Blog > Credit Card Processing in Microsoft Dynamics 365: Benefits and Getting Started

Credit Card Processing in Microsoft Dynamics 365: Benefits and Getting Started

As digital transactions become the norm, businesses need robust solutions to seamlessly handle financial activities. Enterprise Resource Planning (ERP) systems emerge as an essential tool to ensure these seamless financial activities.

One ERP that stands out is Microsoft Dynamics 365, a powerhouse for managing business operations, including the pivotal task of credit card processing.

What is Microsoft Dynamics 365?

Microsoft Dynamics 365 is a comprehensive suite of cloud-based business applications that help organizations manage and automate their customer relationships, operations, financials, and more.

Microsoft Dynamics 365 is an adaptable ERP system and customer relationship management (CRM) platform that combines a range of capabilities under one roof. This suite offers modularity, allowing businesses to select and license only the applications they need, such as sales, customer service, field service, finance, supply chain management, and commerce. Each is designed to facilitate seamless business processes and enhance overall efficiency.

What is Microsoft Dynamics F&O?

Microsoft Dynamics F&O, short for Finance and Operations, is an enterprise-grade ERP solution tailored for large-scale organizations with intricate operational and financial requirements.

Designed to manage complex business processes across various industries, Dynamics F&O offers extensive functionalities spanning finance, supply chain management, manufacturing, manufacturing, retail, and more.

This highly customizable platform allows businesses to configure and adapt it to their specific needs, whether it involves multi-site operations, global supply chains, or compliance with industry regulations.

With both cloud-based and on-premises deployment options available, Dynamics F&O provides scalability, flexibility, and robust capabilities to support the growth and evolution of large enterprises.

What is Microsoft Dynamics BC

Microsoft Dynamics BC, short for Business Central, targets small to medium-sized businesses seeking an all-in-one ERP solution to streamline their operations and drive growth.

Unlike F&O, Microsoft Dynamics 365 Business Central credit card processing offers a more user-friendly and easily configurable platform tailored to the needs of smaller organizations with simpler business processes.

While it may lack the complexity and extensive customization options of Dynamics F&O, Dynamics BC provides essential functionalities for finance management, sales, purchasing, inventory, and project management.

Getting started with credit card processing in Microsoft Dynamics 365

Getting started with Microsoft Dynamics credit card processing, also known as D365 credit card processing, involves a multifaceted approach to integrating electronic payments into your business processes.

For businesses utilizing Dynamics 365, incorporating credit card processing capabilities streamlines transactions, optimizes cash flow, and enhances customer service while maintaining rigorous standards for security and compliance.

- Select a payment gateway and processor. Selecting a payment gateway for Microsoft Dynamics 365 is a decisive step toward efficient D365 credit card processing. Once you’ve chosen a payment processor, the payment gateway they provide must seamlessly integrate with your Dynamics 365 environment, ensuring secure and reliable transaction processing. It’s important to consider various factors, including the payment methods supported, the credit card processing fees involved, the geographical regions served, and the security measures offered are paramount, as data breaches can have grave implications for your business. Look to payment gateways that offer services such as encryption and tokenization for an extra layer of security. By carefully evaluating your business needs against the features of potential gateways, you can select an option that not only complies with the required compliance standards but also enriches your Microsoft Dynamics 365 payment processing capabilities.

- Configure your new gateway in Dynamics 365. Once a payment gateway is selected, the next step is configuring Microsoft Dynamics credit card processing. The setup process typically involves several stages, including inputting merchant account details, configuring transaction settings, and mapping the payment processing workflow according to your business’s operations. It’s crucial to ensure that the configuration supports all classes of transactions your business requires, such as sales, refunds, or recurring payments. Additionally, you may need to customize user roles and permissions for employees to manage these transactions appropriately. Ensuring the account entries flow correctly into your financial management system to update accounts receivable and the general ledger in real-time is also essential. While the process may seem intricate, Dynamics 365 is designed to facilitate a simplified configuration, leading to a robust and user-friendly payment processing environment.

- Testing and validation. Before fully implementing a new credit card processing system, conducting thorough testing and validation is crucial. This phase is pivotal to identifying any potential hiccups in the transaction flow, verifying payment processing accuracy, and confirming that the system records transactions effectively. By running multiple test transactions, businesses can examine real-time data updates, assess the user experience, and ensure customer card data is handled securely. Validating these elements helps to prevent any issues that could affect customer interactions or lead to financial discrepancies. Moreover, this step is essential for instilling deployment. Once testing and validation yield satisfactory results, you can proceed with the confidence that your Dynamics 365 platform is well-equipped to manage credit card transactions proficiently.

Now that you know how to get started with processing payments in Microsoft Dynamics 365, you should familiarize yourself with some best practices to ensure your system is running smoothly.

Best practices for payment processing in Dynamics 365

Having the right best practices in place for payment processing is crucial. They ensure that the system is implemented effectively, that customer transactions are handled efficiently and securely, and that businesses can maximize the benefits of using Dynamics 365 for their financial operations.

Data security measures

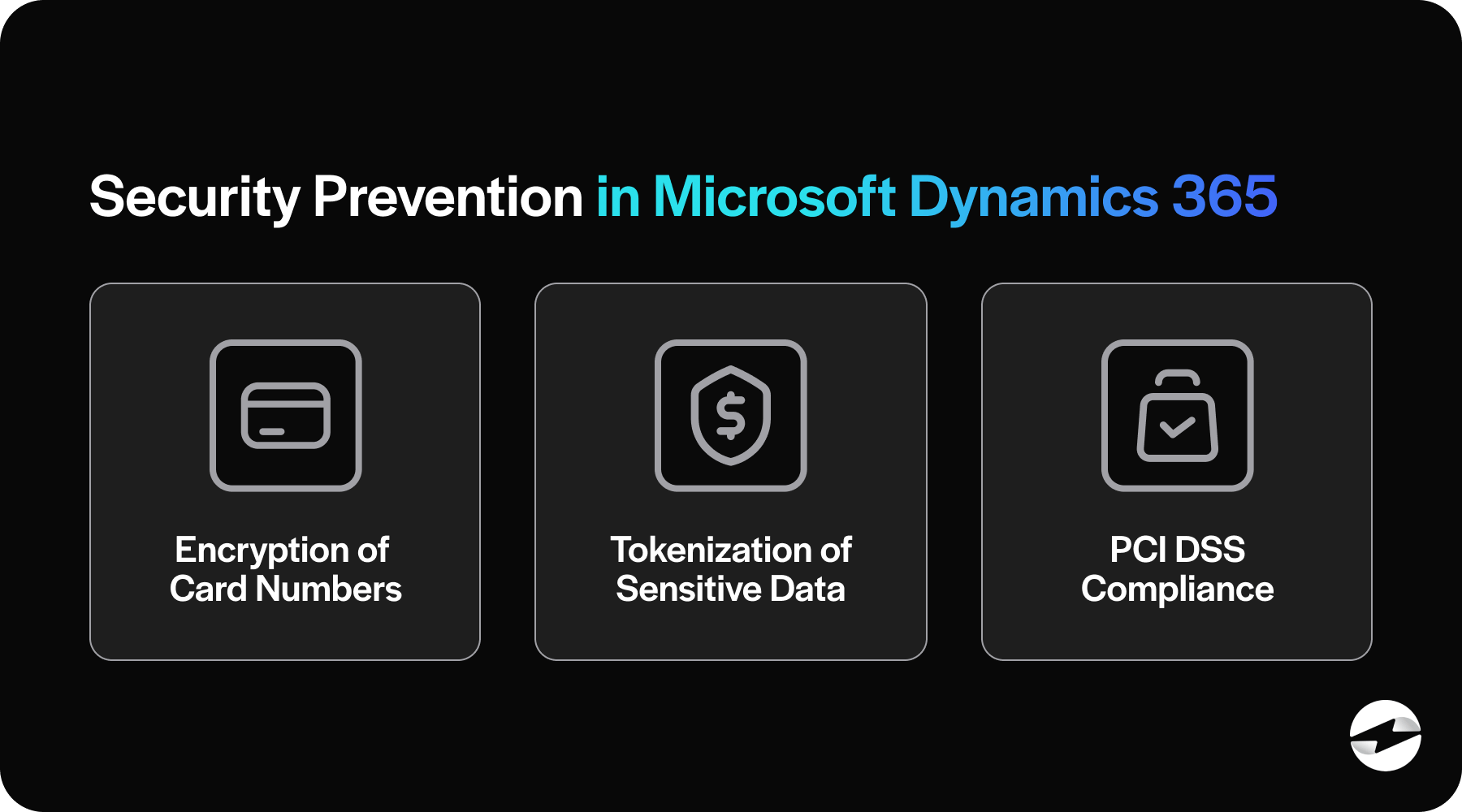

Securing sensitive payment information is paramount when processing credit card transactions. Within Microsoft Dynamics 365, several data security measures must be taken to ensure compliance with industry regulations, such as the PCI DSS Standards.

To enhance security, tokenization can be used to replace sensitive card data with unique identification symbols that retain all essential information without compromising security. Additionally, encrypting data both in transit and at rest protects against unauthorized access.

Businesses should also implement strong access control measures that limit data exposure to authorized personnel only. Conducting regular security audits helps identify and mitigate these potential vulnerabilities.

Integration with financial management

For a seamless payment integration, ensure the payment processing module is well-synced with accounting and financial modules for real-time data updates.

Utilizing automation features for payment reconciliation can save time and reduce manual errors. It’s also important to verify that your chosen payment solution is compatible with existing financial management workflows and processes in Dynamics 365.

Maintaining a central data repository within Dynamics 365 can streamline financial reporting and analytics, creating a unified data source for better efficiency and accuracy.

Monitoring and reporting

Monitoring transaction activities and generating reports are essential to managing financial operations in Dynamics 365. This process provides insight into customer payment behavior, enabling more focused customer service strategies. It also aids in detecting and preventing fraudulent activities through the surveillance of transactional anomalies.

Monitoring and reporting allow for assessing payment processing efficiency, identifying areas for improvement. Furthermore, this practice supports compliance with financial regulations through detailed record-keeping and reporting, ensuring that all transactions meet required standards.

Staying ahead of best practices allows organizations to reduce the risk of fraud, optimize customer service, and improve cash flow.

Now that you know some best practices for processing payments in Microsoft Dynamics 365, it’s time to look at the benefits of using this top-rated system.

The benefits of processing payments in Dynamics 365

Credit card processing integration within Microsoft Dynamics 365 brings many advantages to modern businesses, driving operational efficiency and financial agility.

As an integral component of ERP systems, Dynamics 365 facilitates a cohesive framework for managing business processes, and its payment processing capabilities are an extension of this robustness.

Streamlined payment process

Dynamics 365 credit card processing significantly streamlines the collection and reconciliation of payments.

By partnering with the right payment provider and leveraging Dynamics 365’s powerful payment processing features, businesses can minimize manual entry, reduce errors, and accelerate the speed at which payments are received and logged.

Automation of invoicing and receipt issuing within a unified system ensures a smoother transaction flow, directly enhancing cash flow and accounts receivable management. This modern approach to financial transactions reduces administrative burdens and fosters a more efficient payment lifecycle, from sale to settlement.

Enhanced customer experience

An exceptional customer experience is grounded in convenience, speed, and security. By offering various payment options, Microsoft Dynamics 365 positions businesses to meet and exceed customer expectations.

With the ability to accept all the most popular payment methods, facilitated by a top-rated and trusted payment solution, customers are more inclined to remain loyal due to the ease and flexibility of transactions. This commitment to customer satisfaction, driven by payment diversity and reliability, shows patterns that their convenience and preferences are paramount, fostering lasting relationships and enhancing the overall customer service experience.

Real-time financial insights

The dynamic nature of business today demands real-time access to financial data for informed decision-making.

Integrating Dynamics 365 credit card processing gives businesses immediate visibility into payment activities, ensuring that financial insights are always current and actionable. This instantaneous access to transactional data serves as a foundation for comprehensive financial analysis and facilitates strategic planning.

Paired with a top-rated payment provider, Dynamics 365 can deliver enhanced reporting features and analytics, turning raw data into powerful insights that drive business growth.

Increased security

In an era where data breaches are a prominent threat, ensuring secure payment processing is non-negotiable. Microsoft Dynamics 365, combined with a capable payment processor, offers a formidable defense against potential security risks.

With features such as encryption, tokenization, and strict adherence to the PCI Compliance standards, sensitive customer data is vigorously protected. This commitment to security not only guards against fraud and unauthorized access but also bolsters customer confidence in the reliability and safety of their transactions.

As a result, businesses can foster a trustworthy environment where security is a cornerstone of the payment process.

Integrating credit card processing into Microsoft Dynamics 365 via EBizCharge enhances the efficiency and security of financial transactions for an even more seamless payment processing experience.

Leveraging EBizCharge for a streamlined payment experience

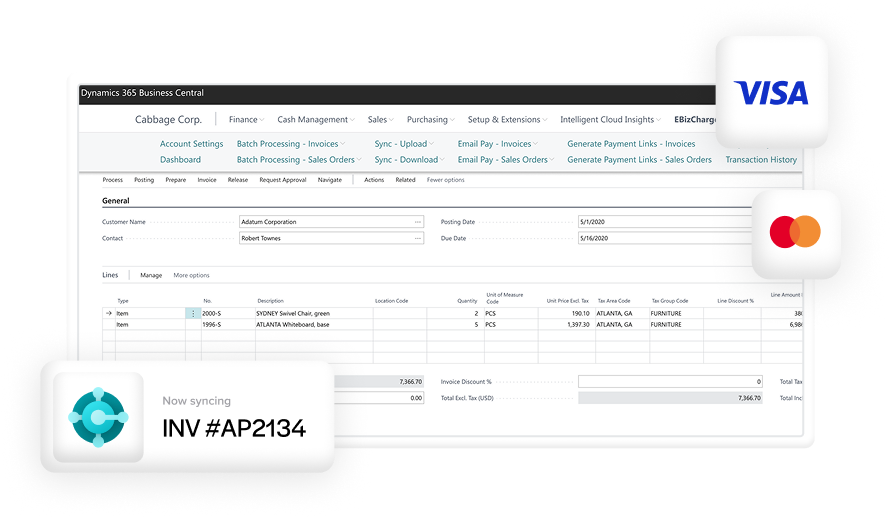

Ranked as a top-rated payment processor, EBizCharge simplifies the payment process by seamlessly syncing with Microsoft Dynamics 365’s interface.

The EBizCharge payment integration offers a robust, user-friendly platform that expedites cash flow, optimizes customer service, and maintains an accurate record of accounts receivable.

With features like real-time processing, support for multiple payment gateways, and straightforward management of customer card information, the powerful EBizCharge payment solution facilitates a smoother experience both for businesses and their customers.