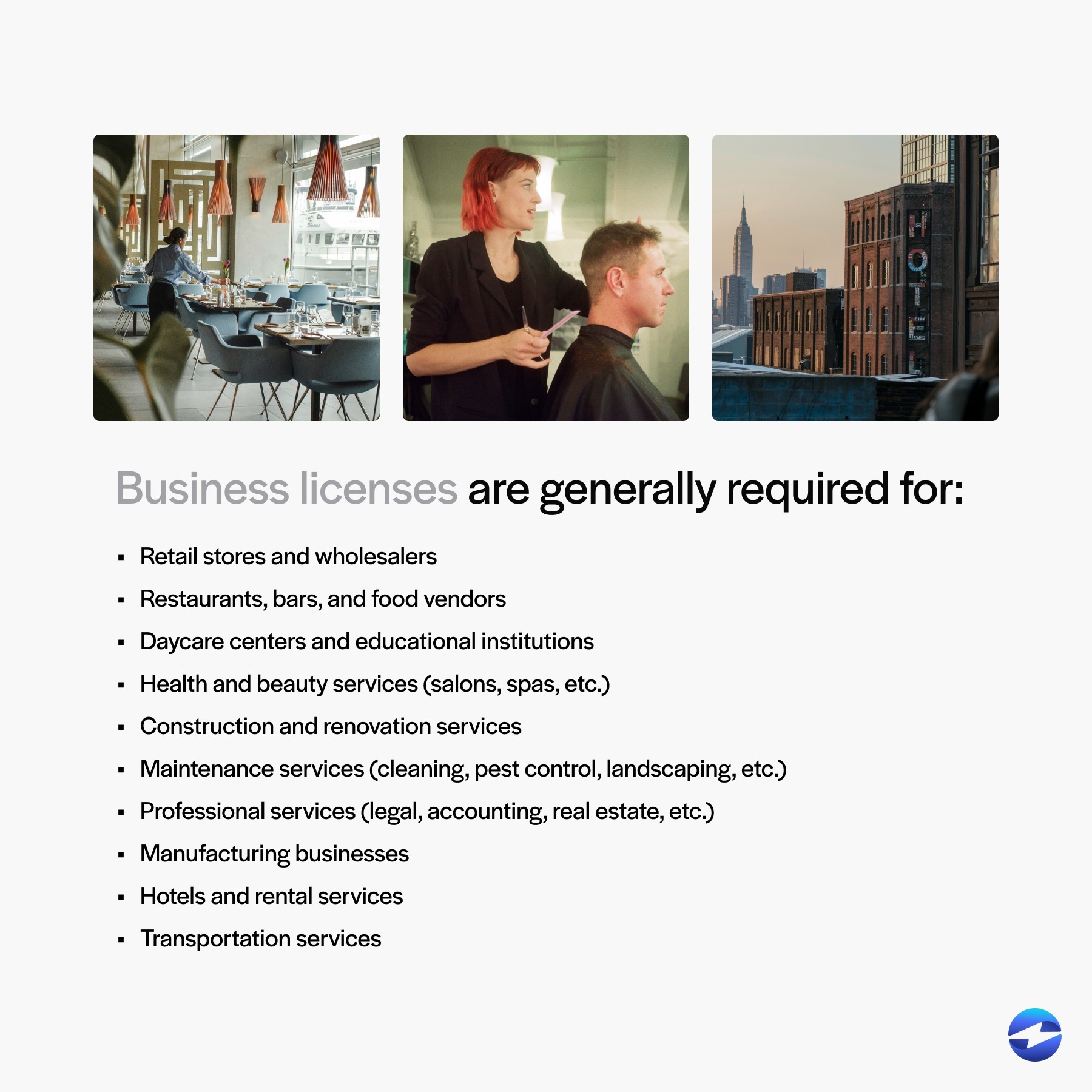

Understanding which companies require business licenses is crucial since operating without the proper documentation can lead to legal repercussions.

Still, license requirements can vary based on the nature of the business, its location, and industry regulations. Generally, business licenses are required for:

- Retail stores and wholesalers

- Restaurants, bars, and food vendors

- Daycare centers and educational institutions

- Health and beauty services (salons, spas, etc.)

- Construction and renovation services

- Maintenance services (cleaning, pest control, landscaping, etc.)

- Professional services (legal, accounting, real estate, etc.)

- Manufacturing businesses

- Hotels and rental services

- Transportation services

It’s important to research specific licensing requirements and types based on your business classification, local legislation, and industry standards.

Now that you know which businesses require a license, the following section will explain the various steps of acquiring a business license.

How to get a business license

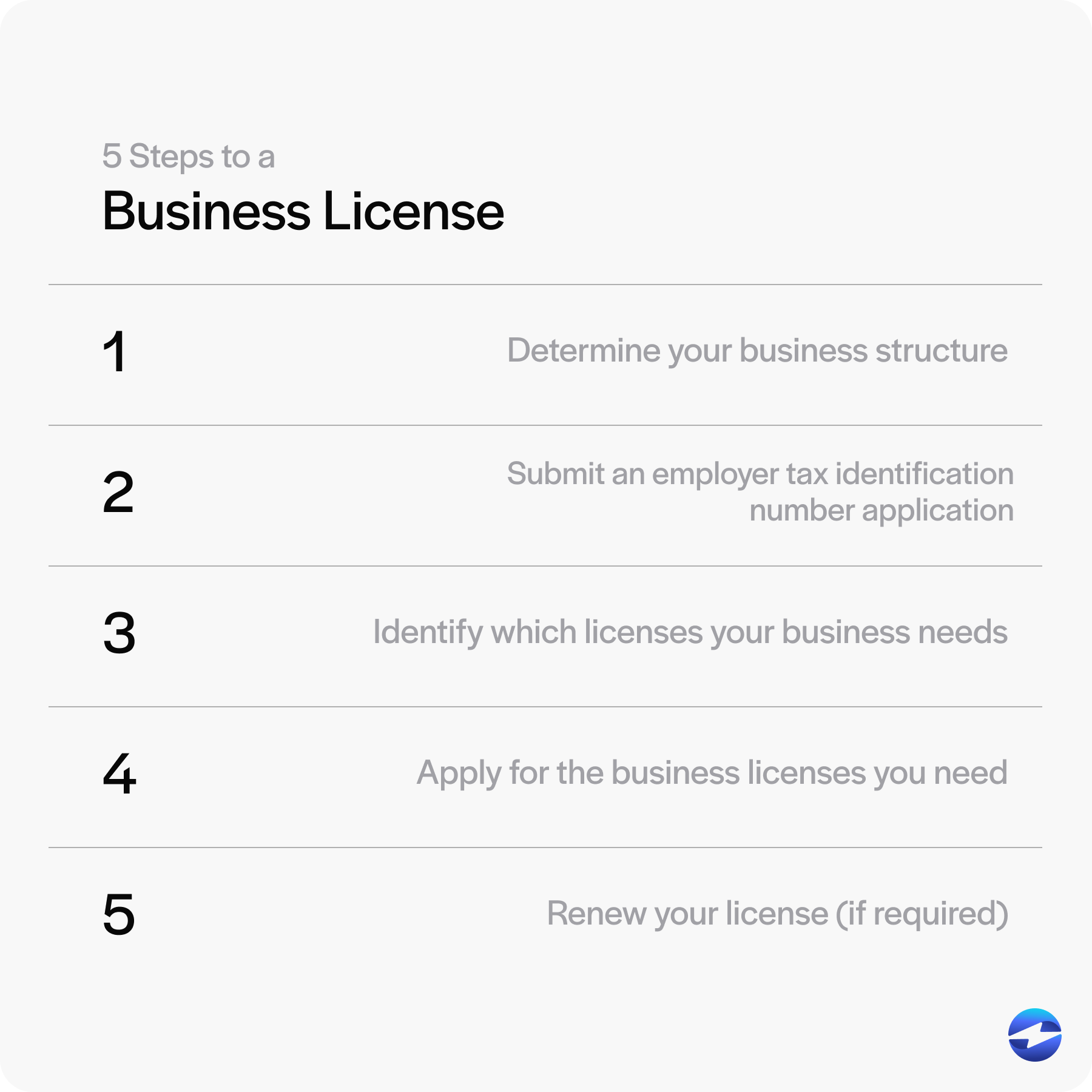

Knowing how to get a business license is essential for the legality and credibility of your business.

To help with this, here are five steps to follow to apply for this license:

- Determine your business structure: Before you can apply for a business license, you must determine your business structure as it affects the licensing requirements. Common types of business structures include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each structure has different implications for liability, taxes, and regulatory obligations.

- Submit an employer tax identification number (EIN) application: Most businesses must apply for an EIN from the IRS, which is used to identify your business entity to the federal government for tax purposes and is required for most businesses, especially those with employees. The EIN is often needed when applying for business licenses and permits, opening a business bank account, and handling other business-related legal and tax matters. The application is free and can be completed online via the IRS website.

- Identify which licenses your business needs: The next step is determining the specific licenses and permits required for your business. Different business activities may necessitate various professional licenses, and the requirements can fluctuate depending on whether your company is brick-and-mortar, online, or an in-home business. Certain industries may also have specific obligatory federal licenses. To obtain a comprehensive list of licensing requirements, consult local and state government websites or a business licensing service.

- Apply for the business licenses you need: After identifying the necessary business license, you must fill out and submit the required license applications to the appropriate government agencies. This may include inputting company details, such as business plans, ownership information, and proof of compliance with local zoning laws. Business licensing costs vary by jurisdiction and may depend on the type of business, location, and other factors. Most applications are now online, though some may require in-person submissions or additional documentation.

- Renew your license (if required): Many business licenses expire and require renewal on a regular basis. Keeping your license current is crucial because operating with an expired license can result in fines, legal penalties, or the closure of your business. The renewal process may involve updating your information, paying business license fees, and, in some cases, demonstrating ongoing compliance with regulations. Staying proactive and marking renewal dates on your calendar or setting reminders can help ensure you maintain uninterrupted legal authority to operate your business.

Governments mandate business licenses as a form of regulation to ensure public safety and trust in the legitimacy of businesses operating within their jurisdiction. These licenses establish your business entity in the eyes of the law and can also shield you from certain liabilities.

Before implementing these steps, you’ll first need to evaluate your operations to determine your business type before reviewing which business license you’ll require.

5 types of business entities

When applying for a business license, assessing your internal business structure is vital to determine what type of company to operate as.

How you classify your business can affect your liability, tax obligations, personal asset protection, business management, registration requirements, and ongoing compliance.

Here are five types of businesses your company may fall under:

- Corporation

- Sole proprietorship

- LLC

- General partnership

- Nonprofit corporation

1. Corporation

A corporation is a legal entity that’s separate and distinct from its owners, known as shareholders. Corporations offer limited liability protection to protect shareholders’ personal assets if the business accrues debt or faces legal action.

Corporations are subject to corporate tax rates and must follow stringent record-keeping and reporting practices. Additionally, they can sell stock to raise capital, which can be beneficial for growth.

Given its complex nature and double taxation (once at the corporate level and again on personal income from dividends), the corporation category is often better suited for larger companies planning to raise significant investment capital.

2. Sole proprietorship

A sole proprietorship is the simplest form of business entity where there’s no legal distinction between the owner and the business. It’s relatively easy to set up and requires minimal paperwork and fees.

However, sole proprietorships are personally liable for all business debts and obligations. This means personal assets can be used to satisfy business debts and liabilities. For tax purposes, business income is reported on the owner’s personal tax forms, and the profits are subject to self-employment taxes.

Sole proprietorships are widely chosen by individuals or companies in the start-up phase, especially if they’re pursuing lower-risk business activities.

3. LLCs

An LLC blends characteristics of corporate structures with those of sole proprietorships or partnerships. It offers personal liability protection to its owners (also known as members) to safeguard their personal assets.

LLCs offer a flexible approach to taxation since they can be taxed as sole proprietorships, partnerships, or corporations. This provides more adaptability to suit the various financial circumstances of its members. LLCs benefit from a wide range of business deductions, including ordinary and necessary expenses.

The legal formalities for running an LLC are less stringent than those for corporations, though specific requirements vary by state. This structure is popular for small to medium-sized businesses seeking flexibility and protection.

4. General partnership

In a general partnership, two or more individuals own the business and share operating responsibilities. This type of business entity is relatively easy to form, often requiring only a partnership agreement.

Each partner is personally liable for the debts and obligations of the partnership, and they share in the profits of the business, which are reported on their personal tax returns.

The simplicity of their structure and the eliminated need for formal registration in some regions make general partnerships attractive for collaborative business ventures starting on a modest scale.

5. Nonprofit corporation

A nonprofit corporation is a legal entity organized for a purpose other than generating profit. It benefits from certain tax exemptions and typically focuses on charitable, educational, religious, or public service objectives.

While it may generate revenue, any surplus must be reinvested into the organization’s mission rather than distributed to members or leaders.

Compliance with specific regulations and transparency to the public about operations are required to maintain the nonprofit status and associated tax benefits.

Each business classification offers distinct advantages and drawbacks to suit various company infrastructures and their associated goals and needs. Recognizing these characteristics allows businesses to select the most advantageous entity for their endeavors and ensures proper adherence to legal and licensing requisites.

Now that you’ve classified your business type, the following section will explain the licenses and permits your company may need to obtain.

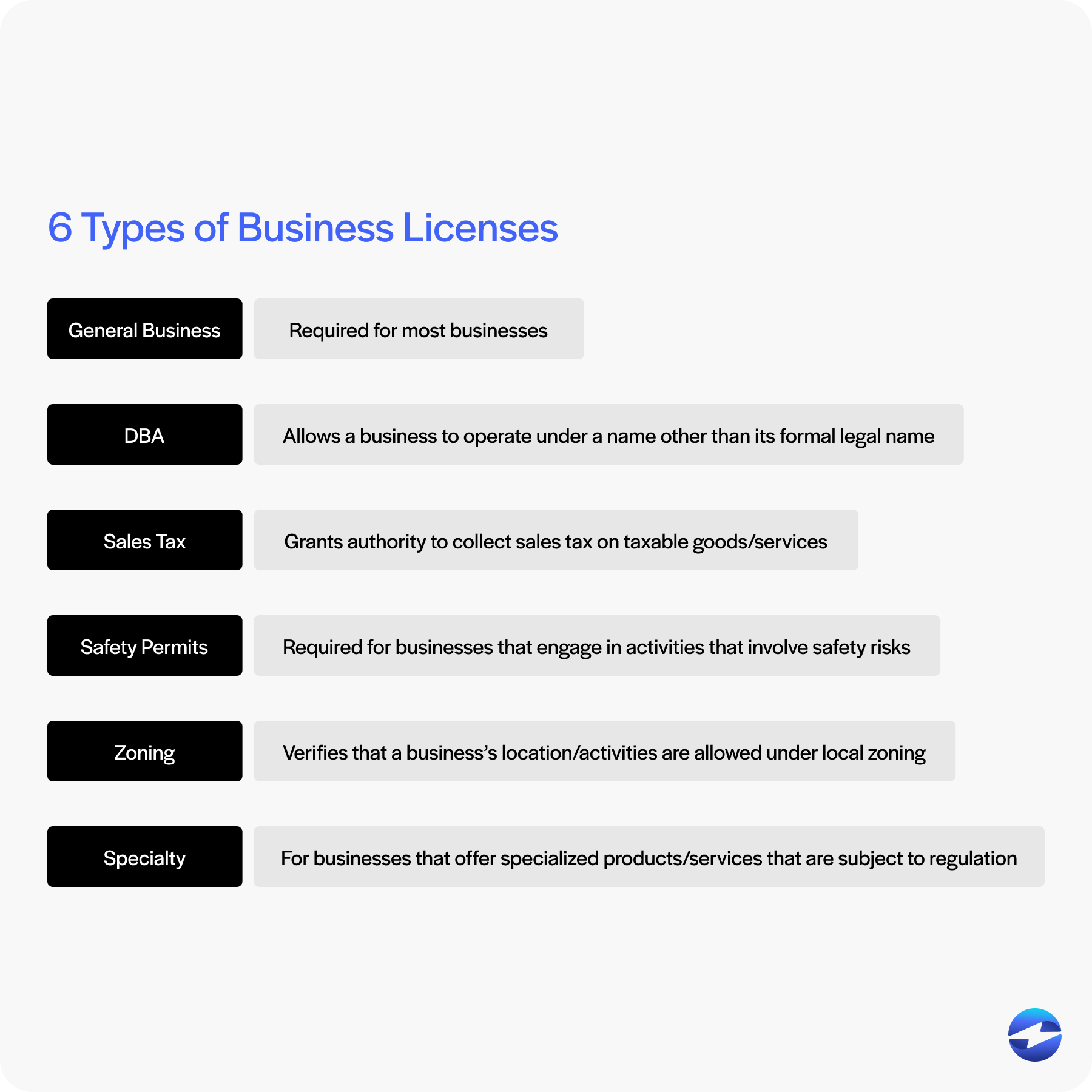

6 types of business licenses

Understanding the various business licenses and how they apply to your business will help you navigate the regulatory landscape, avoid penalties, and build a solid foundation for growth.

From general business licenses to more specific permits like sales tax licenses and safety permits, each license serves a unique purpose. Here are six business licenses to know:

- General business license: A general business license is the most common permit businesses must obtain to legally operate since it registers your company as a taxable entity with local and state governments. Most cities or counties require a general business license for all businesses operating within their jurisdiction. The requirements for this license vary by locality, but they often involve submitting an application, paying a fee, and renewing the license periodically.

- Doing business as (DBA) license: A DBA license allows a business to operate under a name other than its formal legal name. This is particularly common among sole proprietorships and partnerships that want to create a separate business identity without forming a corporation or LLC.

- Sales tax license: A sales tax license, also known as a seller’s permit, grants a business the authority to collect sales tax on taxable goods and services. This is a state-level requirement in most U.S. states, and businesses must regularly report and remit the collected sales tax to the state Department of Revenue. Business owners can apply for a sales tax license through their state’s tax department, often via an online application.

- Safety permits: Safety permits are required for businesses that engage in activities that can affect the health and safety of employees, customers, or the public. These permits ensure that businesses comply with occupational and public safety regulations. Businesses that may require safety permits include construction companies, manufacturing plants, and restaurants. The requirements for safety permits vary based on the specific risks associated with the business’s operations.

- Zoning license: A zoning license, or a zoning permit, verifies that a business’s location and activities are allowed under local zoning regulations. This permit is particularly important for home-based businesses that require a physical alteration of a property, as well as specific industries like agriculture or manufacturing. The local city or county zoning office typically handles zoning licenses, ensuring the business use aligns with the area’s designated land use.

- Specialty license: Specialty licenses pertain to businesses that offer specialized services or products and may be subject to additional state or federal regulations. Examples include liquor licenses for bars, health department permits for food service establishments, and childcare licenses for daycare providers. These permits are often industry-specific and are issued by various regulatory agencies to ensure that companies meet the professional and operational standards required to safely and legally deliver their specialized services or products.

Each license and permit type has its own application procedures, registration requirements, and associated fees. Businesses must maintain these licenses and permits by staying informed and complying with any new regulations, renewing them on time, and keeping their information up to date with the issuing agency.

Once your business has secured the proper licensing and permits, you’ll want to look into opening a merchant account. It’s a great way to simplify your payment processing and boost your revenue. You can work with a top-rated solution like EBizCharge to get setup tp process customer payments efficiently.

Transform your payments processing operations with EBizCharge

After getting a business license that complies with local and federal regulations, your company can generate more revenue by working with a reliable payment solution. Providers like EBizCharge are instrumental in helping merchants streamline payments and enhance cash flow.

By integrating with over 100 accounting, ERP, CRM, and eCommerce platforms, EBizCharge automates and simplifies transactions by enabling businesses to accept and process credit cards and ACH/eChecks directly inside these business systems for a more secure and efficient way to collect and manage payments.

EBizCharge accommodates various payment methods, reduces processing fees, and enhances the user experience with its all-in-one payment platform. This payment software offers robust features, including secure click-to-pay links, an online customer payment portal, recurring billing, PCI compliance and advanced security, 24/7 support, and more.

With EBizCharge, merchants can focus on high-priority business activities and avoid the complexities of payment processing operations to transform customer payments and their overall finances.