Blog > Cash Discounting Programs: What Are They and How Do They Work?

Cash Discounting Programs: What Are They and How Do They Work?

Have you noticed businesses offering lower prices for paying with cash? That’s a cash discounting program in action. For business owners, this practice isn’t just a thoughtful nod to customers—it’s a smart move to reduce payment processing costs and encourage more cash transactions.

This article will explore what cash discount programs are, how they work, and the pros and cons involved. Whether you’re a small business owner or a curious customer, this is your guide to understanding cash discounts better.

What is a cash discounting program?

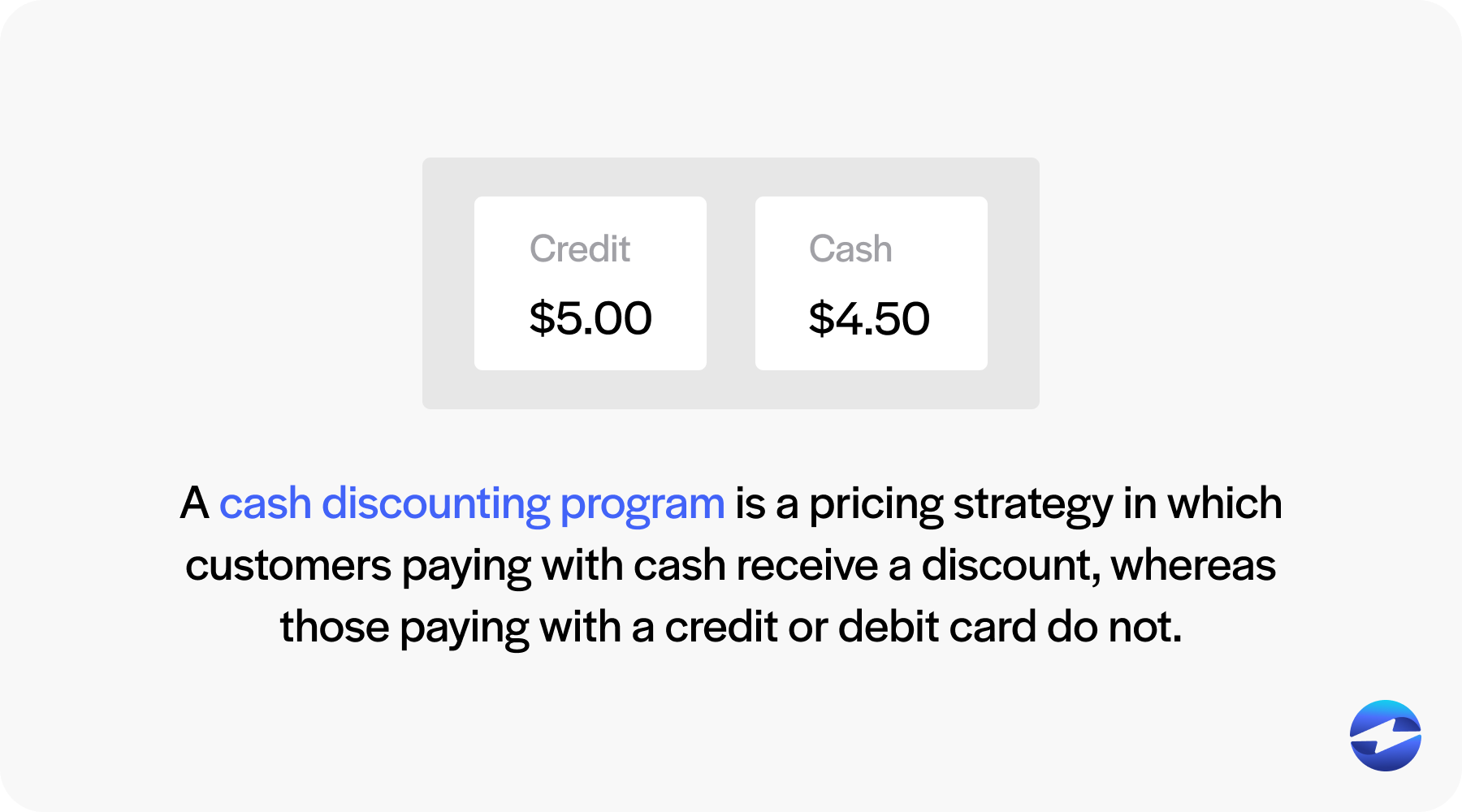

Businesses often implement this strategy to offset the costs of card payment processing fees. Essentially, customers save money by paying with cash, while businesses reduce their reliance on card payments.

For example, imagine a café that advertises coffee for $5.00 but offers a 10% discount to cash payers. Customers paying by cash would only pay $4.50—a straightforward cash discount example.

Cash discounts are legal across the United States but must comply with specific guidelines and transparency requirements to avoid legal discrepancies.

Cash discount vs. surcharge: What’s the difference?

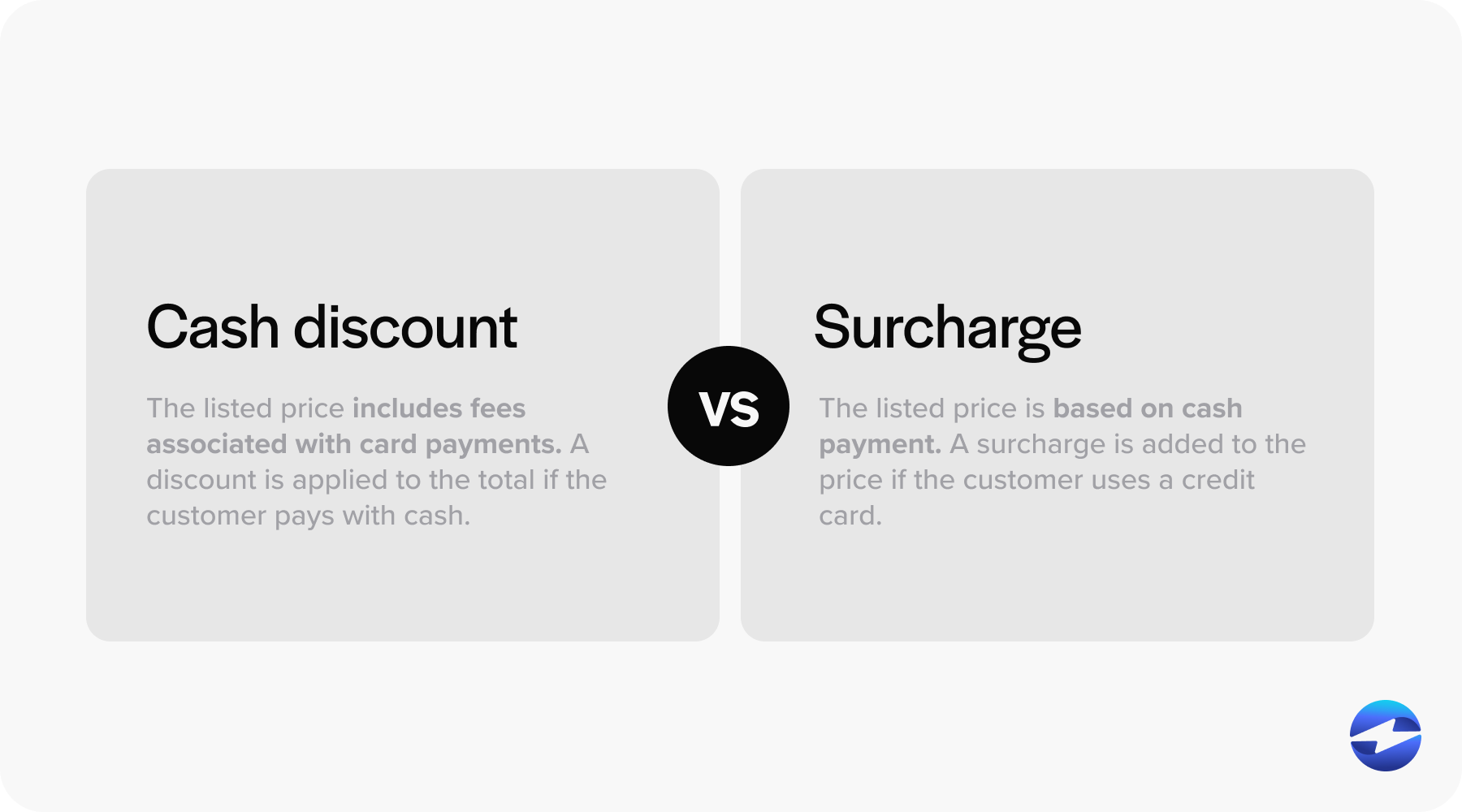

One common point of confusion is the difference between cash discounting programs and surcharging. While both address the costs of card payments, they work in opposite ways:

- Cash Discount Program: The listed price includes fees associated with card payments. A discount is applied to the total if the customer pays with cash, avoiding the card processing fees entirely.

- Surcharge: The listed price is based on cash payment. A surcharge is added to the price if the customer uses a credit card.

For instance, if a pizza shop lists a slice at $3.50 and offers cash discount pricing, customers paying by credit card pay the full price of $3.50, while cash customers pay less. Conversely, if surcharging is in place, the $3.50 price applies to cash payments, but an additional fee (e.g., $0.25) is added for card users.

Both methods require care to ensure transparency, as misleading pricing can damage customer relationships or lead to legal non-compliance.

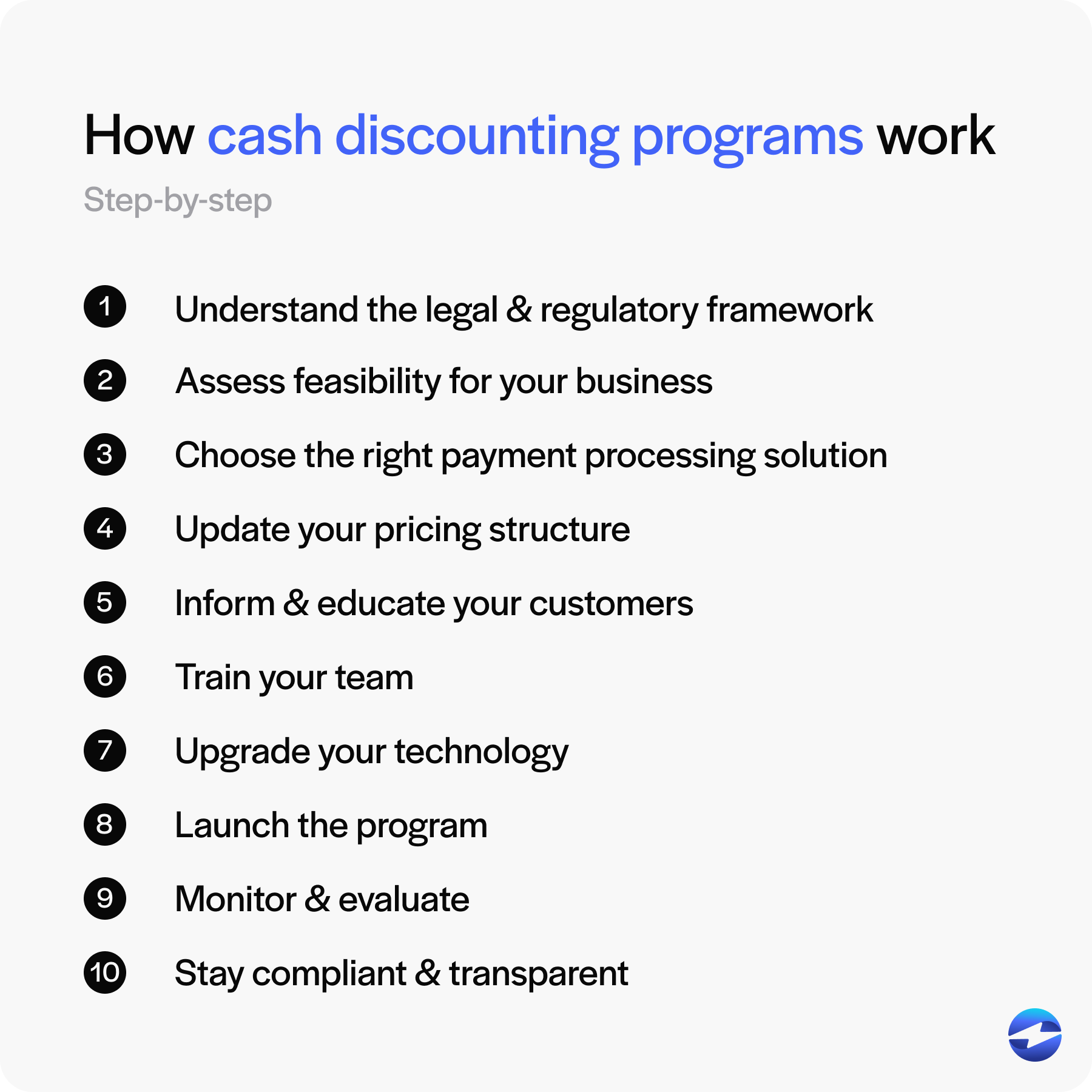

How do cash discounting programs work?

Implementing cash discounting programs involves several steps, requiring a balance of legal, operational, and customer-focused considerations.

Here’s a detailed guide to getting started:

1. Understand the legal and regulatory framework

Before starting a cash discount program, it’s important to understand the legal requirements to stay compliant. Cash discounts are legal nationwide but adhere to specific rules and regulations. A key factor is displaying pricing policies to ensure transparency and avoid disputes. Some states may have unique requirements, so it’s important to research and follow local guidelines.

2. Assess feasibility for your business

Evaluate your customer base and transaction trends carefully to determine if implementing a cash payment discount program aligns with your business model. Start by analyzing how your customers prefer to pay—are they primarily using cash, cards, or mobile payment options? If the majority of your customers favor card or mobile payments, a cash discount program might not generate significant savings for your business. Additionally, consider whether offering cash discounts would appeal to your target audience or incentivize behavior changes. Weigh the potential benefits against the administrative effort and assess how it might impact overall customer satisfaction and profitability.

3. Choose the right payment processing solution

Many payment processors provide features specifically designed to facilitate cash discounting programs, making it easier for businesses to implement this cost-saving strategy. These programs allow merchants to offer customers a discounted price when paying with cash, helping to offset credit card processing fees. When selecting a payment processor, choosing one that aligns with your specific operational needs is essential, as well as offering tools and support for smooth program implementation. Look for a provider that provides user-friendly technology, comprehensive customer support, and transparent pricing.

4. Update your pricing structure

Adjust your pricing strategy to incorporate cash discount pricing and clearly differentiate between cash and card payment prices. This approach allows you to offer customers a discount for paying with cash while covering the processing fees associated with card payments. Ensure the final prices for both payment methods are clearly displayed to avoid any confusion at the point of sale. Transparency is key to building trust with your customers, ensuring they fully understand the pricing structure and their options.

5. Inform and educate your customers

Transparent communication is essential for building trust with your customers. To ensure clarity, use prominent signage at your business to explain that the listed prices reflect card payments while cash transactions qualify for a discount. This helps customers understand the pricing structure upfront and minimizes confusion. Additionally, providing a cash discount receipt that clearly outlines the details of the discount reinforces transparency and professionalism. This receipt shows the savings customers earn by paying with cash, creating a more positive experience.

6. Train your team

Equip your staff with the knowledge, skills, and tools they need to explain the program confidently and effectively. Ensure they are well-prepared to address common questions, clarify details, and can handle any potential customer objections. Providing thorough training and resources will help build their confidence and significantly improve customer interactions.

7. Upgrade your technology

Ensure your point-of-sale (POS) system is equipped to handle dual pricing for smooth transactions. Modern POS systems often use built-in features that simplify implementing cash discounts and calculating surcharges. This ensures compliance, improves efficiency, and provides a seamless experience for both businesses and customers.

8. Launch the program

Begin by rolling out the program and paying close attention to customer responses. Gathering feedback during the initial stages is essential for identifying potential issues and making necessary adjustments. A smooth and positive launch experience lays the foundation for effective implementation and long-term success, ensuring customer satisfaction and program efficiency.

9. Monitor and evaluate

Your cash discount program shouldn’t operate on autopilot. It’s important to regularly evaluate its performance by analyzing its impact on your finances and customer satisfaction. By consistently reviewing and gathering feedback, you can identify areas for improvement and make necessary adjustments to ensure the program remains effective and beneficial for your business.

10. Stay compliant and transparent

Compliance is critical for maintaining trust and avoiding legal issues. It’s essential to stay updated on the latest regulations within your industry and ensure your business aligns with them. Additionally, prioritize clear, transparent, and honest communication about your pricing model to build credibility and customer trust over time.

Now that you understand how these programs work, you should understand the advantages of cash discounting programs as well as their limitations.

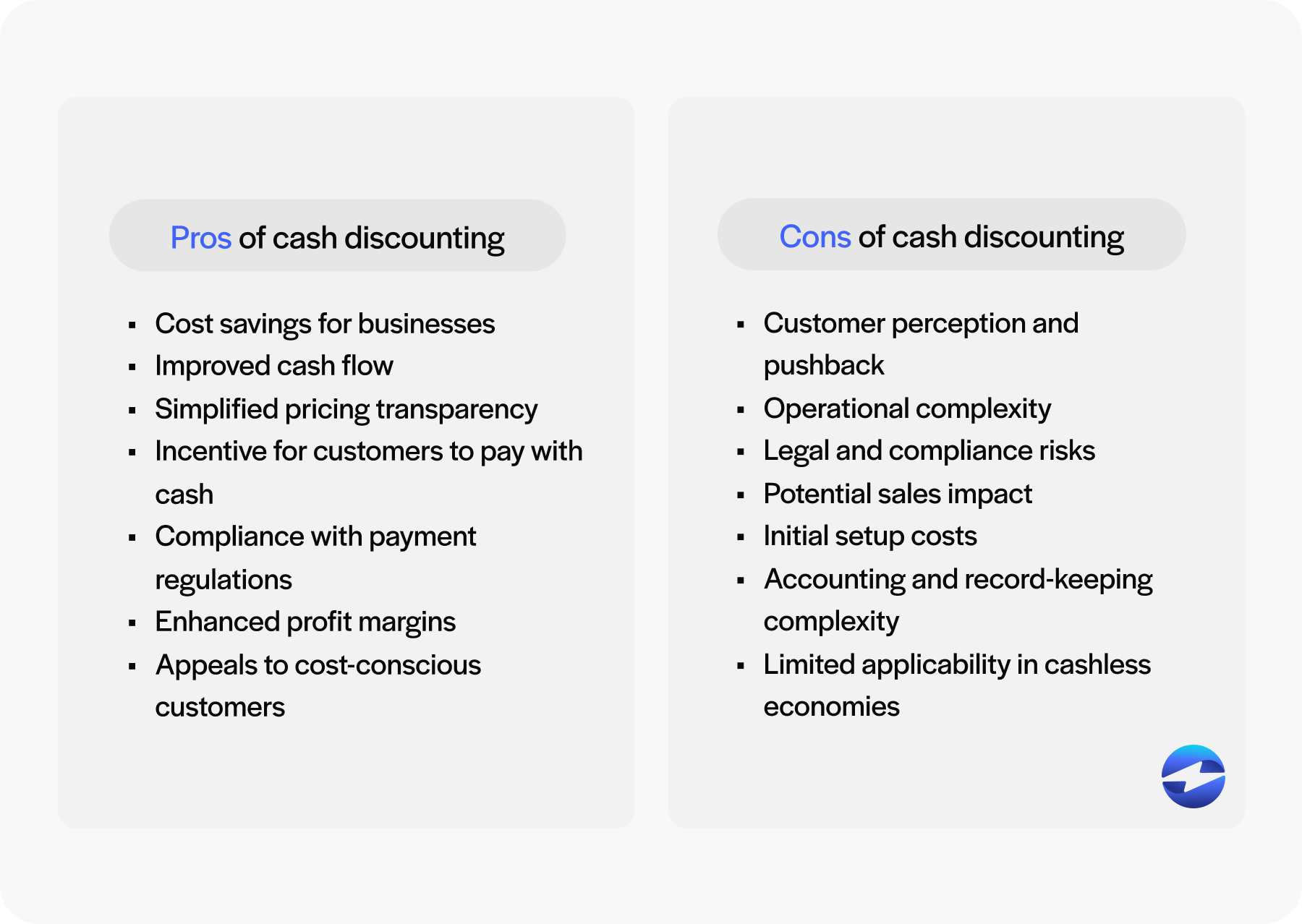

7 pros and cons of cash discounting programs

Cash discounting programs offer a strategic way for businesses to save on credit card processing fees by incentivizing customers to pay with cash. While these programs can be a powerful tool for cost reduction and customer engagement, they also come with potential challenges.

Below is a detailed look at their pros and cons:

Pros

- Cost savings for businesses: By offering a cash discount, you can reduce your dependency on card transactions and avoid steep processing fees.

- Improved cash flow: Cash transactions provide immediate liquidity, easing day-to-day business operations.

- Simplified pricing transparency: Customers appreciate honesty. Clear communication about cash discounts builds trust.

- Incentive for customers to pay with cash: Cash discounts encourage customers to opt for cash over cards, indirectly reducing costs for your business.

- Compliance with payment regulations: Unlike surcharges, cash discount programs generally face fewer legal hurdles when implemented correctly.

- Enhanced profit margins: Without processing fees eroding profits, businesses can enjoy wider margins on sales.

- Appeals to cost-conscious customers: Offering savings for cash payments resonates with buyers looking to stretch their dollar further.

Cons

- Customer perception and pushback: Some customers may misinterpret a card payment as a penalty and feel alienated.

- Operational complexity: Implementing a cash discount program requires coordination across pricing, staff training, and point-of-sale updates.

- Legal and compliance risks: Businesses that fail to follow transparent practices risk fines or legal action.

- Potential sales impact: Customers who prefer cards may go elsewhere, affecting sales negatively.

- Initial setup costs: The cost of upgrading POS systems or revamping pricing models can be significant.

- Accounting and record-keeping complexity: Tracking discounts and reconciling accounts may increase administrative burdens.

- Limited applicability in cashless economies: As digital payments grow in popularity, cash-based incentives may become irrelevant in some markets.

By weighing the pros and cons, businesses can determine whether this approach aligns with their operational goals and customer preferences.

Reducing costs with cash discounting programs

Cash discounting programs present a compelling opportunity for businesses to optimize costs and engage with value-conscious customers. However, their success depends on careful implementation, clear communication, and a solid understanding of your customer base. This approach isn’t a one-size-fits-all solution – it requires assessing whether the benefits align with your operational goals and customer preferences.

By prioritizing transparency and compliance, businesses can build trust while navigating the challenges of adopting a cash discount program. Ultimately, this strategy offers a pathway to reduced costs and improved cash flow, but its effectiveness hinges on thoughtful planning and execution. Whether you’re considering cash discounts to save on fees or enhance customer loyalty, weighing the potential advantages against the challenges is essential to making an informed decision.