Blog > Billable Expense Income: What It Is, How to Track It, and More

Billable Expense Income: What It Is, How to Track It, and More

Understanding the concept of billable expense income is crucial for accurately charging clients and maintaining your business’s financial health.

Often overlooked yet vital, billable expense income ensures you recoup costs directly incurred as a result of client work.

What is billable expense income?

Billable expense income is the revenue generated when a business charges clients for expenses incurred on their behalf. These expenditures are often passed on to clients as part of the billing process.

Billable expense income is separate from the regular fees for services or products provided. For example, a construction company may bill its client for the raw materials used on a project, or an independent contractor may charge for travel costs directly related to a client’s project.

Distinguishing between billable and non-billable expenses is crucial. Billable expenses are recorded as income by a business because the third-party client reimburses them, while non-billable expenses are absorbed as regular business costs.

Using accounting software like QuickBooks, business owners can track these expenses for accurate financial records and profit margins.

Tracking billable expense income is essential for maintaining accurate accounting records, determining correct tax liabilities, and managing a business’s financial health.

Now that you know what billable expenses income is, it’s essential to understand what these expenses include.

What’s included in billable expenses?

Billable expense income can result from various direct and indirect charges that clients accrue when completing a project or a service on your company’s behalf.

Business owners catalog these expenses and charge them back to the client to ensure fair compensation. Some of the most common billable expenses include shipping costs, travel reimbursement, cost of materials, and more.

Shipping costs

Shipping costs represent billable expenses when items must be transported to fulfill client orders or requirements. This can involve sending documents, products, or equipment.

These costs are often marked up to cover handling and delivery process management, becoming part of the billable expense income.

Digital payment processing fees

Businesses often incur payment processing fees when they accept payments through credit cards or digital platforms.

These fees can be passed on to the client as billable expenses, mainly when the payment is for client-specific transactions. This ensures businesses aren’t absorbing these costs as part of their regular business expenses.

Subscriptions and fees for service providers

Businesses often rely on third-party services or subscriptions, such as cloud services or specialized software, to complete client work. The portion of these fees directly attributed to a client’s project can be billed to them.

For instance, the associated costs can become billable expense income if a software subscription is used exclusively for a client’s project.

Client materials

Materials explicitly purchased for a client’s project, such as specialized paper for a printing job or unique construction materials for a building project, are direct billable expenses.

The cost of acquiring these client-specific materials is often passed through to the client via invoicing.

Client engagement tools

Tools used to facilitate client engagement, such as Customer Relationship Management (CRM) software or meeting platform subscriptions, can be billed to clients if they’re a vital part of the service offered.

Typically, this would be prorated based on the level of use dedicated to the client.

Research and planning expenses

Expenditures arising from research, data analysis, or planning exclusive to a client’s project are billable expenses.

This may include fees paid to consultants or the cost of market research reports necessary for preparing the client’s strategy.

Travel expenses

Travel-related costs like airfare, lodging, and local transportation can add up quickly when a business travels for client-related work.

These expenses are typically billable to the client, especially when travel is necessary to meet with the client or to work on-site.

Supplies and materials

Physical supplies and tangible materials used during a project can be billed to the client.

This may include office supplies, construction materials, or items purchased explicitly to execute the client’s work.

Communication costs

Businesses may incur communication-related costs in delivering services, such as international phone calls, specialized communication apps, or postage for client correspondence.

Such costs are considered billable when essential for client communication and can be directly attributed to a client’s project.

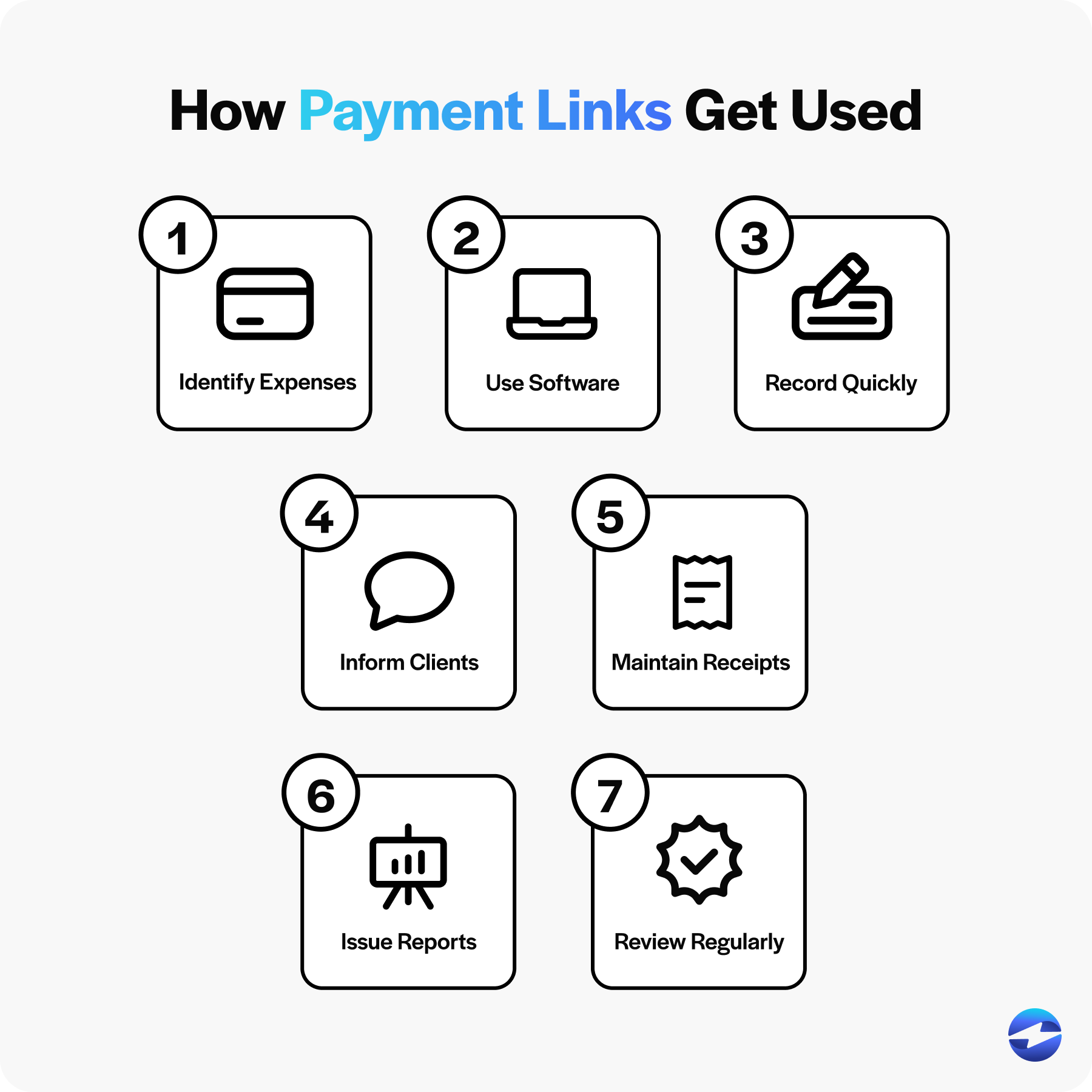

7 steps to track billable expenses

Tracking billable expenses ensures a business accurately charges its clients for out-of-pocket expenses incurred during a project.

To track these expenses effectively, follow these steps:

- Identify expenses: Determine which costs are directly related to client projects. Common billable expenses include travel costs, materials, and shipping costs.

- Use software: Leverage accounting tools like QuickBooks to categorize and record each billable expense. QuickBooks users can find this function under “billable expense income QuickBooks.”

- Record promptly: Enter the expenses into the financial records as soon as they occur to maintain accuracy and provide timely billing.

- Inform clients: Clearly communicate with clients about billable expense income and the types of expenses they’ll be billed for.

- Maintain receipts: Keep all receipts and documentation for expense transaction reporting and tax purposes.

- Issue reports: Periodically provide clients with detailed expense reports, including the date, expense category, and the total amount charged.

- Review regularly: Monitor and review your billable expense management process to ensure all expenses are tracked and reported accurately.

By adhering to these steps, businesses can effectively manage their billable expense income, maintain client transparency, and ensure proper financial management.

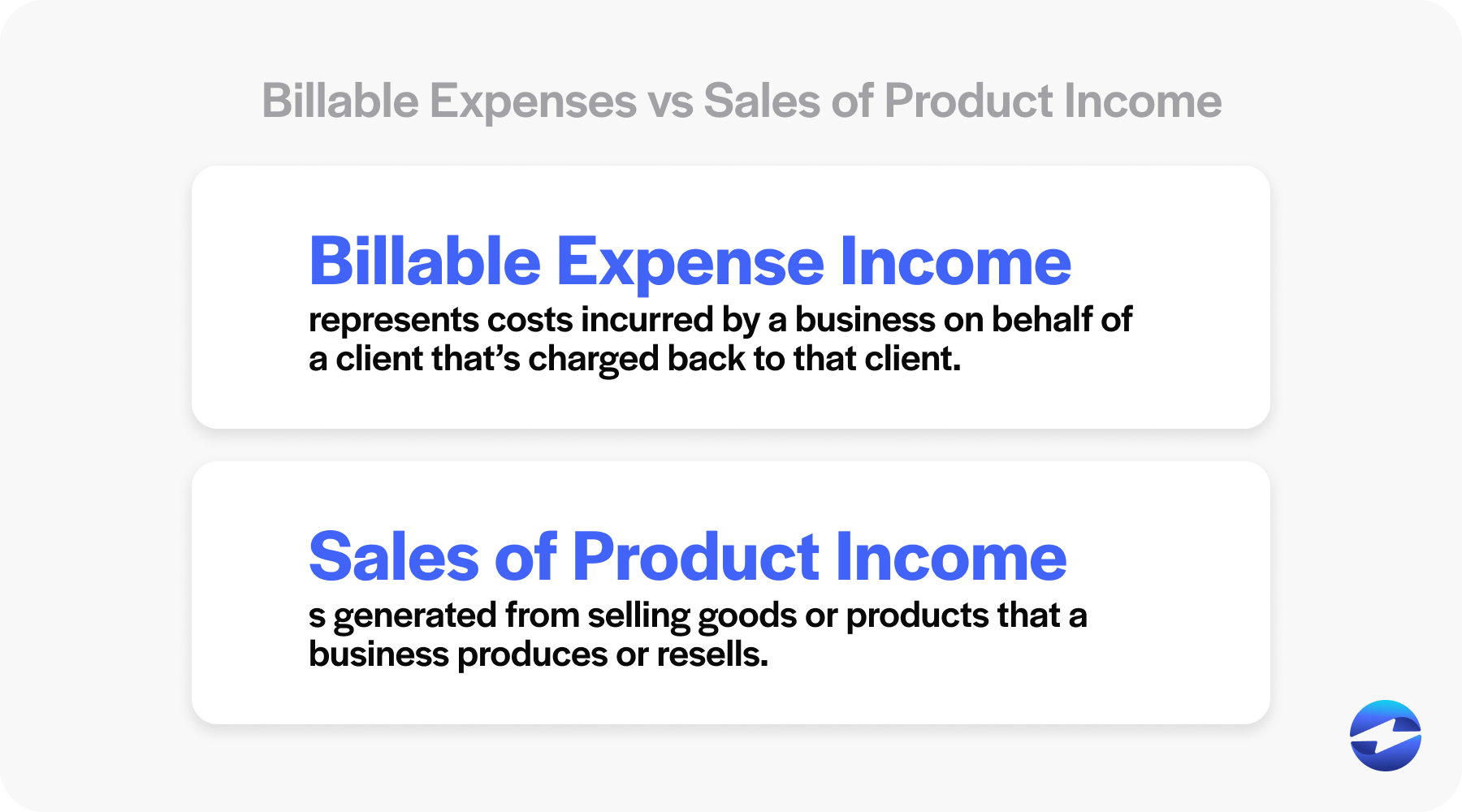

Billable expenses vs sales of product income

Billable expense income and sales of product income are distinct categories in financial management that businesses need to understand for accurate accounting records and tax liabilities.

Billable expense income represents costs incurred by a business on behalf of a client that’s charged back to that client. This is recorded as income since the client reimburses these expenses.

Billable expense income includes travel expenses, shipping costs, and materials purchased for a client project. Tracking these expenses separately is essential to ensure accurate billing and profit margins.

On the other hand, sales of product income is generated from selling goods or products that a business produces or resells. This income isn’t related to client-specific costs but comes from regular sales transactions.

Sales of product income constitutes the core revenue stream for businesses in retail or manufacturing.

Understanding the difference aids business owners in categorizing financial statements correctly and managing expense transaction records efficiently.

Why is billable income essential to understand?

Understanding billable expense income is crucial for maintaining accurate financial records and ensuring profitability. By accurately tracking and billing these expenses to clients, companies can avoid absorbing unnecessary costs to protect profit margins.

For instance, if a construction company purchases materials for a specific project, these costs should be billed to the client as a separate item. Failing to do so can lead to underreporting revenue, distorting financial statements, and potentially decreasing the company’s perceived value. Moreover, proper categorization of expenses helps forecast budgets and assess a business’s financial health.

Being diligent about billable expense income also has tax implications. These expenses are usually tax-deductible when incorporated into the billing process and recorded in accounting records.

Such diligence ensures businesses only pay taxes on actual income after deducting the reimbursable costs. Consequently, understanding and effectively managing billable expense income is a critical financial management component for any business.

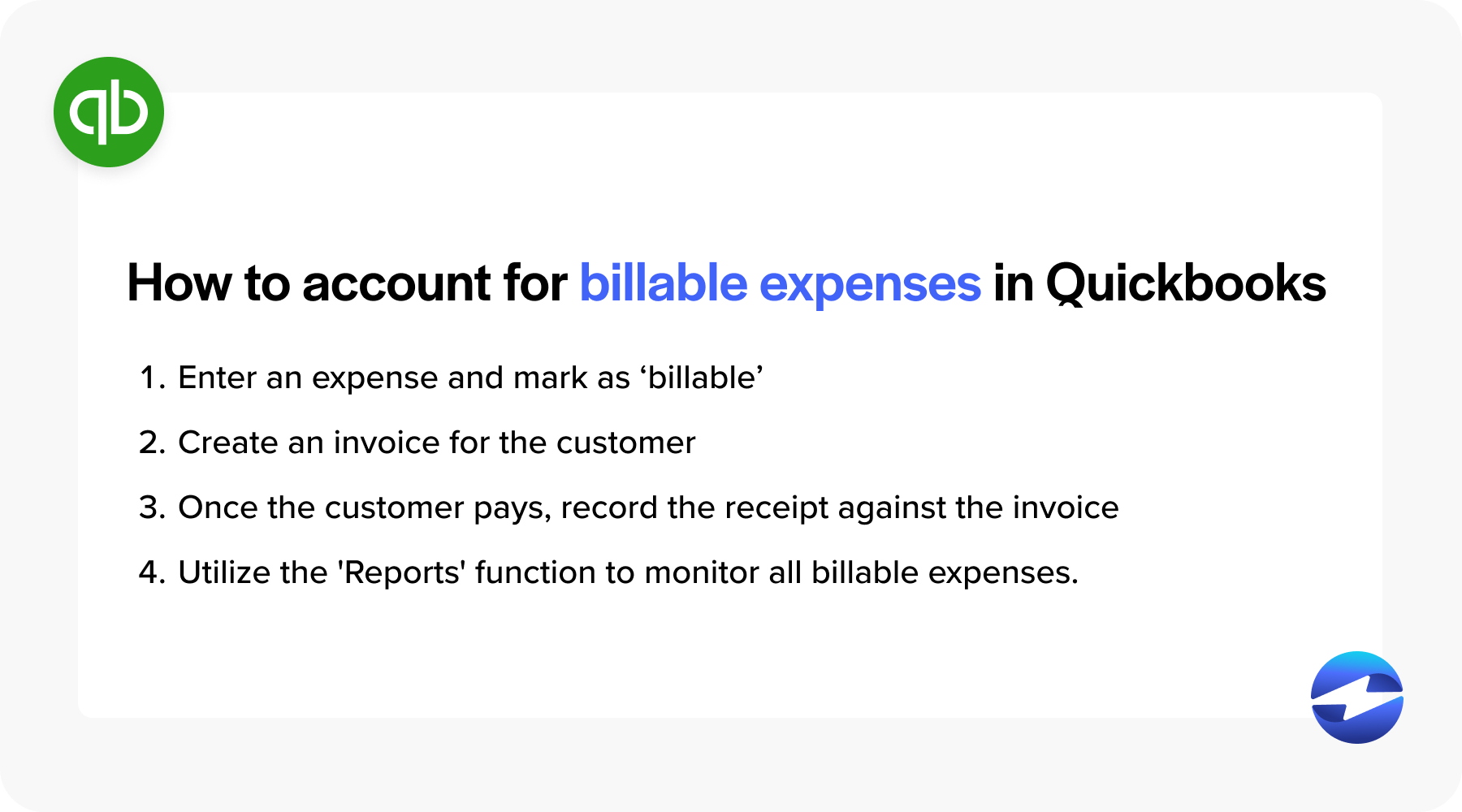

How to account for billable expenses in QuickBooks

Managing billable expenses in QuickBooks is a straightforward process that aids in accurate financial tracking and invoicing.

Here’s a concise guide to account for these expenses:

- Enter the billable expense: Choose the appropriate vendor and enter the relevant expense details. Mark the expense as ‘Billable’ and assign it to the specific customer or project.

- Invoicing the customer: Create an invoice for the customer. Add the billable expense from the list of outstanding billable charges.

- Recording payment: Upon customer payment, record the receipt against the invoice.

- Tracking and reporting: Utilize the ‘Reports’ function to monitor all billable expenses. Ensure that all reimbursable expenses are accounted for in financial statements.

Businesses should always promptly enter expenses, maintain a consistent expense categorization procedure, and regularly review billable expenses for any unbilled items.

This method ensures that expenses incurred on behalf of clients are adequately recorded, billed, and reconciled in QuickBooks, contributing to precise financial management and profitability assessment.

Simplify billing with EBizCharge

EBizCharge offers an innovative solution seamlessly integrated into QuickBooks for businesses looking to simplify their billing process. By incorporating EBizCharge into your financial management strategy, you can streamline the handling of billable expenses and enhance your company’s expense tracking. This system reduces the complexities of billing, allowing for more straightforward expense reports and improved accuracy in accounting records.

EBizCharge offers top-rated payment features that streamline the billing process, easily track billable expenses, enhance financial statement accuracy, and securely handle sensitive payment data. EBizCharge also integrates into 100+ existing business systems to accelerate and automate customer payments.

Businesses that utilize EBizCharge benefit from an optimized billing process that can contribute to better financial records and potentially higher profit margins. This tool can transform how your company approaches billable expense management, providing a clear advantage in today’s competitive business environment.