Blog > Free Credit Card Processing Platforms: Pros, Cons & Hidden Fees

Free Credit Card Processing Platforms: Pros, Cons & Hidden Fees

“Free” credit card processing is a catchy phrase, and it’s showing up more and more in small business circles. If you’re a merchant trying to reduce your expenses, it might sound like a dream. Who wouldn’t want to eliminate those processing fees entirely, right?

Unfortunately, these platforms aren’t always what they seem. What they call “free” often just means the fees are being shifted, usually to your customers.

What is Free Credit Card Processing?

At its core, “free” credit card processing usually means the business isn’t paying the processing fees. Instead, those fees are passed on to the customer through a surcharge or a practice known as “cash discounting.”

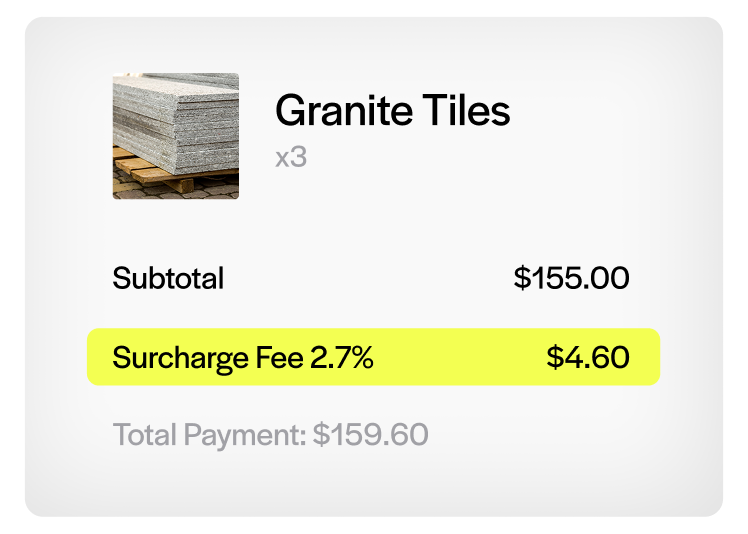

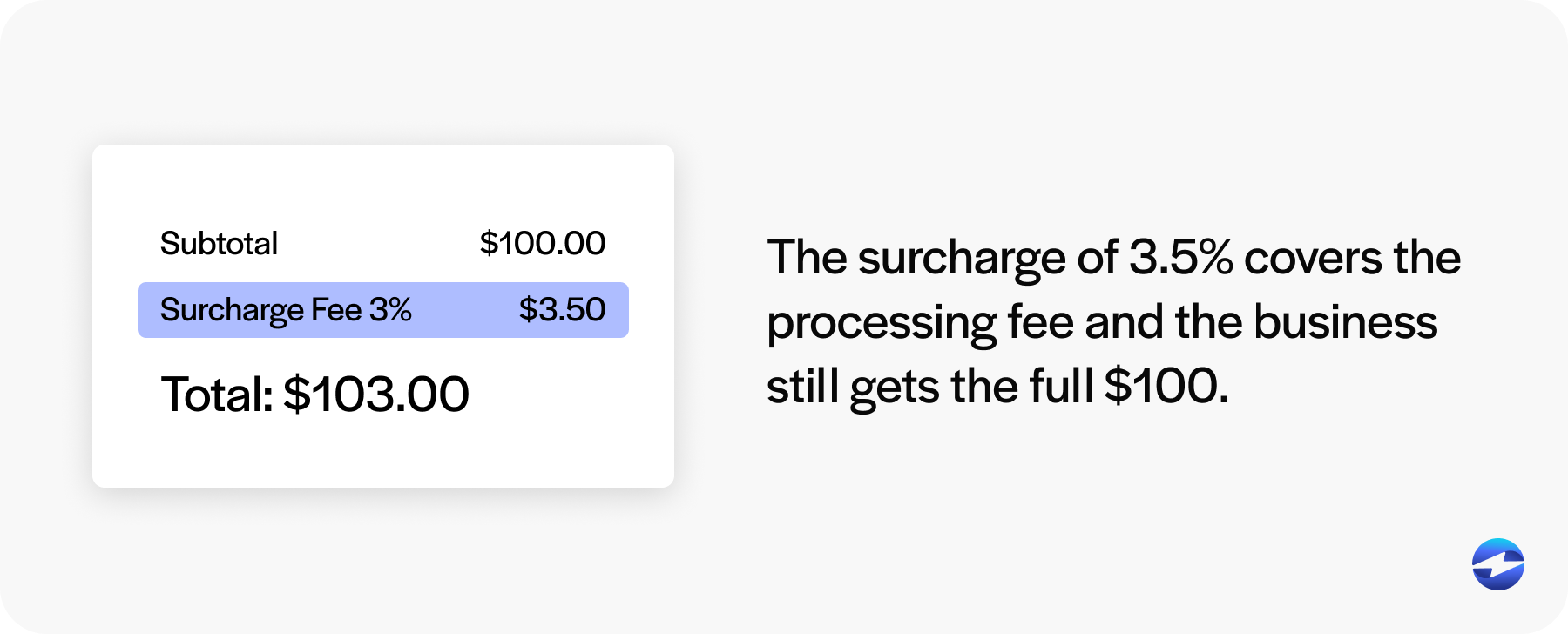

The idea is simple: when a customer pays with a credit card, a small percentage (say 3% to 4%) is added to their total. That extra amount covers the cost of the transaction, so the merchant doesn’t have to.

It’s not that processing becomes free; it’s just that someone else is footing the bill.

How Free Online Credit Card Processing Works

Let’s say a customer is buying something that costs $100. Instead of eating the 3.5% processing fee, the business adds that fee to the purchase. Now, the customer pays $103.50. That extra $3.50 covers the processing fee. The business still gets the full $100.

To pull this off, merchants typically need software or a payment platform that supports surcharging or cash discounting. When looking for a provider, be adamant about finding one that is surcharge compliant. There are many legal and compliance rules to follow when adding charges and having a surcharging solution that is complaint can save you from future headaches.

Pros of Free Credit Card Processing Platforms

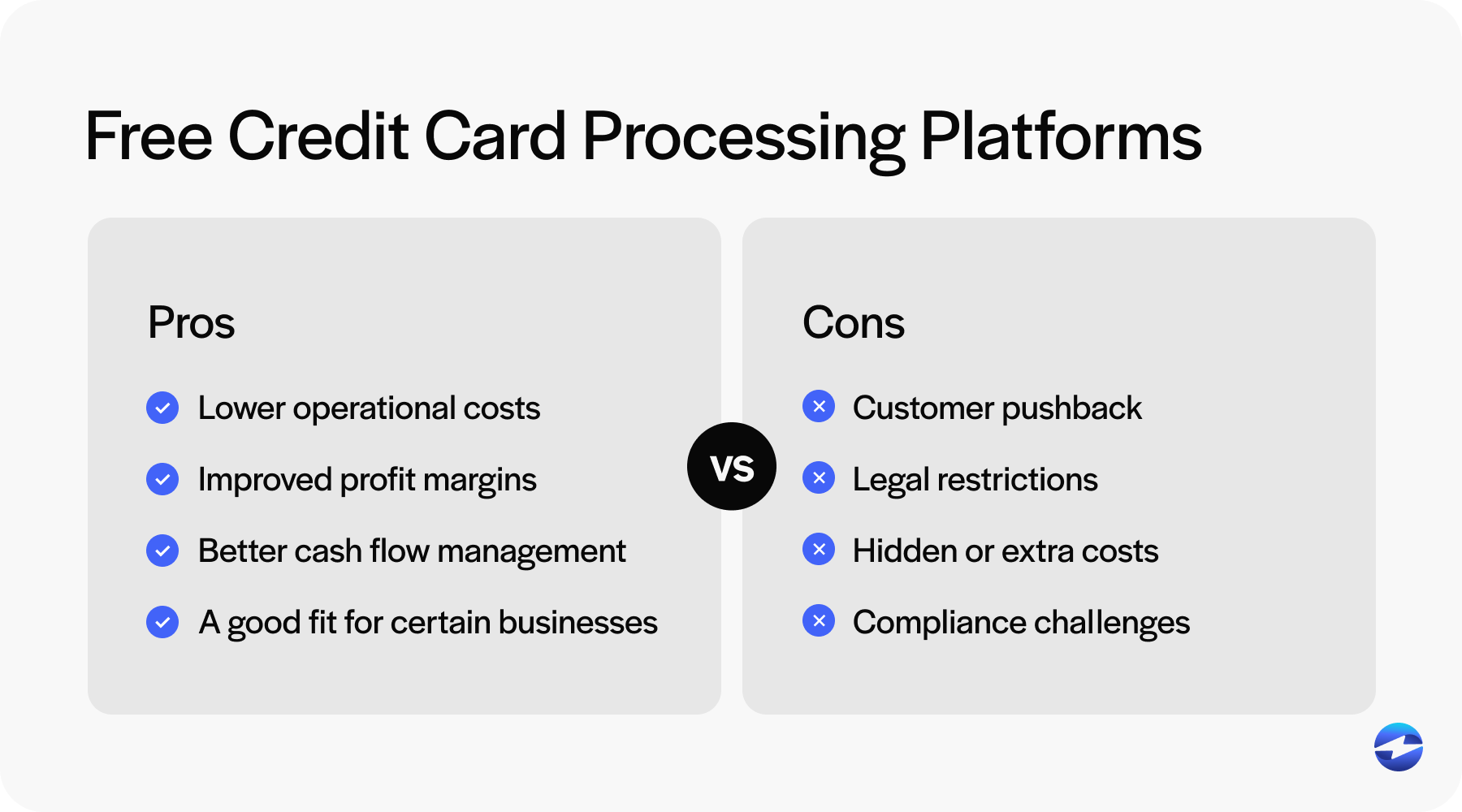

It’s important to recognize the real benefits that zero-fee processing can offer. If you’re a business owner looking for ways to reduce the costs of payment processing, these advantages can make a noticeable difference in your bottom line:

- Lower operational costs – When you pass processing fees to customers, your business saves money on each credit card transaction.

- Improved profit margins – Especially helpful for businesses operating with tight margins, such as restaurants or small retailers.

- Better cash flow management – Without recurring processing charges, budgeting becomes more predictable, and reinvestment in your business gets easier.

- A good fit for certain business types – This model works particularly well for B2B businesses or low-volume retail, where customers are generally more accepting of added fees.

Passing along the fees associated with credit card processing can be a big help for businesses looking to reduce their operating costs. On paper it can look like an easy way to increase your profit margins, but there are a couple of considerations to think about before giving the expense of card processing fees to your customers.

Cons and Considerations

Free processing sounds great, but it comes with trade-offs. Here’s what you’ll want to weigh before making the switch:

- Customer pushback – Customers just don’t like extra fees. According to a PYMNTS study, up to 72% of credit card holders view surcharges negatively, especially when they appear unexpectedly at checkout.

- Legal restrictions – Not every state allows surcharging. Some have strict rules about how it’s disclosed.

- Hidden or extra costs – “Free” platforms may still charge for software, terminal rentals, compliance support, or even a service fee. Don’t assume it’s all inclusive.

- Compliance challenges – If you don’t handle compliance properly, you could land in hot water. Missing the required signage or disclosure could result in some hefty fines or even bard your ability to process card transactions altogether. Maek sure to keep your reputation and customer trust intact.

Understanding both sides will help you make a choice that truly supports your business goals—not just one that sounds good on paper.

Hidden Fees to Watch Out For

Here’s where things can get sneaky. Many “free” platforms still bake in fees elsewhere. These might include:

- Monthly platform or software fees

- PCI compliance charges

- Terminal rental or leasing costs

- Early termination fees or long-term contracts

- Extra markups on interchange rates (even under so-called “pass-through” pricing)

Just because the processing is called “free” doesn’t mean the service is. Always ask for the total cost breakdown.

Comparison of Free Credit Card Processing Providers

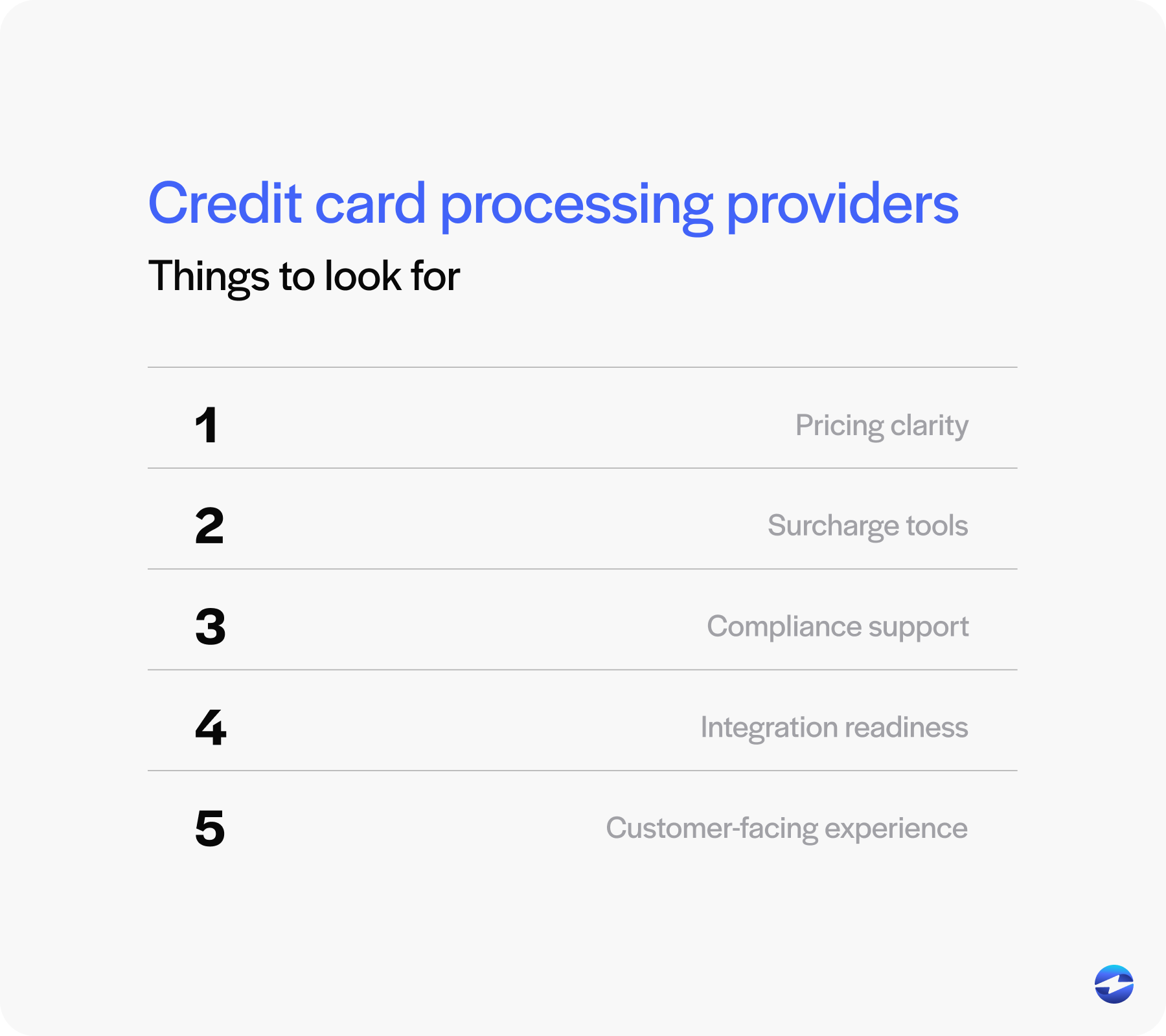

Not all platforms are created equal—and if you’re a business trying to stay compliant, save money, and avoid clunky tech, the details really matter. Here are a few things to consider as you evaluate your options:

- Pricing clarity – Look beyond “free.” Does the provider clearly spell out all associated costs—software fees, equipment rental, PCI compliance, etc.?

- Surcharge tools – Does the system handle surcharge calculations automatically at checkout? Are receipts and signage templates built in?

- Compliance support – Are they staying on top of state-by-state laws? Do they help you stay compliant, or do they leave you figuring it out?

- Integration readiness – Will it work with what you already use? Look for direct compatibility with POS systems, eCommerce sites, accounting software, and email invoicing tools.

- Customer-facing experience – Does the checkout process explain the fee in plain language? Can you preview how it looks before going live?

Many platforms promote surcharging as a “feature,” but if the provider forces you into a rigid setup or shifts the compliance burden entirely to you, it may not be worth the risk. Look for transparency, flexibility, and support.

Is Zero Fee Processing Right for Your Business?

Choosing to add a surcharge isn’t just a pricing decision—it’s a business strategy. Like any strategy, it has to align with how your customers think and how your business operates.

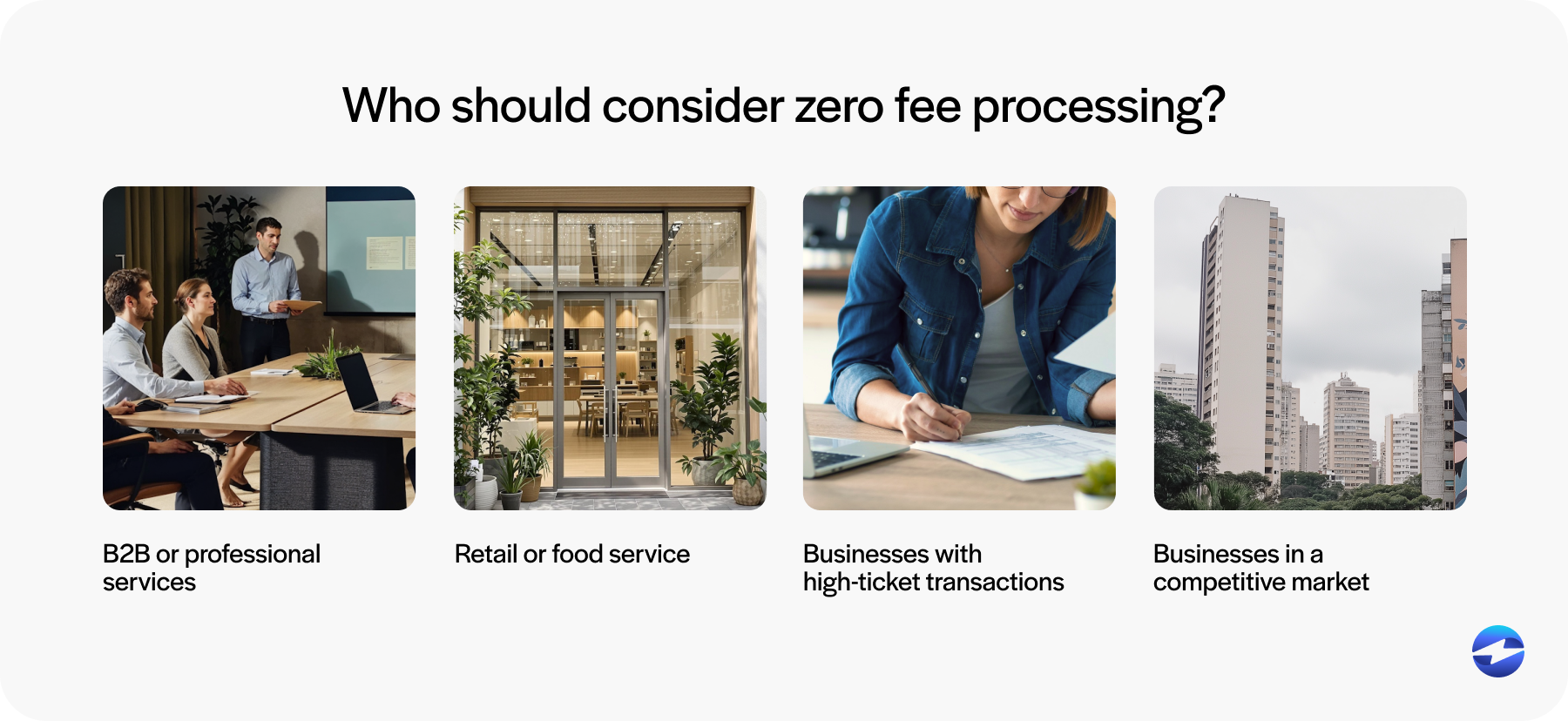

- If you’re in B2B or professional services. Clients are generally used to administrative or convenience fees. A 3% card fee on a $2,000 invoice? Not likely to raise eyebrows. Plus, they often care more about net terms than the checkout experience.

- If you’re running a retail store or food service. Things get trickier. A customer pulling out a card for a $3 coffee might feel nickel-and-dimed if they see an extra charge pop up. If your brand depends on loyalty or regular foot traffic, tread carefully.

- If your average transaction size is high. The savings can be meaningful. A 3.5% surcharge on $500 is $17.50 you no longer owe the processor. Infrequent but high-value transactions can be ideal for this model.

- If you’re dealing with tight competition. Think about what your competitors are doing. If they’re absorbing the cost but you’re not, you’ll need to clearly communicate your fee structure and justify its value.

So, is it the right fit? Ask yourself not just what you’ll save but how your customers will perceive it. The right choice balances your margins with their expectations.

This model isn’t a one-size-fits-all. If you’re in a B2B space where customers are used to seeing service fees or convenience charges, you’ll probably have fewer issues. If you run a boutique retail store or a coffee shop, you might want to think twice. Passing on fees to customers can feel awkward—or even drive them away. Consider your average transaction size as well. The impact of a 3% surcharge feels different on a $500 invoice than it does on a $4 latte.

You know your customers better than anyone. Think about how they’ll respond before making the switch.

How EBizCharge Supports Surcharging and Transparent Processing

At EBizCharge, we believe surcharging should be both compliant and customer-friendly. That’s why we’ve built a platform designed to support merchants with everything they need to implement surcharging confidently and effectively.

- Full legal compliance – Our tools are built to meet federal and state-level regulations, including support for required surcharge disclosures and automated fee handling.

- Automated calculations and disclosures – Surcharges are applied in real-time at the point of sale or invoice, with proper fee breakdowns shown to the customer upfront.

- Pre-made signage and documentation – We offer downloadable templates and digital disclosures that make it easy to comply with notice requirements.

- Customizable surcharge settings – Choose which payment types incur a surcharge and control how fees appear based on your business model.

- Tight integrations – EBizCharge connects with popular tools like QuickBooks, NetSuite, Microsoft Dynamics, WooCommerce, and more—so you can keep your existing workflow.

- Omnichannel support – Whether you’re processing online, in-store, or through emailed invoices, our platform accurately applies surcharges across all channels.

With EBizCharge, you get more than just a workaround to cut costs. You get a complete, customizable platform that ensures your business stays compliant, looks professional, and keeps your customers informed.

Final Thoughts on Free Credit Card Processing

There’s a lot of noise out there about free credit card processing. Some of it’s true. Some of it’s marketing.

Before you jump in, take a moment to think about your business, your customers, and your long-term goals. Free isn’t always free—and sometimes, saving a few bucks in fees can cost you more in other ways.

Curious about implementing surcharging the right way? EBizCharge offers a fully compliant and flexible platform that streamlines surcharging while preserving your customer experience. With automated fee calculations, legal signage support, and seamless integration into your existing systems, EBizCharge helps you reduce costs without compromising compliance.

- What is Free Credit Card Processing?

- How Free Online Credit Card Processing Works

- Pros of Free Credit Card Processing Platforms

- Cons and Considerations

- Hidden Fees to Watch Out For

- Comparison of Free Credit Card Processing Providers

- Is Zero Fee Processing Right for Your Business?

- How EBizCharge Supports Surcharging and Transparent Processing

- Final Thoughts on Free Credit Card Processing