Blog > Epicor Payment Processing Fees: What You’re Really Paying

Epicor Payment Processing Fees: What You’re Really Paying

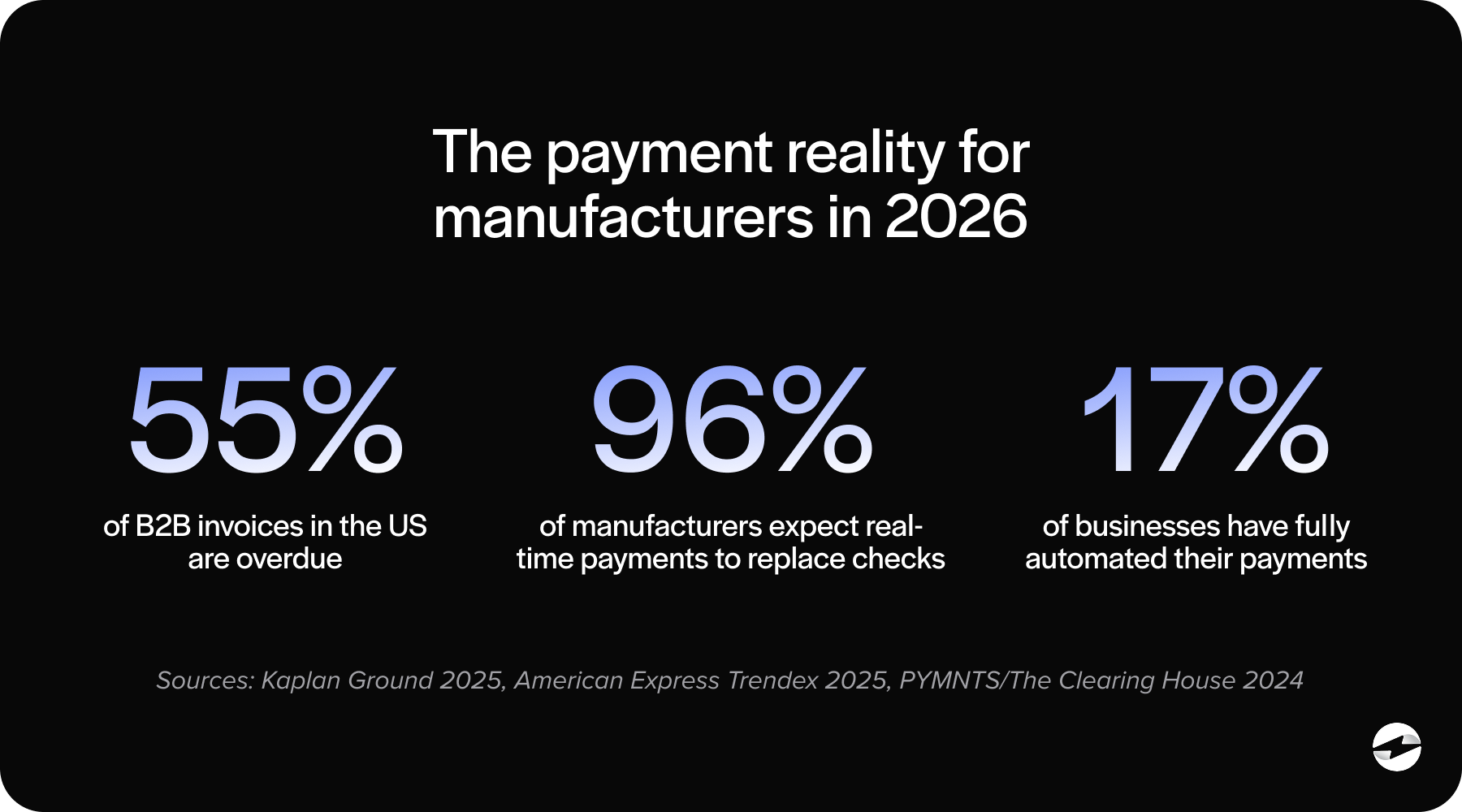

Over time, payment processing fees, and the work that goes with them, can quietly add up.

If you’re responsible for finance, AR, or operations inside Epicor ERP, you’ve probably noticed this. Payments are flowing, but margins feel tighter than expected. Reconciliation takes longer, reporting isn’t as clear as it should be, and it’s hard to say with confidence what you’re really paying to accept customer payments.

This article is for Epicor users who want clarity. Not marketing language or rate quotes taken out of context, but a practical breakdown of Epicor payment processing fees, where they come from, and why many manufacturers eventually rethink how payments are handled inside Epicor software.

How Epicor Payment Processing Fees Typically Work

At a high level, Epicor payment processing follows the same path as most ERP-based payment flows. A customer submits a payment. That payment is routed through a payment gateway, approved by a payment processor, and then posted back to Epicor so invoices close and balances update.

Each step introduces costs.

Some fees are obvious, like credit card processing rates. Others are less visible, buried in monthly statements or offset by internal labor required to manage payments once they hit the system.

Epicor Payment Exchange (EPX), Epicor’s native payment option, sits directly inside Epicor ERP. It simplifies the workflow by keeping payments within the system, but it also centralizes how fees are structured and presented to the business.

Understanding this lifecycle is critical because Epicor processing costs aren’t just about rates. They’re about how much effort it takes to get payments from “received” to “fully reconciled.”

The Types of Fees Epicor Users Commonly Pay

Most Epicor users are familiar with the headline numbers tied to Epicor credit card processing. These usually include interchange fees set by card brands, plus markups added by the processor.

But that’s only part of the picture.

Many manufacturers also pay transaction fees, batch fees, settlement fees, and other per-event charges that don’t stand out until volume increases. Bundled pricing models can make it difficult to see exactly what portion of the cost is negotiable and what isn’t.

Over time, these charges blend together. What looks like a reasonable rate on paper turns into higher-than-expected monthly totals.

This is where Epicor payment fees start to feel opaque—especially when reporting doesn’t make it easy to trace costs back to specific payment activity.

Hidden and Indirect Costs Beyond the Rate

The biggest payment costs usually aren’t the ones listed neatly on a processor statement.

A lot of the real expense shows up as manual work. When AR teams spend time applying payments, fixing mismatches, or tracking down discrepancies, that effort adds up quickly. Even a competitive processing rate can lose its appeal if internal workload keeps growing.

Reconciliation is another quiet drain. When payments don’t post cleanly, finance teams end up spending extra time matching Epicor records to bank deposits. Close cycles slow down, and the risk of small errors creeping in goes up.

Reporting can add friction as well. Without clear visibility into payment activity, it’s harder to spot trends, forecast cash accurately, or question rising Epicor processing costs.

As payment volume increases, these indirect costs can start snowball. What feels manageable at 100 payments a month can turn into a real strain once that number reaches 1,000.

Epicor Payment Exchange (EPX) Fees in Practice

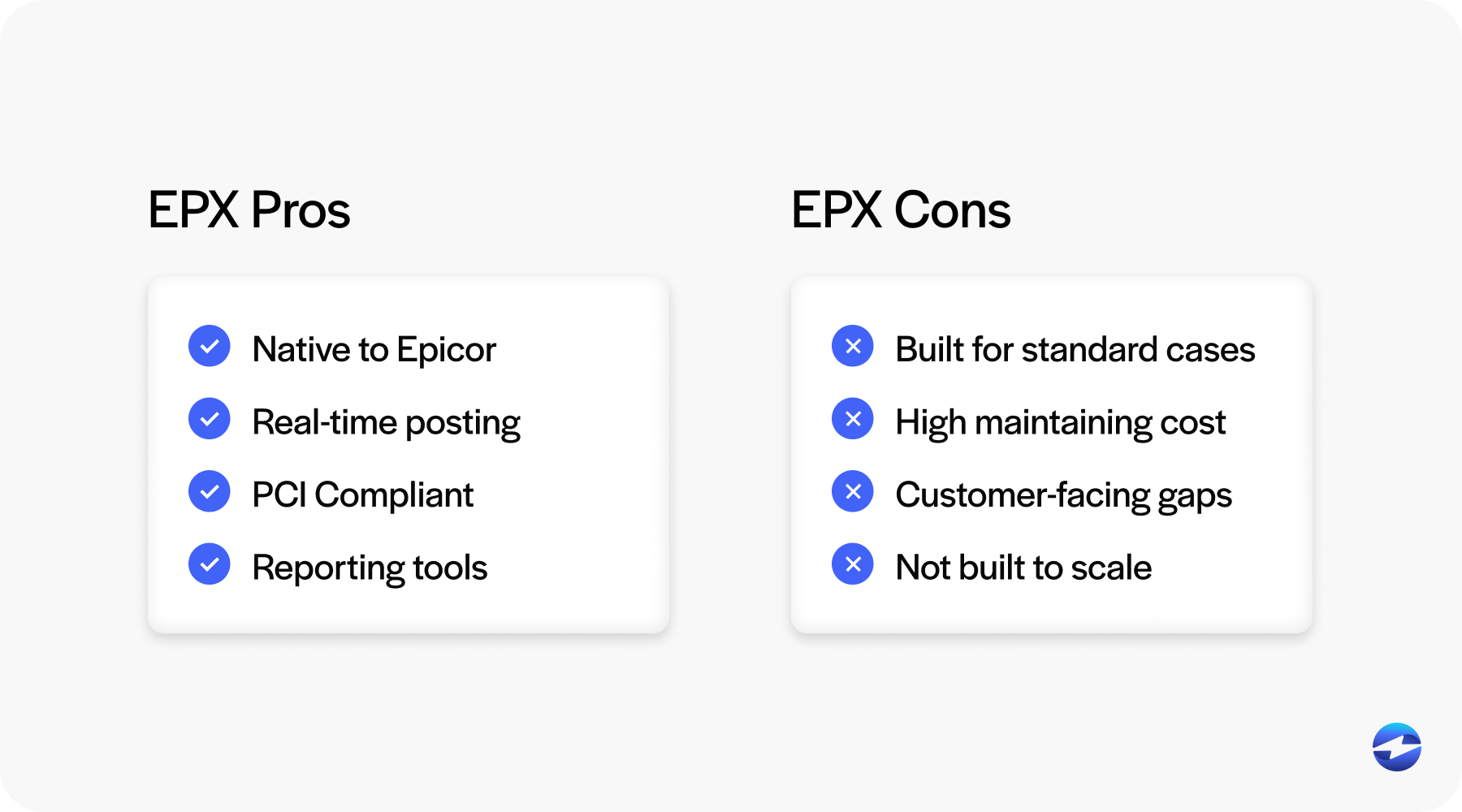

At first glance, Epicor Payment Exchange can seem like a sensible, low-friction option – especially for teams that are just getting started with Epicor.

Because EPX is built directly into Epicor ERP, there’s less to set up and fewer systems to manage. Payment data stays centralized, and for lower volumes with simple payment scenarios, that built-in approach can feel like an easy win.

Over time, though, many teams start to notice trade-offs around visibility and flexibility. Epicor payment processing fees are often bundled together, making it harder to understand what’s actually driving changes from one month to the next.

As volume increases, manufacturers often find that EPX still functions, but not as efficiently as they need. Fees rise, manual steps creep back into AR workflows, and keeping a handle on the true total cost of payments becomes more difficult.

How Third-Party Payment Solutions Change the Cost Equation

Third-party payment solutions approach cost from a broader perspective.

Instead of focusing only on transaction rates, they look at the entire payment workflow. A well-designed payment processing solution integrates directly with Epicor, automates payment entry and application, and reduces the manual work that inflates indirect costs.

Through deeper Epicor integration, payments still flow into Epicor ERP, but with better automation and cleaner data. Fewer exceptions mean fewer hours spent fixing problems.

Pricing models also tend to be clearer. While rates still matter, manufacturers gain better insight into what they’re paying and why.

For many teams, this shift isn’t about chasing the lowest rate. It’s about reducing the total cost of ownership.

Why Manufacturers Start Questioning EPX Costs

The move away from EPX isn’t usually driven by a single big issue. It’s incremental.

Transaction volume increases. Payment types diversify. Customers expect online options and faster confirmation. Internally, finance teams push for faster closes and more reliable reporting.

At the same time, Epicor payment fees become harder to explain. Monthly totals rise, but it’s unclear which costs are unavoidable and which are tied to inefficiencies.

Eventually, teams realize the problem isn’t just the rate—it’s the system supporting it.

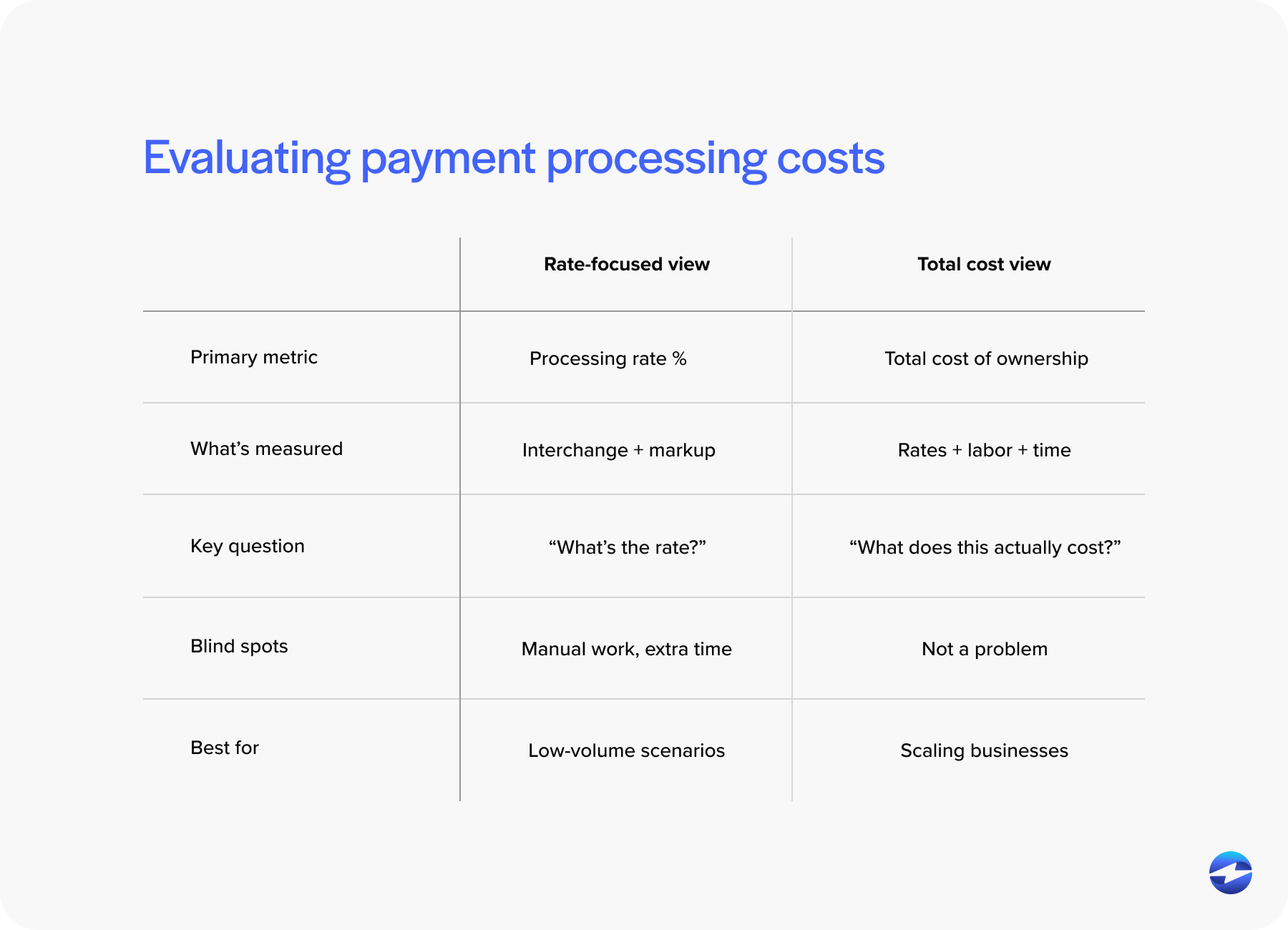

Evaluating the True Cost of Epicor Payment Processing

To accurately evaluate Epicor payment processing, it helps to zoom out.

Processing rates are important, but they’re only one piece of the puzzle. Labor, reconciliation time, reporting clarity, and scalability all factor into real cost.

Ask practical questions. How many hours does your team spend managing payments each month? How often do errors require follow-up? How predictable are Epicor payment processing fees as volume grows?

A solution that reduces internal effort can deliver more value than one that simply advertises a lower percentage.

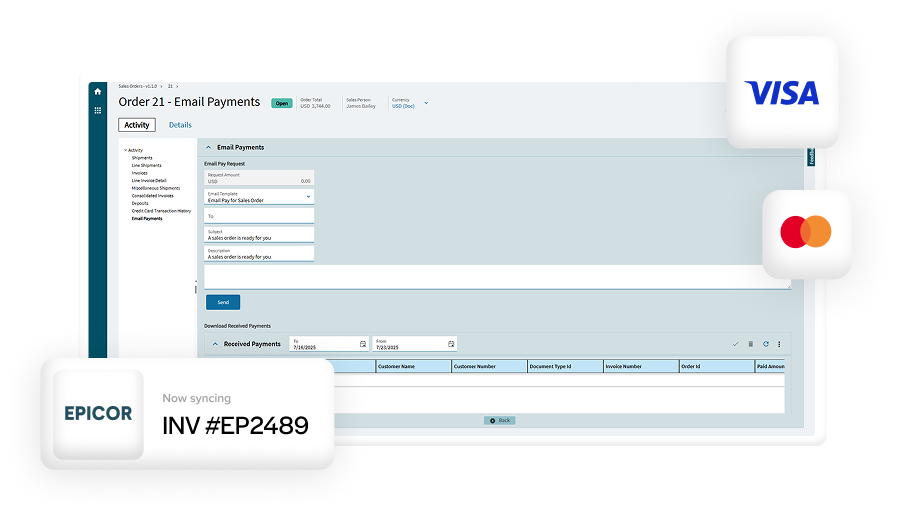

How EBizCharge Helps Epicor Users Gain Cost Control

For many Epicor users, EBizCharge comes into the picture once teams start taking a closer look at where time and money are really going.

EBizCharge integrates directly with Epicor ERP, so payments are entered and applied automatically while all the data stays inside Epicor. That tighter Epicor integration reduces manual work and makes it easier to see what’s actually happening with payments.

When workflows are streamlined, teams spend less time correcting issues and more time reviewing results. Clearer pricing and reporting also make it easier to track and manage Epicor processing costs without guesswork.

That combination of automation and transparency is what leads many manufacturers to move away from Epicor Payment Exchange and adopt EBizCharge as their business grows.

Key Takeaways for Epicor ERP Users

Epicor payment processing fees are rarely just about rates. They reflect how payments move through your business.

Understanding the full picture—from transaction costs to internal effort—is critical for long-term scalability. As volume grows, small inefficiencies become expensive habits.

Taking a full-cost view of your payment processing solution can help ensure payments support growth instead of quietly working against it.

- How Epicor Payment Processing Fees Typically Work

- The Types of Fees Epicor Users Commonly Pay

- Hidden and Indirect Costs Beyond the Rate

- Epicor Payment Exchange (EPX) Fees in Practice

- How Third-Party Payment Solutions Change the Cost Equation

- Why Manufacturers Start Questioning EPX Costs

- Evaluating the True Cost of Epicor Payment Processing

- How EBizCharge Helps Epicor Users Gain Cost Control

- Key Takeaways for Epicor ERP Users