Blog > EBizCharge vs Sage Payment Solutions: 2026 Comparison

EBizCharge vs Sage Payment Solutions: 2026 Comparison

Choosing the right payment processor inside the Sage Intacct ERP system can have a bigger impact on your operations than many realize. The payment tool you select affects how quickly you get paid, how clean your data stays, and even how much you end up spending on processing fees. This guide will explore two popular options: EBizCharge and Sage Payment Solutions. Both are capable tools built to streamline billing and reconciliation, but they approach these goals in very different ways.

This comparison breaks down how these platforms stack up in 2026, looking closely at their integration with Sage Intacct, automation features, cost models, and flexibility. It’s written for professionals who rely on their financial systems daily and need clear, practical insights rather than buzzwords.

Understanding Sage Intacct Payment Processing and Integration

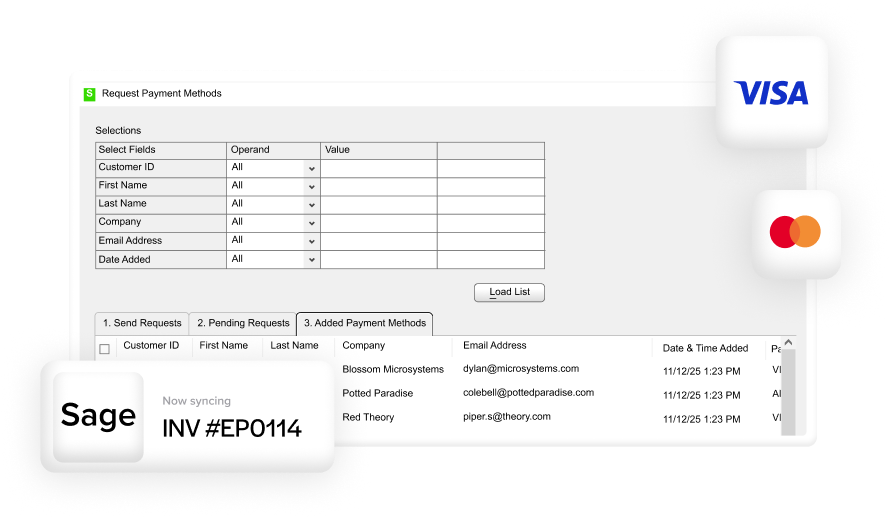

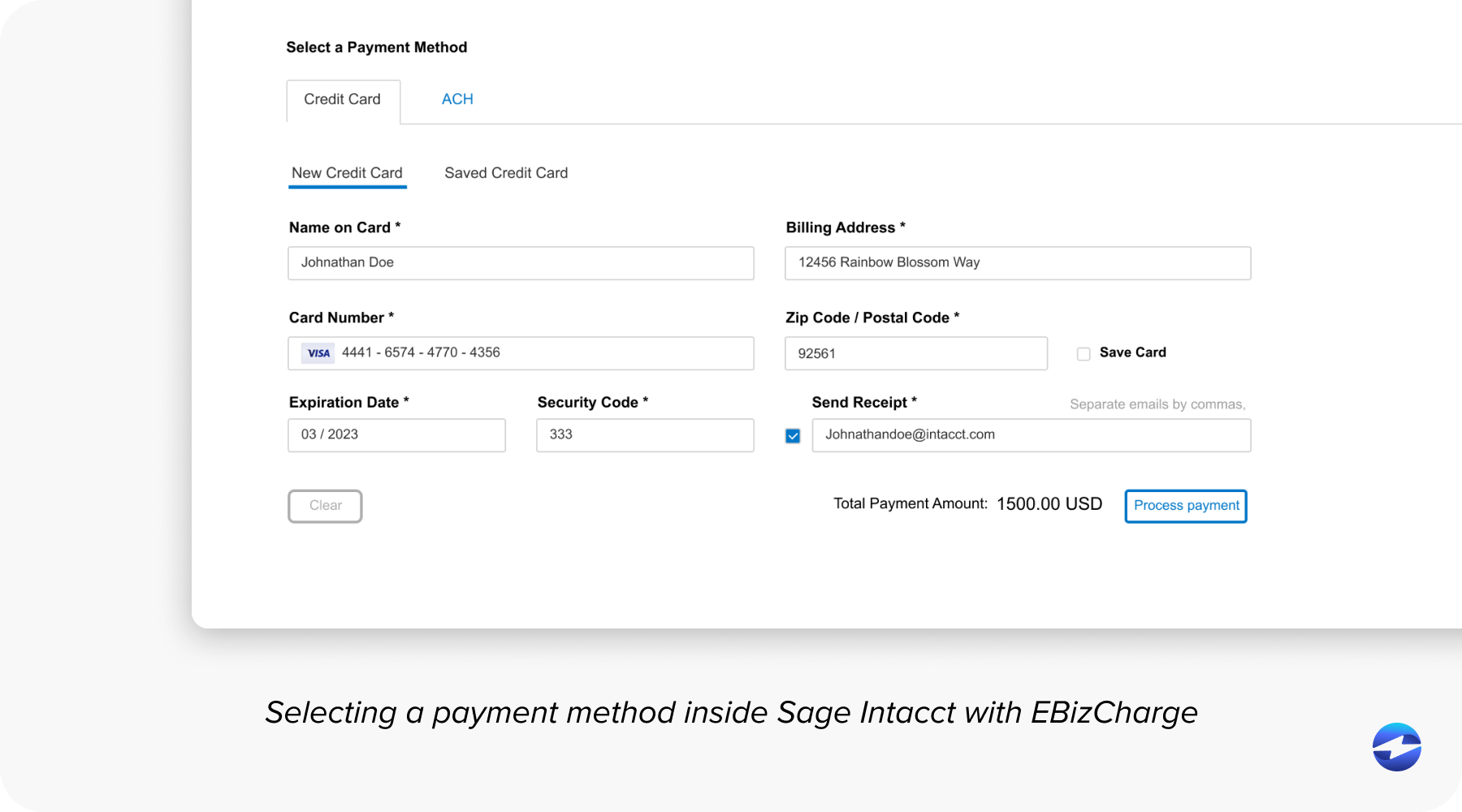

The Sage Intacct ERP system has become a cornerstone for finance and accounting teams because of its ability to centralize billing, payments, and reporting. Sage Intacct payment processing ties these components together by linking customer transactions directly into invoices and the general ledger. When a customer makes a payment—whether through a card, ACH, or digital wallet—the data flows into Sage Intacct automatically, keeping records accurate without the need for manual entry.

Integration is where things start to diverge between EBizCharge and Sage Payment Solutions. Both are designed for Sage integration but differ in depth and flexibility. Sage’s built-in system is convenient—it comes preconfigured and works within the standard modules of the platform. However, that convenience can also mean limited customization for businesses that need more control over how transactions are handled.

EBizCharge, on the other hand, was designed from the ground up to integrate natively with Sage ERP software integration frameworks. It syncs payment data directly to invoices, accounts, and opportunities in real time, which means no double entry and fewer reconciliation headaches. For IT and finance teams, this difference in automation and workflow efficiency can translate into hours saved every week.

EBizCharge vs Sage Payment Solutions: Feature Comparison

When comparing these two systems, it’s best to break them down by what matters most to most businesses: integration, automation, security, flexibility, and support.

Integration and Ease of Setup

Sage Payment Solutions is already baked into the Sage Intacct ecosystem, making it easy to activate and use. However, its one-size-fits-all approach doesn’t always fit growing businesses that need custom billing or multi-location setups. It’s simple, but it’s not always adaptable.

EBizCharge offers a deeper level of Sage ERP integration. Setup is still straightforward, but it allows for more configuration. Users can define how transactions post, which accounts receive updates, and how customer records are linked. This flexibility ensures the integration works around your workflow—not the other way around.

Automation and Efficiency

Both tools help reduce manual work, but EBizCharge takes automation a step further. It handles recurring payments, automates failed payment retries, and even streamlines reconciliation so finance teams don’t have to close transactions by hand. Sage Payment Solutions automates basic billing, but more complex scheduling or subscription management often requires additional setup or outside tools.

Security and Compliance

Security is strong in both systems. Sage Intacct credit card processing within Sage’s platform is PCI-compliant and secure, and EBizCharge matches that standard while also including built-in tokenization and advanced fraud detection. EBizCharge’s approach also minimizes PCI scope since sensitive card data never touches the Sage environment directly—a big plus for compliance and audit teams.

Customization and Flexibility

Customization is another key difference. Sage Payment Solutions provides a consistent, standardized framework that works well for smaller businesses or those who prefer predictability. EBizCharge, in contrast, lets users customize everything from customer payment portals to approval workflows. It adapts to complex billing setups and can handle multiple entities, currencies, or divisions—all without extensive development work.

User Experience and Support

Sage’s built-in support is well-documented but can be generalized since it serves a large base of Sage users. EBizCharge stands out with support teams trained specifically in Sage systems. When issues arise, users often deal with experts who understand both the ERP and payment workflows. That difference can make troubleshooting and deployment noticeably smoother.

Cost Considerations: Sage Intacct Payment Processing Costs

Pricing is often the deciding factor. While Sage Intacct pricing varies depending on user count, modules, and volume, how payment processing is billed can significantly impact total cost. Sage Payment Solutions typically uses a bundled rate model—one flat percentage for all transactions. It’s simple, but that simplicity can hide how much you’re actually paying on certain card types, particularly rewards or business cards that carry higher interchange fees.

EBizCharge, by contrast, uses interchange optimization to lower rates automatically. This means every transaction is categorized into the least expensive interchange bracket available. For companies handling hundreds or thousands of transactions a month, this feature alone can save a meaningful amount each year.

From a broader perspective, the more transparent model from EBizCharge allows finance leaders to clearly see where each dollar goes. For businesses focused on scaling, flexibility in cost structures and clearer insights into margins often provide better long-term value than flat-rate convenience.

Alternatives to Sage Intacct Solutions

EBizCharge isn’t the only third-party processor available for Sage Intacct payment processing, but it’s often considered one of the best. Other providers, like Paya or Repay, also integrate with Sage ERP software integration frameworks and serve different use cases. However, EBizCharge’s native connection and full automation capabilities make it stand out as a preferred payment processing solution for companies that want control without adding technical complexity.

For organizations already embedded in Sage, switching to an external payment tool can feel risky—but when it results in lower fees, faster reconciliation, and better reporting, that shift usually pays off. EBizCharge makes this transition relatively seamless with its plug-and-play integration and experienced implementation teams.

Why EBizCharge Stands Out in 2026

In 2026, efficiency and flexibility continue to drive ERP innovation. For businesses using Sage Intacct, the ability to control costs, automate workflows, and maintain clean data is no longer optional—it’s a necessity.

EBizCharge gives companies that control. It combines direct Sage integration with smart automation and clear pricing, allowing finance teams to focus on strategy instead of manual processes. Its native Sage Intacct credit card processing capabilities make it easy to accept payments, reconcile data, and ensure everything stays accurate across departments.

Sage Payment Solutions remains a strong option for companies that want simplicity and prefer to stay fully within the Sage ecosystem. However, it’s less flexible for those looking to optimize costs or add customized automation.

For most businesses aiming to grow and modernize their financial operations, EBizCharge tends to be the more adaptable and cost-effective choice. It provides a scalable payment processor that enhances rather than limits how you use your Sage Intacct ERP system. In the end, both solutions have merit—but for 2026, EBizCharge delivers the kind of freedom, transparency, and efficiency that today’s finance professionals depend on.