Canadian Merchant Accounts: Top-Rated Payment Processing with EBizCharge

Canadian Merchant Accounts: Top-Rated Payment Processing with EBizCharge

Open your Canadian Merchant Account with EBizCharge and start collecting payments faster and easier than ever before.

For Canadian businesses navigating the increasingly complex world of payment processing, having a reliable and efficient merchant account is essential.

Whether handling credit card transactions and mobile payments or ensuring compliance with banking regulations and data security standards, the right merchant account can streamline operations and reduce costs. Yet, many merchants struggle with high fees, limited integration, and fragmented tools that fail to meet their specific needs.

This article will explore what Canadian merchant accounts are, common challenges they face, and how EBizCharge can alleviate those challenges.

What is a Canadian merchant account?

A Canadian merchant account is a type of business bank account specifically designed for companies operating in Canada that need to accept credit and debit card payments.

Unlike standard merchant accounts available globally, Canadian merchant accounts are tailored to meet the regulatory, banking, and processing requirements unique to Canada. This makes them an essential tool for Canadian businesses that process a high volume of card transactions online, in-store, or both.

Merchant accounts must be configured with online payment gateways or physical terminals/point-of-sale (POS) systems to process transactions and often include value-added features such as customizable payment solutions and tools for managing accounts receivable (AR).

Many merchant accounts and services also offer advanced security measures, such as fraud detection and tokenization, to protect both the business and its customers.

While merchant accounts can offer numerous benefits, Canadian businesses may still face some obstacles when processing payments.

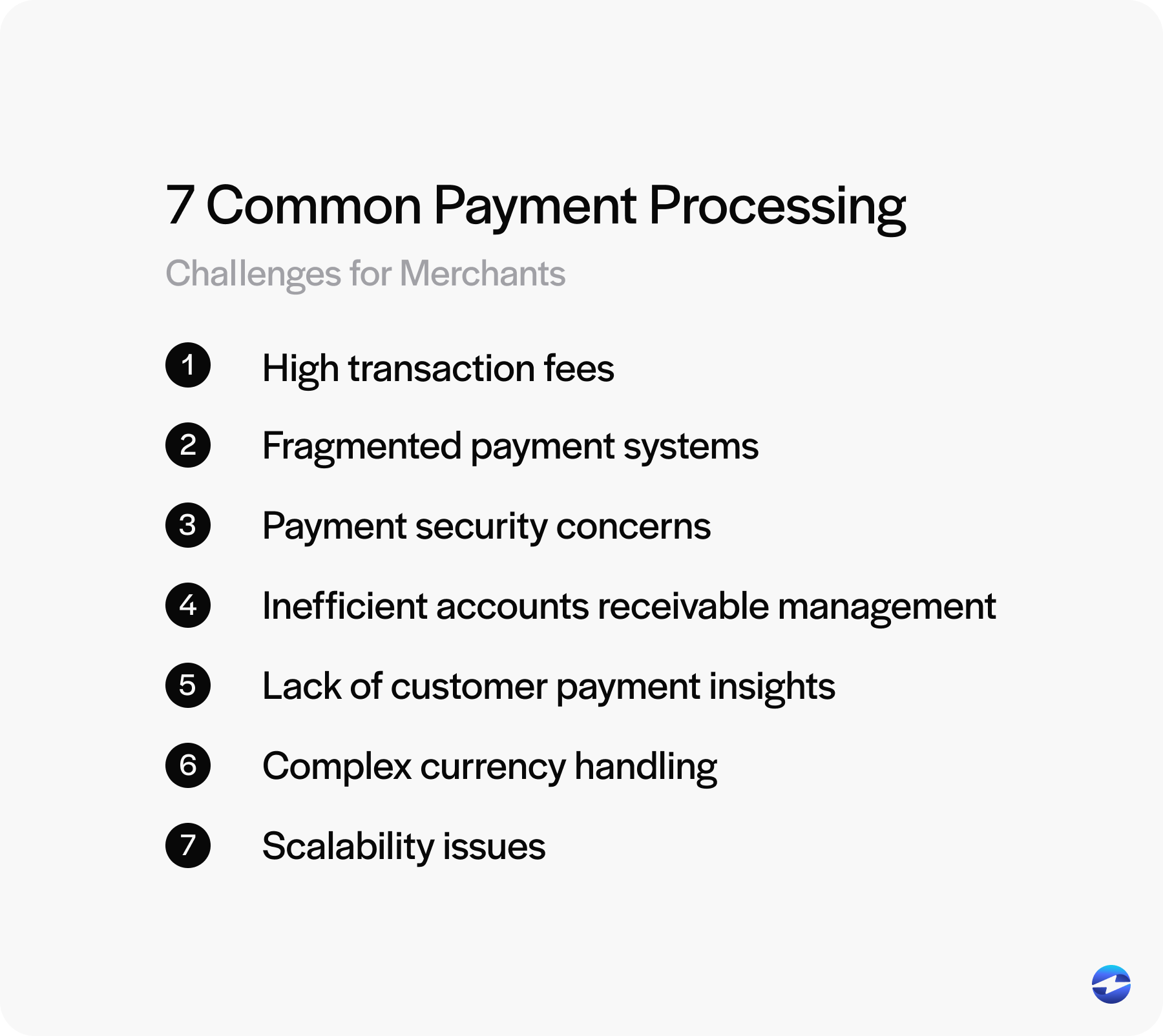

7 common payment processing challenges for merchants

Canadian merchants may encounter several challenges when it comes to processing payments and managing financial operations.

Here are seven common payment processing challenges for Canadian businesses:

- High transaction fees: Credit card processing costs can significantly reduce profit margins.

- Fragmented payment systems: Unaligned payment systems may force businesses to juggle multiple platforms, providers, and processes to accept and reconcile payments. This lack of cohesion can lead to operational inefficiencies and errors and make it harder to scale or adapt to changing customer preferences.

- Payment security concerns: With increasing threats like fraud, chargebacks, and data breaches, many businesses struggle to adapt to evolving compliance standards and security protocols, which can decrease customer trust and revenue.

- Inefficient accounts receivable management: Limited integration between payment systems and accounting/AR tools can hinder cash flow and visibility.

- Lack of customer payment insights: Without comprehensive reporting tools, it’s difficult to analyze and respond to customer payment behaviors.

- Complex currency handling: Managing transactions in multiple currencies and across borders can add significant operational strain.

- Scalability issues: As businesses grow, handling diverse payment methods and expanding compliance requirements becomes increasingly overwhelming.

These hurdles can raise processing costs, create inefficiencies, and hinder business growth if left unaddressed. Fortunately, the right payment processor can alleviate most, if not all, of these challenges.

Working with a reliable payment processor

Not all payment processors are equipped to handle the specific needs associated with Canadian merchant services, especially in terms of multi-currency support, regulatory compliance, and seamless integrations with local banks and platforms.

Along with facilitating successful transactions, a reliable payment processor will simplify complex operations, help you lower costs, and provide you with the tools to scale.

The best payment processors will also offer transparent pricing, advanced fraud protection, responsive support, and flexible integration options that work with your existing tech stack. More importantly, they understand the unique challenges of doing business in Canada – from managing cross-border transactions to maintaining Payment Card Industry (PCI) compliance and offering comprehensive support when needed.

Luckily, EBizCharge serves as a comprehensive payment solution that provides all the above for Canadian merchants.

How EBizCharge serves Canadian merchants

EBizCharge offers top-rated Canadian merchant services specifically tailored to meet the needs of Canadian merchants.

EBizCharge is designed to handle credit and debit card transactions with ease, providing a comprehensive merchant account experience that enhances payment efficiency and financial control for Canadian businesses. It features a proprietary payment gateway equipped with advanced security features, including tokenization and encryption technology, to safeguard sensitive data and prevent fraud.

Additionally, EBizCharge integrates seamlessly with over 100 popular enterprise resource planning (ERP) and accounting software, customer relationship management (CRM) systems, and eCommerce platforms, enabling businesses to streamline AR workflows and simplify customer payments. These integrations include QuickBooks, Sage, NetSuite, Salesforce, Microsoft Dynamics, and other popular business software solutions.

Canadian merchants can benefit from EBizCharge’s straightforward and flexible processing capabilities that support a range of payment methods, including electronic payments and mobile transactions.

EBizCharge also offers beneficial payment collection tools, including unlimited transaction history for detailed financial tracking, powerful fraud prevention protocols, mobile payment functionality for on-the-go transactions, a user-friendly customer payment portal, secure click-to-pay links, EMV payment terminals, and more.

With EBizCharge, Canadian merchants can reduce transaction fees, improve processing efficiency, and gain valuable insights into their payment operations, ultimately enhancing their performance and the overall customer experience.

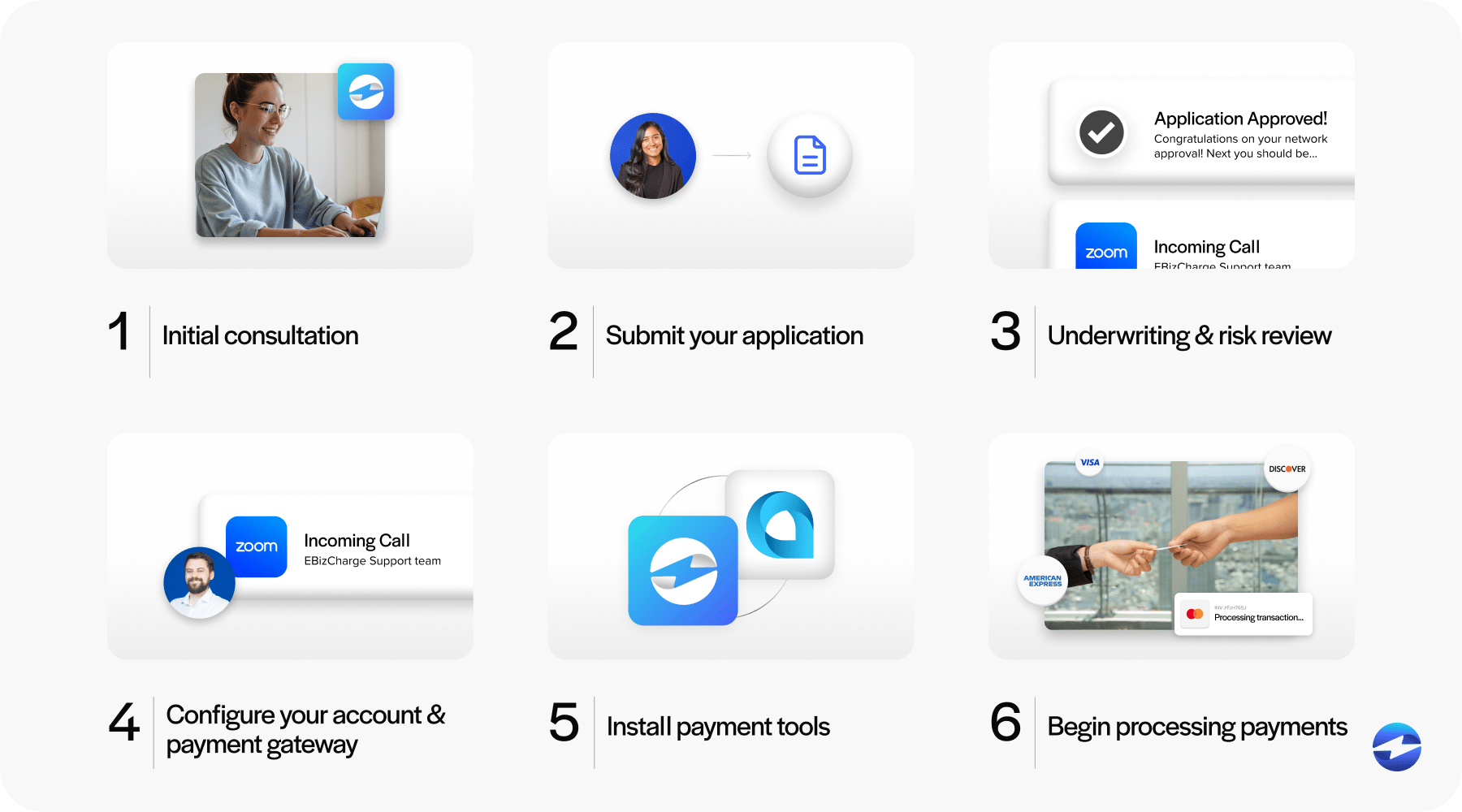

How to apply for a Canadian merchant account

Getting started with a merchant account through EBizCharge is a simple and efficient process designed to meet the needs of businesses of all sizes.

Whether you’re a new business looking to accept card payments for the first time or an established company seeking better rates and functionality, EBizCharge makes the application process fast, secure, and hassle-free.

Here’s how the merchant account setup process works:

- Initial consultation

- Application submission

- Underwriting and risk review

- Configure your merchant account and payment gateway

- Install payment tools

- Begin processing payments

1. Initial consultation

Start by reaching out to the EBizCharge team to provide the necessary information they need to set up your merchant account successfully.

During this initial conversation, a representative will learn about your business, including your industry, payment processing needs, and sales volume. This helps determine the best solution and pricing structure for your specific operation.

2. Submit your application

Once your needs are assessed, you’ll need to complete and submit a merchant account application with vital company information.

The application form typically requires merchants to provide their business name, contact information, business structure details, estimated monthly processing volume, bank account details, and valid government-issued identification.

3. Underwriting and risk review

After submitting the application, EBizCharge’s underwriting team will review your business profile to evaluate risk and ensure compliance with Canadian financial regulations.

This step will likely include reviewing credit, financial health, internal business infrastructure, supporting documents, and risk classification:

- Credit and financial checks: Underwriters may perform credit checks for the business owner(s) and assess the company’s financial health using documentation such as bank statements, tax records, or past processing history.

- Business model review: Underwriters can examine your products or services, sales channels, and refund and chargeback policies to understand your risk exposure. Businesses in high-risk categories may need to meet additional requirements or implement specific safeguards.

- Verification of supportive documents: Submitted documents, such as legal IDs, voided checks, or articles of incorporation, are reviewed for authenticity and completeness.

- Risk classification: Based on these factors, your business will be classified into a risk category. Low-risk businesses may be fast-tracked, while higher-risk businesses may require enhanced documentation or additional approval layers.

Overall, the underwriting and risk review process assesses a merchant’s creditworthiness, risk factors, and financial standing to determine eligibility for a merchant account.

4. Configure your merchant account and payment gateway

Once your business is approved, EBizCharge will set up your Canadian merchant account and provide you with a built-in payment gateway. This gateway allows you to begin securely accepting credit and debit card payments right away.

After account activation, the EBizCharge team will guide you through the integration process to sync your payment gateway with your existing business systems. Whether you’re using an ERP, accounting, CRM, or eCommerce software, the EBizCharge gateway is designed to integrate directly into these tools, minimizing disruption and making payment management more efficient.

Before going live, you can test transactions in the EBizCharge gateway to ensure everything is working correctly and securely.

This step focuses on tailoring the payment processing environment to your business operations for seamless integration and usability.

5. Install payment tools

Once your business is set up with a merchant account/services, a payment gateway, and any additional integrations, you’ll gain access to EBizCharge’s suite of tools designed to simplify billing processes and enhance the customer experience.

EBizCharge goes beyond basic payment processing by offering advanced, user-friendly features, including secure email payment links, auto pay options, recurring billing, a branded customer payment portal, and more.

These tools are customized to meet your business needs and provide a smooth, secure payment experience for your customers.

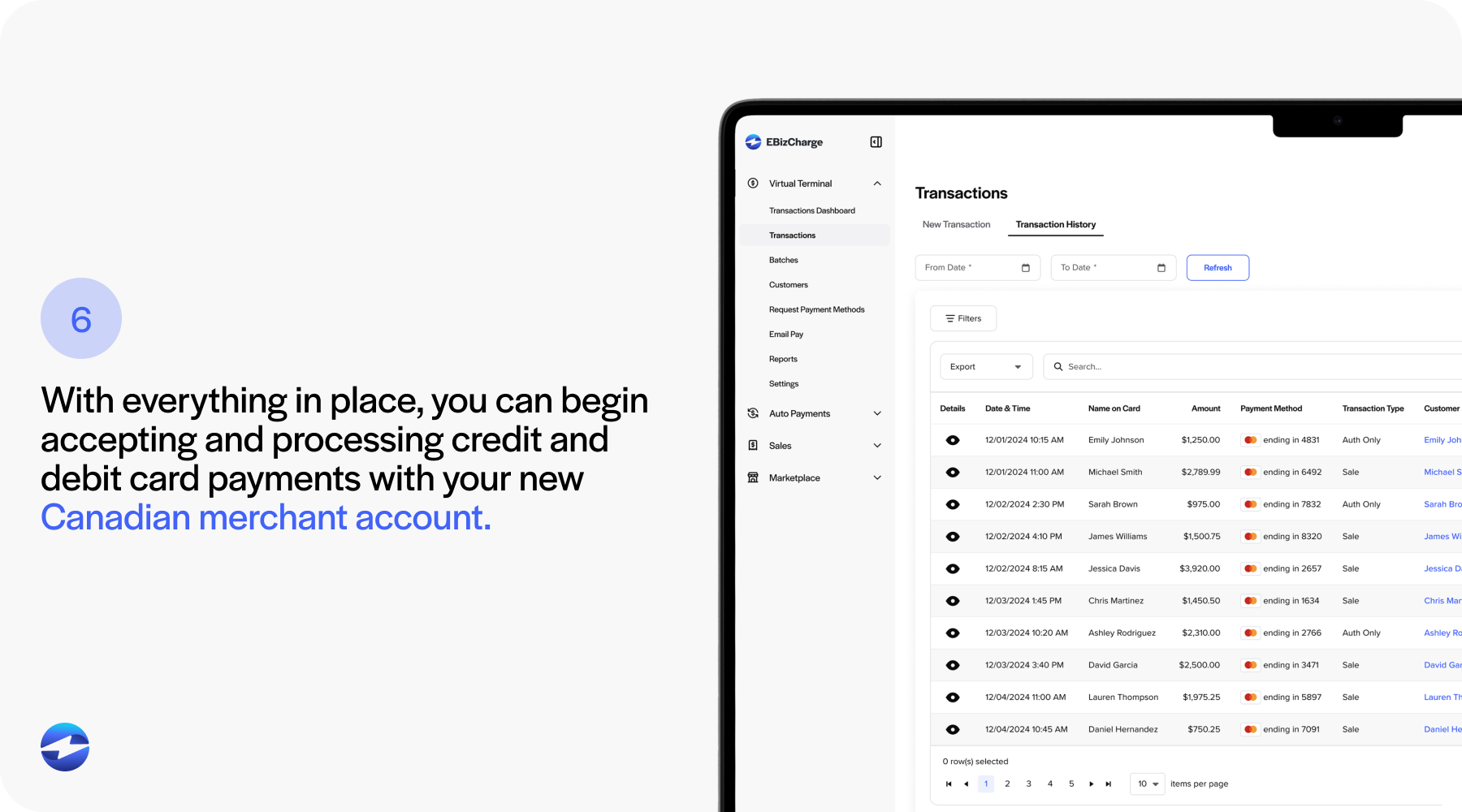

6. Begin processing payments

With everything in place, you can begin accepting and processing credit and debit card payments with your new Canadian merchant account.

EBizCharge’s support team will be available to assist with onboarding, training, and any technical questions to ensure your company can process payments successfully.

From the initial online application to full integration with your business systems, each step is designed to minimize friction and maximize efficiency.

Simplifying Canadian merchant accounts with EBizCharge

As the landscape of digital commerce evolves, Canadian businesses need more than just a basic payment processor – they need a solution that grows with them.

EBizCharge not only delivers powerful tools and seamless integrations but also a deep understanding of the unique financial and operational challenges faced by Canadian merchants.

By choosing a platform like EBizCharge that prioritizes security, scalability, and local compliance, businesses position themselves for sustainable success in an increasingly competitive market.

Whether you’re just starting your credit card processing journey or looking to refine your payment collections, partnering with a trusted Canadian provider like EBizCharge ensures you’re building a payment infrastructure that’s resilient and future-proof.