Blog > Configuring Acumatica to Handle Incoming Credit Card Payments

Configuring Acumatica to Handle Incoming Credit Card Payments

Acumatica is a cloud-based enterprise resource planning (ERP) system with a comprehensive suite of tools to help businesses manage their finances, operations, and customer relationships.

In today’s fast-paced world, businesses need a secure and efficient solution for accepting and processing payments, and that’s where Acumatica comes in.

This article will simplify how to handle incoming credit card payments in Acumatica.

Handling incoming credit card payments in Acumatica

A key feature of Acumatica is its ability to handle incoming credit card payments, making it a valuable solution for businesses of all sizes.

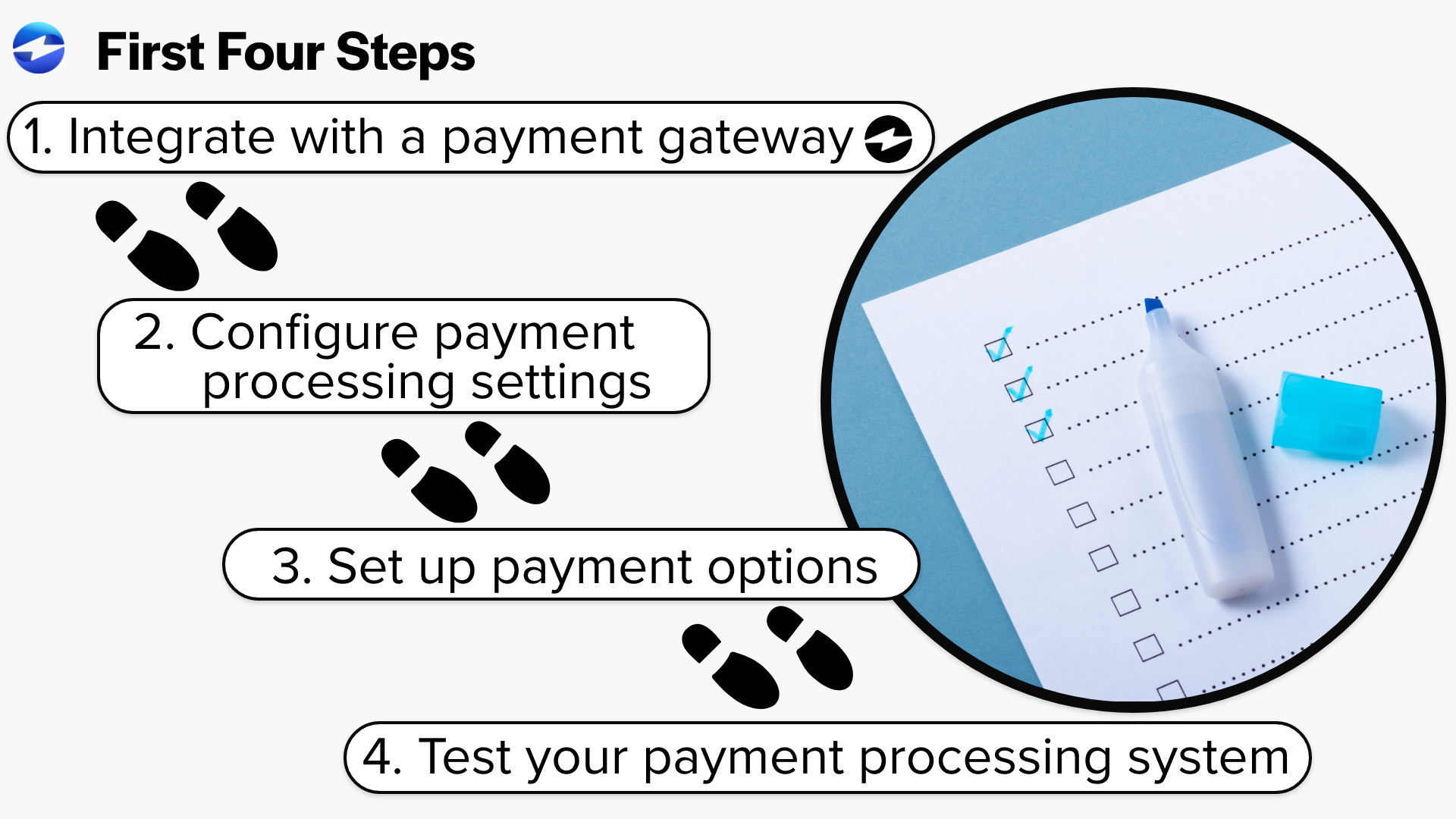

Here are four steps to ensure your business is ready to handle incoming credit card payments from customers in Acumatica:

- Integrate with a payment gateway

- Configure payment processing settings

- Set up payment options

- Test your payment processing system

Step 1: Integrate with a payment gateway

The first step to managing credit card payments in Acumatica is integrating with a payment gateway.

Payment gateways are intermediaries that provide a secure connection between your business and the payment processing network. Acumatica offers integrations with several popular payment gateways, including EBizCharge and PayPal.

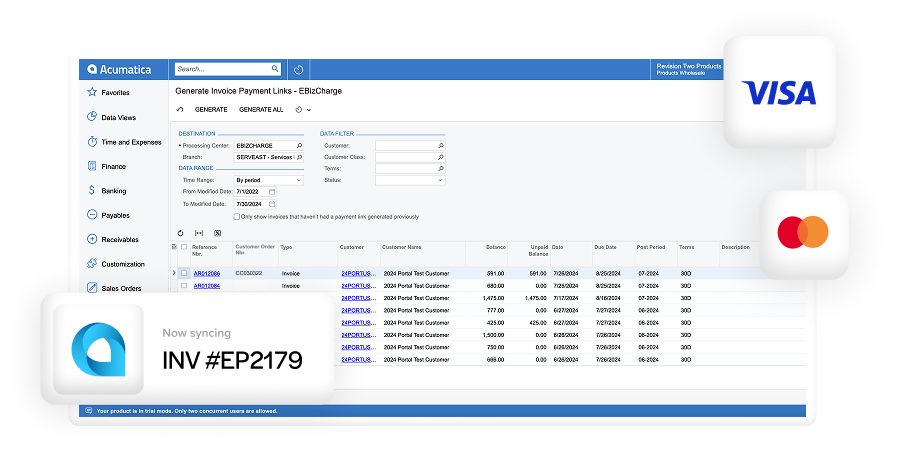

To integrate with a payment gateway, you’ll create an account with a gateway provider and obtain the necessary API keys. This information will be entered into Acumatica to connect automatically with the payment gateway and allow you to start accepting payments.

Step 2: Configure payment processing settings

Once you’ve integrated with a payment gateway, you’ll configure the payment processing settings in Acumatica. This will include specifying the payment types you accept, such as credit or debit cards, and each type’s default payment processing behavior.

For example, you can automate the authorization and capturing of credit cards, or manually review and approve payments before they’re processed.

Step 3: Set up payment options

Next, your business will need to decide which payment methods to offer customers, which can include online payment options on your website or directly from invoices within Acumatica.

You can also set up recurring payment options, such as monthly payments, to automate the payment process and ensure customers always have a convenient payment method.

Step 4: Test your payment processing system

Testing your company’s processing system to ensure everything is properly working before you start accepting payments is essential.

You can do this by simulating a payment to verify the gateway receives and processes transactions correctly. This ensures your customers can make payments and resolve issues before they affect your business.

Payment processing in Acumatica

Acumatica offers a robust and secure solution for businesses to accept and process payments. Its built-in integration with payment gateways like Authorize.Net and PayPal allows companies to efficiently manage credit card transactions inside the Acumatica system.

Acumatica’s payment processing solution is also PCI-compliant, meaning it meets the strict security standards set by the Payment Card Industry (PCI) to protect sensitive credit card data.

With Acumatica’s payment processing capabilities, your company can securely and efficiently process transactions without manual intervention and ensure sensitive credit card data is protected to reduce fraud risks.

Acumatica’s customizability in payments

Acumatica payment processing is designed to be flexible and customizable for businesses to choose the payment methods that work best for them and their customers.

Acumatica offers customizable payment options for businesses to tailor their payment processing to meet their needs. You can customize your payment processing to set up recurring payments, manage subscriptions, and even multiple currencies.

In addition to Acumatica credit card processing, your company can also accept payments via bank transfers, checks, and other methods.

Getting the most out of Acumatica

Payment processing in Acumatica is a valuable tool for businesses to streamline their financial operations and improve their cash flow management.

Acumatica’s payment processing solution also offers real-time reporting and analytics to track and monitor payments and make informed financial decisions. With the ability to view payment history, monitor payment status, and reconcile payments, businesses have the information they need to manage their cash flow effectively.

To streamline payment collections in Acumatica even further, you can apply a comprehensive payment integration like EBizCharge to accept credit cards and eCheck payments directly inside this system.