Blog > Digital Wallets and BNPL Are Rising, but 54% Of Customers Still Prefer Traditional Methods. Here’s Why:

Digital Wallets and BNPL Are Rising, but 54% Of Customers Still Prefer Traditional Methods. Here’s Why:

In an era where convenience often reigns supreme, the rise of digital wallets and Buy Now Pay Later (BNPL) options reflect a significant shift in consumer behavior. However, despite the allure of these modern payment solutions, most customers still cling to traditional methods.

Understanding the mechanics behind digital wallets and BNPL reveals their appeal and limitations.

This article will explore the reasons for the enduring preference for traditional payment methods, the importance of familiarity, security concerns, and other factors contributing to this unexpected trend.

Understanding digital wallets and BNPL

In recent years, digital wallets and Buy Now Pay Later (BNPL) services have gained popularity among consumers since they offer innovative ways to manage and make payments.

Many people, however, continue to rely on traditional methods. To understand the shift in payment preferences, it’s essential to know what digital wallets and BNPL are.

What are digital wallets?

Digital wallets are applications on smartphones or computers that securely store payment information. With digital wallets, consumers can make transactions without needing physical cash or cards.

Popular digital wallets include Google Pay, Apple Pay, and PayPal. They offer convenient online payment methods and are gaining widespread adoption. Users value the speed and ease of contactless payments and real-time payments.

What is Buy Now Pay Later (BNPL)?

Buy Now Pay Later is a service that allows consumers to make purchases and pay over time. BNPL is an alternative to using credit cards, offering personalized experiences with flexible payment plans. These services appeal to those who may not have access to traditional credit and prefer self-service options.

BNPL offers customers more control over their spending while shopping online or in-store. This service is becoming more integrated into various online transactions and digital channels.

While it’s important to understand the difference between these payment methods as they have become increasingly popular, a recent survey indicates that customers still favor traditional payment methods over these newer ones.

The continued preference for traditional payment methods

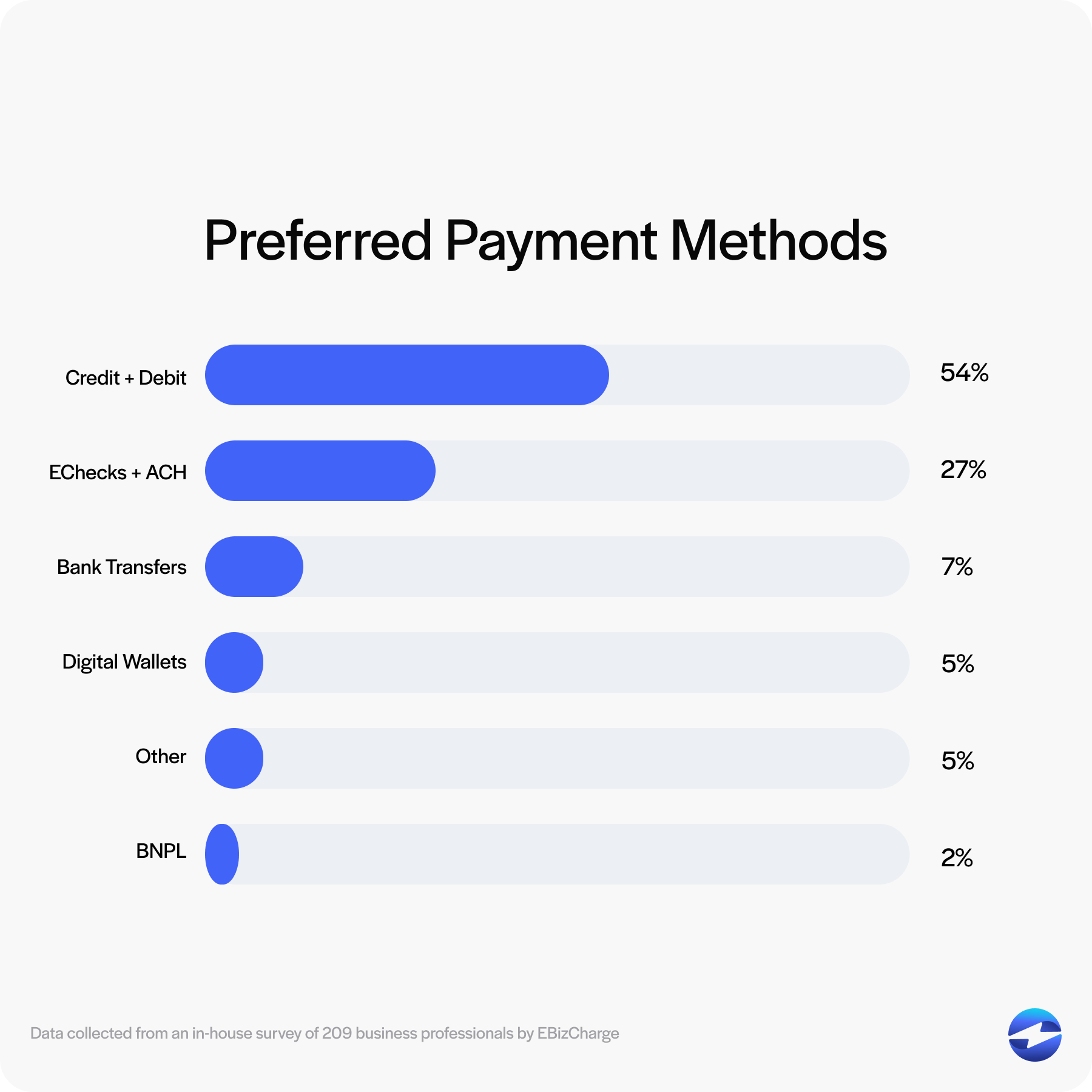

In Q1 2025, we surveyed 209 payment decision-makers to assess their customers’ preferred payment methods.

Here’s what the survey found:

- Credit and debit cards are the most preferred method, used by 54% of participants’ customers. This shows that traditional card payments remain dominant among customers.

- EChecks and Automated Clearing House (ACH) payments come next, with 27% of participants selecting these methods. These electronic payments appeal to those who prefer direct bank transactions.

- Digital wallets account for 5% of the preferences. This relatively small proportion suggests that digital wallets aren’t the top choice yet despite their growing popularity.

- Bank transfers accounted for 7%. This indicates moderate use for direct account-to-account transfers.

- BNPL accounted for only 2%, reflecting limited adoption or preference for this payment method.

- Lastly, other payment methods collectively accounted for 5%, indicating that some participants prefer methods not listed explicitly in the survey.

The results suggest that customers value familiarity, convenience, and widespread acceptance of traditional payment methods, particularly credit and debit cards, over newer alternatives.

Why customers prefer traditional payment methods

Even with the growth of digital payments, many still favor traditional methods, so why is this still the case?

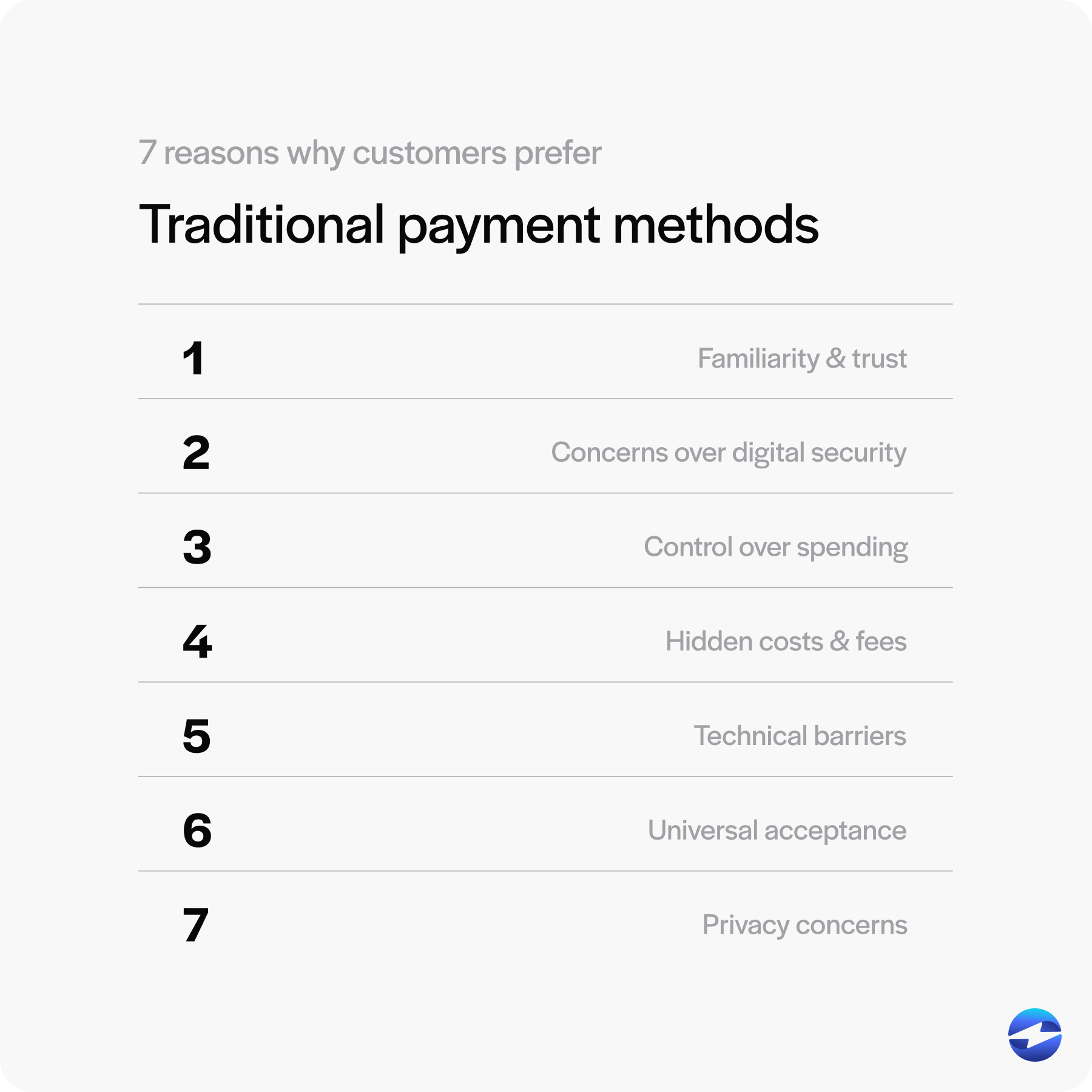

Here are seven reasons why customers may prefer traditional methods like credit or debit over newer options:

- Familiarity and trust: Customers are used to credit and debit cards. They find them dependable and easy to use. Digital wallets and BNPL options are new. Some customers don’t feel as confident with them yet.

- Concerns over digital security: Payment security has become a significant concern for many nowadays, and customers don’t want to worry about their information being stolen. Since traditional methods have long-standing security measures, they make users feel safer when using them.

- Control over spending: With traditional methods, you know exactly what you have. Credit and debit cards can help consumers manage finances, build credit, and track spending habits. Buy Now Pay Later, on the other hand, may offer convenience but can also lead to unexpected debt if not managed carefully. This lack of immediate control can worry consumers.

- Hidden costs and fees: Traditional payment methods are usually straightforward, notifying customers of any fees beforehand. Digital wallets and BNPL may include hidden costs, which can cause surprise expenses later.

- Technical barriers: Digital payments may not be easy for consumers who have never used these methods or are less tech-savvy. This can hinder them from venturing away from traditional options.

- Universal acceptance: Credit and debit cards are accepted almost everywhere and are used for online and in-person purchases. Digital wallets and BNPL aren’t widely recognized yet, making them less accessible.

- Privacy concerns: Using digital methods often means sharing more personal info, which can lead to privacy concerns for some users. Traditional methods ask for less personal data, which many prefer.

It’s easy to see why traditional payments are still popular. While the shift to alternative payment methods may be slow, it continues to gain momentum.

The future of payment methods

With new technologies, people have more choices than ever before. Digital wallets like Google Pay and BNPL services continue to gain traction, offering convenience and speed in online transactions. So, what will the future of transactions look like moving forward?

The future of payments will likely include traditional and digital methods, innovative payment security, more reliable technology, and generational payment trends.

Coexistence of traditional and digital payments

Cash and cards aren’t going anywhere, as consumers aren’t likely to abandon traditional payments completely.

Traditional methods offer a sense of safety and tangibility that digital payment methods can’t fully match yet. Traditional methods also meet customer expectations for secure payments and customer satisfaction.

In many places, cash is still king, especially where digital infrastructure is weak. A blended approach will likely dominate the future. Digital payments will complement rather than replace cash and cards. This blended method provides flexibility, giving customers a seamless, positive customer experience.

Role of innovation

Advancements in financial technology will likely make digital wallets and BNPL even more attractive to consumers.

As enhanced security features address concerns over online transactions, real-time and contactless payments can improve usability and reduce friction.

Personalized experiences can also offer positive customer interaction through digital channels. These innovations are also helping make bad experiences rare. They make digital options not just viable, but appealing.

Generational shifts

Younger generations are digital natives since they grew up with smartphones and tablets and are more comfortable using online payment methods.

As this generation ages, the balance may tip further in favor of newer payment methods since they expect seamless digital experiences and self-service options. This shift is likely to continue, reshaping customer experiences. However, traditional methods will remain a part of the landscape, offering security and familiarity.

A mix of traditional and digital payment methods will shape the future. Innovation will continue to refine digital options, while generational changes will shift usage trends. Customers will have more choices, and the key will be finding the right blend of old and new.

Adapting to the evolving payment landscape

Traditional methods persist as trusted pillars of financial transactions due to their simplicity, universal acceptance, and established security measures, which may indicate that consumers value reliability alongside technological progress.

The payment landscape will likely evolve as innovation refines digital payments and addresses their limitations. However, the coexistence of traditional and modern payment methods is essential to meet diverse consumer needs. Financial service providers must strive to bridge the gap by educating users, enhancing digital infrastructure, and building trust in newer technologies.

Ultimately, the future of payments will hinge on offering consumers the flexibility to choose the method that aligns with their comfort, needs, and circumstances.