Blog > Clearing vs. Settlement Systems: Why They Matter to Banks

Clearing vs. Settlement Systems: Why They Matter to Banks

In an increasingly complex financial world, it’s essential to thoroughly understand operations that involve transactions and financial institutions.

Financial clarity is especially important since banks engage in countless daily transactions that require clearing and settlement processes to ensure payments are accurately transferred between parties, reducing risks and maintaining economic stability.

As global commerce expands and digital transactions increase, efficiency is vital to ensure financial institutions can manage liquidity, mitigate fraud, and keep up with modern banking demands.

This article will discuss the difference between settlement and clearing systems and why they matter to banks.

What is clearing?

Clearing occurs after a transaction is initiated and involves payment instructions and verification to ensure sufficient funds are available to complete the transaction.

Clearing is typically performed by financial institutions or central banks using payment systems like the Automated Clearing House (ACH). During the clearing process, an intermediary (often a clearing house) matches the transaction details between the buyer and seller to reduce the risk of errors or defaults. This intermediary plays a vital role in maintaining the stability of financial markets by managing systemic risk.

While clearing timeframes can vary, they usually align with the settlement cycle, which indicates the number of business days required to finalize a transaction. Understanding this phase is essential for banks and financial institutions to manage liquidity and meet margin requirements efficiently.

The clearing stage precedes the actual transfer of funds or securities, known as the settlement process.

What is settlement?

The settlement process consists of finalizing a transaction, resulting in the transfer of funds between parties. Settlement ensures sufficient funds are available and adequately transferred according to the agreed terms.

Settlement typically occurs on a specific business day during the settlement cycle, which varies depending on the transaction type. For example, transactions may take a few business days, while foreign exchange transactions can often settle on the same day. The involvement of intermediaries like clearing houses and central banks mitigates systemic risk and transaction failures to ensure more seamless payment processing.

Financial institutions rely heavily on efficient settlement services to manage liquidity and reduce exposure to counterparties. ACH and payment systems are crucial since they provide infrastructure support, ensuring the timely execution of payment instructions.

Now that you know what’s involved in the clearing and settlement processes, it’s crucial to understand how they differ.

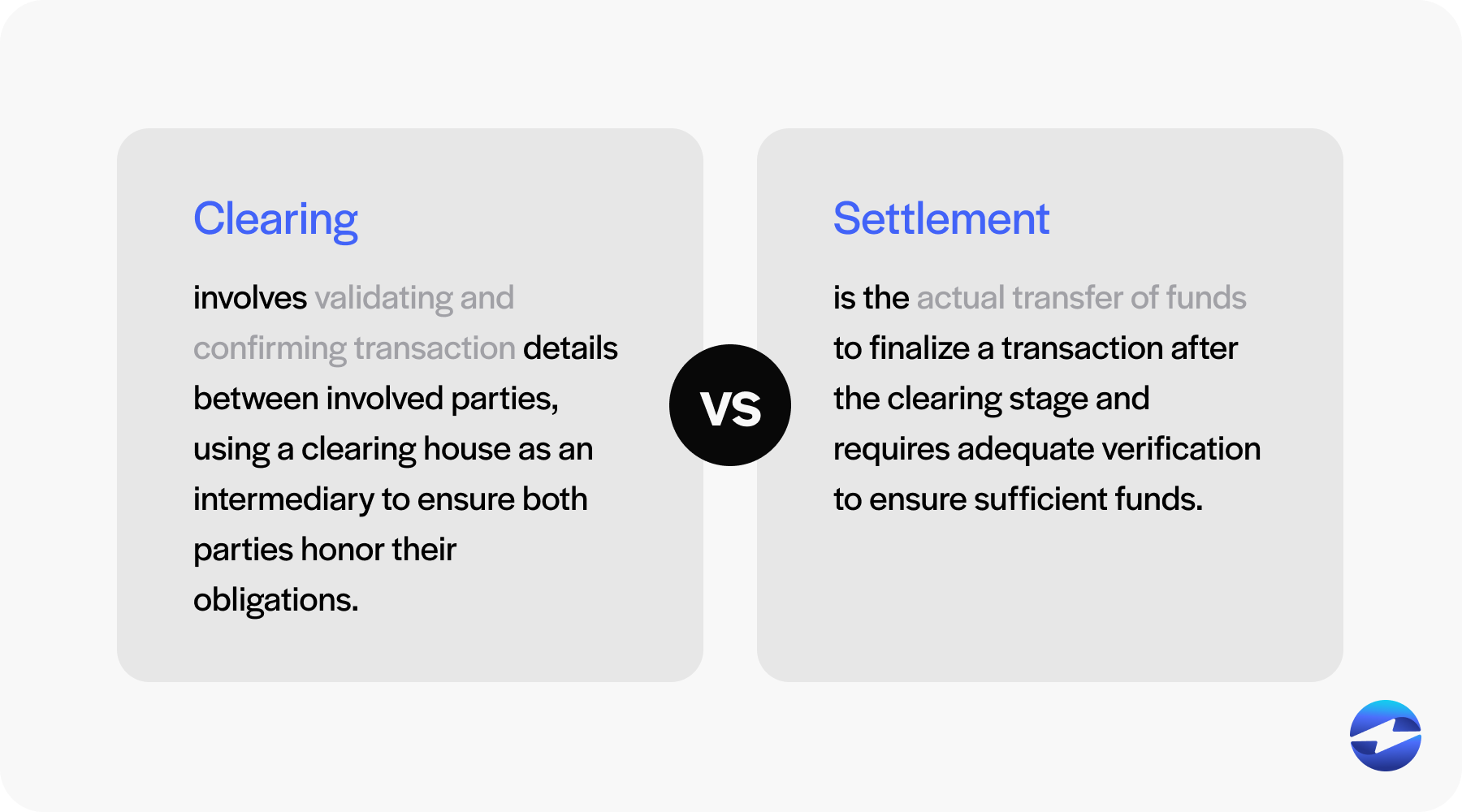

Settlement vs. clearing: What’s the difference?

Settlement and clearing are critical components of financial transactions, but they serve different functions.

Clearing involves validating and confirming transaction details between involved parties, using a clearing house as an intermediary to ensure both parties honor their obligations. Settlement is the actual transfer of funds to finalize a transaction after the clearing stage and requires adequate verification to ensure sufficient funds.

Despite their differences, clearing and settlement are essential when dealing with banks.

Why is settlement and clearing important to banks?

Settlement and clearing are necessary for banks since they validate the accuracy of transactions and eliminate security risks, thus improving the overall payment experience.

For banks, the clearing and settlement processes enhance operational efficiency and reduce the risk of failures that can have systemic repercussions. This is especially vital in high-volume financial markets or foreign exchange transactions.

Reliable clearing processes ensure security before funds are exchanged during settlement, while efficient settlement services minimize transfer delays and decrease risk exposure for financial institutions.

Despite their varying purposes, settlement and clearing processes reduce threats and can enhance the payment process, thus garnering more client trust, payment security, and consistent revenue.

Optimizing your settlement and clearing cycles

Understanding settlement and clearing processes helps financial institutions align with regulatory requirements and optimize these cycles for all parties involved.

By mastering clearing and settlement, banks can effectively manage risks, optimize transaction processing, adapt to evolving financial environments, and strengthen their service offerings while ensuring trustworthy operations.