Blog > Can I Legally Charge a Credit Card Fee?

Can I Legally Charge a Credit Card Fee?

When it comes to accepting payments, businesses often grapple with the costs of credit card processing fees. The question “Is it legal to charge a credit card fee?” is a legitimate inquiry for merchants seeking ways to offset these expenses. This article will explore the legality of charging such fees as well as the pros and cons associated with them.

The Legality of Charging Credit Card Fees

The legality of charging credit card fees to customers, a practice often referred to as surcharging, varies depending on location and the credit card (CC) company’s policies. Surcharging is legal in many states and is regulated at the state and federal levels. In states where surcharging is legal, merchants must notify the credit card company and clearly disclose the surcharge to customers at the point of sale and on receipts to avoid any hidden credit card fees. That said, not all states allow this practice. For example, Colorado, Connecticut, Massachusetts, and others have laws prohibiting surcharges.

Determining the legality of charging credit card fees requires understanding various individual state laws, card network regulations, and the type of fee being charged. It’s essential to check with legal counsel or financial advisors to align with the latest legal standards and avoid potential penalties or customer disputes.

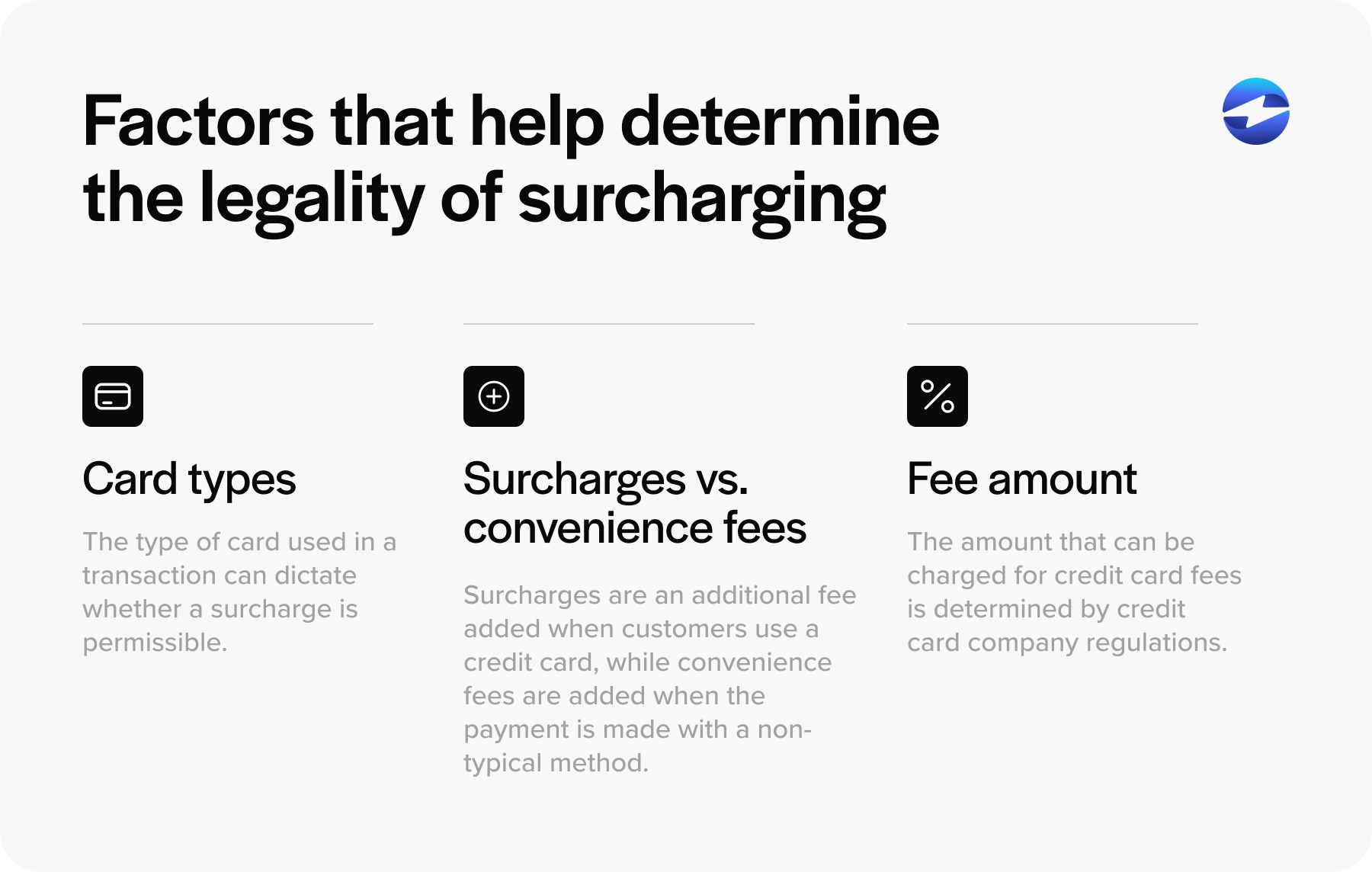

Here is a quick look at some factors that can determine the legality of surcharging.

Card types

The type of card used in a transaction can dictate whether a surcharge is permissible. Credit card (CC) surcharges are subject to different rules than those for debit cards. While retailers can impose surcharges on credit card purchases, debit card transactions are shielded from such fees, including when the debit card is run “as credit.” Credit card surcharges are also subject to regulations by the credit card networks such as Visa, MasterCard, and American Express, which enforce their own set of guidelines for surcharging practices.

Surcharges vs. Convenience fees

Surcharges and convenience fees are two distinct charges that merchants may consider adding to a transaction. A surcharge is an additional fee that a merchant adds to a customer’s bill when they use a credit card instead of another form of payment like cash or check. Conversely, convenience fees are charged for using alternative payment channels

that aren’t typically used for the business’s goods or services, such as payments made over the phone or online. It’s crucial for merchants to understand the difference, as convenience fees shouldn’t be used as a workaround for surcharging and should have their own set of regulations.

Fee amount

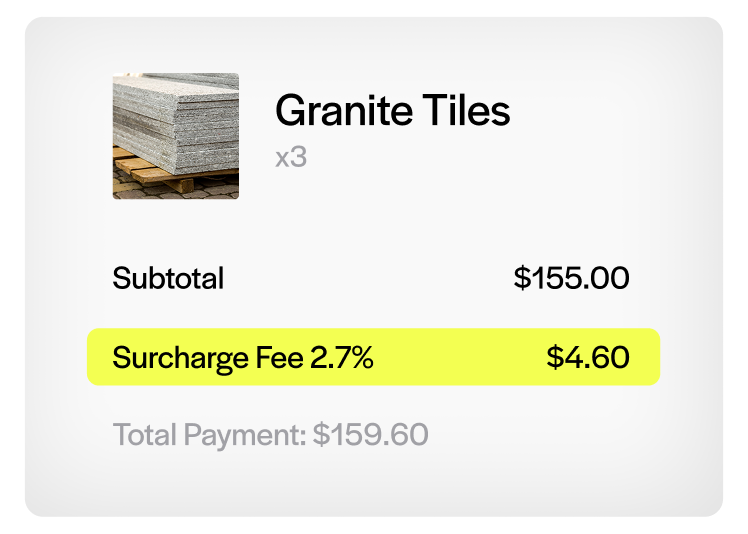

The amount that can be charged for CC fees is determined by credit card company regulations. Credit card networks impose a cap on surcharges, typically restricting them to no more than the merchant’s cost to process credit card transactions or up to 3%, whichever is lower. Consequently, merchants cannot profit from these fees; their purpose is solely to cover processing costs. It’s imperative for merchants to calculate these fees accurately and ensure that any surcharge reflects the true cost of processing to remain compliant with card network rules and avoid the appearance of price inflation.

Although it may be legal to charge these fees in certain states, they carry some downsides to keep in mind.

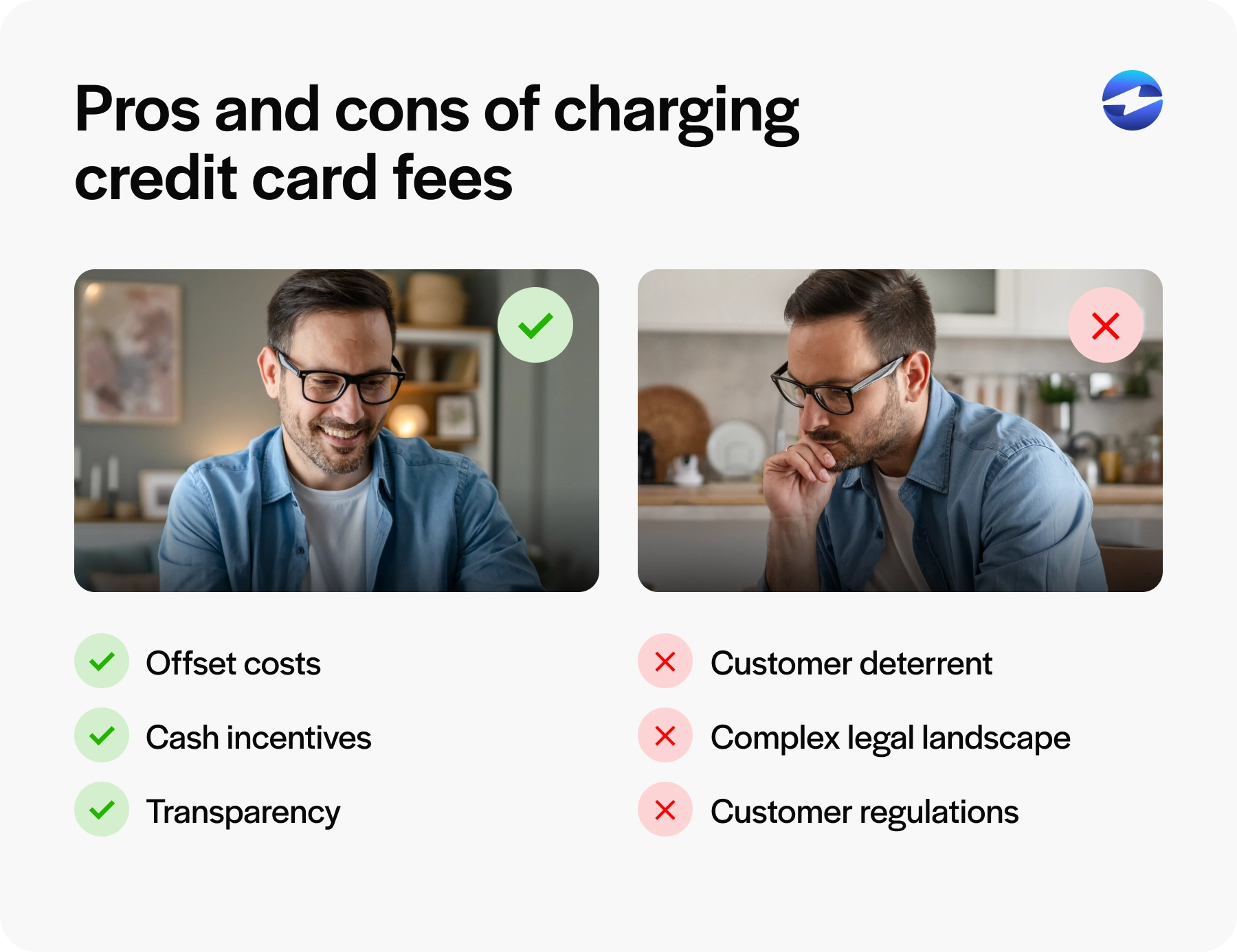

Pros and cons of charging credit card fees

Surcharges can be a means for merchants to offset processing fees, but their legality and acceptance vary. Here’s a concise overview:

Pros

Offset costs: Merchants can recover the typical 3% credit card fee charged by credit networks for each transaction.

Cash incentives: Offering a cash discount can encourage cash transactions and reduce credit card processing fees.

Transparency: Explicitly displaying credit card surcharges can inform customers of the costs associated with credit card purchases.

Cons

Customer deterrent: Extra fees could dissuade customers from making a purchase, potentially reducing overall sales.

Complex legal landscape: Laws on credit card surcharges vary by state, and some states prohibit them, requiring businesses to navigate a patchwork of regulations.

Customer regulations: Surcharging can negatively impact the customer experience, leading to dissatisfaction or harm to the business’s reputation.

While businesses consider these pros and cons, it’s essential to comply with legal requirements, ensure transparent pricing, and evaluate customer sentiment to maintain a positive service experience.

Strategies for minimizing credit card fees

Navigating the financial landscape of credit card transactions requires a strategically informed approach to minimize incurred fees. Implementing measures to reduce these fees improves profitability and enhances the flexibility and attractiveness of pricing for customers.

Offer cash transaction discounts

Another way to avoid charging credit card fees is to incentivize customers to pay with cash. By offering discounts on cash transactions, businesses can:

- Reduce the volume of credit card transactions, thus diminishing the overall fees paid to credit card networks.

- Encourage customers to use cash, which can be particularly effective in settings where small transactions are common.

- Improve cash flow, as cash is immediately available without the usual delay associated with processing credit card payments.

The added advantage is that customers often view cash discounts positively, adding an element of savings to their purchases.

Choose a provider with transparent models

Selecting the right credit card processing provider is crucial. Look for one that offers transparent pricing models to avoid hidden fees and unexpected costs. A transparent provider should:

- Clearly outline their fee structure, including interchange fees, transaction fees, monthly fees, and any other potential costs.

- To suit different business needs, offer straightforward pricing models such as flat-rate, interchange-plus, or subscription-based.

- Provide excellent customer service support to address any questions about fees and assist in resolving disputes efficiently.

Businesses can better predict their expenses by choosing a provider with a clear fee structure and choose the most cost-effective processing solution.

Minimize the risk of fraud

Minimizing the risk of fraud is essential in reducing unnecessary CC fees. Fraudulent transactions often lead to chargebacks, which can be costly in terms of time and money. To reduce this risk, merchants should:

- Employ up-to-date security measures such as encryption and tokenization for transactions.

- Use secure payment gateways and adhere to Payment Card Industry Data Security Standard (PCI DSS) guidelines.

- Enable address verification service (AVS) and request the CVV code to verify the identity of the cardholder.

Prevention is always better than a cure; merchants can avoid the fees and penalties associated with fraudulent activities by taking proactive steps to secure transactions.

Using these strategies, merchants can navigate the complexities of credit card fees and reduce their impact on the business’s financial health. With careful planning and informed decision-making, it’s possible to minimize costs while maintaining a high level of customer satisfaction and trust.

Best practices for charging credit card fees

In a digital economy where credit and debit cards reign supreme, businesses must navigate through complex regulations and merchant agreements when processing these payments. Adapting best practices for charging credit card fees is more than just a financial nuance; it’s a hallmark of transparency and ethical business operations.

- Ensure clear and transparent fee disclosure. Clarity is king when it comes to financial transactions. It’s paramount for businesses to ensure that any CC fees charged are disclosed transparently to customers. This means stating the fees explicitly before any transaction is completed, allowing customers to understand any extra charges that will affect their total purchase cost. Clear and transparent disclosure isn’t only a benchmark of customer service; it also helps avoid disputes and maintain compliance with regulations that mandate visibility of any additional fees. Transparency serves as a cornerstone in building trust, reinforcing the customer’s confidence in a company’s fairness and integrity. You can find examples of signs made to disclose credit card fees online if you need guidance on how to get started.

- Be consistent with your fees. Consistency acts as a stabilizing force in the dynamic marketplace of payments. When charging fees for credit card usage, businesses must maintain consistent practices across all transactions. This means the same fees should be applied for the same types of transactions, regardless of the cardholder or the purchased item. Consistent fee charging helps set clear customer expectations and reduces the chances of confusion or perceived bias, which can lead to dissatisfaction or complaints. Moreover, a standardized approach simplifies accounting processes and supports smoother operational flows.

- Adherence to guidelines set by credit card companies. Credit card networks such as Visa, MasterCard, American Express, and Discover have specific rules and guidelines governing how merchants can impose CC fees. It’s crucial for businesses to thoroughly understand and adhere to these policies to ensure they remain compliant. This includes knowing the types of fees permissible, such as surcharge fees or convenience fees, the maximum percentage that can be charged, and the conditions under which these fees can be implemented. Additionally, some credit card providers also prohibit discrimination between different card brands, requiring equal treatment in fee assessment. Adherence to these guidelines protects businesses from legal disputes and preserves their ability to offer diverse forms of payment to their customers. By staying informed and compliant, merchants uphold the rigorous standards set by credit card companies and regulatory bodies, confirming their accountability in the financial ecosystem.

Adapting best practices for charging CC fees is more than just a financial nuance- it’s a hallmark of transparency and ethical business operations. Customers have come to expect clarity and fairness with fee structures, and companies that can effectively manage and communicate their credit card fee policies are poised to build stronger customer relationships and trust.

Enabling surcharges with EBizCharge

Navigating the complexities of credit card fees can be challenging for businesses. Luckily, EBizCharge simplifies this process through its efficient surcharging capabilities. By allowing merchants to pass processing costs directly to customers, EBizCharge helps businesses manage financial burdens while ensuring compliance with state and federal regulations. This top-rated platform facilitates the legal and transparent application of surcharges and integrates seamlessly with existing systems to streamline payment processing. Consequently, EBizCharge stands as a vital tool for businesses aiming to maintain profitability and transparency in their payment operations.