Blog > Credit Card Settlements Explained: How They Influence Your Finances

Credit Card Settlements Explained: How They Influence Your Finances

Since managing credit card transactions can be complex, understanding how their settlements work is essential to maintaining financial health as consumer spending rises.

Credit card settlements involve various processes and parties that ensure transactions are accurately recorded and funds are transferred. This intricate operation is fundamental to merchants and customers in navigating the world of credit card usage.

Understanding how the credit card settlement process works can help businesses optimize their cash flow and improve financial management.

What is a credit card settlement?

Credit card settlement, or payment settlement, refers to the process by which a merchant receives funds from a credit card transaction. Settlement occurs after a sale has been authorized and captured, ensuring the payment moves from the customer’s bank account to the merchant’s account.

The payment settlement process involves various intermediaries, including the card issuer, the acquiring bank, and the payment processor. This makes settlement a crucial step in maintaining business liquidity.

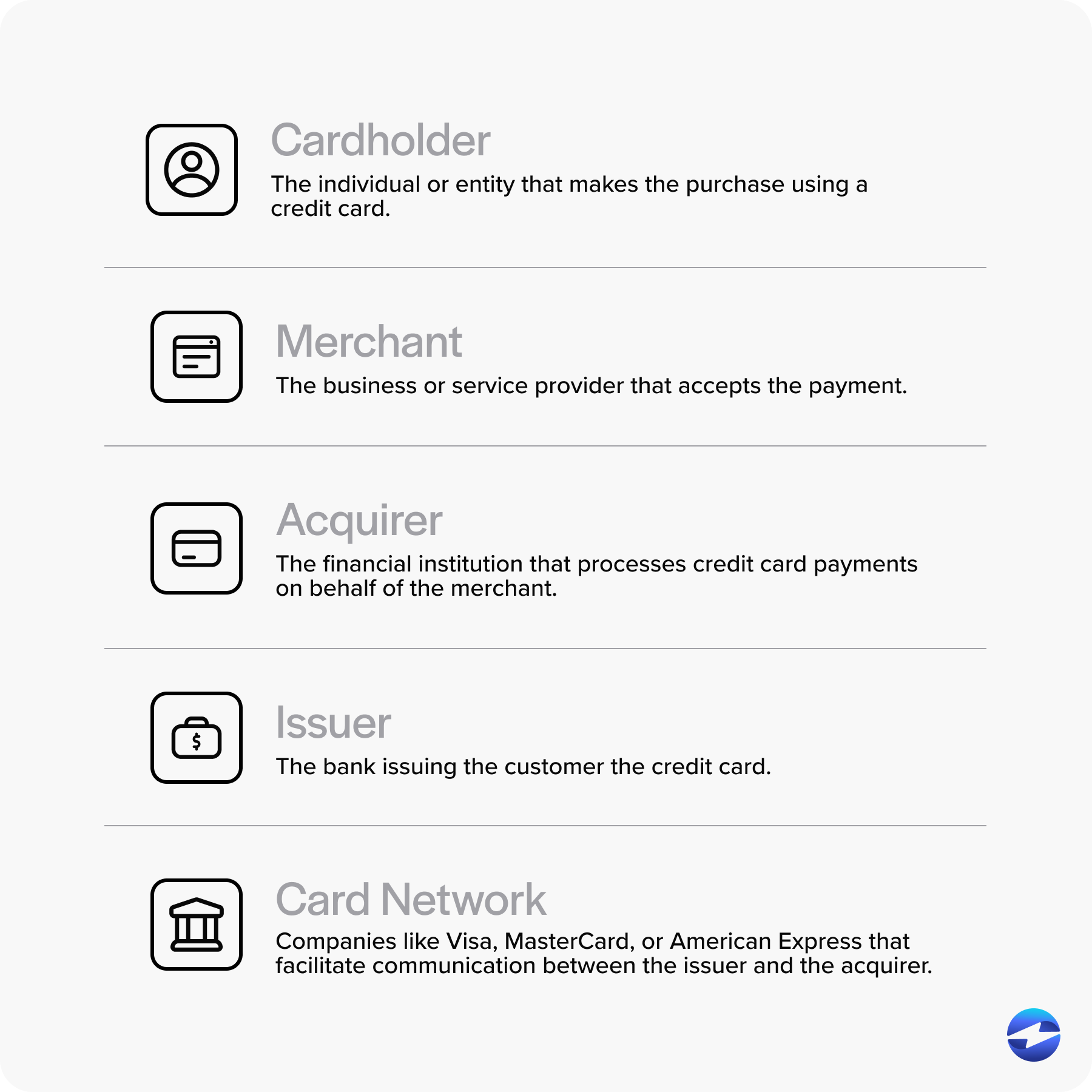

5 critical parties involved in the credit card settlement process

It’s essential to know the roles of various key players involved in the credit card settlement process to better understand how this process works.

Here are five key players that facilitate this payment settlement process:

- Cardholder: The individual or entity that makes the purchase using a credit card.

- Merchant: The business or service provider that accepts the payment.

- Acquirer (merchant’s bank): The financial institution that processes credit card payments on behalf of the merchant.

- Issuer (cardholder’s bank): The bank issuing the customer the credit card.

- Card network: Companies like Visa, MasterCard, or American Express that facilitate communication between the issuer and the acquirer.

These participants work together to ensure the smooth transfer of funds from a customer’s account to a merchant’s account.

Alongside these parties, merchants should be aware of different types of settlements.

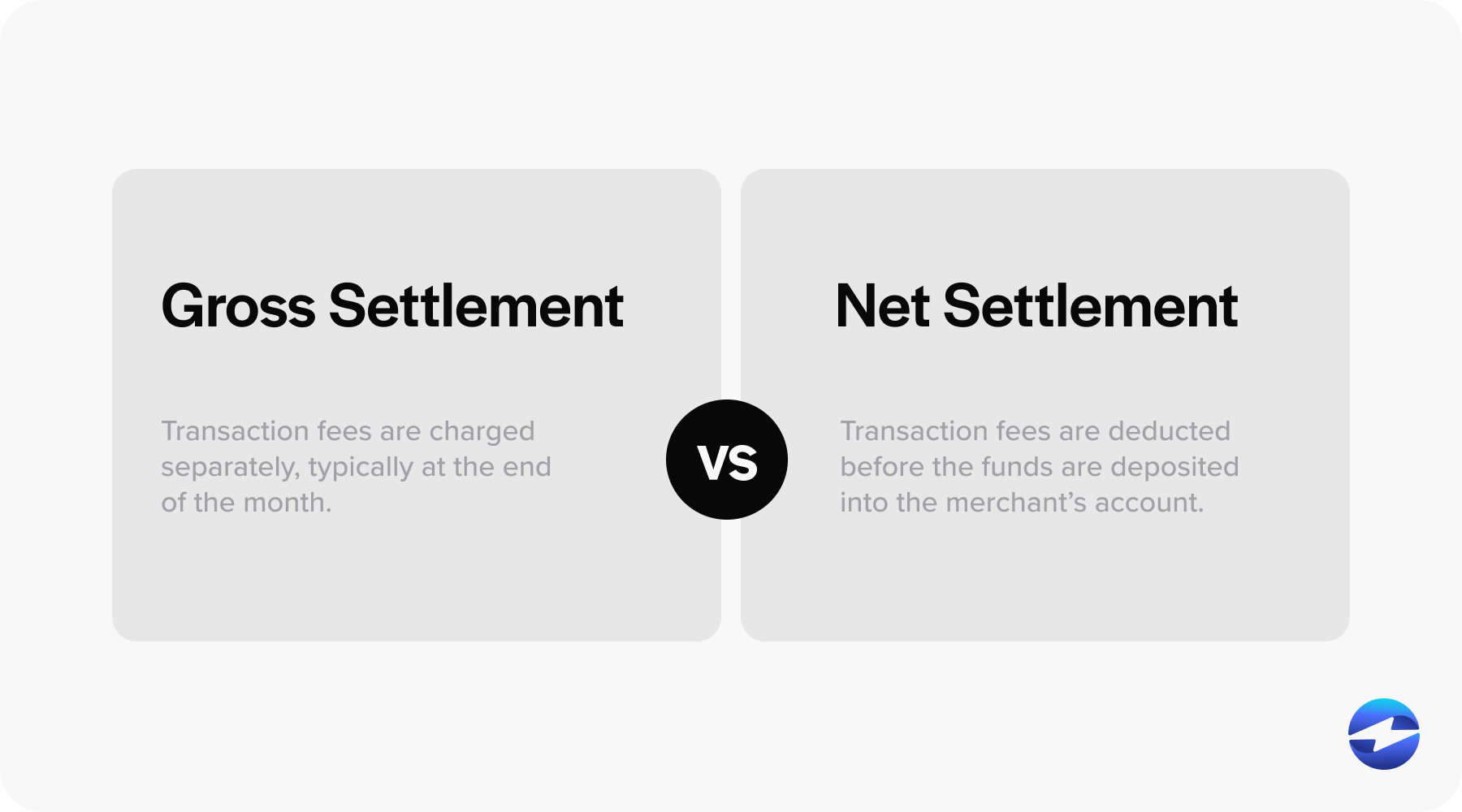

Gross settlements vs. net settlements

Businesses may encounter two primary types of settlements when handling credit card payments: gross settlements and net settlements.

Understanding the difference is crucial for effectively managing cash flow and reconciling accounts. Here’s a quick explanation of each:

- Gross Settlement: The total transaction amount is deposited into the merchant’s account without deducting any fees upfront. Transaction fees, such as processing or interchange fees, are charged separately, typically at the end of the month. This method gives merchants a clear view of their total sales revenue before deductions.

- Net Settlement: Transaction fees are deducted before the funds are deposited into the merchant’s account. Merchants only receive the remaining amount after fees have been subtracted. This approach simplifies accounting by eliminating the need to account for separate fee payments later.

The choice between gross and net settlements often depends on merchants’ preferences and payment processors’ policies. Gross settlements offer greater visibility into sales totals, while net settlements provide more immediate clarity on actual funds received. Now that you know how the credit card settlement process works, different settlement types, and the various parties involved, there are several crucial steps within the process to familiarize yourself with.

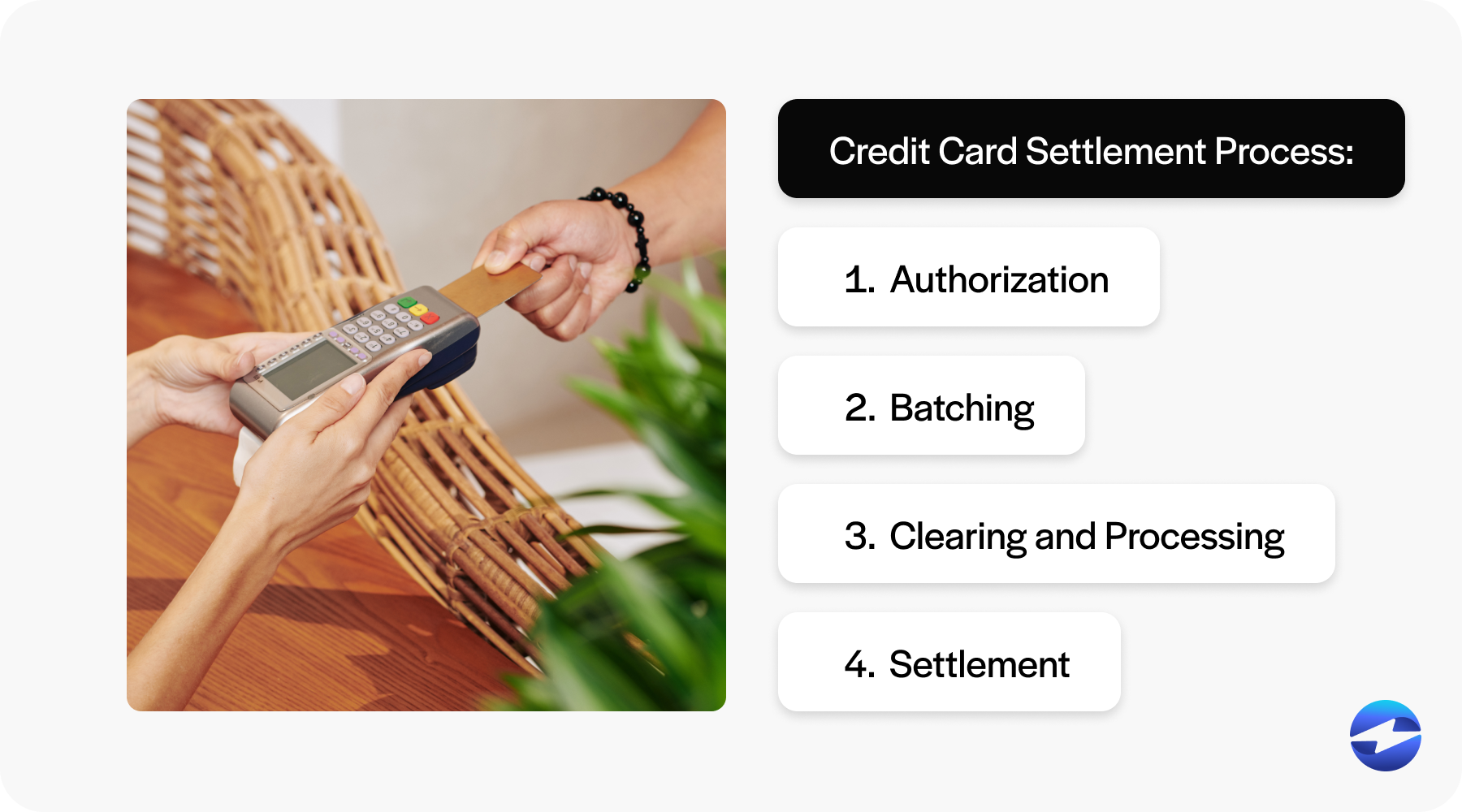

4 steps of the credit card settlement process

A credit card settlement ensures that a transaction is efficiently and accurately processed between cardholders, merchants, and financial institutions. Therefore, this process involves critical steps to verify these payments and successfully transfer funds.

Here are the four steps involved in the credit card settlement process:

- Authorization: Once a cardholder makes a purchase, the merchant submits the transaction details to the acquirer. The acquirer then forwards this request to the card network, which confirms with the issuer to approve or decline the transaction.

- Batching: The merchant compiles authorized transactions into a batch throughout the day. At the end of the business day, this batch is submitted to the acquirer for processing.

- Clearing and processing: The acquirer sends the batch to the card network for clearing. The card network communicates with the issuer to verify the transactions and adjust the account balances accordingly.

- Settlement: The issuer transfers the payment to the card network, which then sends it to the acquirer. The acquirer deposits the funds into the merchant’s account, typically subtracting the transaction fees.

While these steps are intuitive and follow a clear path, there are some important factors to consider that may affect settlement times.

Important factors affecting settlement time

The duration of the settlement process can vary depending on several factors, such as financial institution policies, various payment methods, and more.

Bank policies play a significant role, as each acquirer and issuer may have different rules that affect the settlement timeline. The payment method used can also influence the speed of processing. For instance, credit card payments often settle faster than Automated Clearing House (ACH) transfers or other methods.

Cutoff times are another important consideration, as transactions submitted after a specific time may be pushed to the next business day. Additionally, holidays and weekends can extend the settlement time, as non-business days disrupt regular processing.

Understanding these factors can help merchants set realistic expectations and manage their cash flow more effectively. They can also look for helpful tips to optimize the settlement process.

How long does it take for merchants to get paid?

While credit card settlement times can vary depending on several factors, such as the payment processor and the merchant’s agreement with their acquiring bank, there are general timeframes in which these payments may settle.

Typically, the payment effective date for most merchants is within 1 to 3 business days after the transaction is processed. Howspecific industries, high-risk businesses, or new merchant accounts may experience longer processing times, sometimes up to 7 business days.

To minimize delays, merchants can work with a reliable payment processor and ensure their accounts are in good standing. Understanding these timelines will help you manage cash flow and ensure smoother business operations.

4 tips for optimizing the credit card settlement process

To optimize the credit card settlement process, merchants can adopt several best practices that help ensure efficiency and minimize delays.

Here are four tips you can implement to improve your credit card settlements:

- Submit batches promptly: Ensure that batches are submitted at the end of each business day to avoid delays.

- Use an integrated payment solution: Integrated solutions can automate and streamline the batching and settlement processes, saving time.

- Monitor transaction status: Regularly review transaction statuses to quickly identify and resolve any issues.

- Maintain clear communication with the acquirer: Establish a good relationship with your payment processor or acquirer to get prompt assistance.

By following these strategies, businesses can create a more seamless settlement process that facilitates more cash flow and improves operations.

How EBizCharge enhances and accelerates the settlement process

EBizCharge is a top-rated payment processing software built to simplify and optimize the credit card settlement process for merchants and their customers.

With seamless integration into various ERP and accounting software systems, EBizCharge automates many aspects of payment processing, minimizing manual tasks and reducing the likelihood of errors.

The EBizCharge payment platform offers key advantages, including automated processes and real-time tracking, allowing businesses to track and leverage their customer payments, boost operational efficiency, and ensure timely payment receipts.

By adopting EBizCharge, businesses can transform their payment operations and focus on what matters most — growing their business.

- What is a credit card settlement?

- 5 critical parties involved in the credit card settlement process

- Gross settlements vs. net settlements

- 4 steps of the credit card settlement process

- Important factors affecting settlement time

- How long does it take for merchants to get paid?

- 4 tips for optimizing the credit card settlement process

- How EBizCharge enhances and accelerates the settlement process