Blog > Credit Card Data Encryption vs. Tokenization

Credit Card Data Encryption vs. Tokenization

Tokenization vs Encryption

Tokenization and encryption work together to protect cardholder data throughout the entire transaction process—whether the data is in use, in transit, or at rest.

What is data Encryption?

Encryption is the strongest protection for card data when it’s in transit. From the moment a payment card is swiped or inserted (dipped) at a terminal featuring a hardware-based, tamper resistant security module, encryption protects the card data from fraudsters as it travels across various systems and networks. Encryption is ideally suited for any businesses that processes card transactions in a face to face or card present environment.

What is data Tokenization?

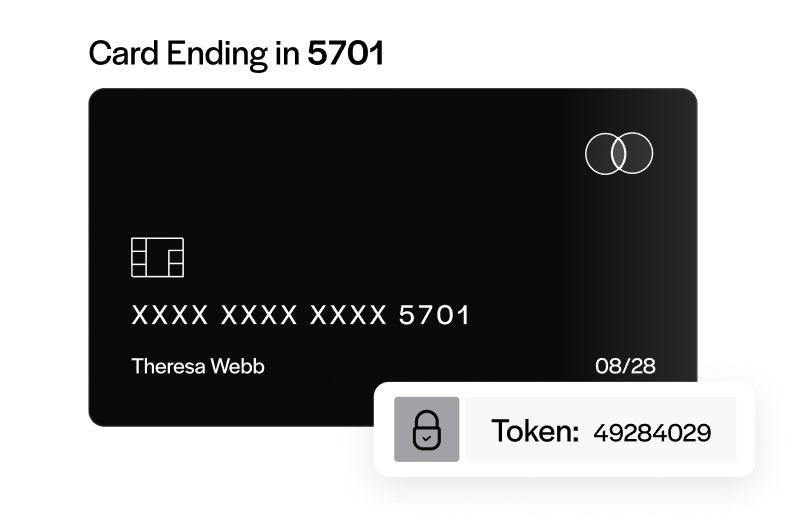

Tokenization protects card data when it’s in use and at rest. It converts or replaces cardholder data with a unique token ID to be used for subsequent transactions. This eliminates the possibility of having card data stolen because it no longer exists within your environment. Tokens can be used in card not present environments such as e-commerce or mail order/telephone order (MOTO), or in conjunction with encryption in card present environments. Tokens can reside on your POS/PMS or within your e-commerce infrastructure (at rest) and can be used to make adjustments, add new charges, make reservations, perform recurring transactions, or perform other transactions (in use).

EBizCharge’s security solutions, combined with EMV and PCI-DSS compliance, add multiple layers of protection to safeguard cardholder data against evolving security threats. By implementing encryption and tokenization correctly, you can also simplify PCI-DSS compliance, lower audit costs, and free up resources to focus on business growth—all while reducing the risk of data breaches.