Blog > Free Credit Card Processing for Small Businesses: Too Good to Be True?

Free Credit Card Processing for Small Businesses: Too Good to Be True?

For many small business owners, every dollar counts. Whether you’re running a local bakery, an online retail store, or a mobile service, credit card fees can quietly eat away at your profits. That’s why the promise of free credit card processing for small businesses sounds so appealing. Who wouldn’t want to accept card payments without paying a dime?

But what does “free” actually mean in this context? And is it really as simple as it sounds?

In this article, we’ll break down the mechanics behind free online credit card processing for small businesses, explain how these programs work, and explore the legal, financial, and customer service angles you should consider before jumping in.

What “free” credit card processing really means

Despite what the headline might suggest, free credit card payment processing doesn’t mean no one is paying. In most cases, “free” means the payment processing cost is shifted from the business to the customer. Instead of the merchant absorbing the fees, the customer pays a small additional charge—known as a surcharge—at checkout.

There are two main ways this is done:

- Surcharge programs: A percentage-based fee (typically around 3%) is added when a customer pays with a credit card.

- Cash discounting: Prices reflect the cash payment amount and a higher price is applied for credit card transactions.

So, while no-fee payment processing sounds great on paper, it’s more of a redirection of cost rather than the elimination of it.

How it works

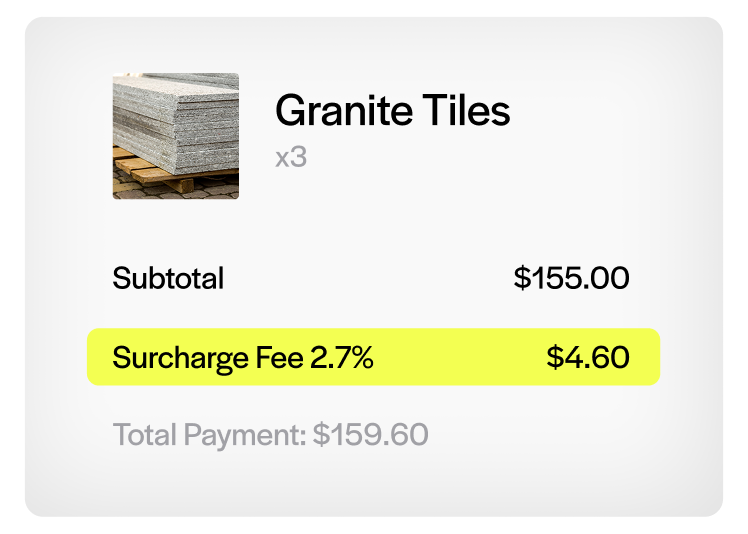

Here’s how it typically plays out. You work with a payment processing solution that offers a surcharge or cash discounting model. They help you configure your POS system or eCommerce platform so it can automatically detect when a customer uses a credit card—and then apply the correct charge only to those qualifying transactions.

This setup involves more than just toggling a setting. It typically includes compliance-ready templates for receipts, signage that explains the surcharge, and software updates that ensure debit card and cash transactions are excluded from any added fees.

For example, if a customer buys a $50 item using a credit card, the system might apply a 3% surcharge—adding $1.50 to the bill. The customer sees this reflected on their receipt or checkout screen. If they choose to pay with debit or cash, the charge doesn’t apply. This level of clarity is essential to help maintain customer trust.

The goal of this structure is to allow merchants to benefit from free credit card processing for small businesses or free online credit card processing for small businesses by shifting the expense in a way that’s transparent and compliant with card brand rules. It’s not truly free in the purest sense—but it can feel that way on your balance sheet if done right.

What’s the catch?

As with anything labeled “free,” there are a few things to keep an eye on.

Some payment processing providers who advertise free credit card payment processing still charge monthly service fees, sell or lease proprietary equipment, or bundle their offers with long-term contracts. These costs may not show up until you’re locked in.

There are also regulatory and reputational issues. Some states restrict surcharging or cash discounting altogether. And even when legal, adding fees at checkout may frustrate your customers—especially if they weren’t expecting it.

Before signing up for any free online credit card processing for small businesses, it’s important to dig into the details.

Legal and compliance concerns

While surcharging is permitted at the federal level in the U.S., the legal landscape becomes trickier at the state level. Some states—like Connecticut and Massachusetts—still have active bans on the practice, while others allow it under strict conditions. That means what’s perfectly legal in one state might land you in hot water in another.

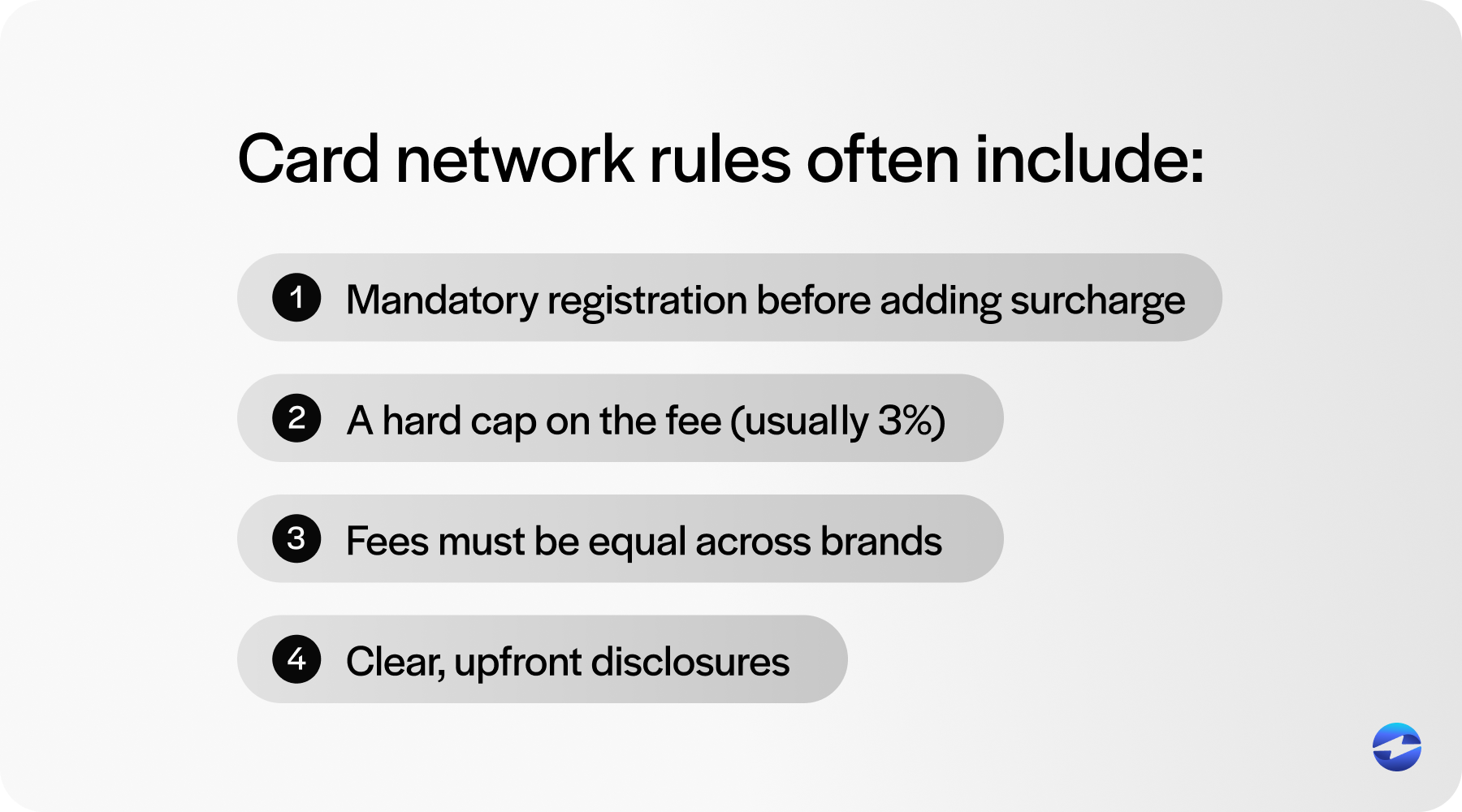

And it’s not just state laws you need to worry about. Major card networks, like Visa, Mastercard, American Express, and Discover, all have their own sets of rules designed to protect consumers and ensure transparency. These typically include:

- Mandatory registration with the card network before adding a surcharge.

- A hard cap on the fee—usually no more than 3% of the transaction amount.

- A requirement that fees are applied equally across all credit card brands (known as brand parity).

- Clear, upfront disclosures—both at the point of entry and at the point of sale.

These requirements aren’t optional. Failing to comply can lead to penalties, chargebacks, or even termination of your ability to accept cards. And while a reliable payment processing solution can help automate compliance and guide you through the setup, the responsibility ultimately falls on you to understand and uphold the rules. If you’re unsure, it’s worth consulting legal counsel or your processor to avoid costly missteps.

Pros and cons for small businesses

Let’s talk about what’s actually on the table when it comes to free credit card payment processing. Like most business decisions, this approach has advantages and disadvantages. The key is to understand where it might fit well—and where it could cause headaches.

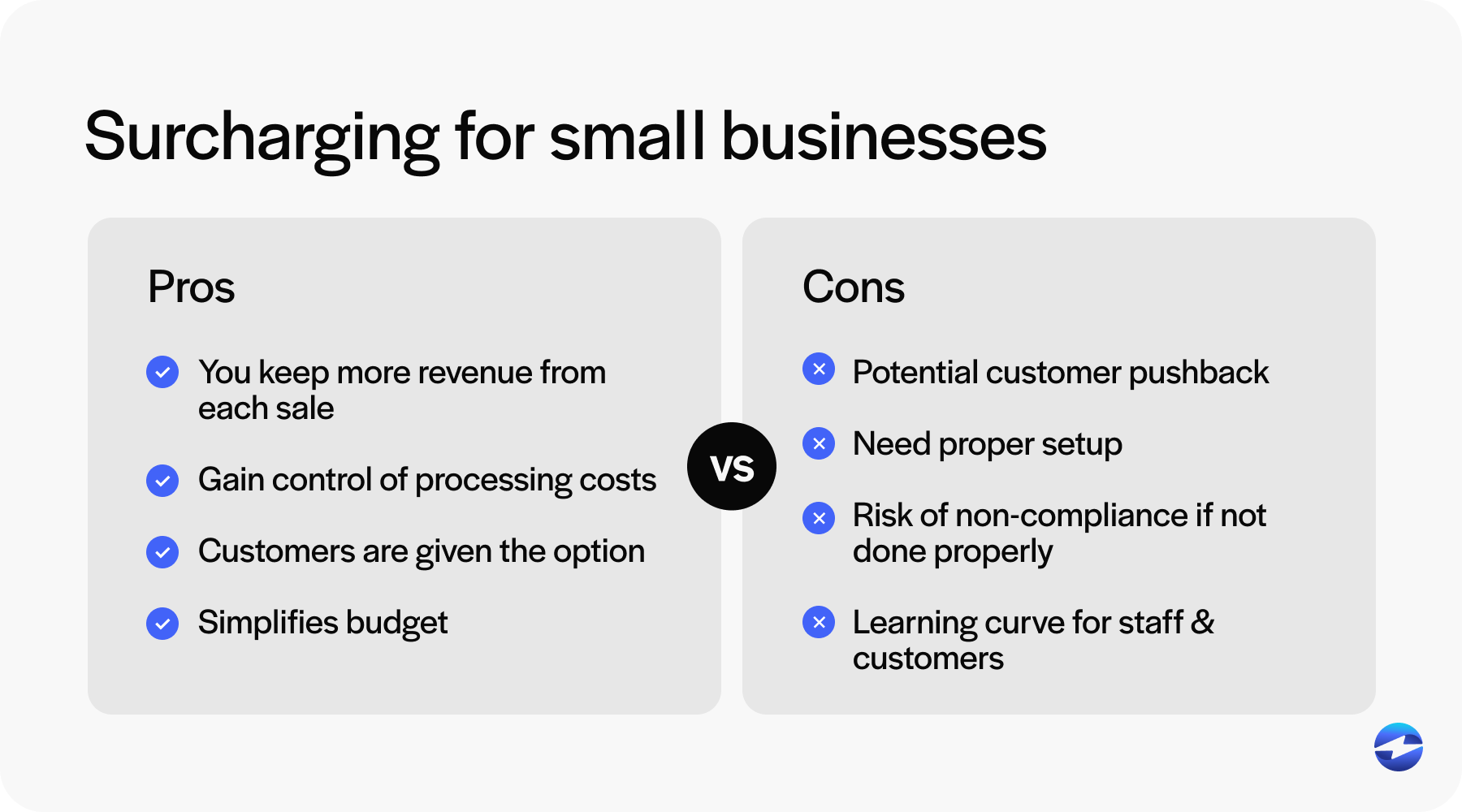

Pros:

- Keeping more revenue from each sale by eliminating processing fees from your balance sheet.

- Gaining control over how and when payment processing costs are applied—whether you absorb them, pass them on, or offer discounts for alternative payment types.

- Customers are given the option to avoid fees by paying with debit or cash, which can foster a sense of choice and transparency.

- Simplifying budgeting, especially for small businesses with tight margins, by creating a predictable financial structure.

Cons:

- Some customers may react negatively to added fees, especially if they’re surprised at checkout. This can affect repeat business and online reviews

- You’ll need the right setup—both technically and operationally—to ensure fees are calculated accurately and disclosed early in the payment process.

- If you’re not careful, you could end up violating state laws or card network rules, which may result in fines or restrictions from your payment processing solution.

- The learning curve for educating staff and customers about surcharging policies can be steeper than expected, particularly in fast-paced retail or service environments.

For many businesses, no-fee payment processing can be a practical tool to reduce overhead—but only if it’s implemented thoughtfully and in compliance with the rules. If you take the time to set it up correctly and communicate it clearly, it can work in your favor.

Is zero-cost credit card processing right for your small business?

Before jumping into free credit card processing for small businesses, take a moment to step back and look at the big picture. This model may offer financial relief, but only if it fits your business structure, customer expectations, and legal environment. Here are a few key questions to consider before making a commitment:

- Are these fees legal in your state? Make sure you’re clear on local regulations before moving forward.

- What are the total monthly costs (not just per transaction)? Ask about hidden fees, equipment leases, or required service plans.

- Can your team clearly explain the surcharge policy to customers? Frontline staff must be confident, consistent, and tactful when addressing questions or complaints.

- Are you okay with potentially losing some price-sensitive customers? Some buyers may walk away if they perceive your checkout fees as unfair or unexpected.

It’s also critical to read the fine print in any contract. Some agreements lock you into long-term deals or include early termination penalties. Others might raise your rates after a few months or charge extra for things like support or reporting tools.

Ultimately, the decision isn’t just about cutting costs—it’s about finding a model that supports your business’s sustainability, compliance, and customer relationships.

Making free processing work with EBizCharge

Free credit card processing for small businesses isn’t necessarily too good to be true—but it does require the right technology and approach. In most models, the cost doesn’t disappear; it’s simply shifted to the customer through a surcharge. This strategy can reduce overhead, but only if implemented with care and full transparency.

That’s where EBizCharge comes in. As a trusted, top-rated payment processing solution, EBizCharge offers a fully compliant and easy-to-deploy no-fee payment processing model. Their platform allows small businesses to apply surcharges automatically at checkout—online or in person—while maintaining compliance with state laws and card network rules. It’s not just about avoiding fees; it’s about doing it right.

EBizCharge equips merchants with all the tools they need: surcharge-ready POS systems, automated disclosures, dynamic fee caps, and integrated reporting. And it’s not just for small businesses—EBizCharge’s robust platform supports companies of all sizes, across a wide range of industries.

So, if your business is struggling with rising payment processing costs, or you’re looking to boost margins without raising prices, EBizCharge can help you turn free credit card payment processing from a marketing promise into a real, sustainable strategy.