Blog > Building Effective Payment Automation Workflows in NetSuite

Building Effective Payment Automation Workflows in NetSuite

If you’re part of an accounts receivable or finance team using NetSuite, you’ve likely run into the repetitive cycle of sending invoices, following up on payments, and reconciling records manually. These tasks may seem small on their own, but they add up—especially when managing dozens or even hundreds of customer accounts.

That’s where payment automation comes in. NetSuite payment automation isn’t just about convenience—it’s about creating a scalable, accurate, and reliable process for getting paid. When done right, it reduces manual effort, improves visibility, and helps you collect cash faster.

This guide will break down how to build effective payment workflows in NetSuite, what tools to use, and how to tie everything together with a payment processing solution that fits your operation.

Key Elements of Payment Automation in NetSuite

NetSuite is a cloud-based ERP platform that helps businesses manage everything from accounting and finance to inventory, customer relationships, and eCommerce. These services can be greatly improved through the use of automation, so it’s worth understanding what NetSuite payment automation can actually do.

Start with automating invoice generation and delivery. NetSuite billing tools let you generate invoices from sales orders, subscriptions, or project milestones. You can then schedule when those invoices are sent and how they’re formatted—email, PDF, or portal-based.

From there, you can trigger reminders and follow-ups automatically based on due dates or payment status. No more calendar reminders or last-minute emails—just predictable, consistent nudges to customers who haven’t paid.

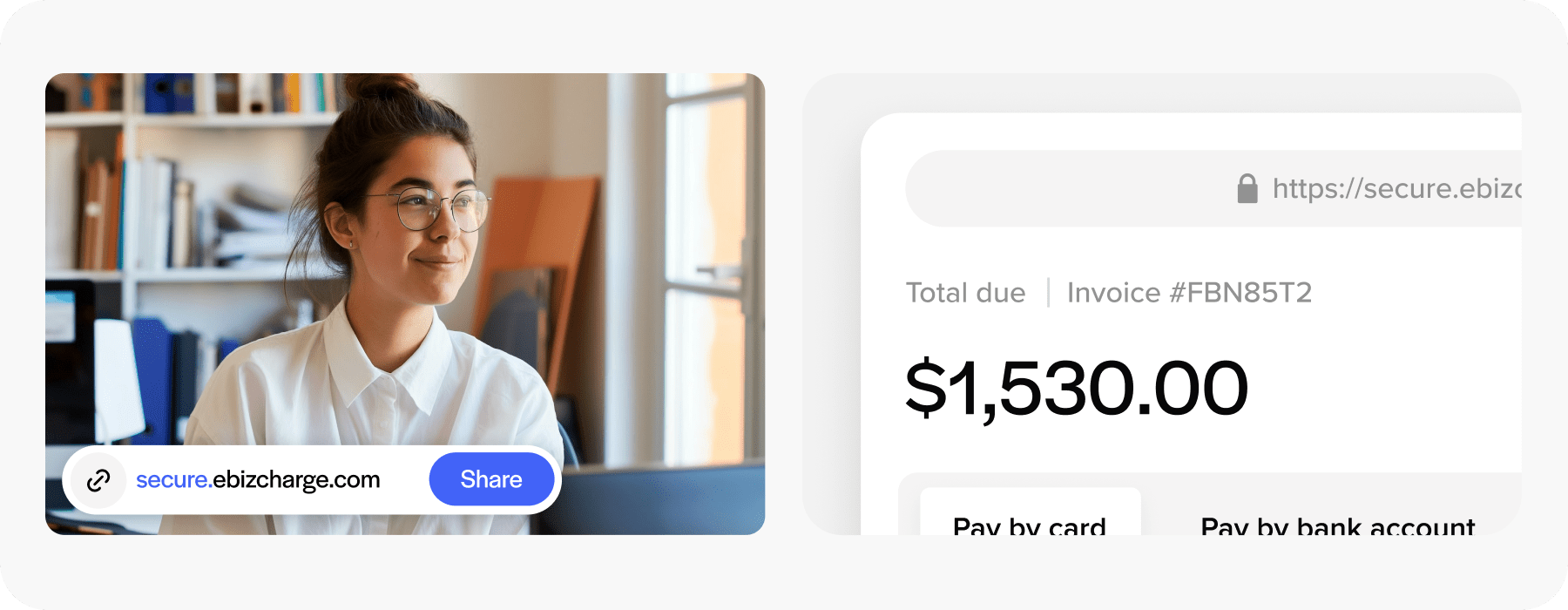

Finally, make it easy for customers to pay. That’s where automated payment collection for NetSuite really shines. Add payment links to invoices, enable self-service portals, and allow customers to save payment methods. These small changes make a big impact on how quickly you get paid.

Leveraging SuiteFlow for Workflow Automation

SuiteFlow is one of the most underutilized features in NetSuite. SuiteFlow lets you build rule-based workflows that respond to events—like invoice creation, overdue status, or payment receipt. You can use it to trigger internal approvals, send email alerts, or update fields automatically.

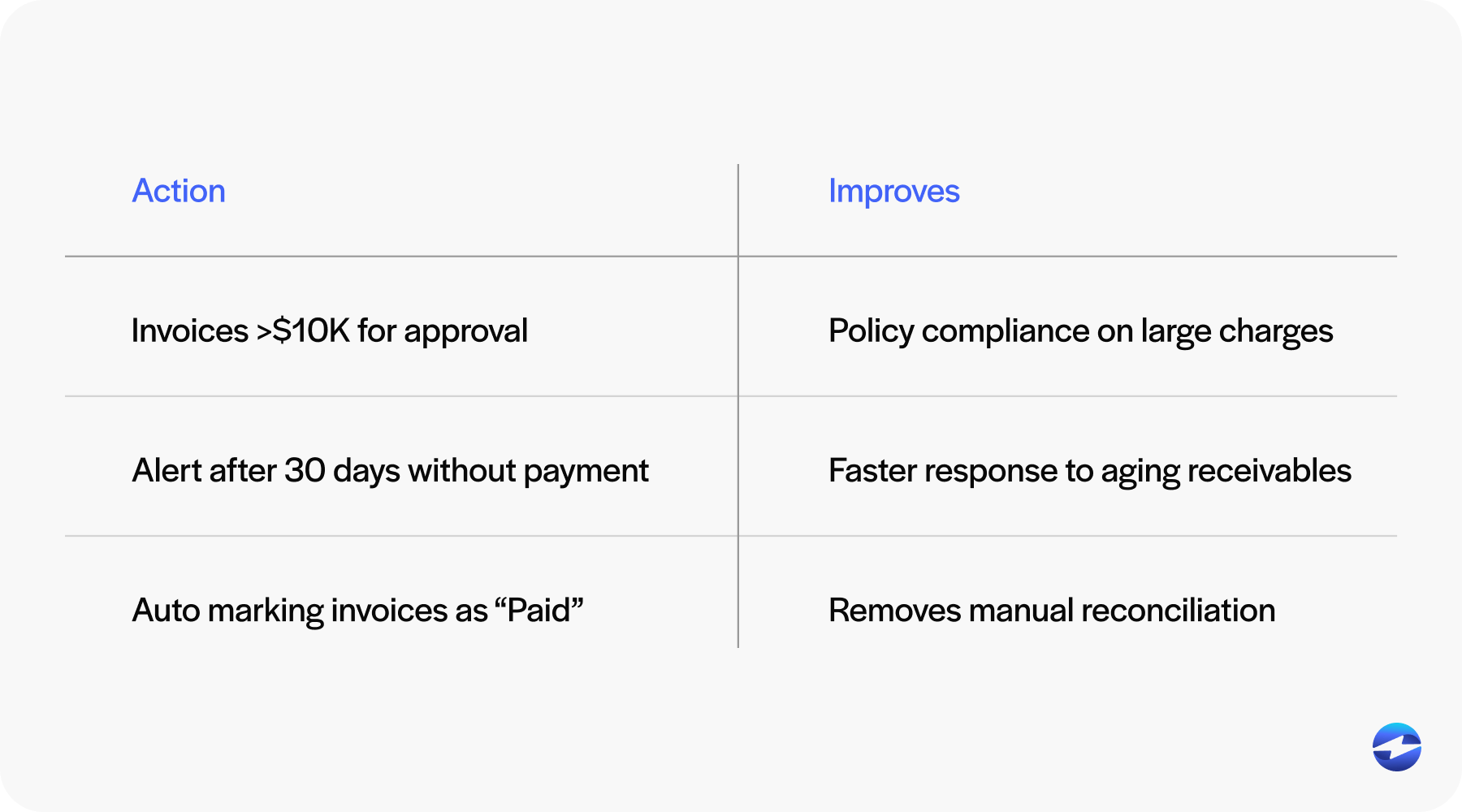

Some examples include:

- Route invoices over $10,000 for manager approval before sending.

- Send an alert if a payment hasn’t been received within 30 days.

- Automatically mark an invoice as “Paid” once payment is confirmed.

This is where payment automation in NetSuite really starts to click. You’re not just pushing out invoices—you’re managing the entire payment lifecycle with less human input and more consistency.

Integrating with a Payment Processor

Out-of-the-box NetSuite billing is solid, but it’s limited when it comes to live NetSuite payment processing. To get the most out of NetSuite payment automation, you’ll want to connect it to a dedicated NetSuite payment processing solution.

An integrated payment processor can bring real-time payment updates, automatically apply payments to open invoices, and handle ACH and credit card transactions from one place. That’s a big upgrade from manually importing files or logging into external portals.

With a good integration, you’re looking at true NetSuite payment optimization—where your system stays in sync and your team stays out of the weeds. It’s less about fancy features and more about reducing friction and speeding up the cash cycle.

Example Workflow Scenarios

Here are a few real-world examples of how teams can put NetSuite payment automation into action:

- Invoice-to-payment flow with approvals: A sales order triggers invoice creation. SuiteFlow routes it for approval based on the amount and then sends it to the customer with a payment link. Once paid, the invoice is closed, and a confirmation email is sent automatically.

- Overdue invoice reminders: Every Monday, NetSuite runs a saved search for unpaid invoices over 30 days past due. The system sends personalized reminders with embedded payment options.

- Recurring billing and auto-pay: A subscription customer is billed monthly. Their saved credit card is charged automatically, and receipts are emailed with no manual intervention. This is automated payment collection for NetSuite at its best.

These are just a few ways NetSuite payment automation can be implemented. As your team identifies repetitive or delay-prone processes, think about how a workflow like one of these could be adapted to your business. Starting with simple automations and expanding gradually allows you to optimize for scale without overwhelming your team or systems.

Monitoring and Optimizing with KPIs and Saved Searches

Automation is only useful if you can monitor what’s working and what’s not.

Use NetSuite’s saved searches and dashboard KPIs to track payment performance. You can build views for:

- Payment delays by customer segment

- Average time to payment across all invoices

- Failed or declined NetSuite credit card processing attempts

These insights help you fine-tune your strategy. Maybe one customer group needs softer reminders. Maybe one payment method results in more declines. The data is there—you just need to look for it.

This is a big part of NetSuite payment optimization: pairing automation with reporting so you’re not flying blind.

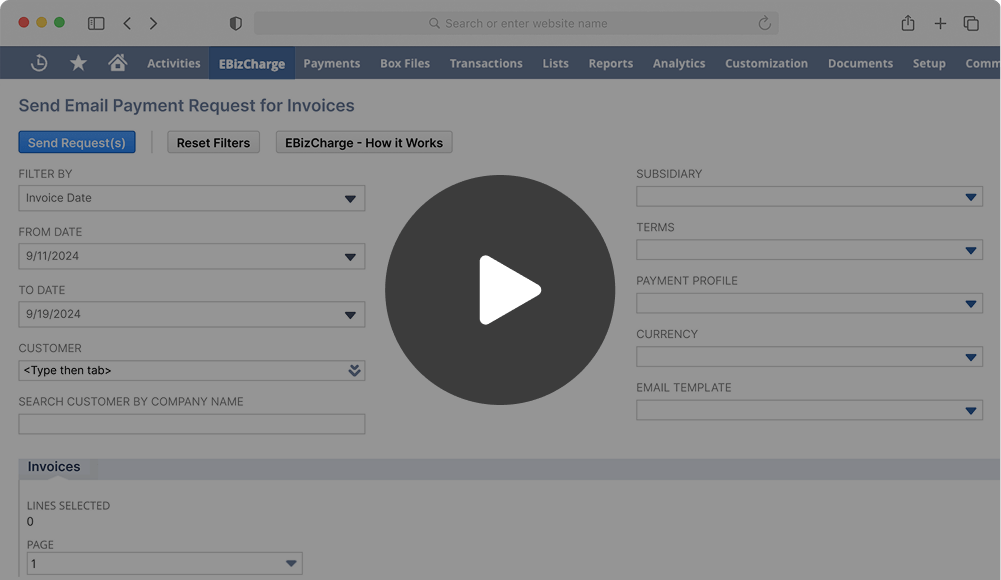

Automating payment collections with EBizCharge

If you want to take your workflows even further, EBizCharge offers a NetSuite integration built specifically for payment automation. It connects directly with your NetSuite ERP, offering secure NetSuite credit card processing, ACH support, and instant payment syncing.

What makes it especially useful for automation is the way it handles payment links, tokenized payment methods, and auto-apply functionality. Once a customer pays—via link, portal, or auto-pay—the payment is matched to the correct invoice without you lifting a finger.

EBizCharge also supports automated payment collection for NetSuite across various of billing models, from one-time invoices to high-volume recurring transactions. And since it’s fully embedded, your finance team doesn’t have to bounce between systems.

If your AR team is stretched thin, this kind of payment processing solution can free up hours each week while improving the customer experience.

Streamlining NetSuite Payments with Automation

Effective payment automation in NetSuite isn’t just about making life easier—it’s about building a process that scales with your business.

By combining NetSuite billing tools, SuiteFlow workflows, and a tightly integrated payment processor, you can cut manual work, reduce delays, and improve visibility across the board.

Whether you’re starting small or ready to go all-in, the key is to align your workflows with your business—and then let automation do the heavy lifting.

If you haven’t yet mapped out your full payment process from invoice to reconciliation, now’s a great time to start. Because with the right payment solution, payment automation in NetSuite can shift from an idea to a real competitive advantage.